| In today’s edition, the World Economic Forum kicks off as President Trump executes orders in rapid f͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi from Davos, where both the air and the crowd feel a bit thin this year.

The World Economic Forum is in full swing and while I promise not to flood you with stories about parties you weren’t at, Davos remains — for now — a place to take the pulse of the global business community.

Peter Goodman popularized the moniker “Davos Man” in his book of the same name, describing them as “so enriched by globalization and so native to its workings that they were effectively stateless, their interests and wealth flowing across borders, their estates and yachts sprinkled across continents.”

Conspicuous consumption aside, Davos Man is a product of 20th-century liberalism. Today’s CEOs, investors, and policymakers came up in a world that was getting more connected. Countries became economic blocs — EU, ASEAN, EMEA, LATAM, CIS — that became markets to sell sneakers and soft drinks and financial advice.

That world has fractured quickly. Not too long ago, Davos was where you went to tout diversity initiatives and climate pledges. This year’s agenda is scrubbed of DEI language, and the USA House is a star-spangled cabana sponsored by a crypto venture.

The conference’s big draws in recent years have been Donald Trump and Javier Milei, populists who came to advertise their defiance. The All-In Pod, so influential in Republican circles, roundly mocked WEF from the ground last year with a musical number called “Oh Davos, Kumbaya.” Jamie Dimon admitted that Trump was essentially right on immigration, China, and tax reform.

WEF’s willingness to continue to elevate its critics credits it. But its theme this year — “Collaboration for an Intelligent Age” — suggests its worldview remains unchanged. Davos Men are changing. Can Davos?

In today’s edition: Goldman’s next gen rises, CEOs weigh in on Trump’s first day, and an M&A scoop to boot.

