| In today’s edition, we look at what the exit of Goldman’s trading chief, Jim Esposito, means for CEO͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business.

I’m down in Miami this week at the iConnections conference, where people with money wear one color badge and people who want the money wear a different color badge so they can identify each other by the pool.

One thing about attending hedge-fund conferences is that you run into a lot of people who used to work at Goldman Sachs, whose trading floor spun out some of the biggest shops on Wall Street. I was here yesterday when Jim Esposito, a senior Goldman executive, announced his departure, the latest in a string of future CEO candidates at the firm to walk.

Deciding, naturally, to start my reporting in the lobby of the Miami Beach Fontainebleau, I asked the obvious question: pushed or jumped? Every one of these Goldman alums, mostly of the mid-2000s vintage, assumed he was pushed. They can’t imagine anyone leaving the Goldman they worked at, especially someone with a line of sight to the CEO job.

My reporting in the real world, which is to say closer to 200 West Street, suggests a simpler story: David Solomon, having survived a very noisy 2023, isn’t going anywhere anytime soon, and the day-to-day job of running a highly regulated division at a highly regulated bank, and scraping for wallet share with clients who make a lot more money than you and stop working when the bell rings at 4 p.m., just isn’t as fun as it used to be.

More on the Goldman succession intrigue below as Wall Street’s favorite parlor game gets another spin.

Plus, a big test for private-equity fundraising, a look at the pandemic fade, and I text with KSL Capital Partners about private equity’s latest maneuver.

➚ BUY: Robot warriors. Details of Eric Schmidt’s drone-army startup, White Stork, are escaping the lab, and Wired has a deep dive on the unmanned war in Ukraine. Defense tech is having a moment — just don’t tell Stanford Business School. ➘ SELL: Robot vacuums. Amazon dropped its $1.4 billion deal for the maker of Roombas under antitrust scrutiny from Europe, a blow to its growing stable of home hardware that includes Ring doorbells and Eero routers. iRobot promptly laid off a third of its workers.  unsplash/Onur Binay unsplash/Onur Binay |

|

|

THE NEWS The buzz around the departure of Jim Esposito, who had run Goldman’s core Wall Street businesses of trading and dealmaking, is building just as the firm’s 400-odd partners head next week to Miami for their biannual retreat. LIZ’S VIEW Morgan Stanley just finished a picture-perfect CEO handoff. Jamie Dimon, fresh off his latest reshuffle, will have his pick of seasoned candidates to succeed him. The departure this week of Goldman’s trading chief, Jim Esposito, suggests a messier road ahead at 200 West Street. It clears one thing up: CEO David Solomon isn’t going anywhere soon. But it exposes a curiously weak bench at a place that’s seen as a magnet for talented and ambitious people. Esposito was a latecomer to the succession stakes — in 2018, he was sharing the title of chief operating officer of a trading-floor subdivision — and he never quite had the gravitas of a central-casting CEO. But he made himself a contender through shrewd internal politicking and good execution. Corporate unrest favors underdogs, and he rose quickly by putting a steady hand on Goldman’s mainstay businesses. (He convinced Solomon to merge them, a move that’s worked out pretty well and conveniently expanded his remit.) During his tenure, Goldman’s traders took the equities crown back from Morgan Stanley and led Wall Street in newer fixed-income products like portfolio trading and private-fund loans. His parting words suggest the decision to leave was his, and I’m told this is the rare corporate departure that looks like what it is: A CEO-in-waiting-in-waiting who got tired of waiting. Solomon survived a trying year, when restive partners and sniping alumni threatened his hold over the firm. But the noise was always louder outside 200 West than inside it, and quieter still in the boardroom. Solomon is sounding lately like a CEO firmly in control of the firm and his job, with a few years’ worth of plans. The job will be John Waldron’s if he stays long enough. But the depth chart falls off quickly. Marc Nachmann is a screw-tightening inside man. Ashok Varadhan is a floor trader at heart. Dan Dees, a well-liked banker, has spent his career in satellite offices. It will take time to replenish the ranks. |

