| In today’s edition, we take the pulse of the annual confab and why the consensus there is usually wr͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi (again, I’m sorry) from Davos, where the mood is noticeably glum.

“There are three reasons Trump’s not going to be president, and the first is that everyone here thinks he’s going to be president again,” Anthony Scaramucci, the former Trump aide turned critic, told Semafor’s Ben Smith this week. The U.S. presidential election officially kicked off the same day as the World Economic Forum and was a constant topic of conversation for attendees from all over the world.

But the Mooch’s comments are relevant beyond the Republican primaries now underway. The consensus that is now hardening in the frosty Alps is almost always wrong. The Davos crowd missed the 2008 economic meltdown and 2018 economic slowdown, and left both Trump and Brexit off its 96-page Global Risk Report in 2016. The 2020 conference remains one of the most absurd gatherings of human beings in history, willfully ignorant of the documented spread of the coronavirus.

I wrote a little about altitude-inspired groupthink on Tuesday, and that’s certainly to blame for some of Davos’ dismal track record. But as I wrote last year: “Davos isn’t biased in favor of being wrong, it’s biased in favor of being optimistic and, to a large degree, globalist.” Today’s CEOs grew up in a world that was steadily opening up, creating a virtuous feedback loop between lower-case liberalism and economic progress.

The world has taken some very illiberal turns, and that recency bias is wearing off, or at least being updated by newer inputs. Thus the gloom. History suggests that’s misplaced, but I agree with them.

We’ll be back to regularly scheduled programming next week — along with some news about our growing team. Until then, auf wiedersehen.

➚ BUY: Incumbents. Flows into newly approved bitcoin ETFs have favored old-line giants, with BlackRock and Fidelity raking in two-thirds of investors’ money so far. ➘ SELL: Mavericks. A U.S. judge sided with antitrust regulators and blocked JetBlue’s merger with Spirit, ruling that the deal would turn a low-cost challenger into a card-carrying member of the oligopoly.  Nicolas Economou/NurPhoto via Getty Images Nicolas Economou/NurPhoto via Getty Images |

|

Welcome back, Athens: Greece threw itself a party in Davos to celebrate its return to investment-grade status. The country’s economy is now growing at twice the eurozone average, youth unemployment is down by nearly half since 2021, and its budget deficits are shrinking.  In 2009, Greece’s years of fiscal mismanagement sparked a continent-wide debt crisis, years of austerity, and helped the rise of political populism and nationalism that has repeatedly threatened the stability of the eurozone. With S&P’s upgrade last month, the country is out of junk status for the first time since 2011. “The first time I came to Davos in 2020, I had a really tough time making the case for investing in Greece,” Prime Minister Kyriakos Mitsotakis said Thursday. “Now the case is much easier.” |

