The News

Argentine President Javier Milei — elected a year ago to rescue an economy in freefall — made the case that his quasi-libertarian policies had set his country on a path to stability.

Writing in The Economist, the self-described anarcho-capitalist said that Argentina “was teetering on the edge of a precipice” when he took office. By slashing spending and eradicating money-printing as a source of government funds, he wrote, monthly inflation has fallen, the government is in surplus, and the economy is now stable.

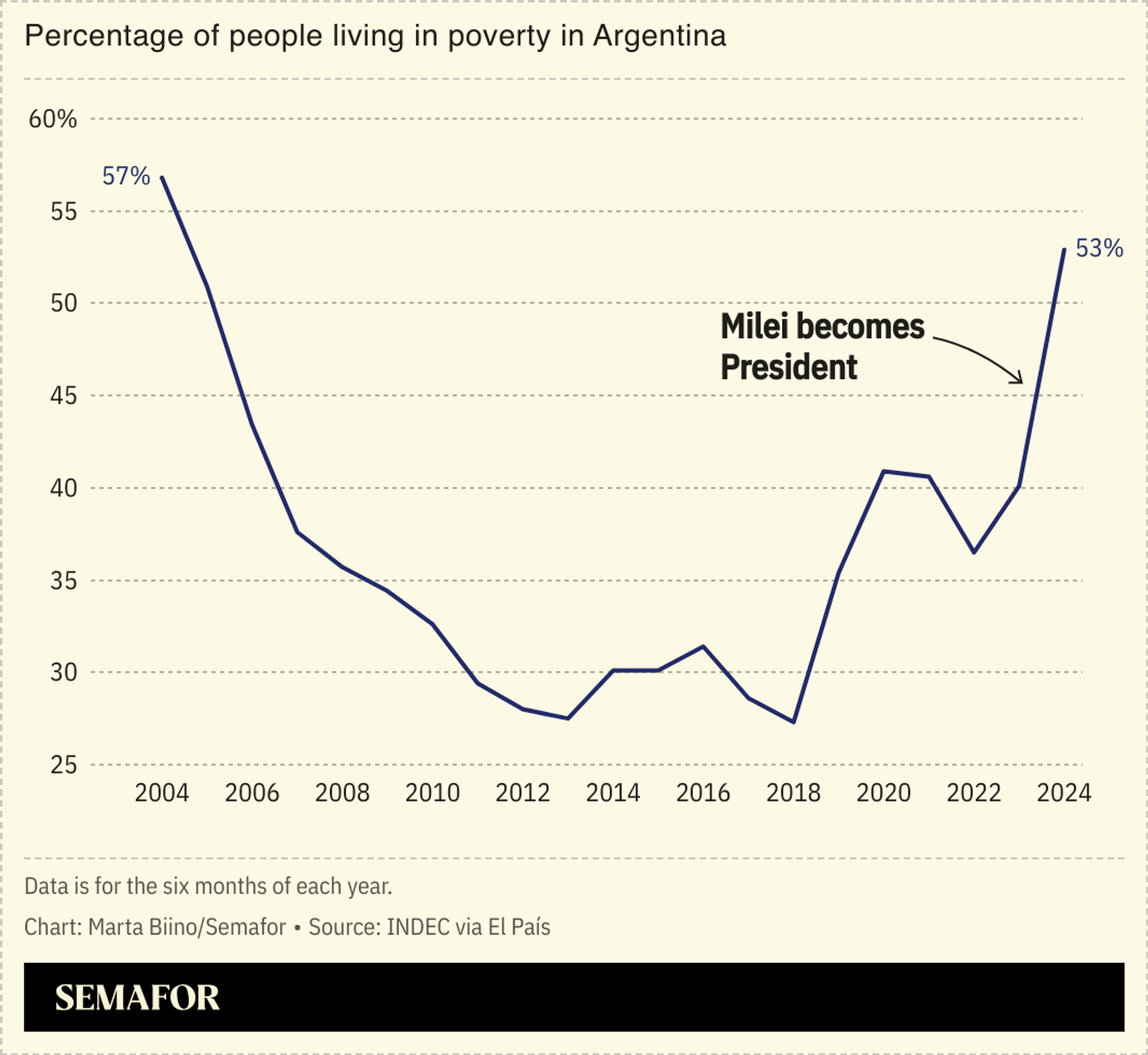

Some commentators foresaw “economic collapse” when Milei was elected, and the country’s poverty rate has reached 50%, but voters are largely still on his side, Reuters reported. “It is no miracle,” Milei said, but simply “governing with macroeconomic prudence.”

SIGNALS

Milei is Trump’s ‘favorite president’

Milei will be a “key player” in Donald Trump’s incoming administration, Semafor’s Brad Glasser wrote, with Trump publicly describing him as his “favorite president” and inviting him to Mar-a-Lago. Milei is expected to try to influence US policy, particularly when it comes to Elon Musk’s newly created “Department of Government Efficiency, El País reported. Musk has reportedly been in touch with Argentina’s Minister of Deregulation because he wants to take inspiration from the country’s public spending “chainsaw,” which is “creating a sensation around the world,” according to Milei. Part of the two presidents’ affinity comes from their shared “anti-establishment,” “anti-woke” rhetoric that has resonated with voters, a political scientist wrote in the Buenos Aires Times.

Argentina’s investors keep betting on Milei

Investors that had bet on Milei’s ability to spearhead Argentina’s economic recovery have been rewarded, Reuters wrote. They are busy pouring money into the country’s stocks and bonds, hoping to profit from the president’s “austerity crusade.” It was to be expected that Milei’s move to stop printing cash and slash spending would be appealing to investors, one analyst said, but the popularity he has retained in the face of cuts, especially to welfare, is striking, and has bolstered investor confidence. The situation, however, is volatile: “It is not ‘I buy Argentina, I put it in a drawer and I sleep’,” one investor said. “This is, of course, something where dynamics can change quickly.”

Milei might soon face a bitter fight with Argentina’s creditors

Milei might soon have to face the country’s former investors who have sued to demand billions in repayments over decisions taken by previous governments, the Financial Times reported. “Unfortunately for Milei, a tsunami of judgments that has been building for two decades is now breaking,” a consultant said. But an ailing economy means Argentina has “no money to pay,” the FT wrote, and Milei’s government has pledged to continue appealing to protect the country’s assets. Some plaintiffs, however, keep their hopes high: “I’ve been doing this continuously for the last 22 years and can say from experience that while collecting from Argentina isn’t easy, it can be done,” said an asset recovery lawyer who has seized more than $70 million from the country.