The News

Japanese automakers Honda and Nissan are exploring a merger as a form of self-defense from the growing dominance of rival Chinese car firms.

Discussions were accelerated after Foxconn approached Nissan about acquiring a stake in the company, and Renault SA — which owns 36% of Nissan — will also have a say in any deal, Bloomberg reported.

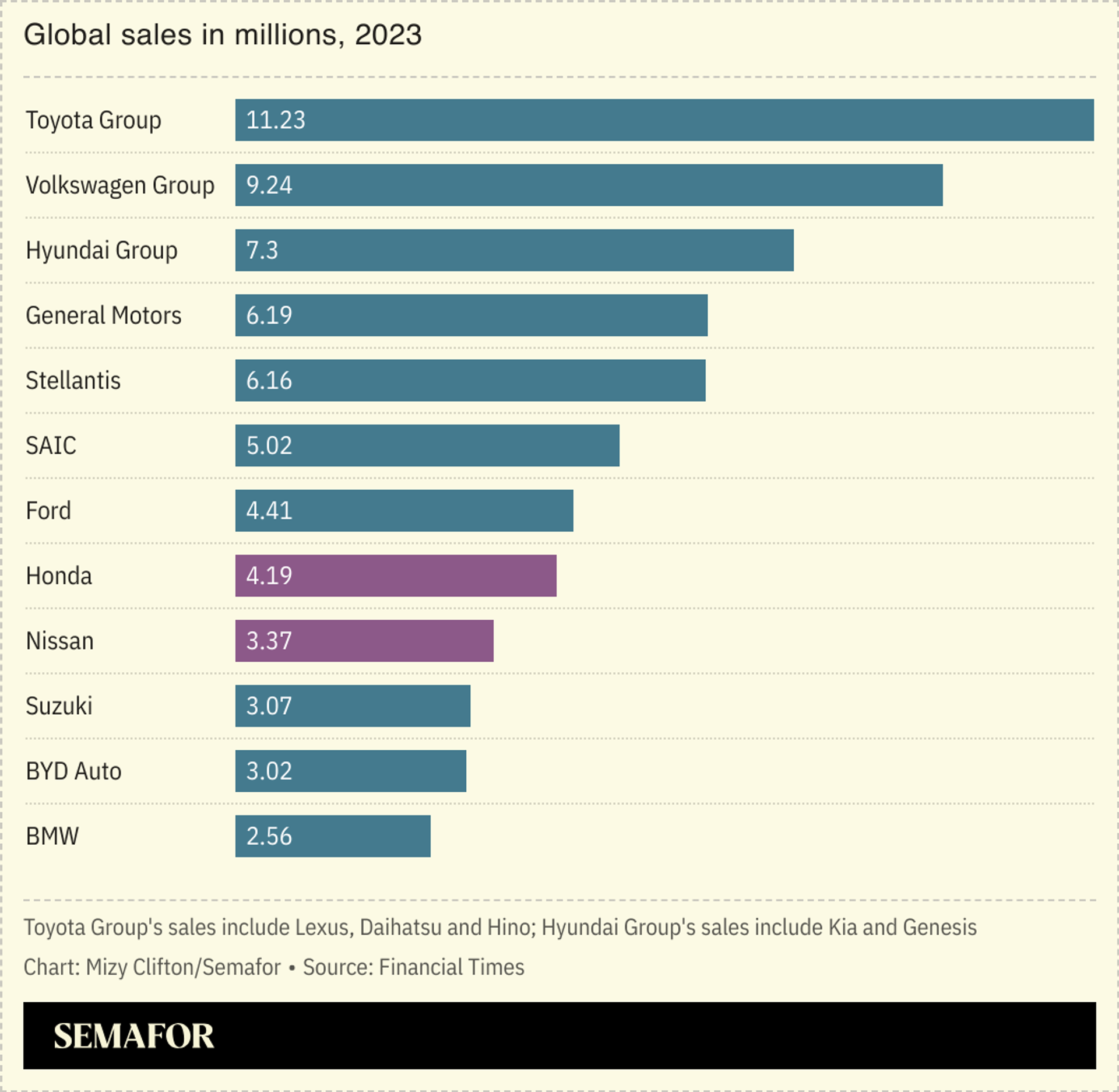

The mammoth agreement — which could also include Mitsubishi Motors, Nikkei reported — would create the world’s third-largest auto company, girding the Japanese market against China’s fast-growing electric-vehicle manufacturers, which are eating into legacy firms’ footprint in Asia and elsewhere.

SIGNALS

Emphasis on drivers’ digital experience boosts tech companies

Chinese telecoms giant Huawei has invested at least $5.6 billion in research on EVs, the Financial Times noted. The fact that tech firms can so rapidly grow their footprint in the car industry puts the incumbents under “even more pressure,” a China business expert told the outlet. The quality of digital experience, rather than driveability, is often what distinguishes one manufacturer’s car from another, TechRadar’s EV correspondent argued: “Bottom line is, cars are becoming increasingly like your phone, tablet or laptop, whether you agree with it or not,” he wrote. Japanese firms have tended to prioritise hardware over software, which has made it harder for them to innovate on EVs that appeal to consumers, The Economist noted.

Japan comes late to the EV race

Southeast Asia has long been the stronghold of legacy brands like Toyota and Honda, but between 2019-2024, Japanese automakers suffered the biggest market share losses of any carmaker in China, Singapore, Thailand, Malaysia, and Indonesia, according to a Bloomberg analysis. Part of the reason is that Japanese brands have been more reluctant to bet on electric vehicles — a strategy that has paid off in North America, where demand for EVs has dropped — but is “costing them dearly” in China and other Asian markets, the outlet noted: Global EV sales reached 14.1 million units between January and October this year, with 69% of those in China, The Guardian reported.