| The biggest investors in the nascent technology aren’t waiting for its carbon footprint to shrink.͏ ͏ ͏ ͏ ͏ ͏ |

| Tim McDonnell |

|

Hi everyone, welcome back to Net Zero.

Spare a kind thought for Brad Crabtree.

As an assistant secretary in the U.S. Department of Energy, Crabtree is the official in charge of carrying out the Biden administration’s controversial decision to pause the issuance of new permits for liquefied natural gas export terminals. This week, he had to defend the policy to a particularly hostile audience: About 2,000 fossil-fuel executives and engineers attending the annual meeting of oilfield services company Baker Hughes. (In fairness, the meeting was in Florence, Italy, so don’t feel too bad for him — or me.)

“[The U.S.] has had the most rapid and dramatic expansion of natural gas production and exports of any country, probably in history,” Crabtree told the crowd, almost by way of apology. Although he didn’t add any new details about what, exactly, the new review process will entail, he said it will actually “serve the industry well, in terms of responding to criticism about the climate implications of our exports.”

Few in the crowd were buying it. “U.S. LNG provides the platform for other countries to hit their climate change goals with coal-to-gas switching, just like the U.S. is doing,” Jack Fusco, CEO of top LNG exporter Cheniere Energy, said in remarks on stage following Crabtree’s. “I’m very confused why that needs to be reanalyzed.”

Walking through the Baker Hughes conference provides a renewed appreciation for why any “pause” in energy policymaking is so frustrating to industry groups. There was a lot of energy transition-related machinery on display, including a hydrogen turbine the size of a bus, parts of a hydrogen electrolyzer, carbon capture machinery, and a scale model of a facility the size of a small town that Baker Hughes is currently building in Iraq to capture and process emissions from nearby oilfields. I’m far from clear on how it all works, exactly, but it all looked very big, complicated, and expensive (I was warned, only in half-jest, not to push any big red buttons).

Some combination of this hardware will be needed for tomorrow’s energy systems, but the exact makeup still hinges on uncertain policy decisions. It won’t get built overnight. If officials like Crabtree want to see more of it get built, there’s no time to waste in settling on clearer guidelines.

If you like what you’re reading, spread the word.

The World Today |  - LNG blowback begins

- Investment is lagging

- Metallica rocks hydrogen

- Solar topples coal

- Buyer’s market for carbon

What wind should learn from solar, and what GM is learning about EVs. |

|

AMANDA ANDRADE-RHOADES/Reuters AMANDA ANDRADE-RHOADES/ReutersCongressional Republicans, plus Sen. Joe Manchin (D-W.V.) are already working to foil the Biden administration’s new LNG policy. “Until Mr. Biden drops this battle against American energy, I’m going to block every nominee he tries to place at the State and Energy departments,” Sen. John Kennedy (R-La.) threatened in a Wall Street Journal column Monday. Meanwhile, House Republicans are working on legislation that would take permitting authority from the DOE and hand it to the independent Federal Energy Regulatory Commission. And Manchin has promised to use his remaining months in office to hold hearings on the issue. In general, Biden’s climate agenda is riling a number of moderate Democrats who are up for reelection and fear any policy that might cause energy prices to increase. |