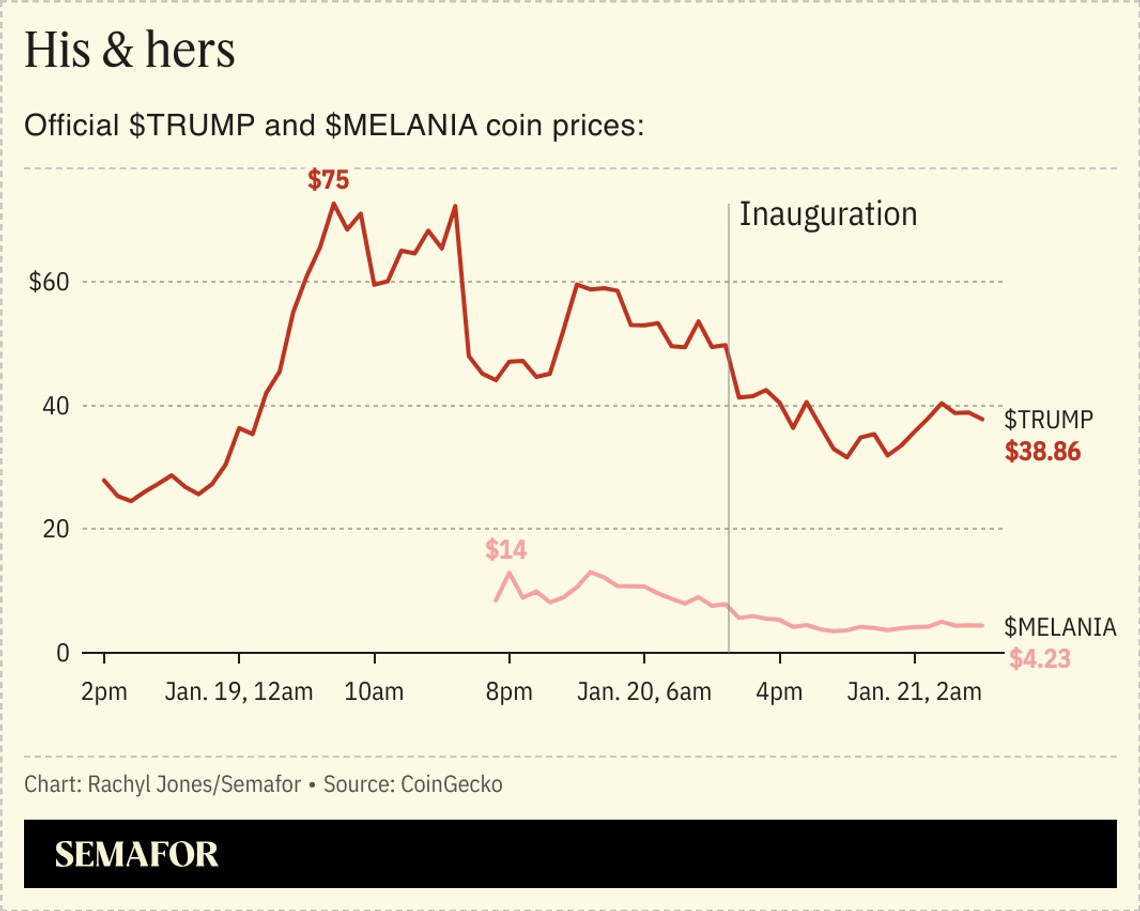

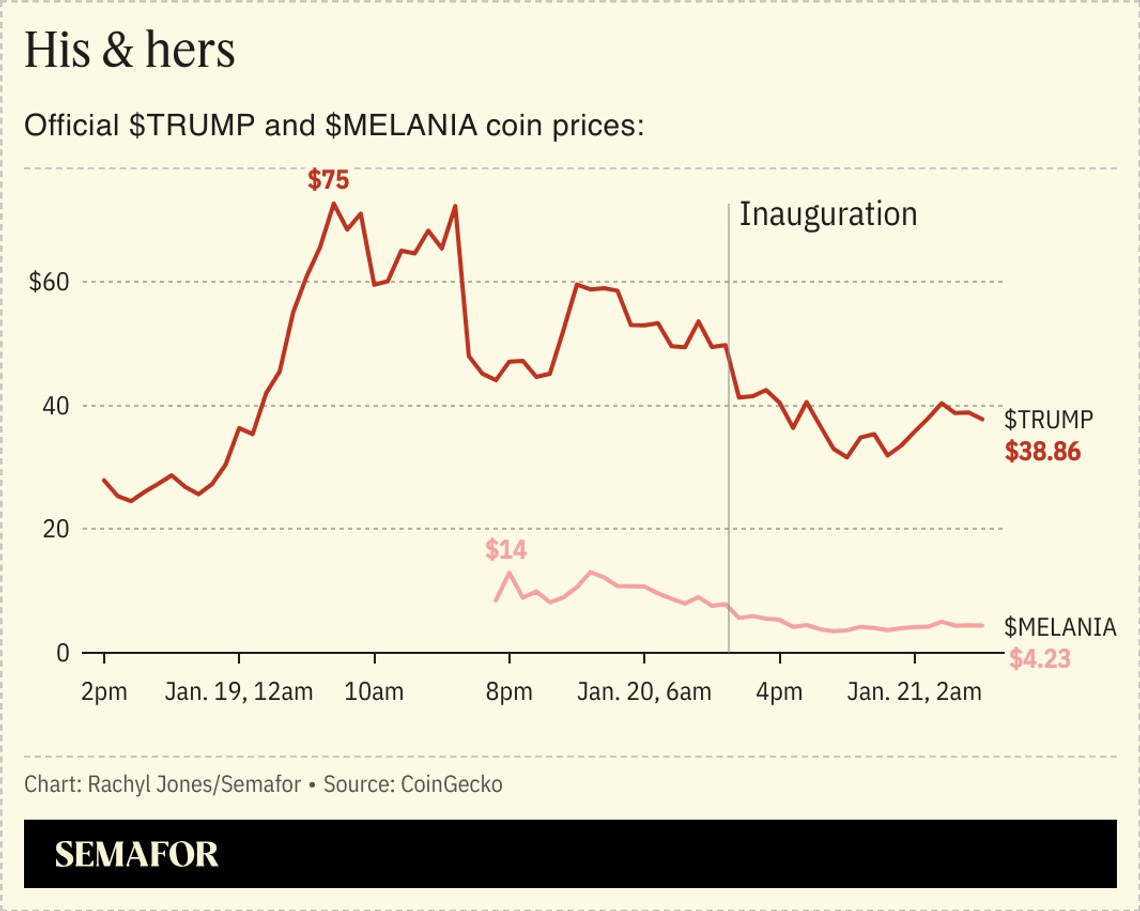

➚ BUY: Trump. The stock market — the President’s preferred measure of economic success — rose on his first day in office, when he dialed down his tariff talk. (More on his business agenda below.) ➘ SELL: $TRUMP. The president’s official memecoin briefly had a $10 billion market value before plummeting after he failed to mention crypto during his inaugural address. The First Lady’s own coin, which launched Sunday, also fell.  |

