The Scene

Two groups of bank CEOs gathered yesterday, one in downtown New York and one in Washington, D.C. Their messages, one humble and the other indignant, showed how last spring’s tumult is reshaping the country’s banking system.

Regional bank executives tried to woo investors back onside at an industry conference in lower Manhattan. Customers were coming back, they said. They were being conservative on risk. They had plenty of capital. In one shareholder presentation after another, they stressed they had enough cash to weather a repeat of the depositor panic that pushed four of their peers into failure this spring.

In Congress, the CEOs of their larger rivals criticized tougher bank rules in a tone so confident it bordered on condescension. Far from the browbeating generally associated with the image of Wall Street bosses behind a hearing-room table, the criticism went in the other direction. “It makes no sense,” said Morgan Stanley’s James Gorman of the proposal, which would require banks to hold billions of dollars in additional financial cushion.

JPMorgan’s Jamie Dimon noted its “lack of economic analysis,” a particular kind of banker burn, and criticized the process: “One frustration you hear from this group is that this question” — what impact the rules would have on lending — “should have been asked before this proposal went out.”

In this article:

Liz’s view

You might chalk up Gorman’s crankiness to senioritis (he’s retiring in January) but his tone, and those of his peers, was remarkable for anyone who followed the industry through the aftermath of the 2008 crisis, when chastened CEOs took the Amtrak to Washington for ritual floggings. This time, flogger-in-chief Elizabeth Warren used her time in front of the cameras to bash crypto, creating a rare moment of televised unity with Dimon, a frequent sparring partner in past hearings.

Their confidence is well-founded. Today’s banks are far safer than they were coming out of 2008, and the risks in today’s system are mostly elsewhere — in hedge funds, private investment firms, and lightly regulated family offices.

But it’s also a consequence of what happened this spring. The nation’s biggest banks were a beneficiary of the panic that swept through midsized regional lenders. Distraught customers of Silicon Valley Bank, First Republic, Western Alliance, Schwab, and others read “too big to fail” as “safe,” and shifted billions of dollars of deposits from smaller banks to big ones. JPMorgan was allowed, even encouraged, to buy First Republic, a deal that otherwise would have been barred by law.

