The Scoop

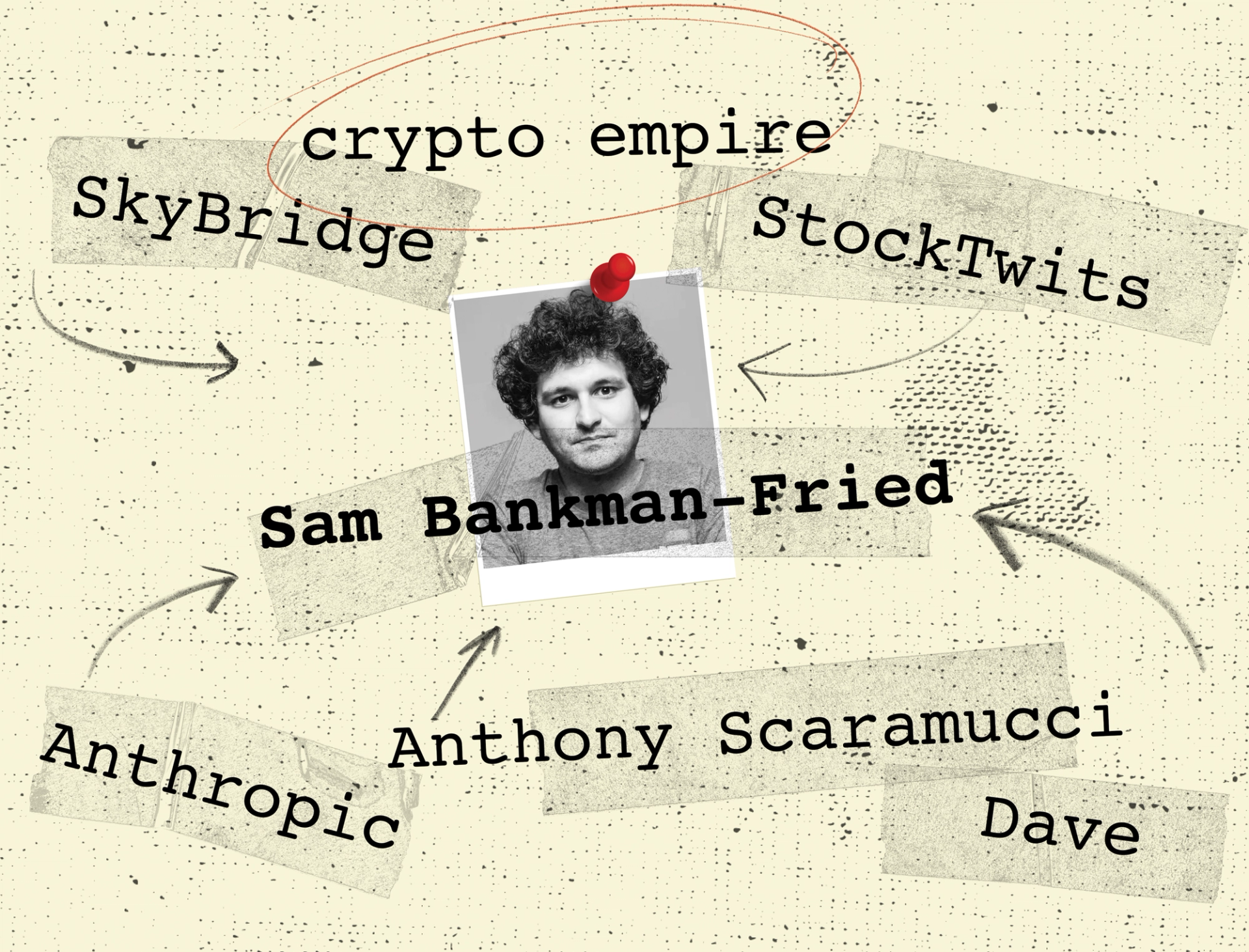

As his crypto empire was collapsing, Sam Bankman-Fried shopped a $4.7 billion grab-bag of venture investments, ranging from fintech firms to crypto assets, around Wall Street in a bid to raise money, according to people familiar with previously unreported documents.

The spreadsheets detail the holdings of Alameda Research, the trading arm controlled by Bankman-Fried, whose financial dealings at FTX are at the heart of federal investigations into the now-bankrupt company.

They list nearly 500 separate holdings, with the vast majority acquired this year, and were shared with potential investors that Bankman-Fried hoped might bail out FTX. None did.

The documents show just how far and fast Bankman-Fried splashed his money around, and suggest a deeper intermingling of assets between Alameda and FTX than previously known.

The portfolio included:

- a $100 million stake in Dave, a mobile-banking app aimed at younger customers

- a $20 million stake in Stocktwits, an online forum for traders to share ideas and make investments

- a $400 million stake in Modulo, which one of the people described as a quantitative trading shop, not to be confused with a Brazilian asset manager of the same name

Some entries match those on FTX’s own balance sheet, which was also shopped to potential investors last week, as reported by the Financial Times. A person familiar with the matter said that FTX had seized certain assets from Alameda after a margin call at the trading firm, which might explain why some of its assets appear in both places.

