| Trump’s victory in New Hampshire is already putting a chill on the energy transition.͏ ͏ ͏ ͏ ͏ ͏ |

| Tim McDonnell |

|

Hi everyone, welcome back to Net Zero.

Big Oil is entering its “cousin Greg” phase.

That’s how Jesse Armstrong, the writer of HBO hit Succession, put it when he compared Shell to his show’s spineless suck-up who sues Greenpeace for defamation. Shell is also suing the group (in real life) over damages allegedly caused by protestors on an oil platform. And this week, the company got a new ally in its Goliath-vs-David campaign against climate activists, as ExxonMobil sued a group of shareholders to block a proposal they filed to force the company to strengthen its climate targets.

Like cousin Greg, the companies might just be bad at reading the room. More likely, the suits signal a deeper shift in how these companies are confronting the energy transition. As my colleague Liz wrote yesterday, Exxon’s suit may mark the end of the ESG era: CEOs are tired of being micromanaged on pesky things like climate change by a minority of shareholders. Even the pension funds of Democrat-led states that are otherwise progressive on climate change are often voting against climate-related shareholder resolutions, a Sierra Club report found this week. Exxon’s suit may also be a pre-emptive maneuver designed to set a precedent that would make it harder for activists to pursue similar proposals in the future when more investors are willing to sign on — which makes it look more like an act of desperation.

Either way, the companies have little to lose in the way of reputational standing with any climate-conscious customers, and are fending off numerous climate-related lawsuits of their own. We’ll see if their effort pans out any better than cousin Greg’s.

If you like what you’re reading, spread the word.

The World Today |  - Trump’s chilling effect

- Power emissions plummet

- Green steel deal

- Waiting for Redwood

- Drowning in cheap solar

Good news on cow farts, and bad news on fishing. |

|

MIKE SEGAR/Reuters MIKE SEGAR/ReutersDonald Trump’s victory in yesterday’s New Hampshire Republican presidential primary makes clear the stark choice on climate coming into view for voters: On one side, an incumbent president whose signature climate achievement — the Inflation Reduction Act — is doing more to accelerate the energy transition than any other U.S. policy against an opponent who continues to deny basic climate science and for whom “drill, baby, drill” is the cornerstone of his energy platform. Clean energy investors may be hoping for the former, but are already preparing for the latter. The renewables and climate-tech sectors “need to avoid magical thinking,” said Jim Kapsis, CEO of the Ad Hoc Group, a climate policy consulting firm. “If Trump is reelected there will be a clean energy reckoning in the first 100 days.” There’s little disagreement that the transition will happen sooner or later. But given the uncertain fate of IRA tax credits and other incentives, some investors are already tapping the brakes on new deals that could be put at risk. The U.S. is already behind the curve on the energy transition compared to China and Europe. So any speed bump will damage the country’s ability to catch up and could lead to significant economic — and climate — costs. “Short of banning renewables, a head of state has little ability to make serious inroads into the market forces driving their expansion,” Julie Gorte, senior vice president of sustainable investing at Impax Asset Management, told me. But “the risk of sharp valuation swings in the sector means we are unlikely to be adding to clean energy positions in the run up to November unless we see severe mispricing.” |