|

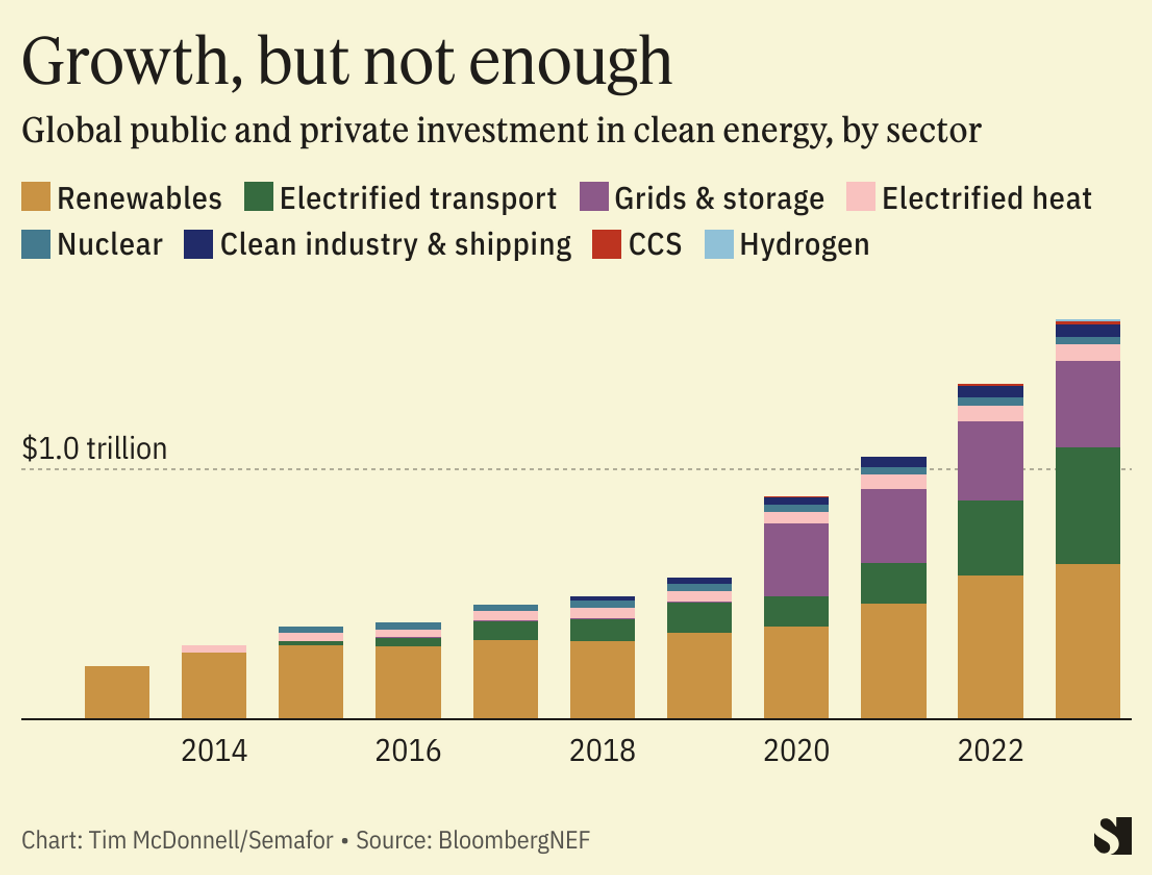

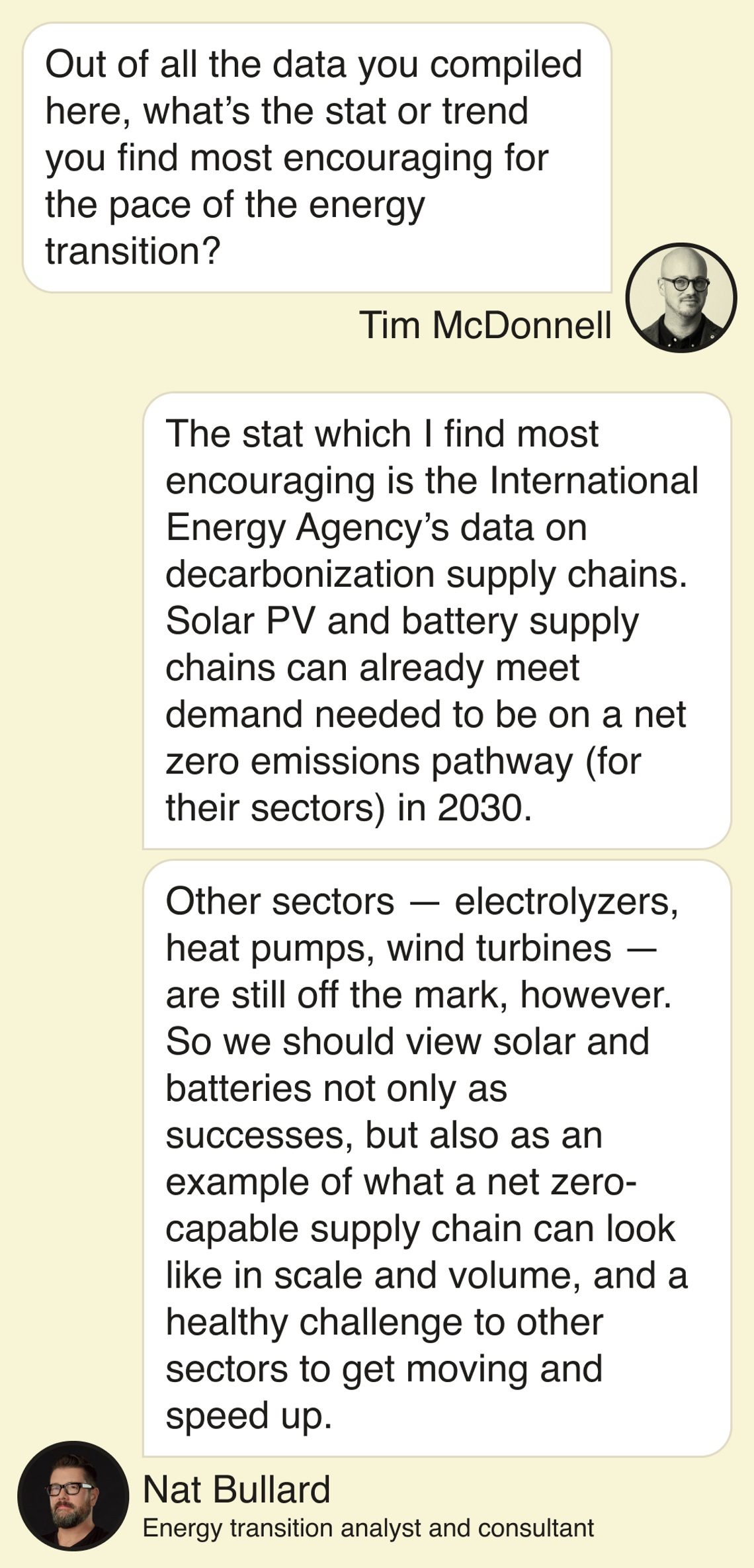

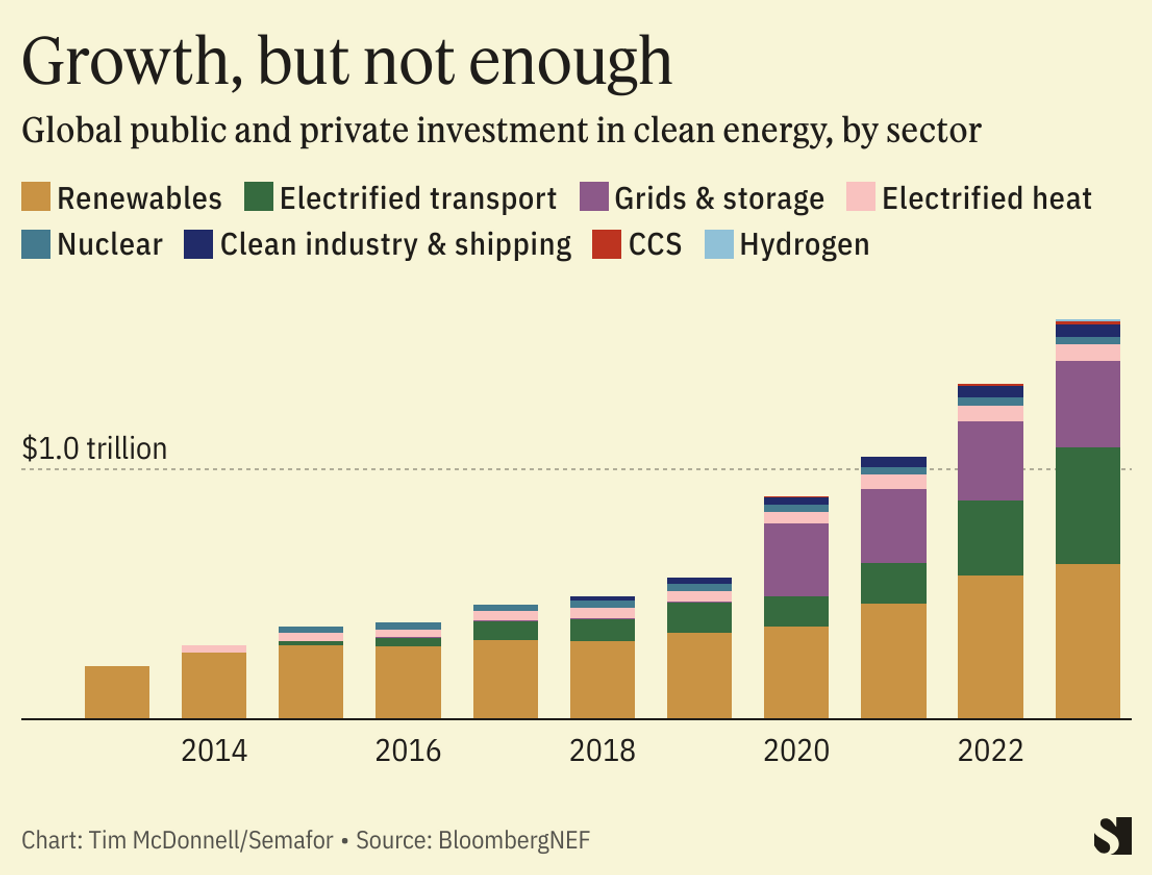

Global investment in clean energy, including from governments, rose to a record $1.8 trillion in 2023, a new BloombergNEF analysis concludes.  That’s 17% higher than the year before, with 38% of the total occurring in China. But it’s still only about one-third of what BloombergNEF projects is needed every year from now until 2030 to meet the Paris Agreement climate goals. High interest rates remain a major obstacle for investment, as well as slow permitting. Investment in the technologies that fossil fuel companies are relying on to enable lower-emissions use of oil and gas remain tiny: Hydrogen and carbon capture drew only 1.4% of investment. |

