The News

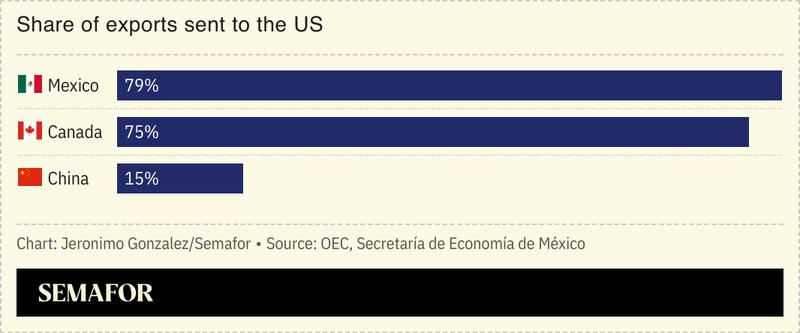

US President-elect Donald Trump pledged additional tariffs on goods from China, as well as new penalties for imports from neighbors Canada and Mexico.

He said the tariffs — which targeted Washington’s three biggest trading partners — were aimed at targeting illegal drug smuggling and immigration into the US.

The announcement could kickstart a costly trade war, upending global supply chains and likely accelerating inflation in the US, experts said. But Trump made trade a central plank of his election campaign, arguing tariffs would protect jobs and ultimately raise tax revenues.

SIGNALS

Trump may see tariff threat as a bargaining chip

Tariffs are almost guaranteed to disrupt and push costs up for US businesses, one expert told the Financial Times, and even just the threat of them could have “a chilling effect.” But some believe the announcement is meant as a bargaining chip, albeit a unique one, looking to achieve the non-trade goal of stricter border controls through a trade tool: “He’s clearly looking for Canada and Mexico to come to him,” the former general counsel at the Office of the US Trade Representative told Bloomberg’s Daybreak podcast. “That’s part of the reason for announcing it well before he’s even in office.” It’s not the first time Trump has floated bold tariff plans, but most never came to fruition, Politico added.

The market impact of tariffs could be more than ‘grandstanding’

Markets were spooked after Trump’s announcement, Reuters reported, with the dollar rising and the Canadian and Mexican currencies falling. European shares also fell, driven by fear that the bloc would be the next logical target of higher duties. Automaker stocks — one of the sectors that relies most on international trade and that could be most impacted — declined sharply. Even if tariffs don’t materialize, it would be unwise to dismiss their market impact as “grandstanding,” ING analysts warned. Mexico’s currency could drop further from its current 20 to 21 to the dollar, inching closer to 24 or 25, and ING expects Mexico’s and Canada’s currencies to suffer more this time than during Trump’s first term, regardless of tariffs.

Even Republican lawmakers are worried

Some Republican lawmakers have expressed concern over Trump’s aggressive tariff approach, especially those from states with a large agriculture sector that could be most impacted by retaliatory measures from foreign countries, Politico reported, adding that trade is expected to be a point of tension in the coming administration. “I’m not for just arbitrary, across-the-board tariffs, but I think they’re a very, very useful tool in getting countries’ attention to play fair,” Sen. John Boozman (R-Ark.), who’s poised to become the chair of the Senate Agriculture Committee, told the outlet. The newest proposal reignited concern: “I’m troubled,” Rep. Adrian Smith, R-Neb., told Semafor. “Seems like a sledge hammer approach that could spike inflation and not really help grow domestic manufacturing.”