The News

SoftBank will invest $100 billion in the US, Donald Trump announced yesterday at Mar-a-Lago with CEO Masayoshi Son at his side. That’s double the $50 billion Son pledged after Trump’s 2016 win, pumping billions of dollars in startup investments that fueled the late 2010s Silicon Valley bubble.

“I say, ‘President Trump is a double-down president, so I’m going to have to double down,’” Son said at Monday’s press conference. “That’s my confidence level.” (Trump asked Son on the spot yesterday to double down again to $200 billion. Son said he would try.)

Trump has been burned before by companies making big, job-creating promises. Foxconn’s planned $10 billion factory in Wisconsin, which was kicked off by a shovel-wielding Trump in 2018, has been dramatically scaled back. Son helped broker that deal and accompanied Trump to the ground-breaking.

In this article:

Know More

Son was, in Trump’s telling, the first CEO to visit him after his 2016 win, but he has plenty of company this time around. Meta, Amazon, AI firm Perplexity and OpenAI founder Sam Altman have each pledged $1 million to Trump’s inaugural committee. And executives including Apple’s Tim Cook, Amazon’s Jeff Bezos, TikTok’s Shou Zi Chew, and Alphabet’s Sundar Pichai have or are expected to meet with Trump at Mar-a-Lago. “The first term, everybody was fighting me,” Trump said at Monday’s news conference. “In this term, everybody wants to be my friend.”

Trump has been burned before by companies making big, job-creating promises. Foxconn’s planned $10 billion factory in Wisconsin, which was kicked off by a shovel-wielding Trump in 2018, has been dramatically scaled back. Son helped broker that deal and accompanied Trump to the ground-breaking.

Liz’s view

SoftBank doesn’t have $100 billion on hand, but assembling giant pools of other people’s money is Son’s specialty. He got half of the Vision Fund’s $100 billion from Middle East governments and funded his dealmaking for years by mortgaging SoftBank’s stake in Alibaba to generate cash. The cornerstone of his telecom and technology empire — the 2006 purchase of Vodafone Japan — was done almost entirely with borrowed money. He has that in common with Trump, who has proudly dubbed himself the “King of debt.”

Semafor reported in October that SoftBank had discussed a partnership of at least $20 billion with Apollo to invest in data centers and other AI infrastructure. Those talks appear to have cooled, but expect Son to tap his global network to make good on his promise to Trump.

I asked Alok Sama, one of Son’s former top deputies at SoftBank, whether his old boss was good for the money. “With SoftBank’s current cash and leverage capacity, perhaps with investment partners, absolutely,” said Sama, whose recent book about his time at the company dives deep into Son’s love of financial alchemy.

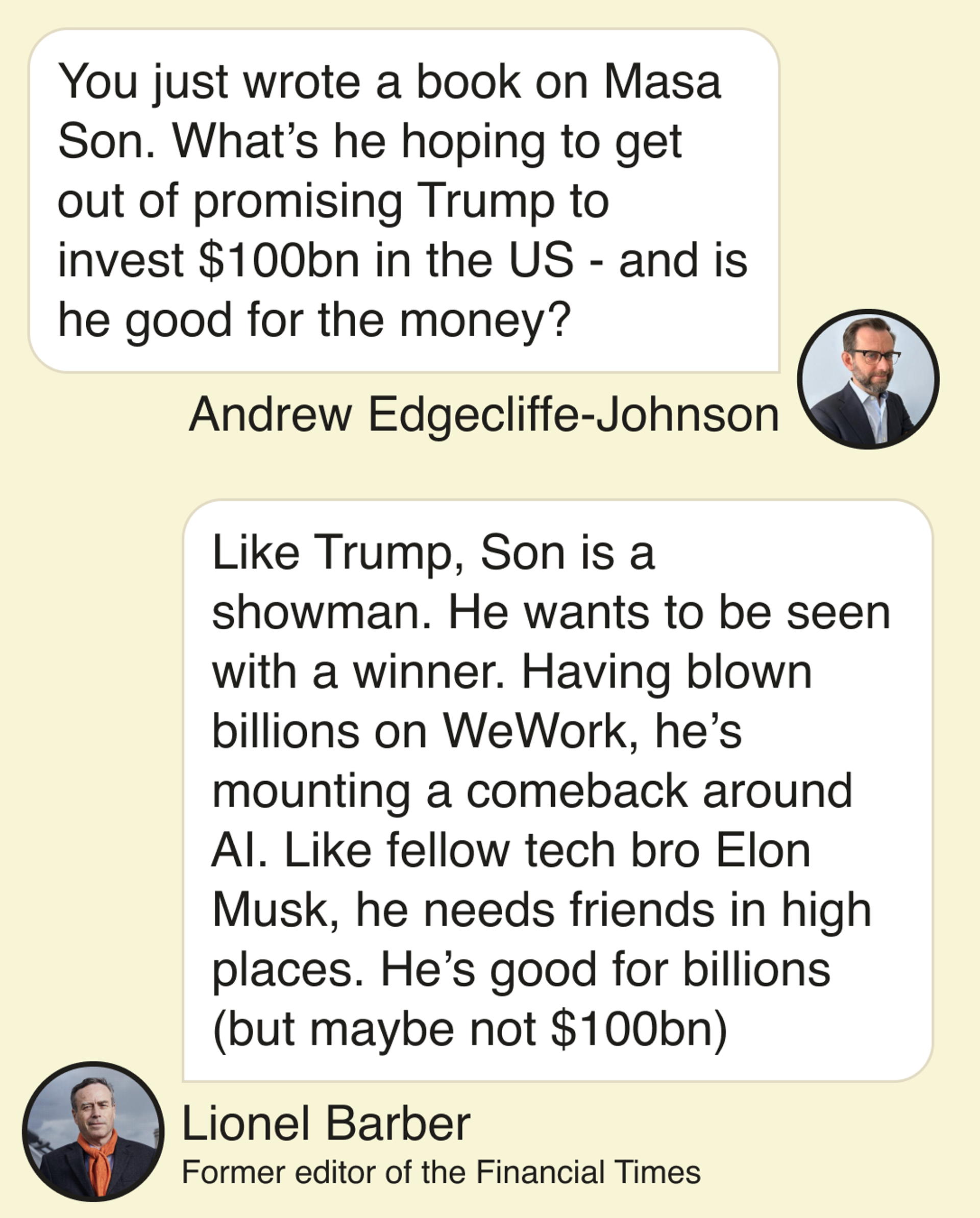

The View From Lionel Barber

Lionel Barber is the former editor of the Financial Times (and Andrew Edgecliffe-Johnson’s former boss). ‘Gambling Man,’ his book on SoftBank founder Masayoshi Son, will be published on Jan. 21 by One Signal.