| In today’s edition, crypto backers begin to doubt Trump’s plans, and a fundraising tailspin. ͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business.

The opposition is starting to stir. Not Democrats — who remain relatively quiet as President Donald Trump pushes his agenda forward — but ideological allies elsewhere are beginning to waver.

It started this week in crypto, where some laser eyes are questioning Trump’s plan for a national coin reserve. “It’s wrong to tax me for crypto bro schemes,” noted crypto bro Joe Lonsdale on X. “This is getting egregious,” venture capitalist Nikita Bier wrote in a since-deleted post. “Every 2 weeks there is a kickback to the family,” a nod to the $Trump coin money grab.

There are signs of reassertion elsewhere, or at least ideological fellow travelers acting in their own interests rather than Trump’s. Saudi-led OPEC+ is going ahead with production increases that will dampen US energy companies’ already shallow enthusiasm to boost drilling, a Trump priority. France’s right-wing populist leader Marine Le Pen called Trump’s retreat from Ukrainian aid “very cruel.” And optimism is fading in some corners of the business community facing the reality of tariffs, regulatory uncertainty, and ideological purity tests. (Here is, regrettably, a word cloud.)

The Trump administration is winning a lot right now and, as Lonsdale noted in his thoughtful critique, it “can afford a bit of deserved criticism without blowing up or being weakened.”

Programming note: Semafor’s Rohan Goswami will be on the ground in New Orleans for the Tulane M&A conference. He will not be joining you all at Caesars casino, but shoot him a line and say hi if you’ll be in town.

