The Scoop

Elon Musk used Twitter, the platform he now owns, to gleefully mock the meltdown of the crypto exchange FTX. His “bullshit meter was redlining” when he met the crypto exchange’s founder, Sam Bankman-Fried, Musk has said.

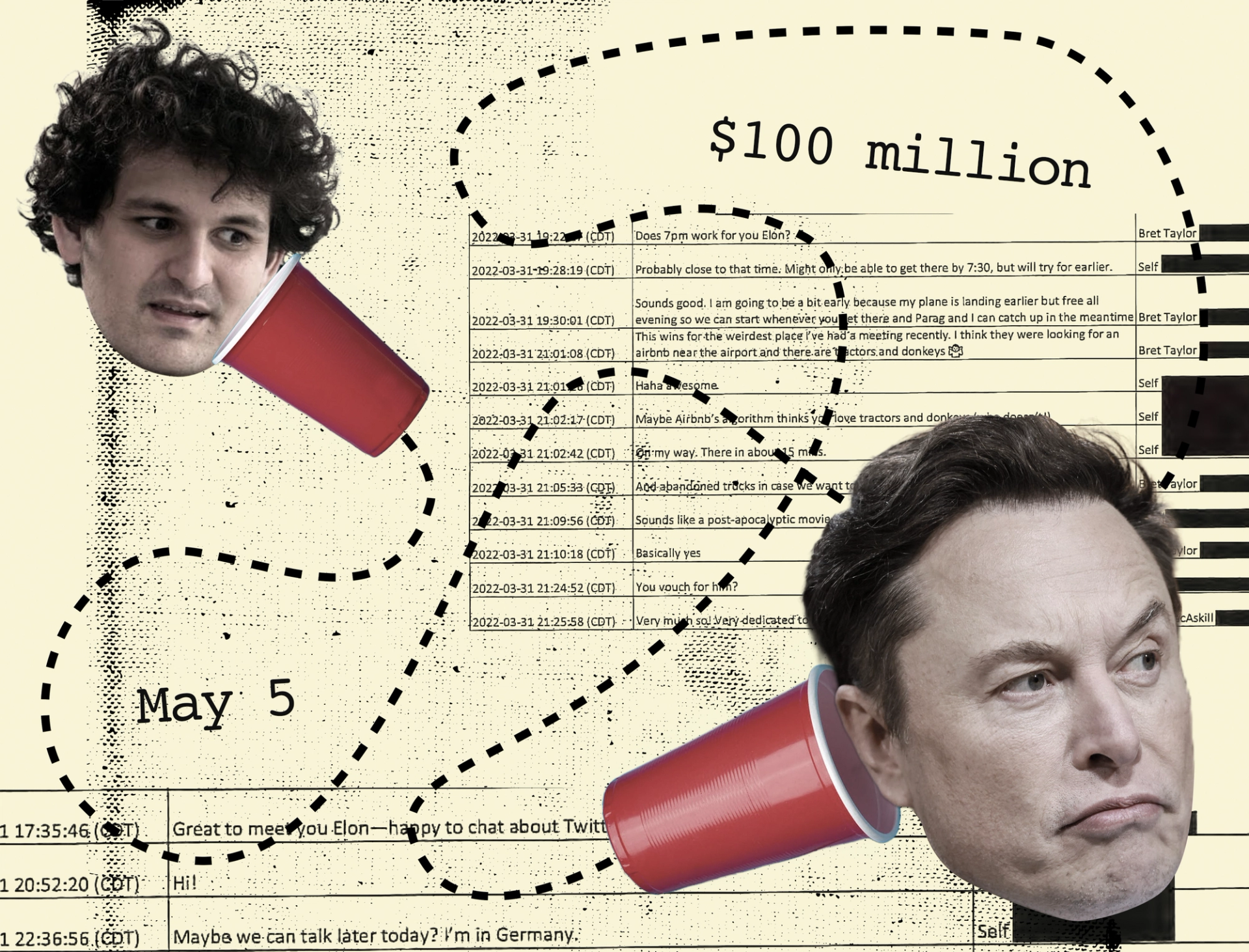

But Musk was in a friendlier mood on May 5. Two weeks after clinching a deal to buy Twitter for $44 billion, he texted Bankman-Fried just after midnight and invited him to roll the $100 million stake he had owned for a few months into a privately held Twitter.