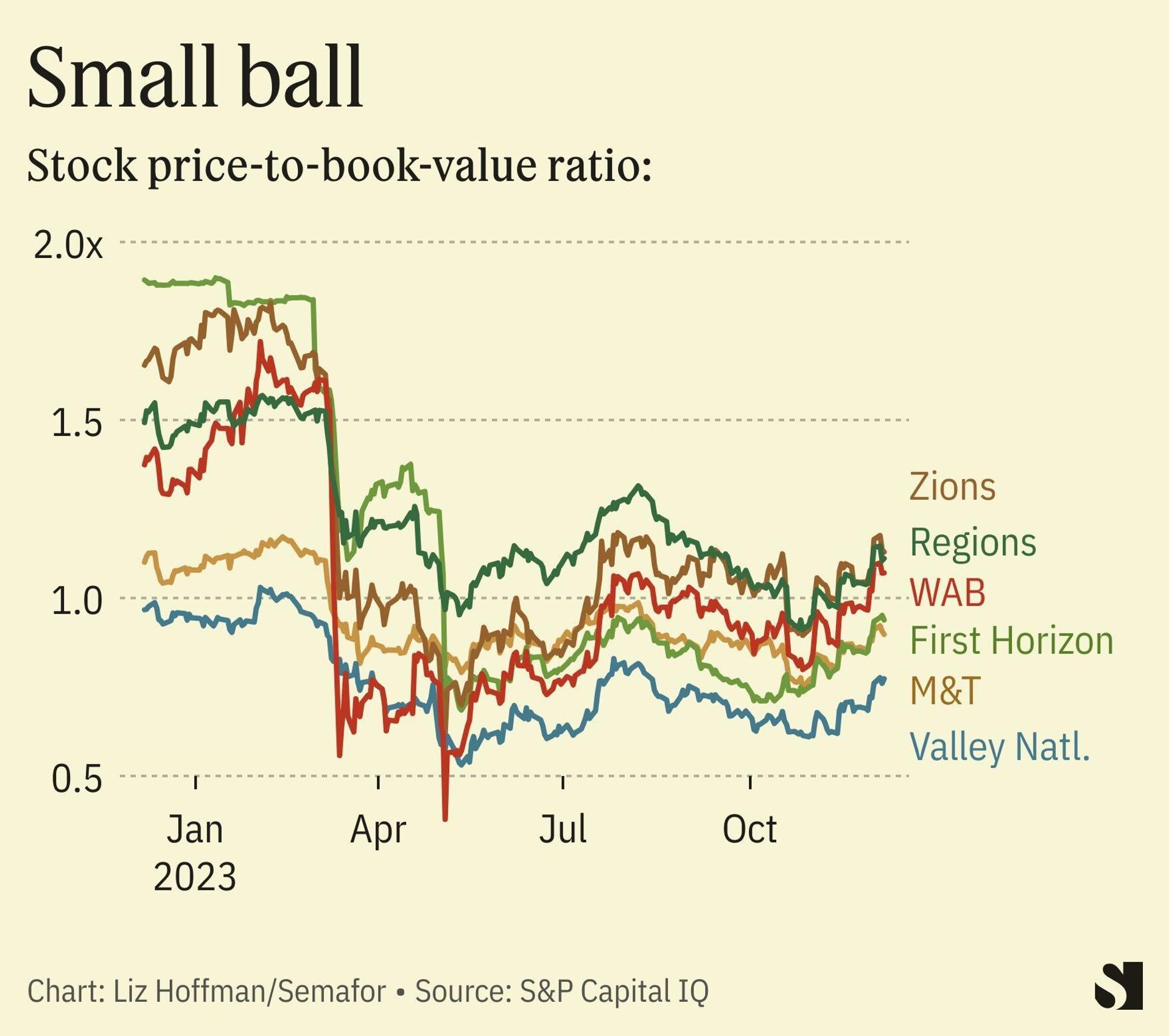

Regional banks, including those making their pitches to investors at the Goldman Sachs-hosted conference in New York, are still limping along. Their stocks are 25% lower than before SVB failed. Deposits are the raw material of banking; the biggest ones are still getting them cheaply, while bruised regional lenders are having to pay up, which crimps their profits.

“There’s an earnings problem,” Citizens Bank CEO Bruce Van Saun told me. His $225 billion bank wasn’t in existential danger this spring, but now trades at 60% of book value. Customers have returned, but at a cost; Citizens’ interest paid on deposits has risen from less than $200 million in the first quarter to $900 million in the third.

Speaking of smaller lenders, he said: “the P&L is going to be upside-down for a while, so you won’t be able to do a whole lot in terms of making loans or growing the bank.” He called them “walking zombies.” (Stay tuned for my full interview with Van Saun.)

That’s put regulators in an uncomfortable position, having essentially swept smaller banks into the “too big to fail” category but gaining little for their efforts. It’s reflected clearly — and I think fairly — in the criticism coming from the CEOs in Washington, too.

Industry complaints are a dime a dozen, and generally get little traction, particularly under watchdogs whose heads, like the Fed’s top cop, Michael Barr, were appointed by Democratic presidents.

But this one — formally, and somewhat ominously, called Basel III Endgame for reasons that aren’t worth getting into — seems different. It feels like a solution in search of a problem, at least when it comes to the largest lenders, which not only weren’t part of the problem in the spring but were actively part of the fix.

Fed Chair Jerome Powell voted in favor of the Basel proposal but voiced skepticism early on, and has been aggressively (in Fedspeak, anyway) hinting that it’s likely to be reworked. “We expect a lot of comments,” he said in November, “and we’ll take them seriously… I’ll say we’re a consensus-driven organization. We’ll come to a package that has broad support on the board.”

The View From Michael Barr

The Fed’s vice chair of supervision is surprised by the industry pushback to Basel, too, but not impressed, particularly by the TV ads airing during NFL games.

“Extremely unusual,” he said, and likened them to the unintelligible sounds adults would make in “Peanuts” cartoons.

Notable

- Bank of America’s Brian Moynihan: “To do the exact same activities that you did yesterday, you have to get a higher return. That will be borne by the customer base.”