The News

Business sentiment among German and UK firms that operate in China is in the doldrums, two recent surveys showed.

More than half of German firms that responded to the survey said their respective industries have deteriorated and that doing business in China has become more difficult during the last year. Less than a third said they expected any improvement in 2025, but notably, 92% plan to maintain their operations in China regardless. Fewer UK firms surveyed seemed optimistic about their future prospects in China than did in 2023, and more UK firms said they are not prioritizing China in their global investment plans compared to last year.

The surveyed German firms, half of which are in the industrial equipment and auto sector, cited weak demand and pressure to lower prices as their biggest challenges.

Julian Fisher, chair of the British Chamber of Commerce, which conducted the UK firm survey, said “the era of boundless optimism” in China was “over.”

SIGNALS

Foreign automakers feel cost of doing business in China

Foreign automakers are suffering heavy losses in China as car sales drop sharply, losing out to domestic brands that focus on low-cost, high-tech electric vehicles and hybrid cars. Ford Motors and Volkswagen have undergone extensive restructuring and closed some factories, while General Motors has taken a $5 billion hit as a result of its flagging China business. Meanwhile, domestic giant BYD is vying to become the world’s top producer of EVs — a symptom of the “massive state support aimed at displacing foreign firms,” a leading China analyst wrote. These and other issues “require a rethinking of China strategy for many foreign companies,” he wrote.

Chinese economists see dim prospects behind official optimism

Two of China’s most-outspoken economists said in recent speeches that Beijing has likely overstated the country’s GDP and grossly undercounted the number of unemployed people, poking holes in authorities’ efforts to censor criticism of the world’s second largest economy, Nikkei Asia reported. The remarks cast further doubt on the accuracy of Beijing’s official figures, a long-standing concern among foreign investors: In 2023, Beijing reported GDP growth at 5.2% for the year, while analysts at US-based Rhodium Group estimated the real figure was likely around 1.5%, while TS Lombard estimated around 3.6%, Nikkei noted.

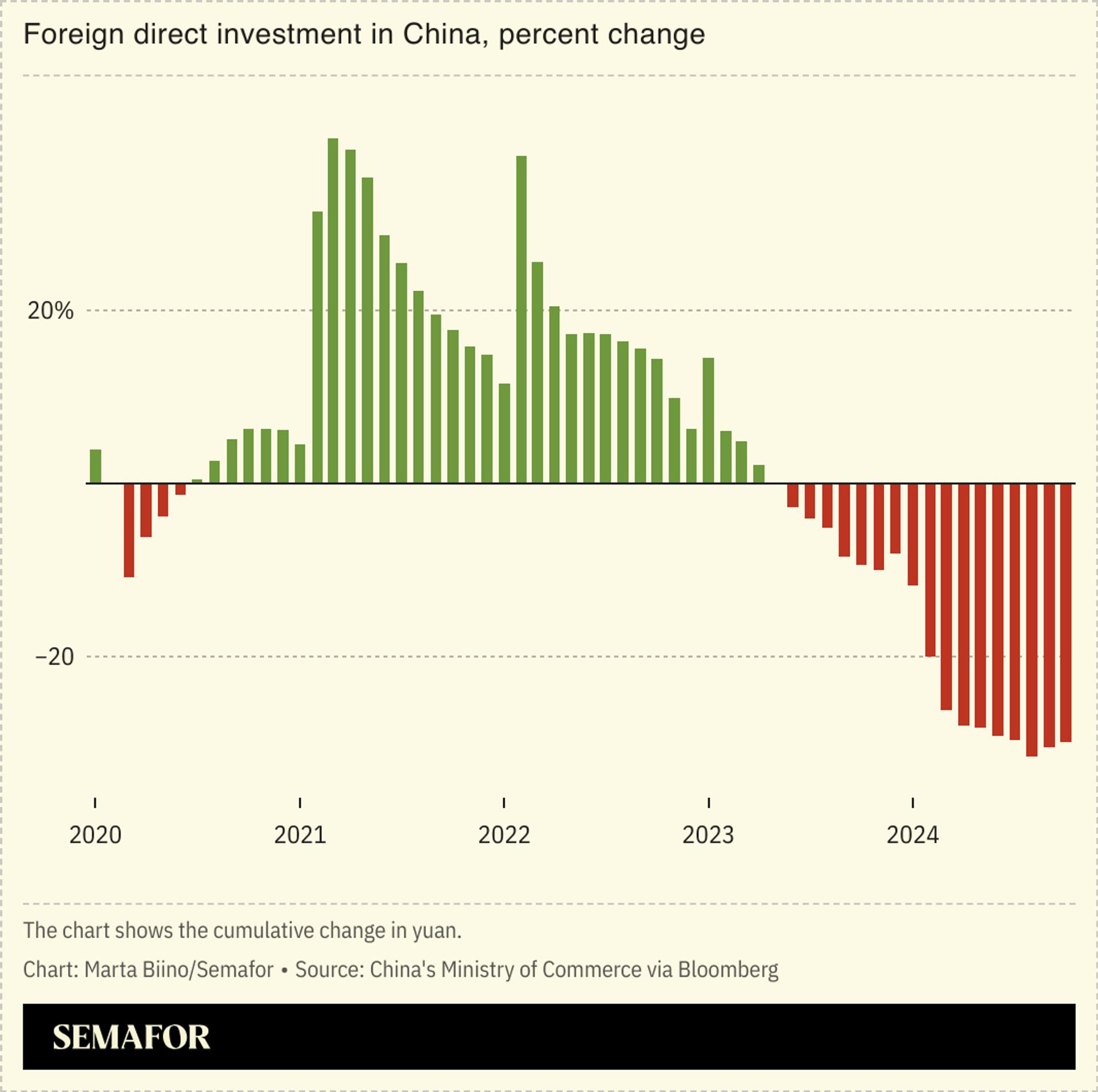

Donald Trump could worsen foreign firms’ China outlook

Foreign direct investment in China has dropped sharply since the end of 2023 after years of growth, the South China Morning Post reported, as businesses become increasingly wary of geopolitical fallout. US President-elect Donald Trump — who is expected to take a hawkish stance toward Beijing — could push more US companies to pull back investment: Geopolitical tension is the top concern among members of the American Chamber of Commerce in Shanghai, Bloomberg reported. China could feel some impact from these losses, particularly in employment, local tax revenues, and industrial economic activities, an economist told SCMP, while technological progress, which foreign companies have historically helped drive, could also take a hit.