| In today’s newsletter: Strategic retreats at Boeing and HSBC, and the real reason corporate America ͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business.

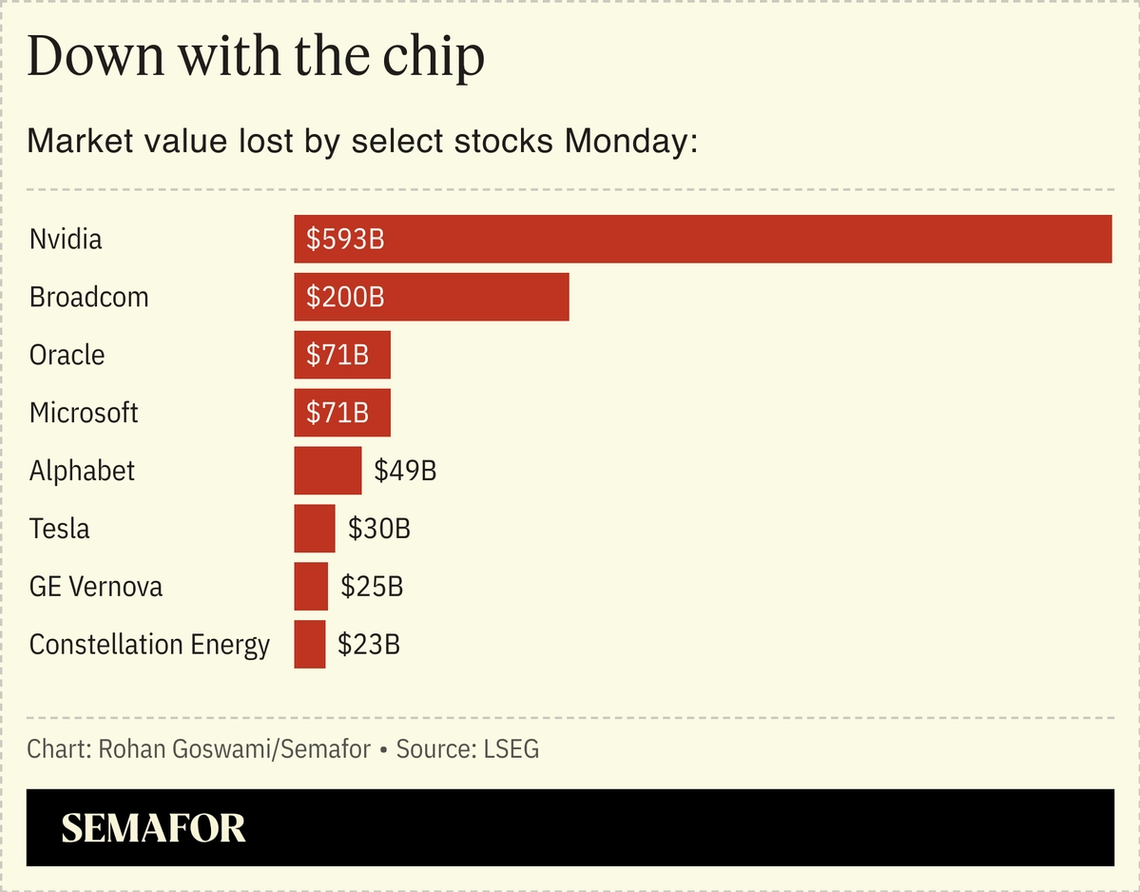

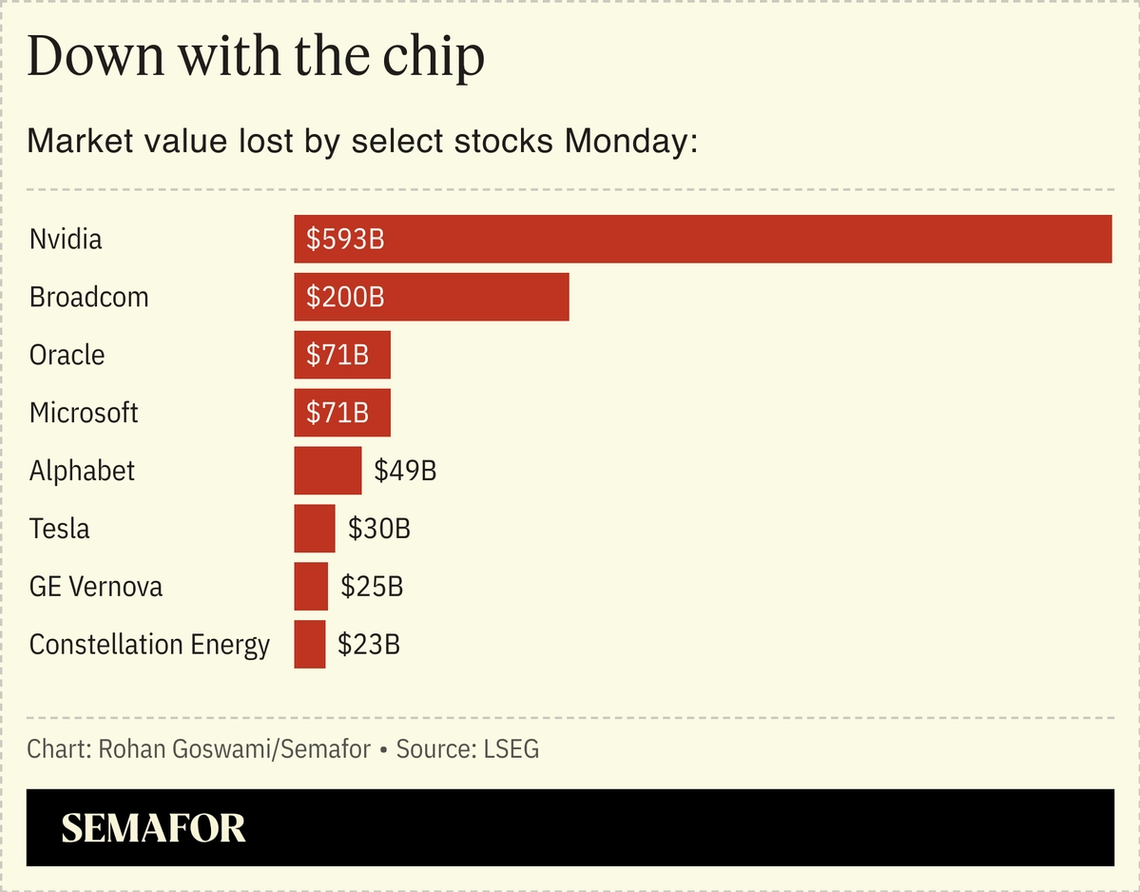

A technical breakthrough at a little-known Chinese AI startup continues to rip through global markets. More than $1 trillion in market value has been lost, most of it at Nvidia, after DeepSeek showed there might be a shortcut to superintelligence that doesn’t require buying billions of dollars of Nvidia’s chips.

I am obviously not an AI expert, and there are questions around DeepSeek’s technology and the geopolitical motivations at play.

But the losses, which also hit shares of electric utilities expected to power the AI revolution, are a reminder that moats can be shallower than they look. The entire US stock market hinges on a handful of companies whose fortunes depend on a technology that, so far, hasn’t made any real money or laid out a clear path to doing so.

We don’t yet know who the winners and losers will be. Apple, which has been criticized for stingy AI spending, may now look smart; its stock is up 7% this week. As the bear case for AI went from “it’s too expensive” to “it’s too cheap” overnight, investors may end up being right for the wrong reasons. There’s an argument that AI models will all end up being equally good and the race will come down to distribution. (A comparison might be AT&T vs. Verizon: Both provide good cell service in most places, so winning is more about availability and marketing.) Who knows?

A few things are clear: DeepSeek’s success challenges the American exceptionalism that’s in the air right now and complicates the “chip diplomacy” that has become key to US foreign policy. And Donald Trump’s nonchalance in the face of the market dive undercuts the theory — clung to across Wall Street — that his desire for stocks to go up will temper his actions.

In today’s newsletter: Strategic retreats at Boeing, HSBC, and Starboard. And the real reason corporate America disliked Biden, gleaned from 1,200 pages of government documents.

