The News

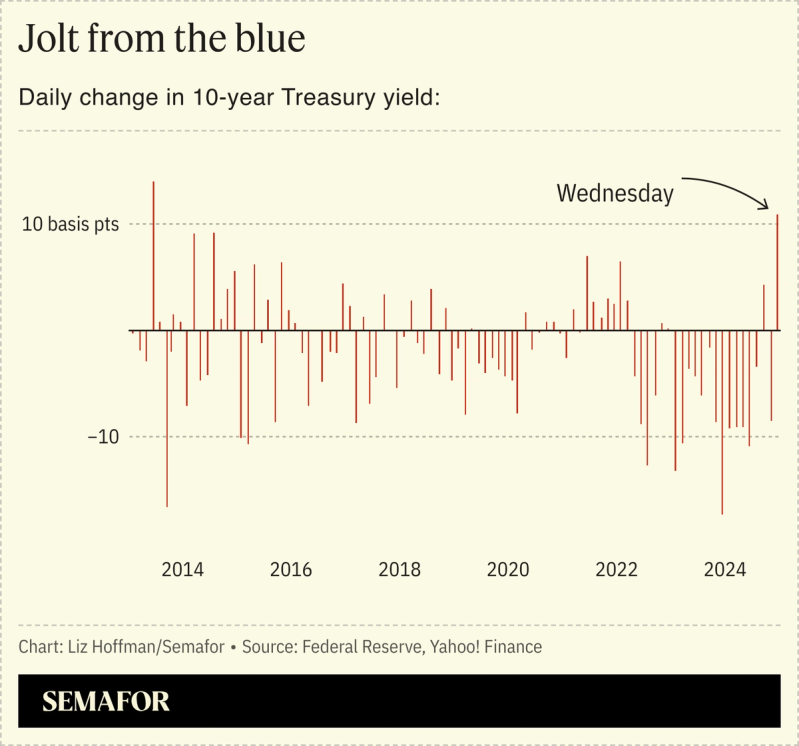

It wasn’t just stock investors who reacted negatively to Wednesday’s Fed interest-rate cut.

US government bond yields had their biggest one-day jump since the “taper tantrum” of 2013, when the Fed said it would gradually reduce its economic support.

Liz’s view

Rates were low then and are high now, but the signal was the same: Investors shouldn’t expect easy money anytime soon.

Fed Chair Jay Powell was just a new member of the central bank’s board back in 2013 and a decisive voice in favor of the move. “We’ve got to jump,” he told his colleagues, according to transcripts later published by the Fed. “There is no risk-free path.”

The same is true now as the economy continues to run hot, as seen in this week’s retail sales data, and Donald Trump (who picked Powell as Fed chair in 2018) is floating immigration and tariff policies that analysts say would fuel inflation.