|

Once more with feeling: Speaking of Goldman, the firm is out raising a new flagship private-equity fund, a key test for a business it’s trying hard to grow. Capital Partners IX is aiming for $12 billion, people familiar with the matter said, a jump from the $9.7 billion it raised two years ago for an earlier vintage. That’s a sizable ask in this fundraising environment, though Goldman can lean on its private bank clients, who typically contribute a quarter or more of its investment funds. After dabbling disastrously in consumer banking, the firm is counting on money management — in particular, high-fee private investment funds — to rev a stock price stuck in neutral. Goldman shares trade below both its banking peers and the investment firms it’s chasing. A spokeswoman declined to comment. |

|

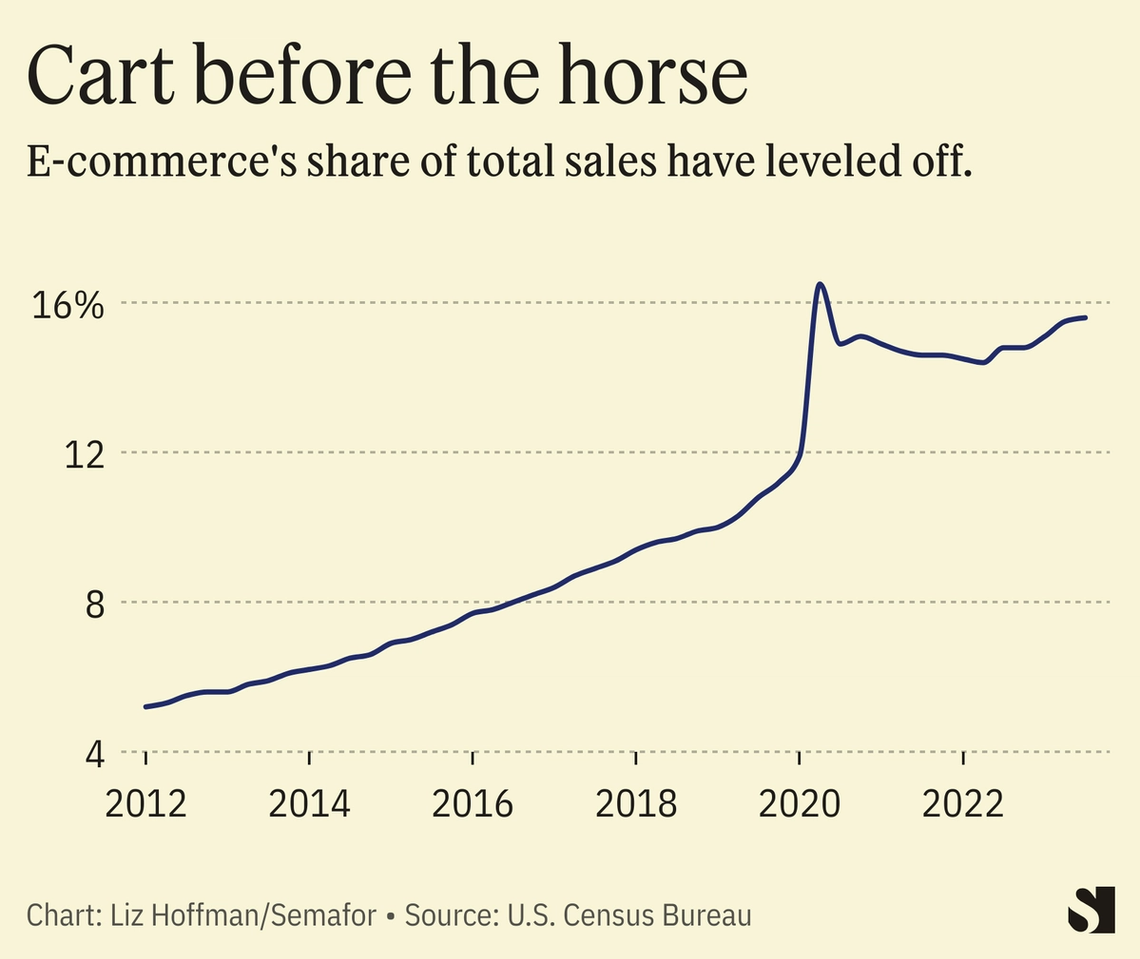

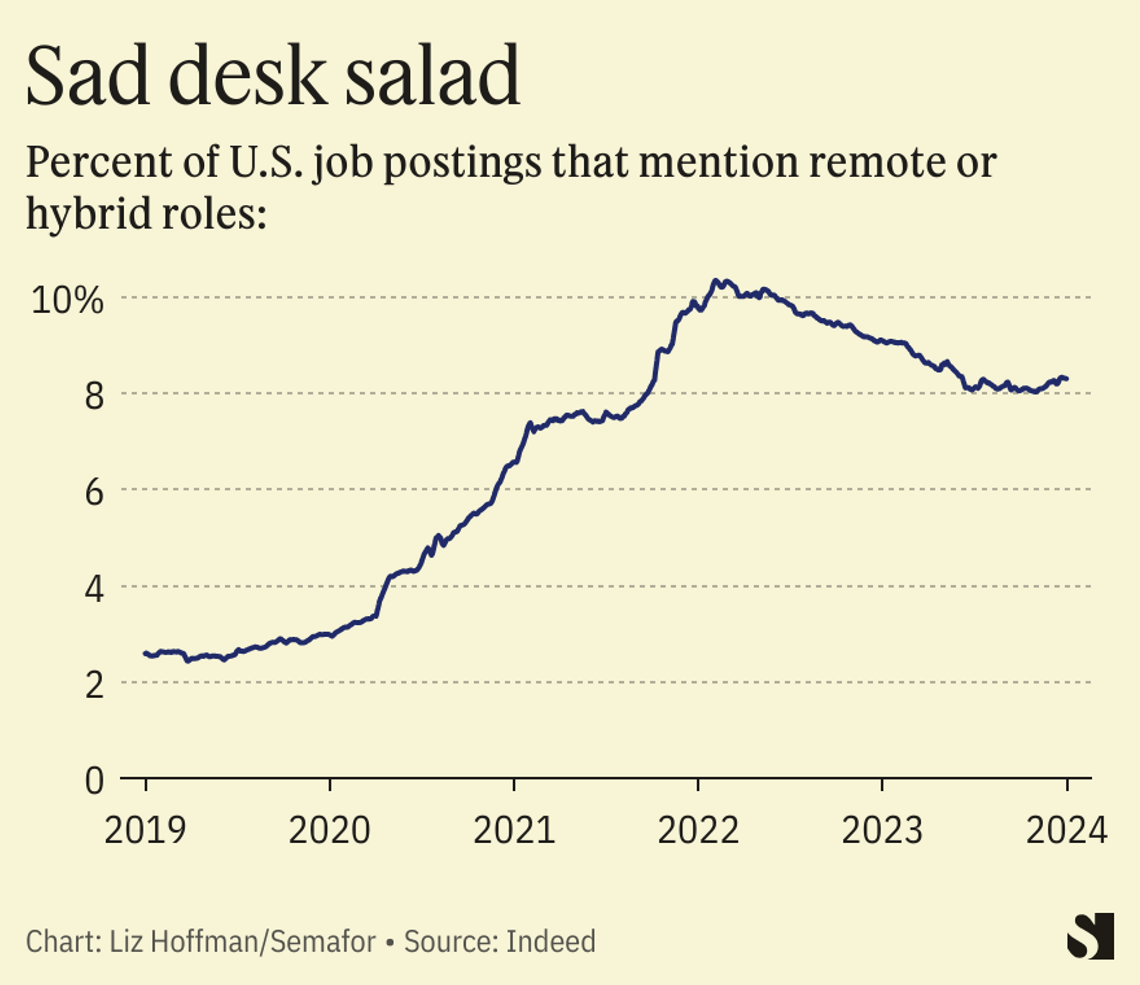

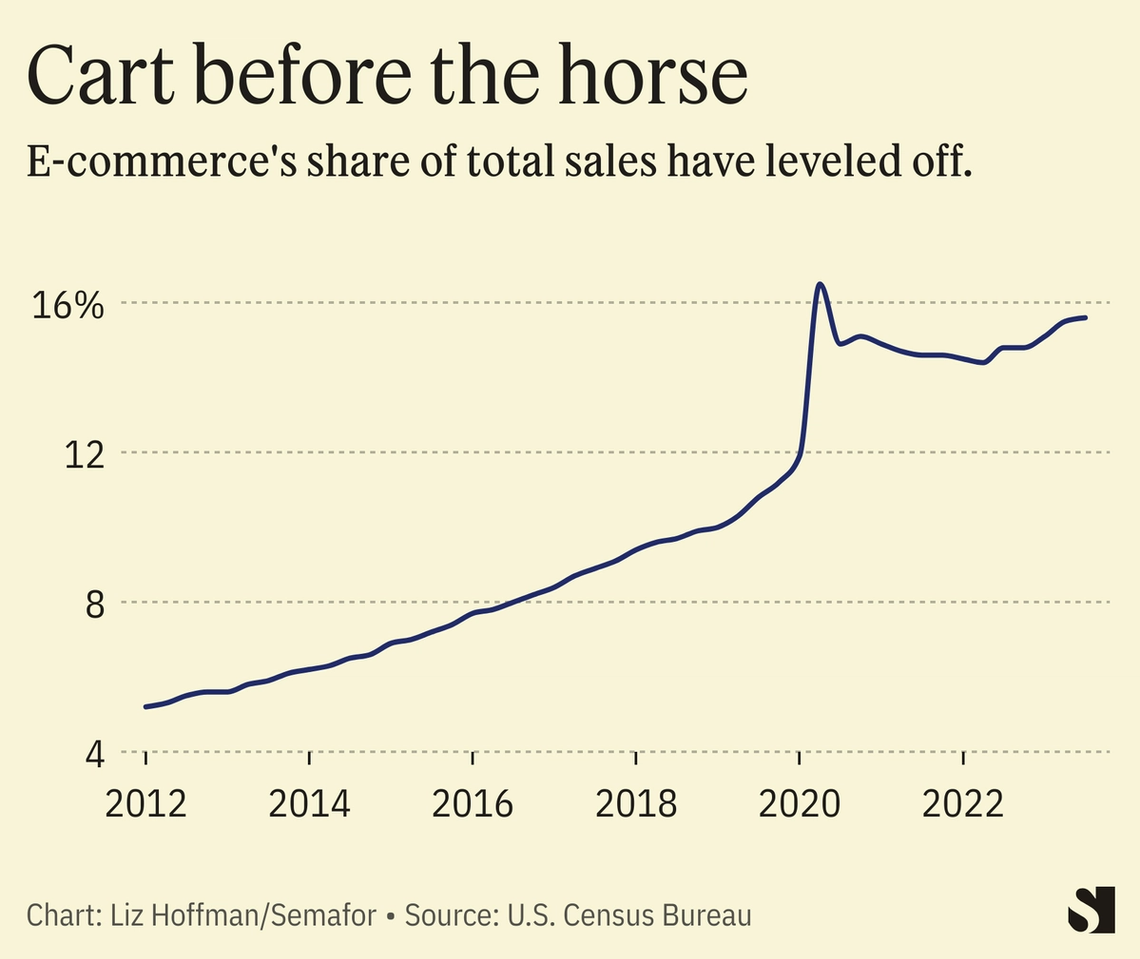

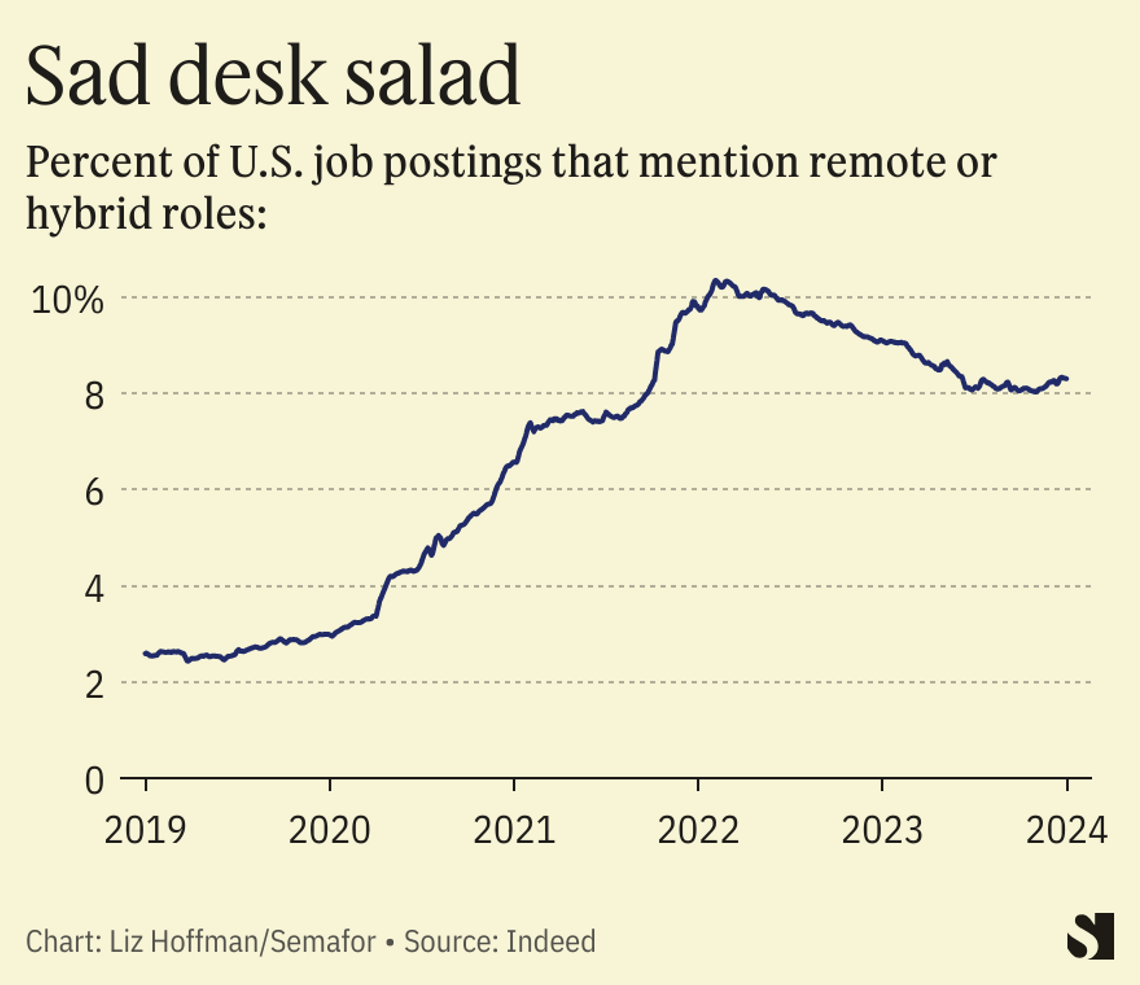

One big question hanging over the economy right now is how many of the pandemic’s seismic changes will be permanent. Three data points today show the biggest ones are already fading. UPS is laying off 12,000 workers, due in part to falling e-commerce shipments. Online sales are back on their pre-pandemic trendline: Lockdowns didn’t so much change the way we shop as pull forward a few years of click-and-ship adoption.  Elsewhere, IBM — which pioneered remote work back in the 1970s when it sent a handful of workers home with desktop servers — told its managers to move closer to an office or find a new job. And in what counts as good news, Pfizer surprised investors with a tiny profit because it only lost $3.5 billion on unused Paxlovid treatments last quarter.  |

|

Very Big Data: Blackstone’s plans for a $25 billion real estate portfolio of data centers to power the AI revolution rests on an investing maxim that’s worked since the age of robber barons: It’s better to own the rails than the trains. Broadband outlasted the dot-com companies that relied on it, and blockchain technology has (so far) survived the token crash. It echoes Blackstone’s $19 billion bet on warehouses in 2019, when the firm became Amazon’s biggest landlord and won big solving the last-mile fulfillment problem. Massive data centers require tremendous amounts of energy and community approvals, which might not be as easy to buy. Knackered: Just how bad is the mortgage situation in England? A member of parliament quit his job because he said he couldn’t afford his home payments on a government salary. The 30-year fixed mortgage is a purely American invention, as is the government support that makes it possible. Most U.K. mortgages reset every few years, meaning that higher interest rates hit homeowners hard. |