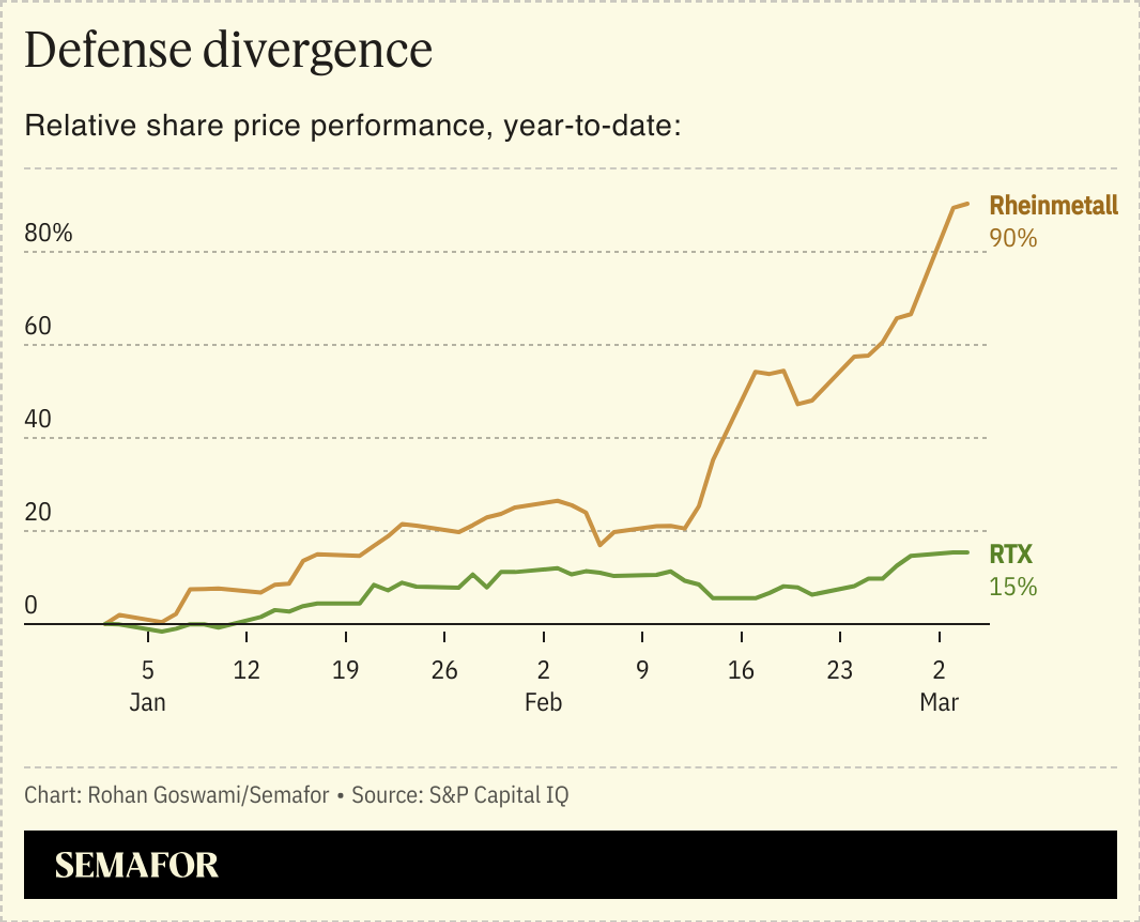

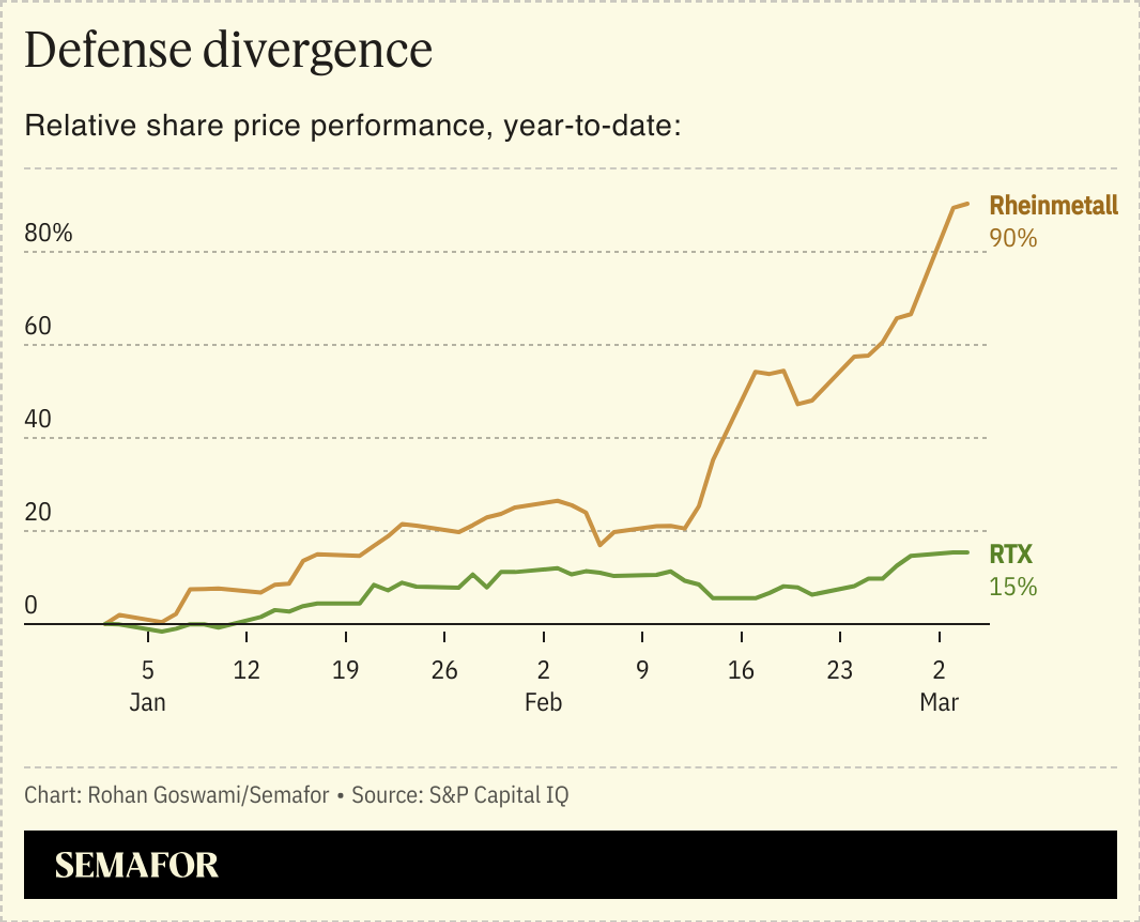

➚ BUY: Hawks. European defense stocks surged as investors bet on beefed-up Euro military spending. Germany’s next chancellor is planning €800 billion in new borrowing for a military buildup, the FT reports. Shares of its defense giant, Rheinmetall, are up 90% since Jan. 1. ➘ SELL: Stocks. Trump’s hardline tariff announcement sent the US market into a nosedive. Even Fox News ran a live ticker of the stock market dropping during his comments. The S&P 500 lost 1.4% and is down another 1.2% so far today. |