The previously unreported message, which was reviewed by Semafor, set in motion a chain of events that has bound the two men, whose companies are both in varying degrees of crisis. Bankman-Fried owns a sizable chunk of a now privately held and debt-laden Twitter, according to an FTX balance sheet prepared after the takeover closed on Oct. 28 and circulated to investors earlier this month, which listed Twitter shares as an “illiquid” asset.

Musk, who initially did not respond to a request for comment, tweeted Wednesday that “neither I nor Twitter have taken any investment from SBF/FTX” and also said Bankman-Fried “certainly does not own shares in Twitter as a private company.”

One snippet of the text message surfaced this summer in a Delaware court, where Twitter was suing to force a cold-footed Musk to close the deal. “Sorry, who is sending this message?” Musk texted Bankman-Fried.

But sandwiching that comment are undisclosed messages between the two men that shed light on the two biggest business stories in the world. The timestamp on the message disclosed in court matched that of the one Semafor reviewed.

Musk’s question followed an upbeat note from Bankman-Fried, saying how enthusiastic he was about Musk’s plans for the platform. He said he was laying low ahead of an upcoming congressional hearing and wouldn’t be able to invest new money in Twitter, but had about $100 million of stock that he was interested in contributing toward the deal.

Bankman-Fried had started accumulating the stake early this year with an eye toward acquiring Twitter himself. (Bankman-Fried is also an investor in Semafor.)

Bankman-Fried’s philanthropic adviser, Will MacAskill, texted Musk on March 29 — a week before the Tesla boss made his stake public — to suggest “a possible joint effort” between the two billionaires, according to the Delaware court documents. It would “be easy,” he told Musk, for Bankman-Fried to commit up to $3 billion to such a bid.

Musk’s banker, Michael Grimes, later added that Bankman-Fried was in for $5 billion and possibly up to $10 billion. Bankman-Fried and Musk later spoke on the phone, Axios reported and Semafor has confirmed, and after that conversation, which was a few days before the text-message exchange in question, Bankman-Fried opted not to invest.

But FTX claimed he did roll over his stake, as Musk suggested.

Since FTX’s collapse, Musk has publicly trashed his now-partner in owning Twitter. “Everyone was talking about him like he’s walking on water and has a zillion dollars,” he said in a Twitter Spaces conversation on Nov. 12, the day after FTX filed for bankruptcy. “And that [was] not my impression… there’s something wrong.”

In this article:

Liz’s view

Musk may have had a more finely tuned B.S.-meter than investors and regulators — and reporters — but he was happy to take Bankman-Fried’s money. At the time, he was canvassing everyone from private equity investor Orlando Bravo to Oracle founder Larry Ellison, seeking contributions to the $21 billion equity check he’d need to write for Twitter. (That number ultimately rose to $33.5 billion after Musks’ camp nixed a loan secured by his stake in Tesla.)

Corporate mergers were once hammered out in boardrooms and papered over by an army of bankers and lawyers. But with wealth now concentrated in the hands of an elite few, individuals can act like companies all on their own. Musk acquired Twitter through sheer force of personality — ambition, hubris, and a refusal to negotiate — and bent Wall Street to his will, to the regret of both.

Notable

- Read the Musk texts for yourself.

- My colleagues Reed Albergotti and Louise Matsakis report that the Centre for Effective Altruism, the philosophical movement that Bankman-Fried helped fund and seemed to embody, investigated allegations in 2018 that he had engaged in unethical business practices at his crypto hedge fund.

- The Wall Street Journal’s deep-dive into FTX’s collapse ends with Bankman-Fried’s father in tears at a Bahamian tiki bar.

Update

After the publication of this story, Elon Musk confirmed that he’d texted with Bankman-Fried about investing, but said that in fact the investment never took place. We’ve added his comment to this story. We’ve also made clear that the suggestion that Bankman-Fried invested in Twitter was based on the asset list circulated by FTX, and removed a line describing the two men as “financial partners.”

Correction

The Wall Street Journal reported that Bankman-Fried’s father was seen crying in a Bahamian tiki bar. A previous version of the story misstated that it was Bankman-Fried.