|

Willscot Holdings, a $6 billion maker of mobile offices (think cargo-container sized buildings that fill construction and industrial sites), has fielded takeover interest from private-equity, according to people familiar with the matter. At least one of those firms has hired bankers to sketch out a formal bid for the company, which, despite its sagging stock price (down 16% over the past year), is exposed to things PE likes: cash flow from leases and a secular boom in fixed investment. Willscot hasn’t put itself up for sale, but one ingredient for a potential transaction is already in place: an activist investor. Ben Pass’ TOMS Capital has a stake in the company. |

|

Carlos Barria/Reuters Carlos Barria/ReutersDonald Trump wasted no time getting down to business, with a raft of executive orders. He delayed tariffs against China but threatened levies of as much as 25% on goods from Canada and Mexico starting Feb. 1, which could violate the NAFTA 2.0 deal that Trump touted at Davos five years ago today. He also saved TikTok from an immediate ban, declared a national emergency to boost US oil and gas production, and dropped Biden’s pro-EV policies —though Semafor’s Tim McDonnell notes these moves could actually help Elon Musk’s Tesla out. The actions will be met with legal challenges while corporate lawyers will have a billing bonanza combing through the fine print. While tariffs are worrisome, most of Trump’s first-day actions will be cheered by executives who relish that America is now open for, and to, business. |

|

Mark Stockwell/Reuters Mark Stockwell/ReutersGoldman Sachs promoted 15 people to its management committee today, a move meant to placate a cadre of executives made restless by a lack of senior rank movement in recent years. It might do that, but it’s sure to rankle others, and it’s a reminder that a quarter-century after Goldman went public — and six years into the tenure of CEO David Solomon, who moved to corporatize it — the firm still carries DNA from its days as Wall Street’s last private partnership. Goldman was once controlled by a powerful committee of partners who ran its various divisions. When it went public in 1999, it replaced its managing partner with then-CEO Hank Paulson, but kept the management committee as a nod to its past. “MC,” as it’s known inside the firm, functioned for a while as a kitchen cabinet, advising Paulson and Lloyd Blankfein in his early days. After 2008, it became a way for the bank to signal to regulators its contrition and virtue by adding risk officers and accountants. At one point, by my memory, a third of its members didn’t run a revenue-producing division. Eventually its most important function was simply existing: CEOs could signal executives on the rise by giving them a seat. When Solomon took over in 2018, he thought about whittling down the 30-person committee to key decision makers (for which, read moneymakers). Ultimately, he diluted its influence by making it bigger and its regular Monday meetings became largely performative. Today’s promotions, along with two last week, will expand the group to more than 40 people. It will likely further weaken it. It’s also a reminder that, as Matt Levine often says, a lot of corporate management comes down to seating charts. |

|

Brendan McDermid/Reuters Brendan McDermid/ReutersThe Federal Reserve relies on time-tested economic datasets like unemployment and inflation figures to make decisions about interest rates. But one Fed official warned that those signposts are starting “to become more muddled,” leaving the central bank without the benefit of precedent as it weighs whether to slow its pace of rate cuts. Chicago Fed President Austan Goolsbee told Semafor that new tariffs promised by Trump or geopolitical instability could cause, for example, energy or steel prices to spike — a temporary inflation shock that wouldn’t necessarily require a response. “We’re going to be in the business of trying to figure out which part of the inflation number we should respond to,” he said. “So I do feel like the job in the near term is going to be a little foggier.” |

|

Nathan Howard/Reuters Nathan Howard/ReutersJoe Biden’s White House homeland security team urged Trump’s team to focus on a number of major threats that include Iran’s plots against dissidents and current and former US officials, Semafor’s Morgan Chalfant scooped. Liz Sherwood-Randall, Biden’s top homeland security adviser, briefed the incoming Trump team headed by Stephen Miller on seven top priorities. |

|