The News

Europe is girding itself for clean-energy competition with China even as it continues to negotiate with Beijing over reducing tariffs on Chinese-made EVs.

Brussels invited bids for €1 billion in grants for EV battery manufacturers, but said it would prioritize firms that were less dependent on Chinese supply chains, and tightened rules on a green hydrogen subsidy program to shut out businesses that were too reliant on Chinese goods.

SIGNALS

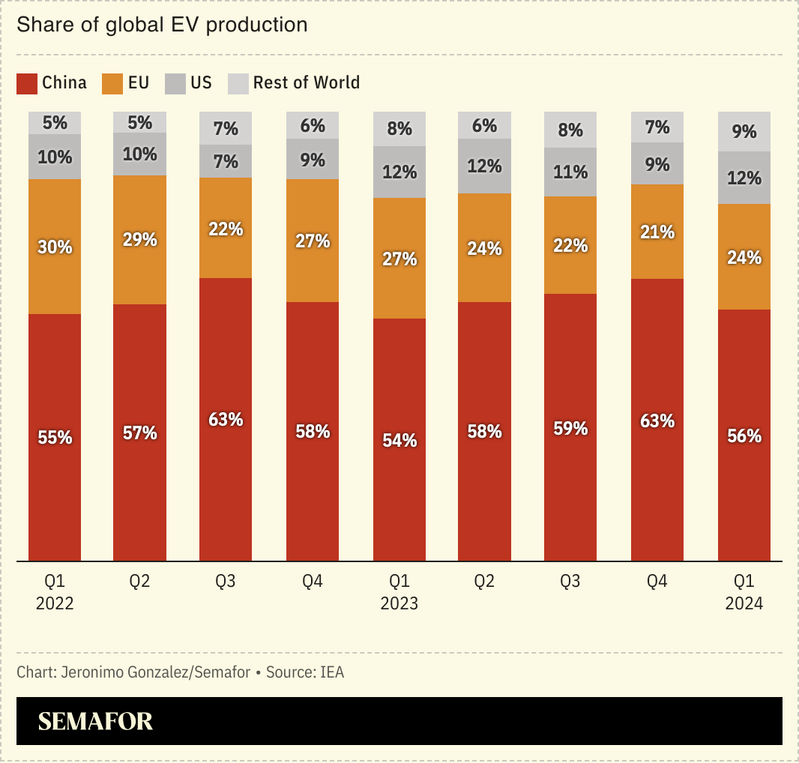

China has an advantage over the EU when it comes to green tech

China enjoys an advantageous position vis à vis the EU, and has more leverage over the bloc than it does other parts of the world, an economist wrote in Bruegel: The EU remains dependent on China for imports of many of the critical minerals and components needed for the energy transition, and years of European investment in Chinese automotives have left European automakers who import EVs from China into Europe exposed to EU tariffs. Rather than relying on “defensive measures” like tariffs, the EU should scale-up industrial innovation at home, as the Biden administration has done with the CHIPS and Science Act and the Inflation Reduction Act, she argued.

The EU also needs to monitor Chinese investments on its soil

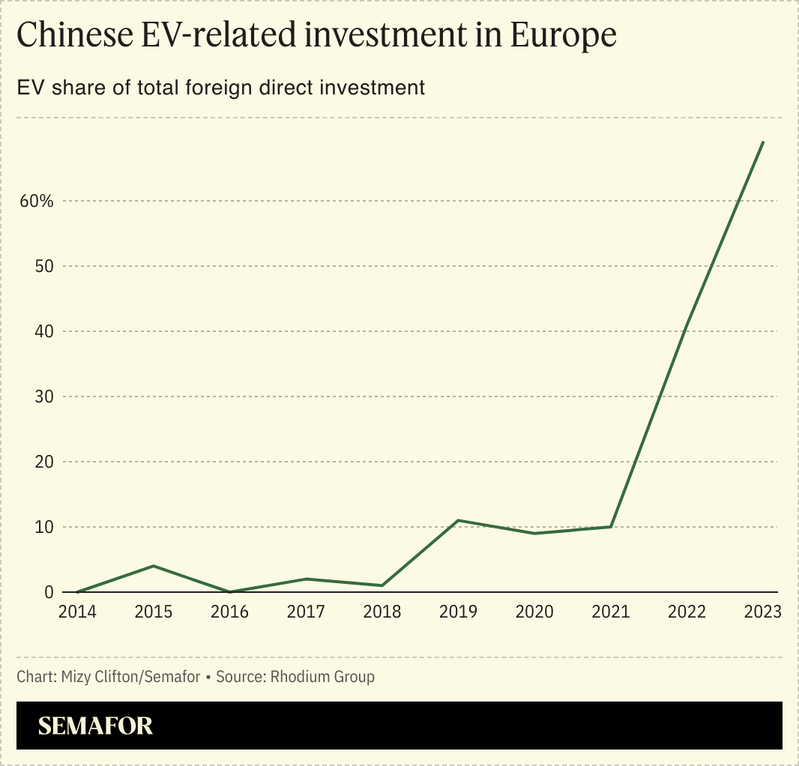

The EU has so far focused its regulatory agenda on the threat of homegrown companies being acquired by Chinese firms, but is “much less well-equipped” to address the growing trend of Chinese foreign direct investment in its EV sector, Rhodium Group experts argued, which accounted for about 70% of total Chinese FDI on the continent in 2023. An overly “permissive” approach — in line with the bloc’s open-door approach to FDI as a matter of principle — would risk distorting the single market, sidelining domestic brands, and creating cybersecurity issues, they wrote. Chinese firms have diversified their cleantech investment portfolios partly in a bid to circumvent US tariffs, according to a report by Australian research group Climate Energy Finance.