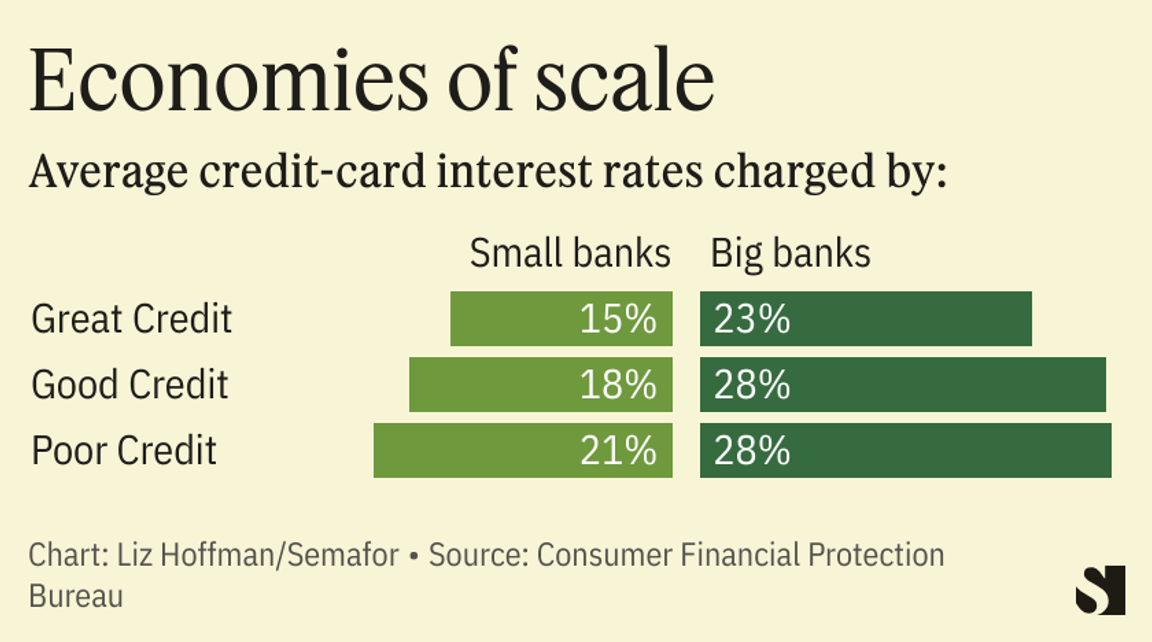

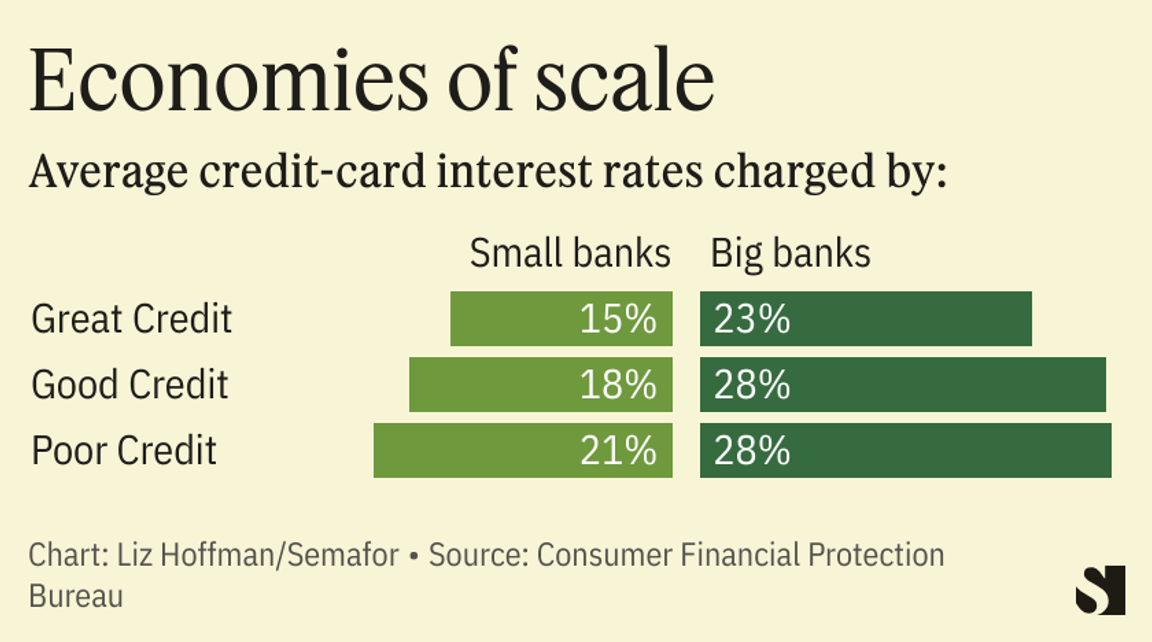

THE NEWS Capital One is buying Discover for $35 billion, a deal that will create one of the country’s biggest credit-card issuers and invite heavy scrutiny from Washington. The companies say the merger, which would form the country’s eighth-largest bank by assets, will help it compete with bigger card companies and further Capital One’s long-held desire to be a payments giant. LIZ’S VIEW In the past two weeks, the following things have happened: - The Consumer Financial Protection Bureau released a study showing that bigger credit-card issuers offer worse terms and higher fees than small ones.

- A top banking regulator announced that it would slow down merger approvals, issuing new guidelines that one top law firm called “more ambiguous, multifaceted and complex.”

- Congress scheduled a hearing on whether there’s enough competition among credit-card companies.

- Bipartisan support has grown for a bill seeking to crack the Visa-Mastercard duopoly — a move that might benefit Discover, but that Capital One has lobbied hard against.

It doesn’t seem like a great moment to be testing Washington, where anti-merger sentiment is already running hot. That CFPB study is an almost comically frosty backdrop for this takeover, which is promising “great deals for consumers” through the heft of a combined company with more than 300 million cardholders and checkout-line hookups to 70 million merchants. No matter the industry, companies tend to justify mergers by saying that size lets them offer better terms to customers. But the industry’s chief watchdog said — again, just four days ago — that the opposite is true for credit-card issuers. Its analysis of 150 companies found that large lenders like Capital One charge interest rates that are between 7 and 10 percentage points higher than smaller banks. Large banks also charge higher annual fees, and use their marketing muscle to pay for better placement on referral websites.  