➚ BUY: Security blankets. CrowdStrike shares have now completely recovered from last year’s breach, which cost it $12.5 billion in market value. ➘ SELL: Moats. The realization that Nvidia’s may be shallower than it looks took $593 billion off its market cap and dragged down tech stocks everywhere.  |

|

| Rachyl Jones and Liz Hoffman |

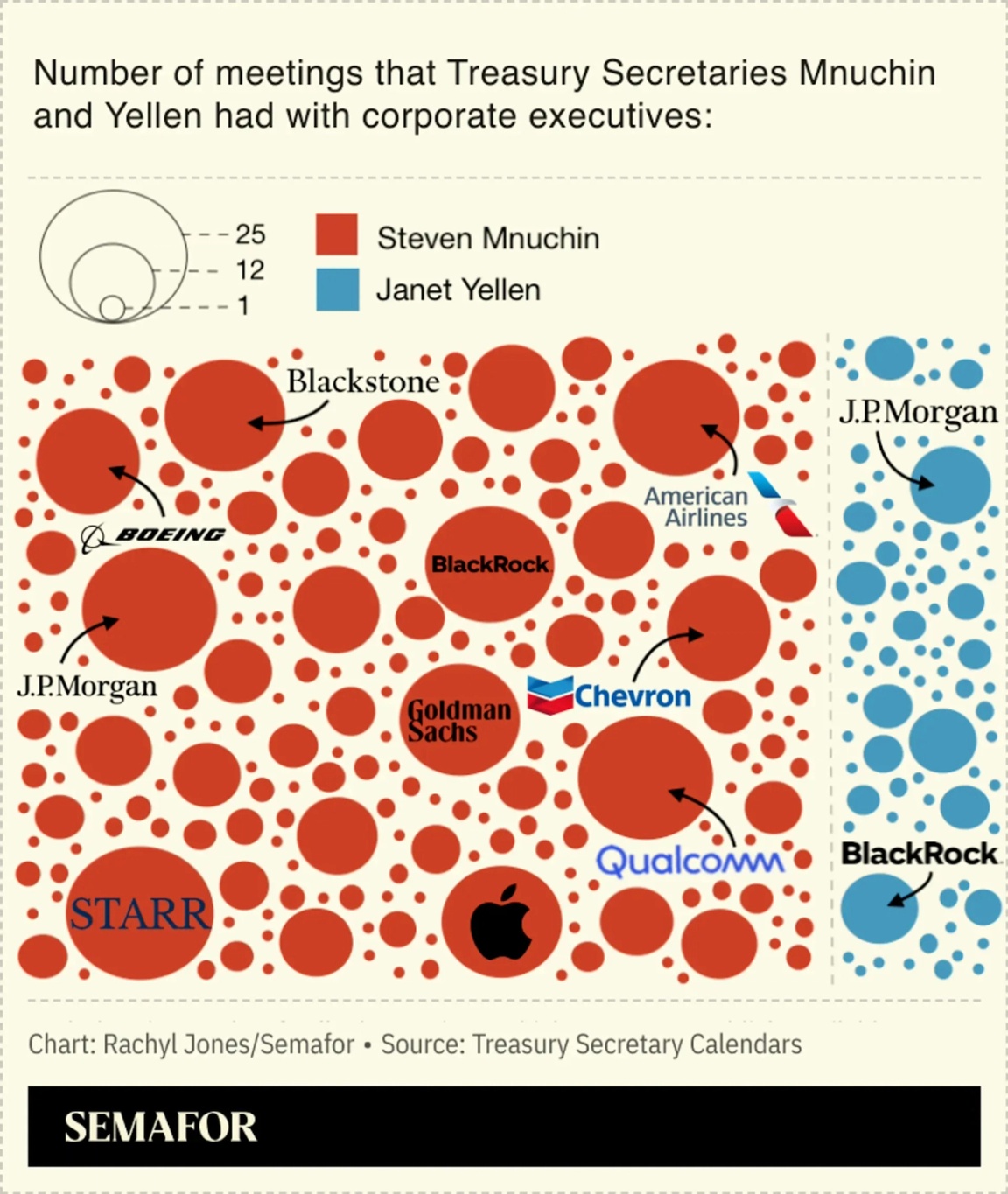

When CEOs called Biden, nobody picked up the phone |

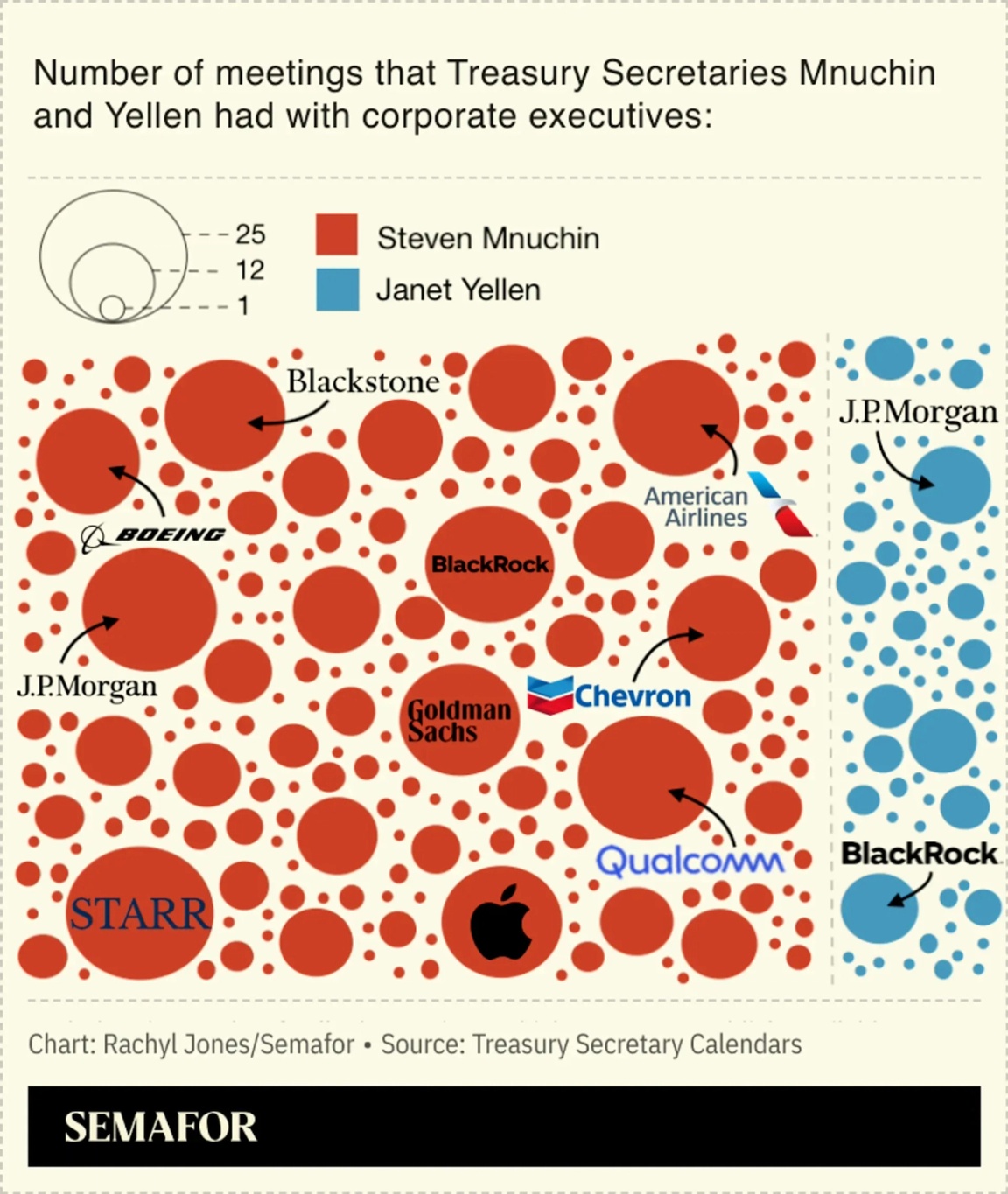

THE SCOOP The Biden administration dramatically curtailed meetings with corporate executives, a retreat that helps explain CEOs’ embrace of Donald Trump and enthusiasm for his appointees, according to a Semafor analysis of government data. Former Treasury Secretary Janet Yellen met with executives far less frequently than her predecessor under Trump, Steven Mnuchin, a review of public calendars shows. Excluding the final year of their respective tenures, when the pandemic saw Mnuchin in frequent touch with airline and bank CEOs, he logged three times as many meetings and official conversations with corporate executives as Yellen. Treasury’s public schedules are an imperfect but telling measure of an administration’s priorities. The secretary is a conduit to the private sector, whose market intelligence and investment plans can signal the direction of the economy.  The numbers undergird a deep tension between the business community and Biden administration that — even by Democratic standards — had relatively little interest in their input. And it helps explain the reception Trump has received from CEOs. Trump understands that business “has a dynamism that can overcome mountains,” Pfizer CEO Albert Bourla told Semafor. “He said, ‘I’ll put my money on you… on the private sector.’” Biden called Bourla a “good friend” in 2021 and championed the Covid vaccine that made Pfizer billions of dollars and helped cement Bourla’s legacy. But the CEO is now unsparing in his criticism of the former administration. “They were vicious to business. They were ideologically committed to hurt business,” he says. Among his list of complaints were terms in the Inflation Reduction Act that capped the prices of certain prescriptions and an “unacceptably” hostile antitrust regime. |