|

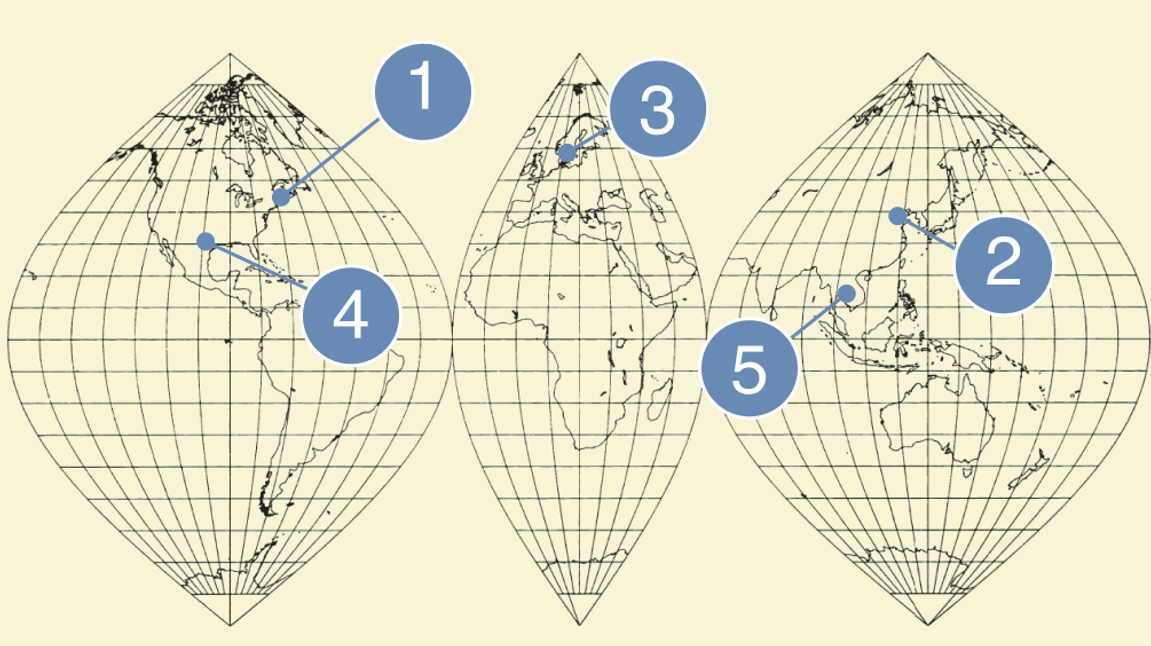

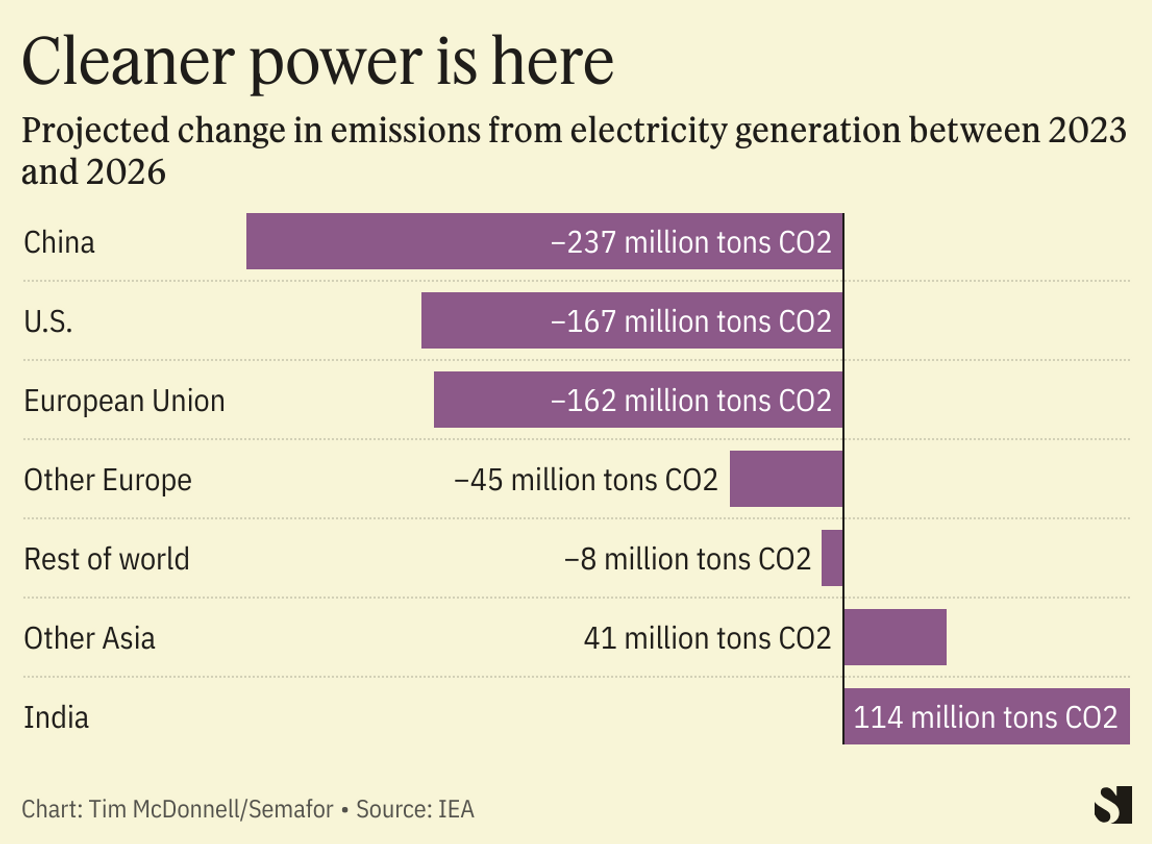

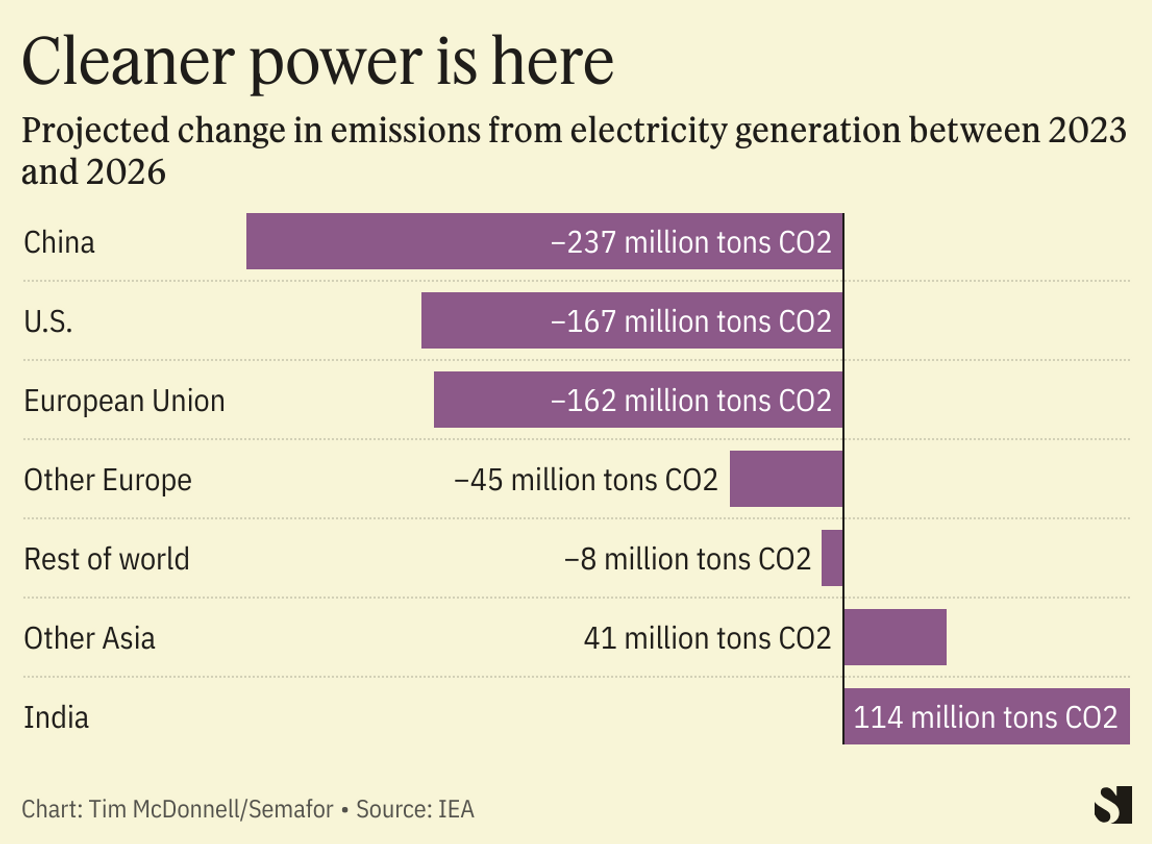

The growth of fossil fuel-powered electricity probably peaked in 2023, according to a new report from the International Energy Agency.  The report finds that global growth in electricity demand from now until 2026 will be matched by global additions of renewable energy, for the first time. Emissions from the power sector, in other words, are now on a structural decline even if global GDP increases. In some middle-income countries, such as India, rising demand still means more fossil fuels, and more emissions. But overall, renewables dominate, and will overtake coal in the global electric grid by 2025. |

|

Rendering via H2 Green Steel Rendering via H2 Green SteelA Swedish company secured $5 billion in debt financing to construct what will be the world’s largest green steel plant. H2 Green Steel will use wind and hydropower to make zero-carbon hydrogen, which it can use as a fuel to replace coal-fired blast furnaces for steelmaking. The company had already raised $1.6 billion in equity and is building its factory in Sweden. Europe is a prime market for green steel; as the EU phases in tariffs on high-carbon imported steel, low-carbon domestic steel will become much more competitive, and cut into a major, long-overlooked source of emissions. But the green steel revolution is still years away; the Swedish project will take until 2030 to reach a production volume equal to 0.25% of global steel demand. |