|

Metallica jumps on the hydrogen tour bus |

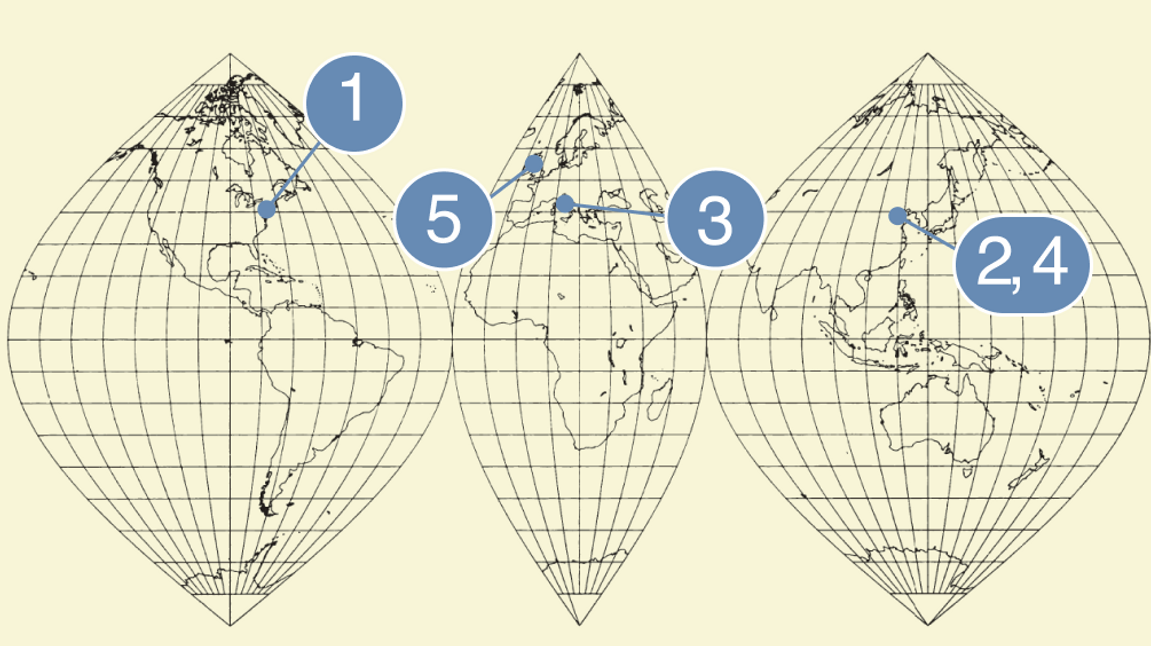

Tim McDonnell/Semafor Tim McDonnell/SemaforMetallica is helping the nascent hydrogen fuel industry thrash its way into existence. When the iconic metal band goes on tour across Europe this summer, some of its guitars and drums will be hauled in trucks powered by hydrogen fuel cells. The band is keen to cut the carbon footprint of its tours, said Gerrit Marx, CEO of the Italy-based truck manufacturer Iveco Group, which is designing custom low-carbon trucks for the tour: “Everywhere they have concerts, we can engage together on sustainability.” The Iveco collaboration makes Metallica the latest advocate for hydrogen, a controversial fuel that could eventually be critical to the clean energy transition but the global supply of which is currently made almost exclusively from unabated fossil fuels. Marx spoke to me on stage during Baker Hughes’ annual meeting in Florence, Italy, where some of the world’s biggest investors in hydrogen said the key to realizing the fuel’s green aspirations is to turn a blind eye, for now, to how it gets made. Instead, they’re chasing any possible end user — from steel plants to metal bands — to scale the industry up on the expectation that falling costs for renewable energy and carbon capture technology will eventually make hydrogen a genuine solution to climate change. “We’re getting into the era now that hydrogen is becoming a reality,” Lorenzo Simonelli, Baker Hughes’ CEO, said in an interview. “We have to invest early on in what we see as the future horizons even though the infrastructure associated with [low-carbon] hydrogen may not be there today.” |

|

Projected share of electricity from wind and solar in China in 2024, topping coal (37%) for the first time. China’s renewables boom is moving at breakneck speed: The country already surpassed its 2030 installation target. |

|

Buyer’s market for carbon |

JOANN RANDLES/Reuters JOANN RANDLES/ReutersNow is a good time for investors to buy carbon credits in government-backed cap-and-trade markets, analysts at the Australian financial firm Macquarie argue in a new research note. Concerns about greenwashing have hurt prices in the voluntary carbon offset market. But in the “compliance” market, in which various local, national, and regional governments set emission caps for high-carbon industries that gradually fall over time, the shrinking supply has prices poised to jump, creating an opportunity for traders. The best buy on the market, in Macquarie’s view, is credits from the U.K. system: Although a decision by the government last year to increase the supply of credits pushed prices down, they are now near the minimum allowable by law, and are forecast to triple by 2027 as the market gets tighter and policymakers seem likely to link the U.K. market to the EU, which would drive demand for UK credits from European industrial emitters. Prices in the California market are likely to dip this year, but are also likely to more than double by the late 2020s, Macquarie projects. |