|

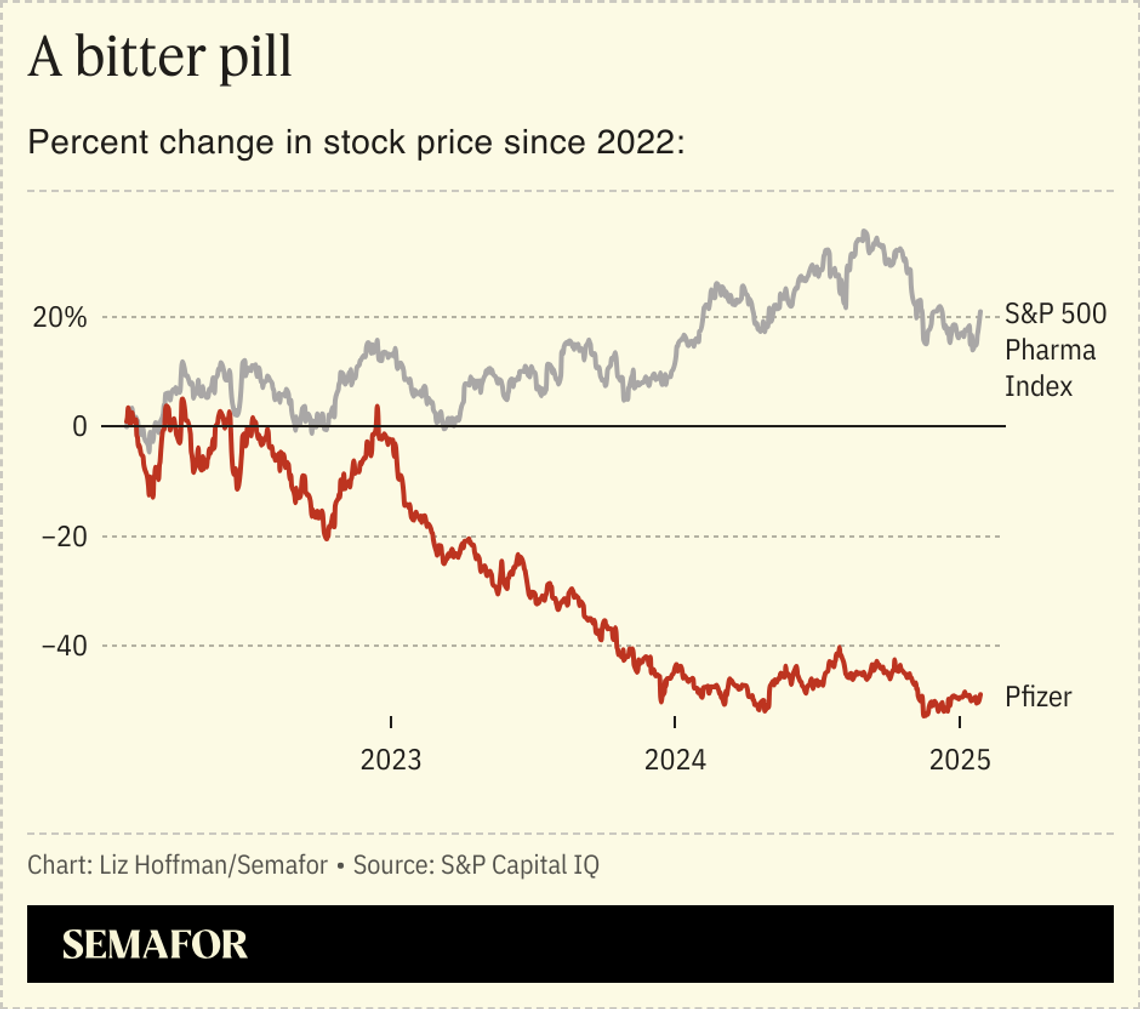

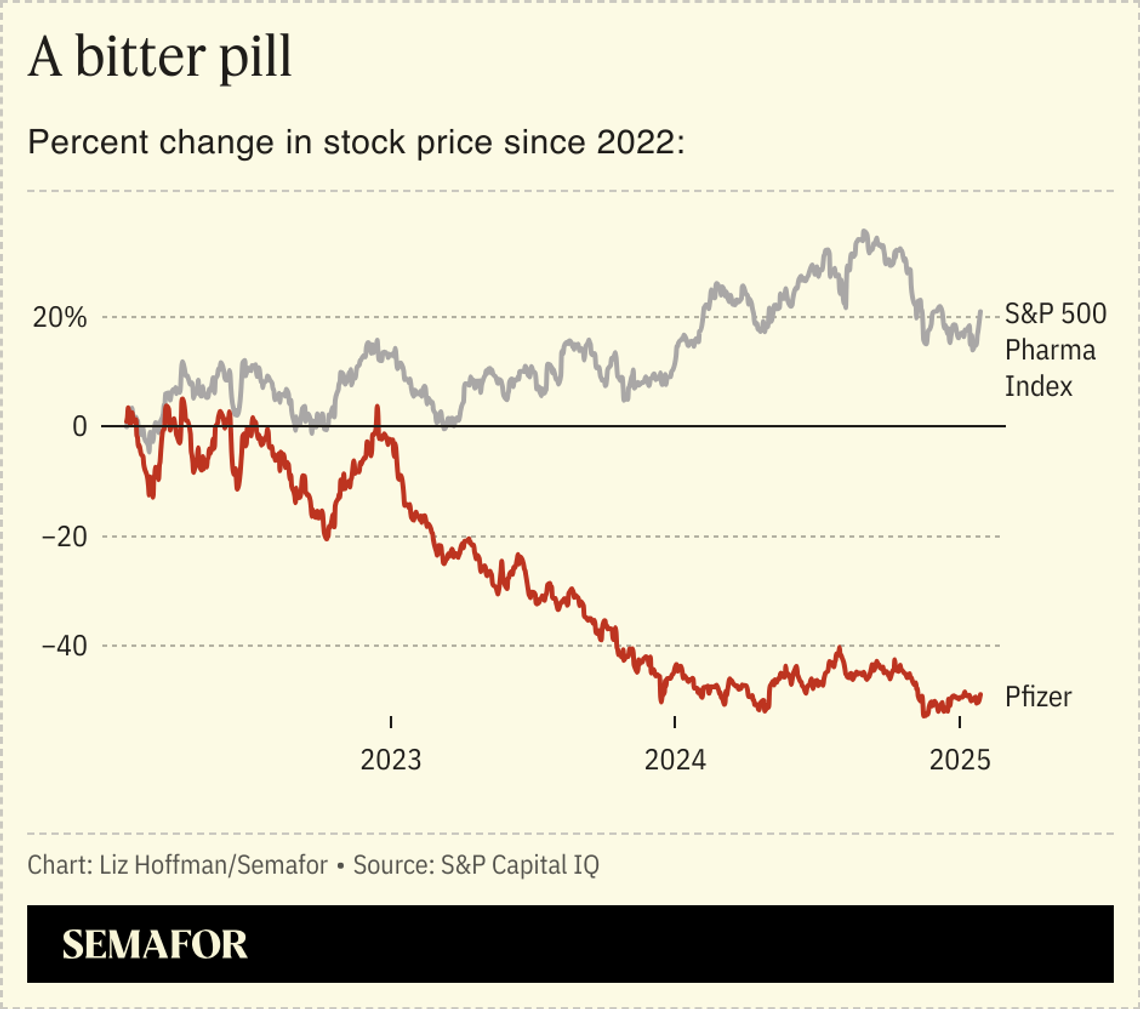

Activist investor Starboard is conceding its fight at Pfizer, seeing little chance of winning board seats or forcing a CEO change. The deadline to nominate candidates to Pfizer’s board passed over the weekend without Starboard notifying the company of its intent to do so, Semafor’s Rohan Goswami reported Monday.  So ends a campaign that stumbled out of the gate — Starboard’s side gave away its game plan in a fat-fingered email to Pfizer’s CEO himself — and failed to capitalize on the company’s underperforming stock price to rally investors. This may not be over: Starboard has run multi-year campaigns before, and the two sides met again earlier this month. |

|

With so many financial newsletters competing for attention, it’s hard to find one that makes sense of the market. That’s why more than one million savvy readers trust The Daily Upside for their daily dose of finance, economics, and investing insights. Created by Wall Street insiders, The Daily Upside delivers clear, actionable analysis — straight to your inbox. Subscribe for free today. |

|