|

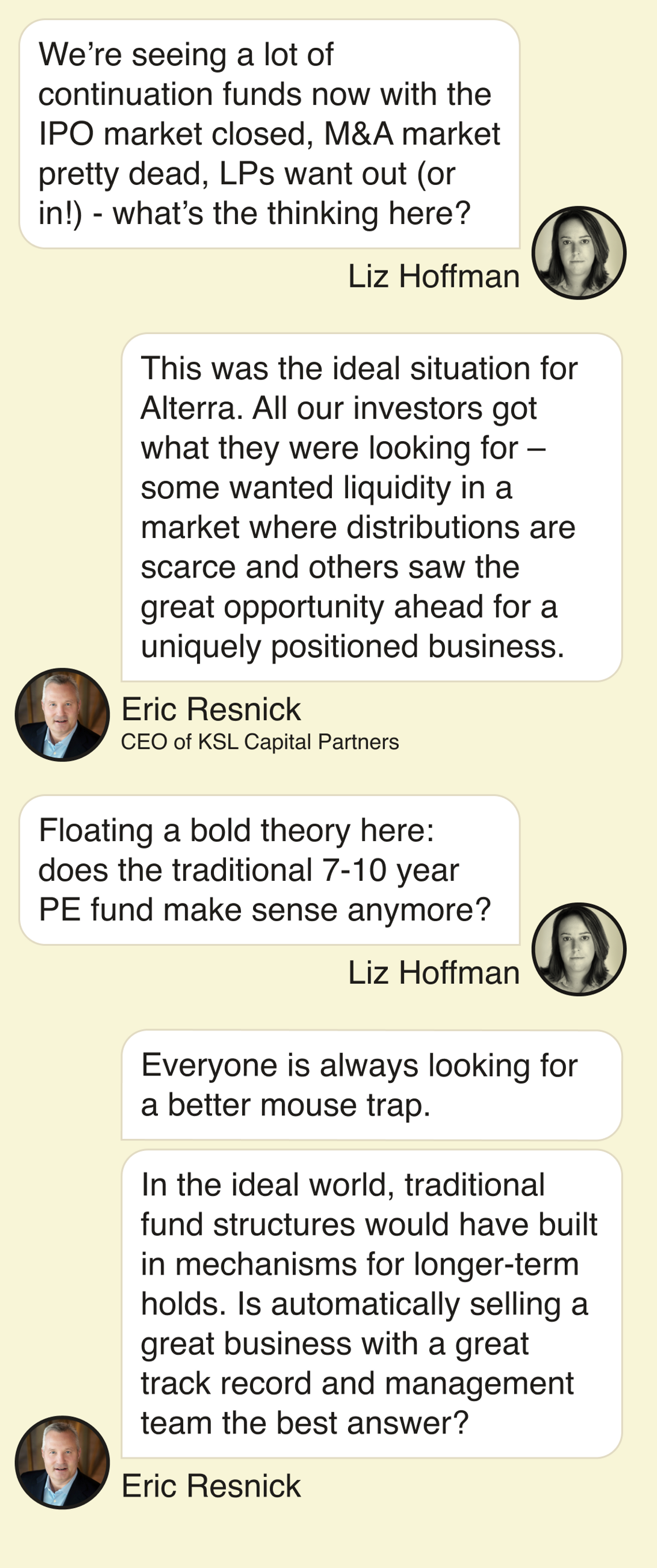

Investment firm KSL Capital Partners created Alterra Mountain Co. in 2018 from a series of ski-resort deals. Yesterday, it announced it raised more than $3 billion to cash out some investors and bring in new ones — a strategy that private equity is increasingly using to extend the life of companies they’re not quite ready, or able, to sell. Eric Resnick is the CEO of KSL.  |

|