Federal prosecutors are investigating those ties, including whether Bankman-Fried dipped into FTX’s customer balances to bail out Alameda after bad investments. That’s against FTX’s terms of service and may violate U.S. laws. Bankman-Fried is an investor in Semafor.

Among the overlapping holdings are a $1.15 billion stake in Genesis Digital Assets, a crypto miner, and a $200 million investment in Sequoia, the venture-capital firm that wrote down its own stake in FTX to zero last week.

The Alameda document also lists a $45 million investment in Anthony Scaramucci’s SkyBridge Capital. FTX acquired a 30% stake in SkyBridge in September, but the spreadsheet suggests it might have transferred the position to Alameda as it sought to ringfence any valuable assets that investors might lend against.

Bankman-Fried and FTX didn’t respond to requests for comment. Alameda couldn’t be reached for comment.

Liz’s view

This presents a troubling window into how freely Bankman-Fried commingled the various buckets of money he controlled at his companies — concerns at the heart of federal investigations into FTX’s collapse. That may make untangling those connections, which is now the job of a U.S. bankruptcy trustee, more difficult.

The documents also show how deeply intertwined Bankman-Fried’s personal investments and FTX’s business priorities were. Alameda’s Stocktwits investment, for example, appears to be tied to an agreement earlier this year for FTX to power crypto trading for the forum’s users.

FTX acquired its stake in Dave this spring, when the two companies were “exploring a partnership to offer crypto trading and holding capabilities” to Dave’s customers, a spokesman said Wednesday. That offering was never launched, and the note isn’t repayable until 2026, he said.

The View From Washington, D.C.

This will sharpen calls for tougher, clear rules in Washington — and raise questions about why they didn’t come sooner.

The characteristics of crypto itself — part security, part commodity, part currency — made it something of a regulatory jump ball. Former Securities and Exchange Commission Chair Jay Clayton wanted it for his agency and made some progress, including preventing the marketing of tokens to U.S. investors. (That’s why most of FTX’s customers are international.) His view was that cryptocurrencies should carry the same disclosures as newly issued stocks or bonds.

When asked whether crypto should be regulated like stocks or bonds, Clayton told Semafor: “If it quacks.”

Some experts think agency regulations, which are prone to being revoked when political winds shift, might not be enough. They have been calling for new laws, similar to the Sarbanes-Oxley law on corporate disclosures that followed the accounting scandals of the early 2000s and the Dodd-Frank law that followed the 2008 crash. Enshrining reforms in law helps ensure they’ll continue to be enforced.

As for prosecutions, a top focus will be on outright fraud — whether FTX misled investors about how their funds would be used and whether it subsequently tapped that money to bail out Alameda or other struggling crypto investments it had made. Bankman-Fried, who has tweeted through the crisis, may not be helping himself, said Aitan Goelman, former head of enforcement at the Commodity Futures Trading Commission.

“If you are in a hole, stop making public statements of any kind,” he said. “There’s a chance this case could go criminal. There’s a chance you could be banned from markets.”

Notable

- Bankman-Fried spouted off to Vox via Twitter DMs about regulators (“Fuck regulators”), slippery slopes (“each step was in isolation rational and reasonable”), and some — though not that many — regrets (“sometimes life creeps up on you”.) He later tweeted that those messages were meant to be private exchanges between friends.

- Temasek, Singapore’s state-backed investment fund, said it had written its stake in FTX down to zero, following Silicon Valley giant Sequoia’s move.

- Binance, the rival crypto exchange that started FTX’s meltdown, stopped taking deposits of a pair of Solana coins Thursday morning. The moves appear to be related to Solana’s health and not that of the exchanges — for now.

Contact

Want to pass along a tip or feedback? Write to me at lhoffman@semafor.com.

More on FTX

The FTX has collapsed astonishingly quickly. To get up to speed, read some of Semafor’s past coverage on the implosion as well as other outlets’ best reporting.

- Semafor: Before deal with rival, FTX scoured Wall Street, Silicon Valley billionaires for $1 billion lifeline

- Semafor: Why Andreessen Horowitz passed on FTX

- Semafor: FTX’s legal and compliance staff quit

- Semafor: FTX files for bankruptcy, disclosed tangled finances

- Semafor: Beleaguered FTX staff leave Bahamas for Hong Kong

- Semafor: SBF lists Bahamas penthouse for $40 million

- Semafor: SBF had plans for a Substack competitor

- Semafor: FTX inner circle had gilded, isolated lives in Bahamas resort

- Semafor: Scenes from FTX’s perch in the Bahamas

- Semafor: After FTX’s meltdown, Congress might finally try to regulate crypto

- Semafor: FTX accuses Bahamian government of directing unauthorized transfer

From elsewhere:

- Coindesk: Divisions in Sam Bankman-Fried’s Crypto Empire Blur on His Trading Titan Alameda’s Balance Sheet

- Reuters: Behind FTX’s fall, battling billionaires and a failed bid to save crypto

- FT: FTX balance sheet, revealed

- Vox: Sam Bankman-Fried tries to explain himself

- The Economist: Is this the end of crypto?