Courtesy of Boeing Courtesy of BoeingBoeing plans to sell side businesses as its new CEO tries to pull the blue-chip icon out of a dive. Kelly Ortberg said today, when Boeing reported its sixth straight annual loss, that he would sell non-core divisions to refocus the company on its core commercial air travel. He wasn’t specific, but Boeing’s space business, which burned more than $5 billion in cash last year, and navigation-software arm Jeppesen are already said to be on the auction block. Those sales will feed a larger unbundling trend at America’s titans. Honeywell reports earnings next week and is preparing to announce a breakup under cordial but sustained pressure from activist hedge fund Elliott, people familiar with the matter said. Comcast hived off its groaning cable assets to focus on streaming, which prompted Warner Bros. Discovery to do the same. DirecTV dumped Dish. Private-equity firms are counting on corporate carveouts to revive a sluggish deals market. Longtime corporate exec Jim Barksdale observed that there were two ways companies made money: bundling and unbundling. The latter is in fashion now, and Boeing is getting on board. |

|

Georges Elhedery in 2017. Tom Arnold/Reuters. Georges Elhedery in 2017. Tom Arnold/Reuters.HSBC is mostly getting out of investment banking, joining a long line of lenders who’ve tried and failed to crack Wall Street. The bank’s new CEO, who took over in September, is axing IPO and M&A operations in the US, Europe, and Britain, acknowledging it can’t compete with American firms on their turf, or on its own. Commercial lenders have long tried to brute-force their way into lucrative dealmaking. Only JPMorgan has conclusively succeeded, chaining its huge balance sheet to sexier mandates like M&A. Wells Fargo is trying again. Deutsche Bank barrelled in during the late 1990s and spent two decades tilting at Wall Street’s elite before retreating in 2018. UBS, Barclays, and Citi have all made charges that either failed or stalled. Meanwhile, Wall Street giants like Goldman Sachs and Morgan Stanley have flirted with growing their lending businesses, but only half-heartedly. Big companies remain happy to get their money from one bank and their advice from another. |

|

Tyrone Siu/Reuters Tyrone Siu/ReutersLos Angeles Times owner Dr. Patrick Soon-Shiong has found his MAGA whisperer, reports Semafor’s Max Tani. According to a Times insider, Soon-Shiong has increasingly solicited advice from Eric Beach — a veteran of California GOP politics and the former head of Great America PAC — in the pharmaceutical billionaire’s quest to shape the newspaper’s internal culture and political leanings. Soon-Shiong also recently appointed pro-Trump CNN commentator Scott Jennings to an advisory role at the paper, Tani noted. |

|