|

New energy- A bipartisan group of senators is pressuring Biden to erect stronger trade barriers to solar panels from China. So far, the administration has been reluctant to discourage solar panel imports, for fear of slowing U.S. solar installations. But that risks undermining the nascent domestic manufacturing industry.

Fossil fuels- Efforts by U.S. fracking companies to curb their operational emissions are putting a strain on the electric grid. A growing number of producers are replacing dirty diesel generators at drill sites with connections to the lower-emissions grid, an effort that could cut upstream oil and gas emissions in half. But it could drive up electricity prices for everyone else.

- Saudi Aramco reversed a longstanding plan to increase its oil output. The move won’t cause any immediate change to the global oil supply, but could be a sign that the Kingdom is lowering its expectations for future oil demand.

Finance- An activist investor group is targeting BP — not for doing too little on climate, but for doing too much. Bluebell Capital Partners, which manages $150 million in assets, wants BP to drop its plan to scale back oil and gas production 25% by 2030, arguing that the company is moving faster to decarbonize than the market and thus sacrificing profit.

EVs KEVIN LAMARQUE/Reuters KEVIN LAMARQUE/Reuters- Slackening demand for EVs notwithstanding, General Motors is cheery about its profit outlook thanks to strong sales of traditional-engine cars. The company expects to net up to $14 billion in 2024, CEO Mary Barra said in an earnings call this week, up from $12.4 billion in 2023. The company also expects to dig a bit out of its $1.7 billion in losses for the EV division, as it improves its production lines and rolls out new models, including a battery-powered Escalade.

Politics & policy - The Biden administration spelled out new energy efficiency requirements for both electric and gas stovetops that are less stringent than what climate activists had hoped for. By 2028, electric stoves will need to use 30% less energy than low-performing models use today; gas stoves will need to use 7% less. Gas stoves will not be banned or confiscated.

Tech- The world’s largest bioethanol producer, South Dakota-based POET, said it will join a controversial new carbon pipeline network. Summit Carbon Solutions is working to build pipelines to carry captured CO2 from ethanol plants and other industrial facilities from the Midwest to a carbon burial site in North Dakota, but has faced opposition from landowners along its route.

|

|

- Why team Biden is unlikely to use E. Jean Carroll against Donald Trump.

- Israel eyes longshot plan of exile for some Hamas leaders.

- South Africa’s Gaza stance threatens trade ties with Israel.

|

|