|

Median analyst forecast of Tesla’s earnings per share in the fourth quarter, according to Barron’s. That’s about 36% lower than a year ago, as Tesla, which was overtaken this month by China’s BYD as the world’s top EV maker, continues to slash its prices in an effort to retain market share. Tesla will report its earnings after the markets close today; its profit margins will be closely watched as an indication of what to expect in the year ahead. Investors are also sure to have questions about “Redwood,” a secretive new compact crossover model the company is reportedly developing for production starting next year. Crossover EVs have been a big hit for Hyundai and Kia, which may have Tesla playing catch-up. |

|

Carlos Barria/Reuters Carlos Barria/ReutersThe U.S. is drowning in low-cost solar panels from southeast Asia, causing a drastic cut in the amount of new domestic solar manufacturing capacity due to come online this year. Martin Pochtaruk, CEO of Canada-based solar manufacturer Heliene, was heartened last August when he heard that the U.S. Commerce Department had concluded his competitors in Vietnam, Cambodia, Malaysia, and Thailand were guilty of dodging anti-dumping tariffs and would have to pay up retroactively. The decision came at a good time for Heliene, which was finalizing plans to expand its assembly lines in the U.S. and Canada. But the administration has continued to keep the back payments on pause until at least June, out of concern they could choke off U.S. solar installations. In an interview, Pochtaruk said there’s essentially no point in trying to compete for now, and that he’s pushed off his expansions until at least the end of this year. Even when the tariffs kick in, he expects the market to be oversupplied well into 2025. His peers seem to agree: According to new BloombergNEF data, only about half of the 60 gigawatts of solar manufacturing capacity announced for the U.S. in 2024 is likely to actually get built. “Not a single project is going to be on time,” Pochtaruk said. “It’s easier to explain to your financiers why you’re holding your breath, than going blind and having to explain why you overspent money and have no return.” |

|

New energy- French oil major TotalEnergies committed to build two new offshore wind farms in northern Europe. The project, in conjunction with renewables developer European Energy, will be up and running by 2030 — barring any more of the power price shakeups that have tanked numerous offshore wind projects in the last year.

- Israel-based solar manufacturer SolarEdge laid off 16% of its workforce, including 500 factory jobs in Mexico, China, and elsewhere.

Finance- Climate activists sued the Dutch bank ING over its fossil fuel financing. The same activist group successfully sued Shell in 2021; its new lawsuit highlights the legal risk that financial institutions take when they commit to emissions targets.

- Guyana’s economy grew by more than 30% last year, driven largely by soaring oil production. It may soon be boosted by the sale of carbon credits. Georgetown estimates that its dense forests, which cover almost 85% of the country, could generate more than $3 million in revenue by the end of the decade. However some are hesitant of the scheme’s success, as most of the forest cover is in the mineral-rich region of Essequibo, which Venezuela claimed as its own in a much-questioned referendum last year.

Batteries & minerals- China has refocused its investments in Latin America towards sectors such as critical minerals, technology and renewable energy in a bid to challenge the U.S. and EU in crucial economic battlegrounds. Flagship investment projects include a new plant in Brazil for the world’s biggest EV maker, BYD, and the acquisition of lithium assets in Chile.

EVs- A $2-3 billion factory for electric truck batteries was announced in Mississippi. The factory is a joint project of Daimler Trucks, energy tech company Accelera, and truck maker PACCAR, and will focus on batteries for long-haul electric semi trucks. be operational by 2027.

- Beijing said it would rein in the expansion of the country’s EV sector in response to western criticism of the industrial policies that have made China’s manufacturers global leaders. Last year, the EU launched an investigation of suspected state-backed subsidies for China’s EV companies, which Brussels claims pose an existential threat to the manufacturing sectors of much of western Europe.

Food & agriculture- Bottom trawling, a fishing technique environmentalists have long opposed for its impact on sea life, is also a major emitter of CO2, new research published found. According to a report on Frontiers in Marine Science, trawling is responsible for about 370 million tons of CO2, more than twice the total amount the global fishing industry emits from burning fossil fuels.

|

|

Andy Jarvis, director of the Future of Food program at the Bezos Earth Fund.  |

|