The News

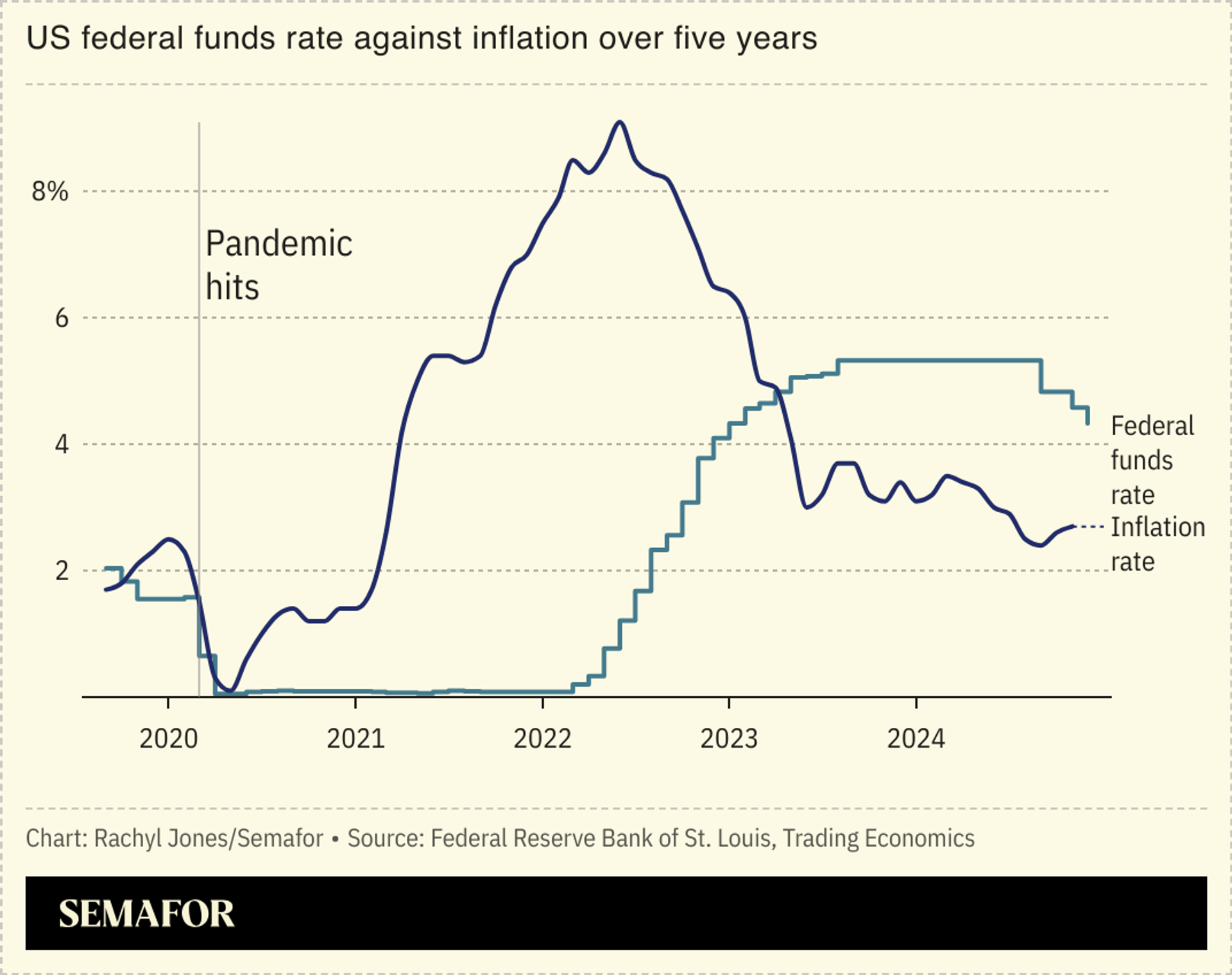

The US Federal Reserve trimmed its key interest rate for the third time this year with a 0.25 percentage point cut Wednesday. Economists and Wall Street traders had largely expected the move, despite concerns that a rate cut could stoke inflation after a recent uptick.

“Today was a closer call,” Fed chair Jerome Powell told reporters at a press conference Wednesday. Lowering rates too quickly could undermine the Fed’s progress on taming inflation since it peaked at 9.1% in 2022, while pausing cuts could further weaken the labor market, he said: “We see the risks as two-sided.”

Central bank officials reined in their projections for 2025, indicating fewer cuts than previously stated. Economists are largely betting that the central bank will pause rate cuts in January and continue to reduce the rate at subsequent meetings.

Know More

US President-elect Donald Trump has proposed policies — including sweeping tariffs on foreign-made goods and mass deportations of migrant workers — that could send prices soaring and undue a lot of the central bank’s work to curb inflation. The Fed won’t preemptively change rates based on those policy promises, however.

“We don’t know what the timing and substance of any policy changes will be,” Powell said following the central bank’s previous rate cut in November. “We therefore don’t know what the effects on the economy would be.”

Eleven members voted to lower interest rates, while one preferred to maintain the existing range.