| In this edition, we analyze the state of play at US Steel, more intel on Intel, and Hulu’s life with͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Welcome back to Semafor Business.

Nick Clegg’s exit as Meta’s policy chief, scooped last week by Semafor, makes more sense in light of two developments this week. The company added Trump adviser and cage-fighting executive Dana White to its board, then announced it would stop fact-checking social-media posts, a practice Clegg championed.

Meta is early and theatrical in its rightward turn as Republicans take over Washington, but it won’t be alone. And while companies may face criticism for MAGA shifts, the business case is probably stronger than it was for the equally theatrical progressive shift these companies made in the late 2010s. The argument then, sort of, was that diversity produces the best talent. The actual reason was that their employees and customers were pushing them leftward in the wake of #MeToo and George Floyd’s murder.

Now Trump is poised to give companies things they want, like less regulation and visas for high-skilled workers, and the broader mood has shifted.

Occam’s Razor offers another theory: Mark Zuckerberg remade his board once, switching out Ken Chenault, Erskine Bowles, and a few other blue-chip graybeards he’d sparred with. White and Zuck are friends from the latter’s martial-arts days. Boards are less clubby than they used to be — and Zuck’s controlling stock means he needs fewer friendly directors than most CEOs — but all things being equal, executives would rather have supportive voices in the boardroom than nags.

Meta’s board now includes two close allies of Trump in White and Marc Andreessen, at least six billionaires, and its lead independent director — on paper, the biggest check on Zuck’s power — is 77-year-old former Treasury official Robert Kimmitt.

In today’s edition: The state of play at US Steel, a Brookfield exec wants to succeed Trudeau, Intel’s intel, and Hulu’s life as a corporate football continues.

➚ BUY: Spin. Corporate spinoffs are outperforming the parents they leave behind, according to Bloomberg. That boosts an already strong case for breakups like those at Comcast and GE. ➘ SELL: Bottle. Liquor stocks are down after the US Surgeon General said alcohol is a leading cause of cancer. Companies like Diageo and AB InBev have been embracing booze-free spirits to keep up with younger consumers who don’t drink.  Sahiba Chawdhary/Reuters Sahiba Chawdhary/Reuters |

|

|

THE NEWS More than a year after its unsolicited bid kicked off a geopolitically fraught M&A battle, the US steel producer Cleveland-Cliffs remains interested in acquiring all or some of US Steel — but the bidding war it started has now driven the price beyond its reach, according to people familiar with the matter. The smaller Cleveland-Cliffs made a roughly $10 billion unsolicited cash-and-stock offer in 2023, putting the iconic Pittsburgh company in play and ultimately producing a better pitch from Nippon Steel. Last week, President Joe Biden blocked the $14 billion deal on national-security grounds. Nippon and US Steel then both sued the president, whose decision the companies say was influenced by politics, and Cleveland-Cliffs’ CEO Lourenco Goncalves, whom they accuse of colluding with steel union boss David McCall to undermine the sale. US Steel shares have held steady, suggesting that investors think Goncalves will make another bid. But at roughly $33 a share in Monday trading, US Steel remains too pricey for Cleveland-Cliffs, which has a market value of around $4.9 billion, to make an offer with a standard deal premium, the people said. |

|

Yesterday’s big media deal adds another branch to a complicated family tree at Hulu, which has one of the strangest corporate ownership journeys in recent memory. The company has had seven partial owners since its launch in 2007. Media companies bought in and out and merged, with their Hulu stakes tagging along. The latest deal, which will merge Hulu’s live-TV business (but not its flagship streaming service) with sports-focused Fubo, will make eight. |

|

Fed Governor Michelle Bowman is a leading candidate to replace Michael Barr, the Federal Reserve’s top cop on Wall Street, who announced he’s stepping down yesterday, according to people familiar with the matter. Bowman, who was nominated to the Fed’s board in 2018, has become a prominent conservative voice and a renegade in a central bank that strives for consensus: In September, she became the first Fed governor to vote against an interest-rate decision since 2005. |