|

The low end of the percentage point that researchers at the Boston Fed say Trump’s latest tariff plans would add to the inflation rate. The high end of their calculations, which assume 25% tariffs on goods from Canada and Mexico and 10% percent on Chinese imports, is 0.8 percentage points, which would take the rate back to summer 2023 levels. Trump confirmed the North American tariffs on Monday, saying there was “no room left” to negotiate a 30-day reprieve that expired today. |

|

Trump’s plans for a national crypto reserve offended some of his most loyal allies in Silicon Valley. The plan, which would see the federal government stockpile Bitcoin and other, more thinly traded tokens to make the US “the Crypto Capital of the World,” risks the first significant rift between the president and his conservative tech base. Lonsdale equated the idea with “steal[ing] my money for grift on the left.” Gemini’s co-founder Tyler Winklevoss said coins like Solana, which Trump said would be included in national holdings, aren’t “suitable.” Naval Ravikant, another member of the conservative tech scene, wrote that “the US taxpayer should not be exit liquidity” — market-speak for the greater fool. Bitcoin surged from $85,000 to $95,000 Monday before falling back to $82,000. |

|

CEOs Larry Fink and Margaret Spellings are convening elected officials, corporate leaders, small business owners, union representatives, pensioners, and state and federal policymakers for the 2025 Retirement Summit to find bipartisan solutions and commitments. The theme of the event, “Redefining Retirement: It’s All of our Work,” highlights how critical it is for both the public and private sectors to think about retirement in new ways to help people live better, longer. Mar. 12, 2025 | Washington DC | Request an Invitation |

|

| Making Business Great Again |

Semafor is keeping tabs on the business community’s MAGA shift. The news is coming fast, and we’ll bring you updates in this newsletter.  Enea Lebrun/File Photo/Reuters Enea Lebrun/File Photo/ReutersA man, a plan: A group of US investors led by BlackRock bought control of ports on either end of the Panama Canal from a Hong Kong company. It’s a win for Trump — and for Larry Fink, deploying his newly acquired infrastructure shop, GIP, in service of the president’s America-first agenda. Fiber optics: The FCC is investigating Verizon’s diversity plans, with regulatory approval for a $20 billion takeover hanging in the political balance. Chairman Brendan Carr said Verizon wasn’t moving quickly enough to walk back its DEI policies and told executives to talk to FCC staffers reviewing its planned acquisition of internet provider Frontier. Carr spoke at Semafor’s Innovating to Restore Trust in News summit on Thursday, where Semafor’s Ben Smith asked him about politically tinged investigations of tech and media companies. Carr said that — in his view — Democrats had set a precedent by politicizing the FCC and he was merely following that precedent. You can watch that part of the conversation here. |