The CFPB doesn’t have an explicit veto over this takeover, but antitrust regulators do. Already, four banks control two-thirds of the U.S. card market, about the same competitive dynamic as U.S. airlines. The Justice Department just blocked the merger of JetBlue and Spirit, a combination the companies claimed would help a scrappy maverick take on the industry’s giants. At least Spirit’s flights are cheaper: Discover doesn’t even charge meaningfully less than Visa or Mastercard. Antitrust regulators might like the idea of putting Discover’s merchant network in stronger hands to help it compete with Visa and Mastercard. I was surprised that Capital One didn’t lead with the duopoly-busting potential of this deal. If it were me, the first slide of the presentation would have been the Visa and Mastercard logos. “There’s a story to tell that it’s both pro- and anti-competitive,” Keith Noreika, the former comptroller of the currency under President Donald Trump, told me. Regulators may see it as “beefing up a failing network to keep it going and competitive with the more dominant ones.” Instead, executives didn’t press their case in their prepared remarks this morning and seemed unprepared for the first question to be on the deal’s regulatory hurdles. Capital One CEO Richard Fairbank said the company would be filing for the necessary approvals “in the next couple months” and moved on. Both of these companies have found themselves in serious legal trouble in Washington in recent years. Capital One just got out of the Federal Reserve’s penalty box, four years after a major data breach, and in 2021 paid a hefty fine to Treasury for “egregious” failures to flag suspicious transactions. Discover just got into the penalty box for sweeping compliance lapses that resulted in its CEO leaving in August. The business logic of this deal is sound enough. Capital One is strong in subprime (61% of its loans are to borrowers with credit scores of under 660) and has been chasing 800-club wealthy borrowers who might otherwise flash an Amex or Chase Sapphire. Discover is stronger in the middle, helping to fill out the barbell. And if it can grow Discover’s network of merchants, Capital One saves money on every swipe that its customers would otherwise pay to Visa or Mastercard. But the companies appear to be underestimating the chances of a chain reaction in Washington. This deal feels like a thought experiment that escaped the lab. |