The Scene

President-elect Donald Trump tweeted and one of America’s largest companies lost $4 billion in market value. He embraced a controversial billionaire, whose company soared in value as a result. He sent shares of foreign companies tumbling with tariff threats.

That was all in 2016.

The company was Lockheed Martin, whose military contracts Trump threatened to cancel. The billionaire was Carl Icahn, whose appointment as a special adviser to slash federal regulations boosted shares of Icahn’s oil-refining business by 12%. Toyota’s stock slumped when Trump demanded the company “build plant in U.S. or pay big border tax.”

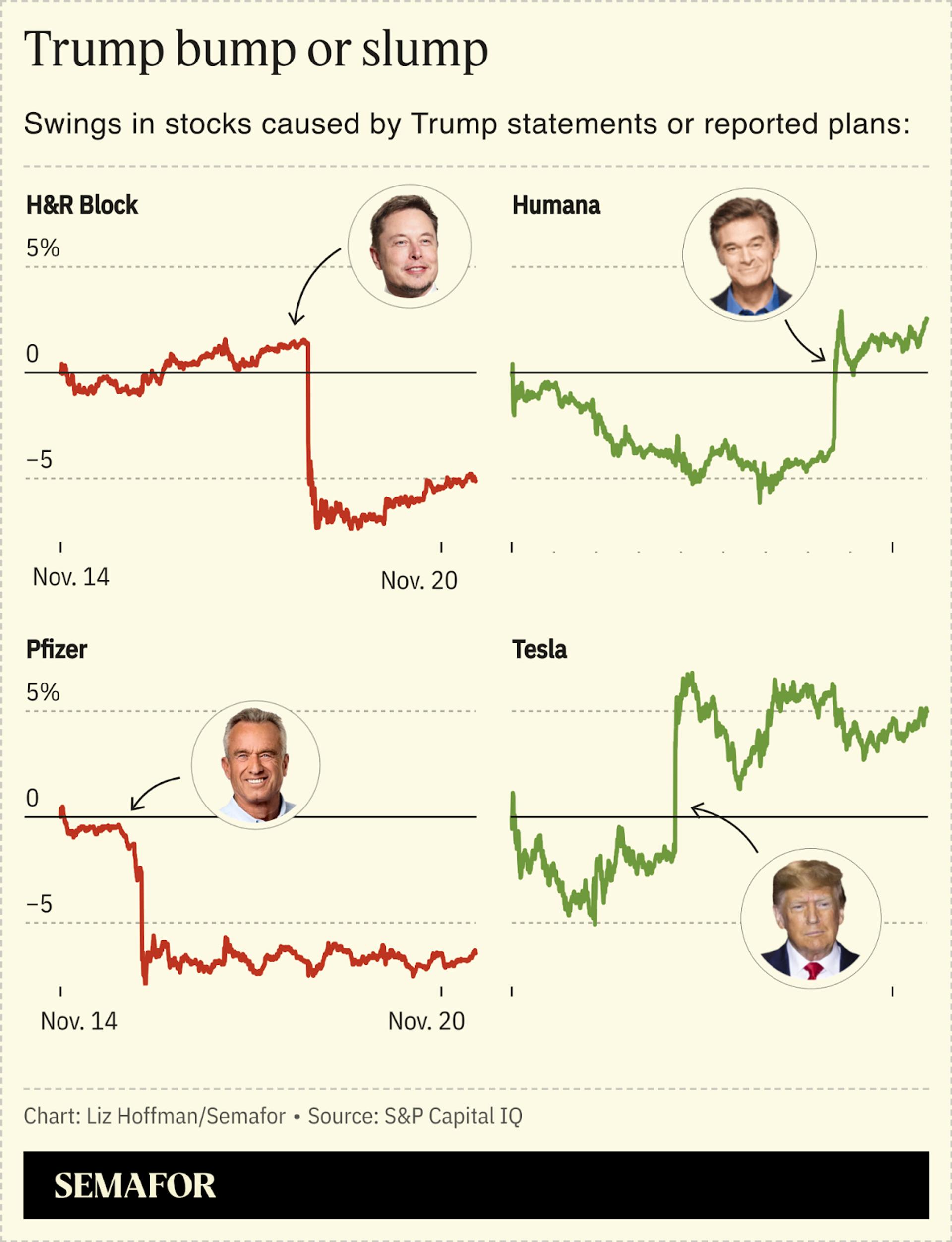

Trump is back and so is the stock-market chaos that accompanied his first win. His nomination of Robert F. Kennedy, Jr., shaved $8 billion off the stocks of six vaccine makers including Pfizer and Moderna.

Shares of insurers UnitedHealth and Humana spiked after analysts resurfaced comments from Mehmet Oz, Trump’s nominee to oversee Medicare and Medicaid, about moving more low-income Americans from government-sponsored plans to private insurance.

Trump’s busy policy teams, swifter to action than in 2016, have added market volatility, too. A Washington Post story that his government-efficiency czars, Elon Musk and Vivek Ramaswamy, want to build a free tax-filing app sent shares of H&R Block and TurboTax owner Intuit down more than 6%. Tesla shares rose on a Bloomberg report that Trump wants to ease rules for self-driving cars.

In this article:

Liz’s view

A word of warning to CEOs who white-knuckled their way through Trump’s tweets eight years ago: It’s going to be wilder this time.

For one thing, the president-elect is angrier now, with fringier and more deeply held ideas about the economy. He knows his way around government and is more sure-footed, with lieutenants eager to do his bidding. He got fewer endorsements and donations from corporate executives in 2024 than he did in 2016, and likes to hold a grudge.

Second, there are more Trumps. Elon Musk xeets more than Trump truths, has 24 times as many followers, and owns the algorithm that fills our feeds.

Third, the army of retail investors that can move stocks or add teeth to corporate boycotts didn’t exist in 2016. It was mostly a creation of the meme-stock craze in 2021, which channeled MAGA’s burn-it-all-down populist energy into the market, and it’s only been stoked since then by a right-wing chorus on X.

Room for Disagreement

In 2017, The Wall Street Journal created a Trump Target Index and analyzed stock prices after a negative tweet from the then-president. As a group, the stocks outperformed the market anyway.

And remember the Goya bean boycott? In 2020, the company’s president publicly supported Trump, which led to one of the truly great Oval Office photo ops and calls from progressives to boycott its products. A study from experts at Cornell, Northwestern, and London’s Imperial College Business School later found that the company’s sales actually rose 22% in the following two weeks, even in Democratic counties.

Notable

- Dr. Oz reported during his 2022 Senate run that he owned hundreds of thousands of dollars of stock of insurers that offer the Medicare insurance he favors expanding — Yahoo News.