|

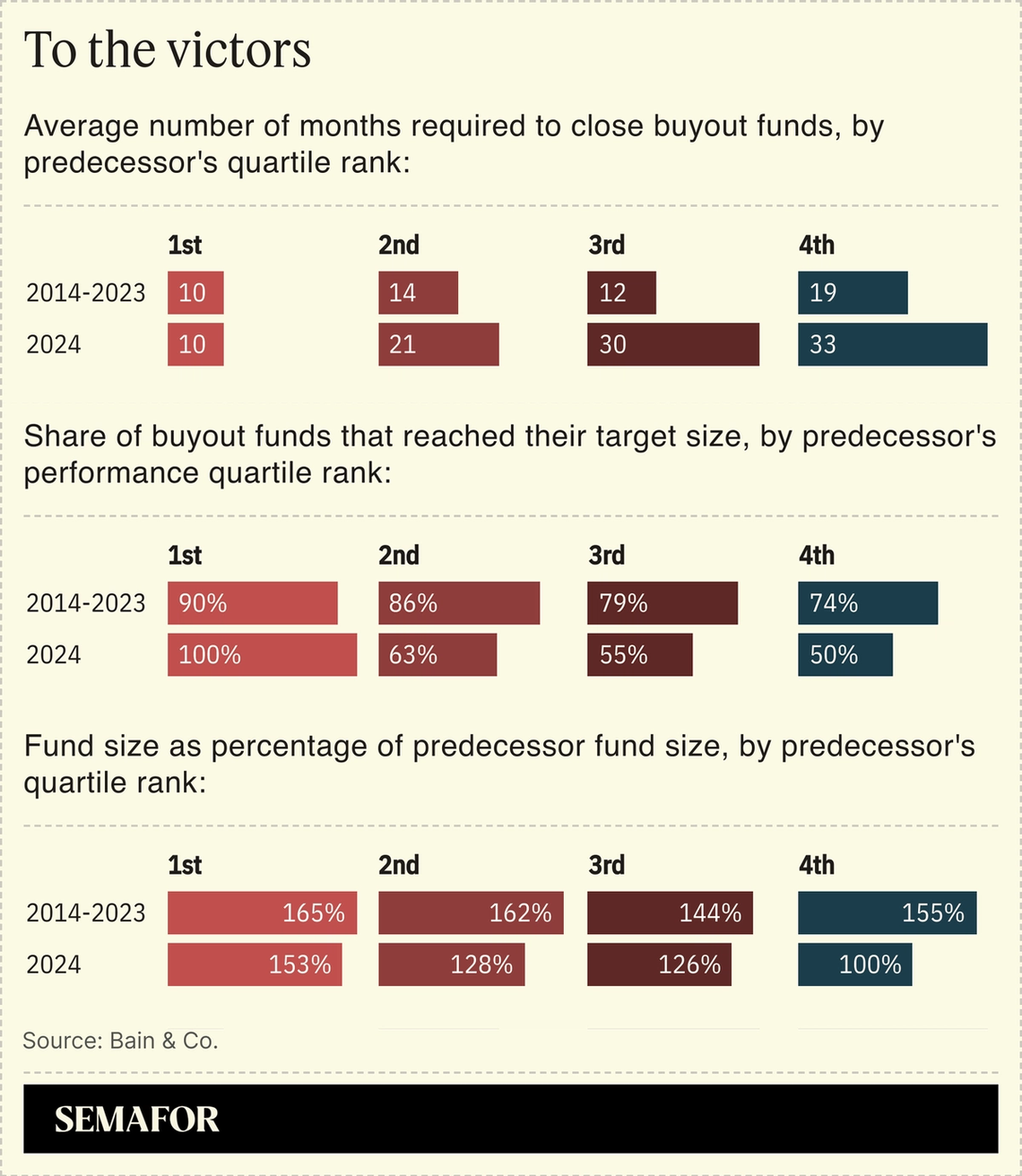

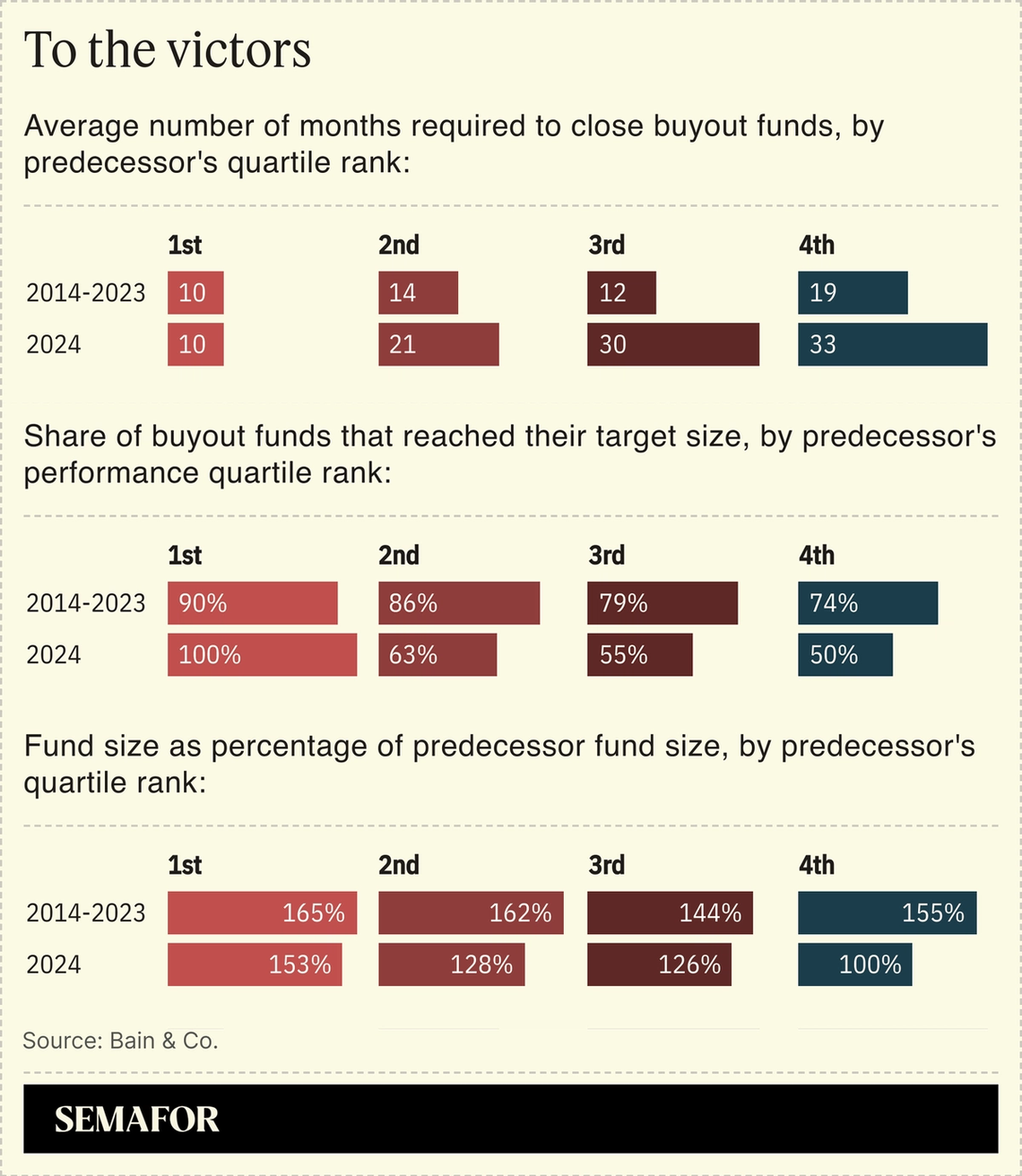

Fundraising is tough in private equity, but the struggles aren’t shared equally. The gap between firms with good track records and those with bad ones has widened, according to new data from Bain & Co. Buyout shops whose previous funds shot the lights out had an easier time fundraising in 2024 than laggards, which raised less money and took longer to do so. “There are fewer dollars to go around,” Rebecca Burack, who runs Bain’s private-equity practice, told Semafor. This should be intuitive — Wall Street is the ultimate pay-for-performance world — but investors were indiscriminate, to put it mildly, for most of the past decade. Between 2014 and 2023, middle-of-the-pack managers found it almost as easy to fundraise as the industry’s leaders did. Now, dealmaking and IPO freezes make it hard for funds to return cash to their investors, who are taking out their frustrations on the worst performers. Here’s that story in three charts:  |

|

Want actionable insights on the global economy? With trade wars and shifting policies, market turmoil could be on the horizon — staying informed has never been more important. That’s why 1M+ readers subscribe to The Daily Upside — subscribe for free today. |

|

Courtesy of Axon Courtesy of AxonThe company that makes Tasers is looking to arm corporate security teams as CEOs worry about their safety after the murder of United Healthcare’s Brian Thompson, Semafor’s Andrew Edgecliffe-Johnson reports. “Over the next year, you might start to hear more about certain CEOs being protected by Taser,” said Josh Isner, president of Axon Enterprise, who said his business had received several inquiries from companies since Thompson’s killing in December. In addition to the signature weapon it sells mostly to law enforcement, Isner said Axon is developing “more covert” devices for “an executive security-type of scenario.” Axon said on its earnings call last week that corporate customers represented one of its largest growth opportunities. The company has started to market equipment to defend corporate headquarters, warehouses, and other facilities against drone attacks. “Think about how easy it is to equip a drone with something bad and fly it into something,” Isner said. Customers listed on a website for Dedrone, the counter-drone defense technology Axon recently acquired, include Consolidated Edison and auto racing group NASCAR. |

|

South Africa government/Flickr South Africa government/FlickrThe Trump administration’s decision to freeze billions of dollars in foreign assistance creates an opportunity for China to strengthen its presence in Africa, but Beijing will not step in to replace the decades-old aid programs now coming to an end, China-Africa analysts told Semafor’s Yinka Adegoke. “The idea that the dismantling of USAID opens the door wider for China in Africa is a misdirection,” said Hannah Ryder, CEO of Development Reimagined, a development consultancy. “They don’t give aid in that way, so they can’t ‘replace’ USAID.” |

|