|

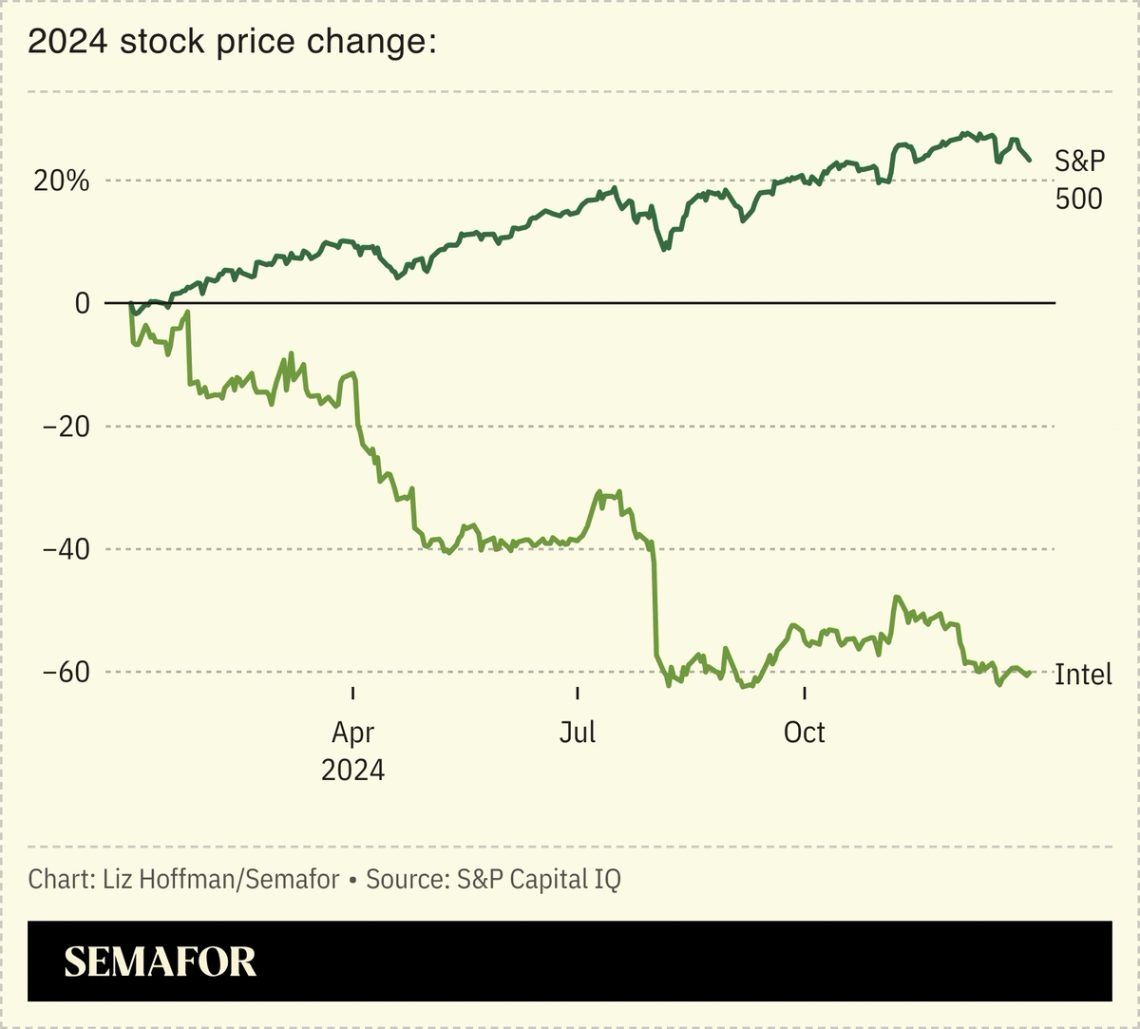

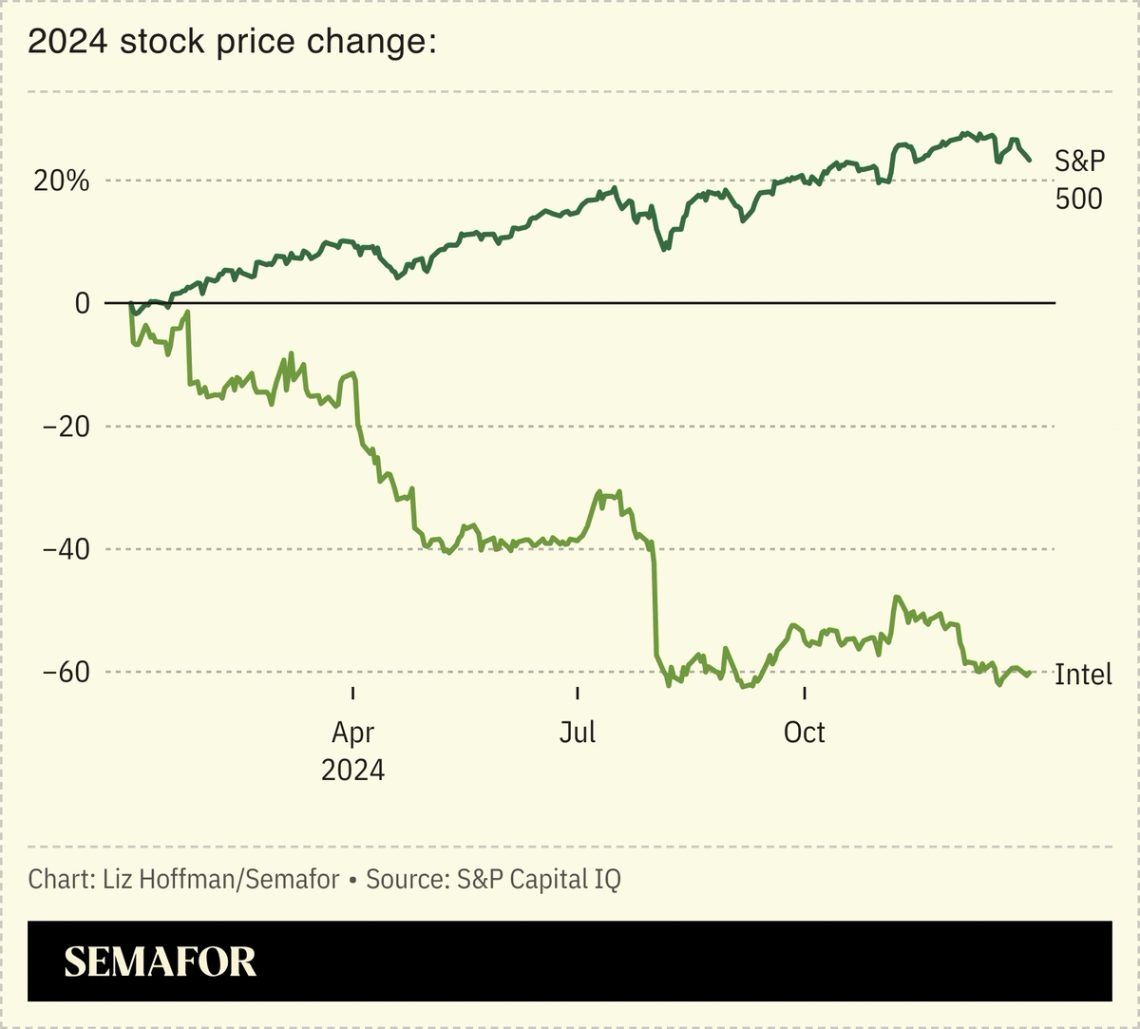

Today is the last day for displeased Intel shareholders — and the company has plenty of them after its annus horribilis — to nominate directors to its board. With about 12 hours to go, Intel hasn’t received any notices from activist investors that they plan to do so, according to a person familiar with the situation. Several firms, including Chris Hohn’s TCI, did deep dives on Intel in recent months, whether surveying the broader landscape or focusing specifically on the chipmaker, people familiar with the matter said. While the stock is cheap and the chance to influence the company’s search for a new CEO is tempting, there’s little an activist investor could do here that Intel hasn’t already done to itself. In just the past six months, Intel fired its CEO, launched a strategic review, added two new directors, and lost one. |

|

Introducing The CEO Signal from Semafor Business, an exclusive, invitation-only membership for chief executives of the world’s largest companies. Helmed by veteran Financial Times editor Andrew Edgecliffe-Johnson, the initiative builds on the success of Liz Hoffman’s Semafor Business and sets a new standard for how global leaders connect, learn, and navigate future challenges. Focusing on exclusivity over scale, the platform will debut as a weekly briefing in January 2025 offering candid, practical insights and interviews tailored for global CEOs who are short on time and seeking actionable intelligence. |

|

