The Scoop

Sam Bankman-Fried has parted ways with the white-shoe lawyers helping him as he faces federal investigations into the collapse of his crypto empire, people familiar with the matter said.

Bankman-Fried, the 30-year-old whose FTX exchange and web of related crypto firms unraveled last week, had been working with Martin Flumenbaum at Paul, Weiss, Rifkind, Wharton & Garrison, a dean of the white-collar bar who defended Michael Milken in his securities fraud trial in the 1990s and AIG in its post-2008 dealings with the Justice Department.

“We informed Mr. Bankman-Fried several days ago, after the filing of the FTX bankruptcy, that conflicts have arisen that precluded us from representing him,” Flumenbaum said in a statement.

Bankman-Fried is now represented by Greg Joseph, former president of the American College of Trial Lawyers. Also on his legal team as an advisor is David W. Mills, who teaches criminal law at Stanford Law School, where Bankman-Fried’s parents are both professors, some of the people said.

Bankman-Fried hasn’t been accused of a crime. The Justice Department and Securities and Exchange Commission are investigating. The Commodity Futures Trading Commission has “boots on the ground” at an FTX U.S.-registered clearinghouse, commissioner Kristin Johnson said at a London conference.

“There’s a chance this case could go criminal,” Aitan Goelman, former head of enforcement at the CFTC, told Semafor.

Bankman-Fried, an investor in Semafor, Joseph, and Mills did not respond to requests for comment.

FTX loaned customer deposits to a trading firm, Alameda Research, controlled by Bankman-Fried, that had suffered losses on its crypto bets, Reuters first reported last week and Semafor has confirmed. FTX said in a bankruptcy filing today that Alameda had loaned $1 billion to Bankman-Fried and $543 million to Nishad Singh, who was head of engineering at the exchange.

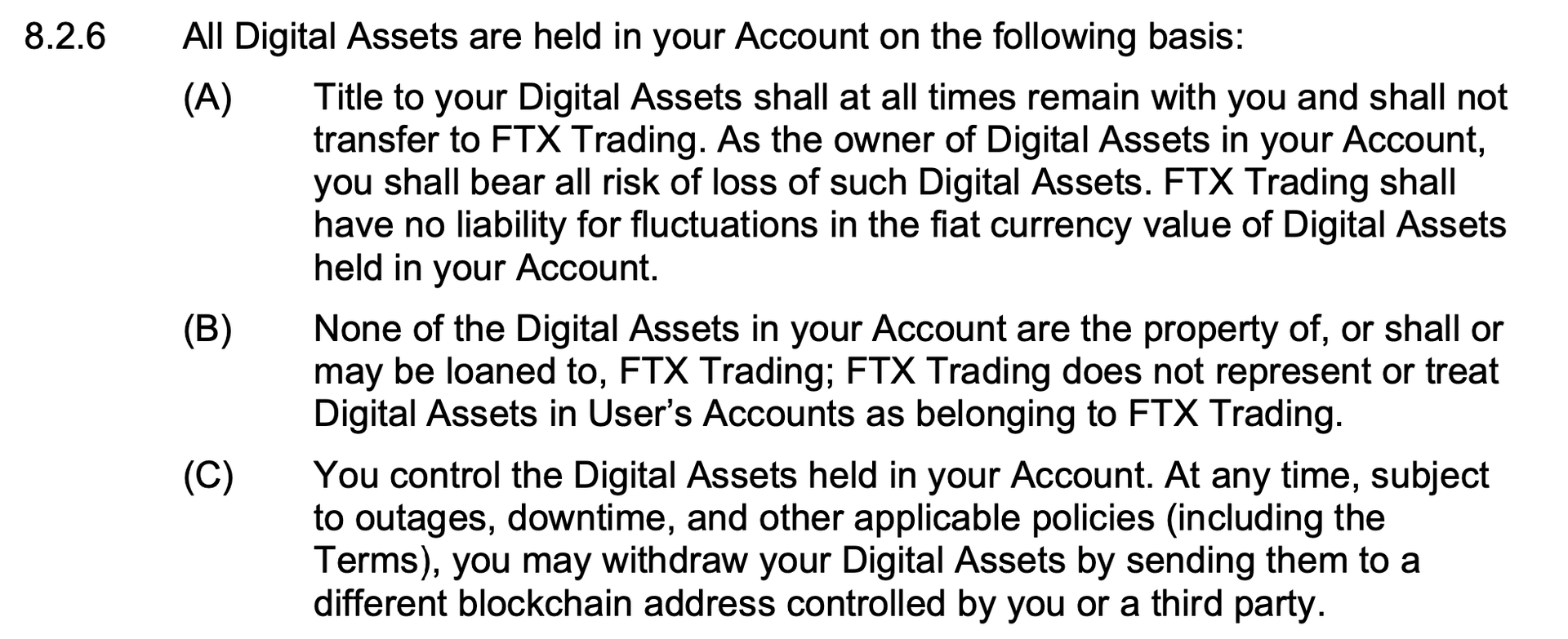

Those transfers could violate U.S. law and are the focus of the federal probes, people familiar with the matter said. They would also likely violate FTX’s terms of service, shown below, which could carry civil penalties.

In this article:

More on FTX

FTX has collapsed astonishingly quickly. To get up to speed, read some of Semafor’s past coverage on the implosion as well as other outlets’ best reporting.

- Semafor: Before a deal with a rival, FTX scoured Wall Street, Silicon Valley billionaires for $1 billion lifeline

- Semafor: Why Andreessen Horowitz passed on FTX

- Semafor: FTX’s legal and compliance staff quit

- Semafor: FTX files for bankruptcy, disclosed tangled finances

- Semafor: Beleaguered FTX staff leave Bahamas for Hong Kong

- Semafor: SBF lists Bahamas penthouse for $40 million

- Semafor: SBF had plans for a Substack competitor

- Semafor: FTX inner circle had gilded, isolated lives in Bahamas resort

- Semafor: Scenes from FTX’s perch in the Bahamas

- Semafor: After FTX’s meltdown, Congress might finally try to regulate crypto

- Semafor: FTX accuses Bahamian government of directing unauthorized transfer

From elsewhere:

- Coindesk: Divisions in Sam Bankman-Fried’s Crypto Empire Blur on His Trading Titan Alameda’s Balance Sheet

- Reuters: Behind FTX’s fall, battling billionaires and a failed bid to save crypto

- FT: FTX balance sheet, revealed

- Vox: Bankman-Fried tries to explain himself

- The Economist: Is this the end of crypto?

Update

Updated to add Greg Joseph is also a lawyer for Bankman-Fried.