The News

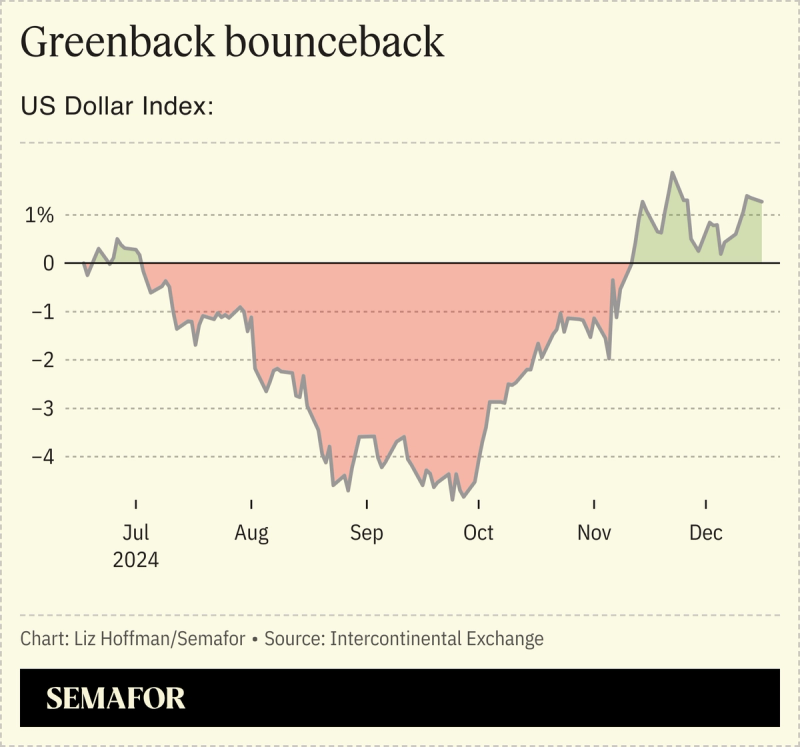

The US dollar has regained almost all the ground it lost against a basket of global currencies since Donald Trump threatened sanctions on any countries that backed away from it.

His comments were aimed at Brazil, Russia, India, China, and South Africa, a loose coalition known as the BRICS that, for more than a decade, has been taking steps to build a global financial system that doesn’t revolve around the dollar.

In this article:

Know More

It’s been a decade since the group launched its own development bank, a competitor to the World Bank, and collectively set up a $100 billion bailout fund. But talk of a common currency hasn’t gone far, and most of its members are facing their own domestic economic problems that an alternative to the Western financial order would do little to help, said Joe Brusuelas, global economist at accounting and advisory firm RSM.

“We’re 10 years into this idea and there’s still no there there,” Brusuelas said.

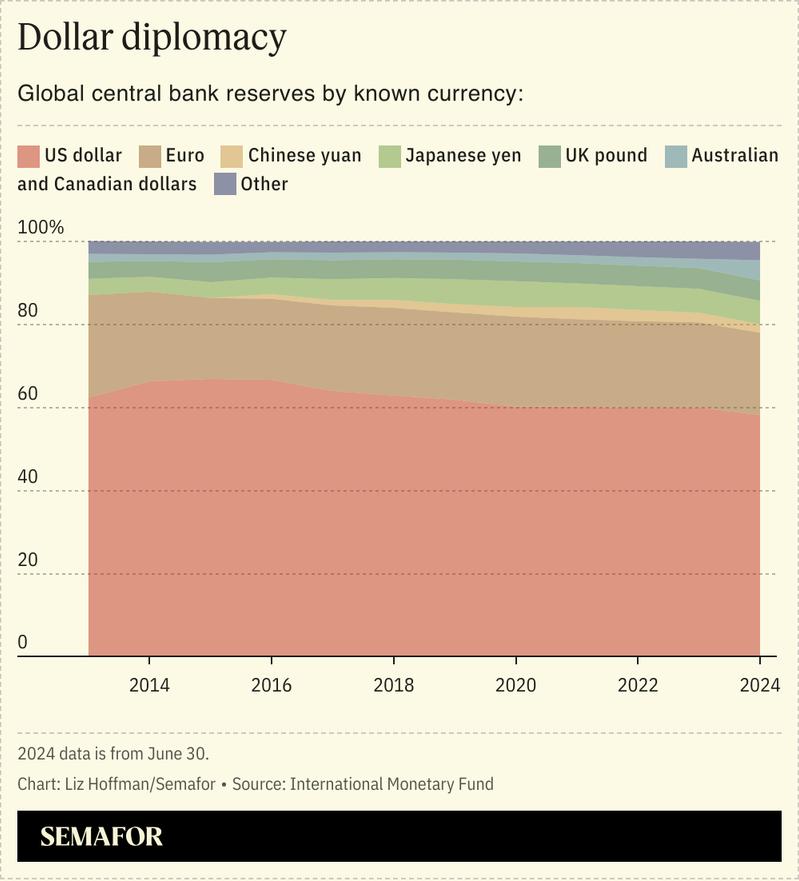

The dollar accounts for 58% of foreign exchange reserves, and while that’s down slightly in recent years, the slack has been picked up by allied currencies like the Japanese yen and British pound. Chinese renminbi has actually fallen to 2.1% of reserves from a peak of 2.8% in 2022 — despite Beijing shoveling its currency into developing economies in Asia, Africa, and Latin America through central-bank swap lines.

“The dollar is a trusted instrument, if sometimes not well liked,” Brusuelas said. Hopes among emerging economies for an alternative are “more aspiration than reality.”

Room for Disagreement

The IMF notes that countries that might be dumping dollars are also likely not to report their holdings of foreign reserves to the organization, which doesn’t have visibility into about one quarter of all global currency reserves.