|

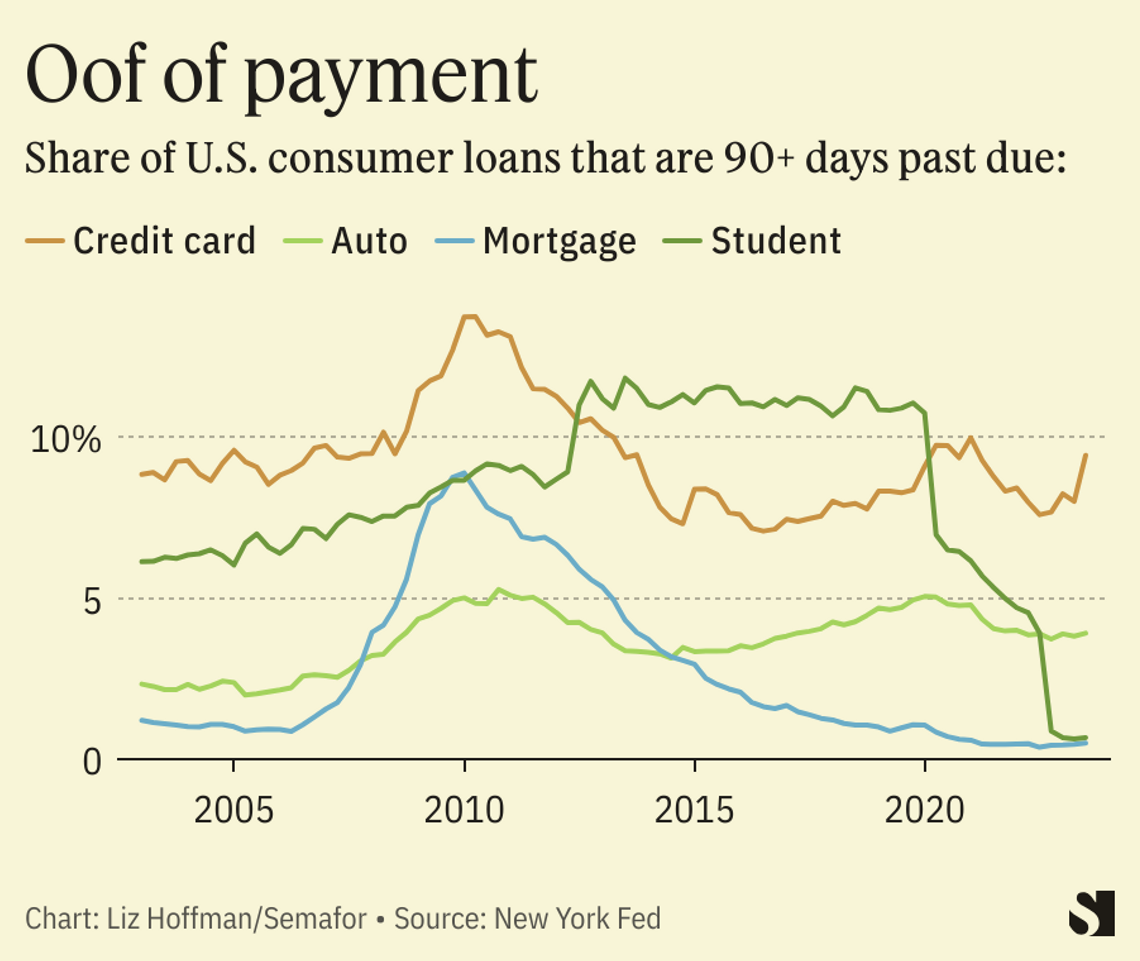

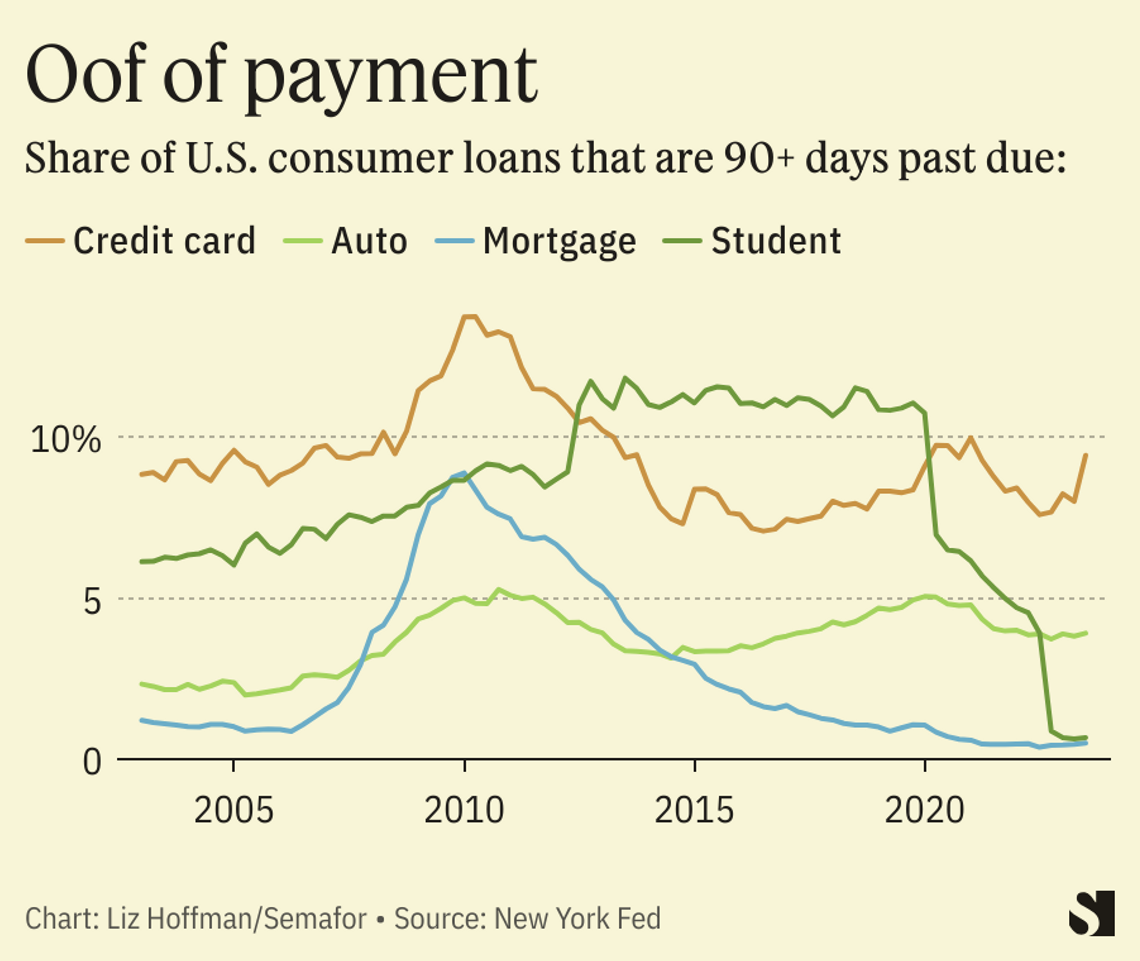

PIN cushion: Bad loans are piling up at Discover, which is down 11% after disclosing that it has set aside almost $2 billion in loss reserves. Discover can be a coal-mine canary because its borrowers tend to have lower credit scores and higher levels of debt. About one-fifth of its credit-card loans are to subprime borrowers, who are facing interest rates that are “over the top, out of control, off the hook right now,” one economist warned last month. With most student loan payments up in the air pending new Biden administration rules, credit cards are the main source of worry over consumer debt levels that have been rising steadily for a decade. Not so fast, fashion: China’s powerful internet regulator has launched a security review of how low-cost clothier Shein handles customers’ and suppliers’ data. The probe could stall the company’s planned U.S. listing, which is already being complicated by political blowback and an oppo-research campaign being quietly nudged along by competitors. Printer jam: HP is being sued — again — by customers for blocking third-party ink. The suit claims that software upgrades that disable printers if non-HP (and, often, cheaper) cartridges are installed is monopolistic. It’s the latest front in corporate subscription envy: By locking consumers into walled-garden delivery plans, HP squeezes more money from each of them. For now, the company is just dealing with angry customers, but this is the kind of corporate move that could attract the attention of Biden’s antitrust regulators. “It’s important to protect our IP,” CEO Enrique Lores told CNBC this morning. |

|