Jeenah Moon/Reuters Jeenah Moon/ReutersMark Carney, a senior executive at Canadian asset-management giant Brookfield, said he’s considering throwing his hat into the ring to replace Prime Minister Justin Trudeau. Carney was governor at the Bank of England and the Bank of Canada, and has never made a secret of his political ambitions — a rarity among central bankers, who tend to be a wonkish bunch. His candidacy would likely be welcomed in corporate Canada, where Trudeau’s higher taxes and heavier regulation have never been popular. True, Carney browbeat global financial firms as the United Nation’s point man on climate change, but as one of their own — he spent 13 years at Goldman Sachs and is a Davos Man to the core — he has a credibility Trudeau never did. (Those banks and asset managers, successfully browbeaten by Carney at ESG’s peak, have almost all dropped out of the initiative, with JPMorgan becoming the latest today.) The power vacuum in Ottawa comes at a perilous moment for an economy already facing slow growth and Donald Trump’s threatened tariffs. And Trudeau’s replacement faces a tough election later this year against Conservative rival Pierre Poilievre, a Covid skeptic whose populist, anti-government message has been signal-boosted by Musk in recent days. |

|

Marco Bello/Reuters Marco Bello/ReutersThe director and producer Brett Ratner will direct a documentary about First Lady Melania Trump for Amazon, the studio confirmed to Semafor’s Ben Smith. Ratner had been forced out of Hollywood at the peak of the #MeToo movement. The move is both a warm embrace by the e-commerce giant for the incoming administration and a dramatic return for Ratner. |

|