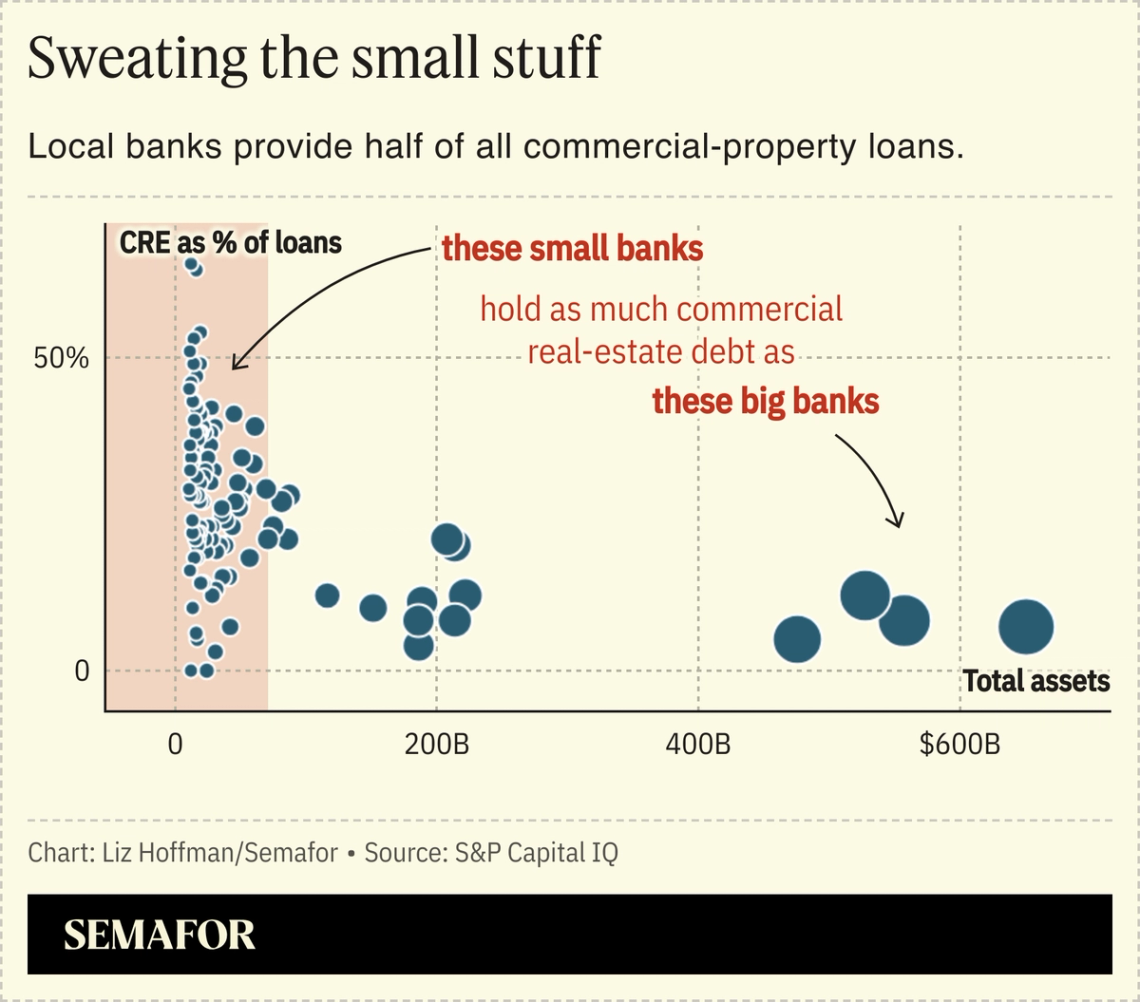

Bill Demchak is the chief executive of PNC, America’s eighth-biggest bank. What were you doing a year ago? I was on a conference call with a bunch of other bank CEOs trying to figure out how to put deposits into First Republic to keep it from failing. Another bank, New York Community Bank, just got rescued. Is this a one-off or the start of another round of problems? I don’t know NYCB all that well, but their problems aren’t new. What’s new is a new regulator looking at old books. There was a big shock of, hey, everything’s fine, oops, no it isn’t, and everything goes downhill fast because people have last year fresh in their minds. They’ve attracted new capital, which is smart capital by all accounts. So I don’t think it’s a here-we-go-again moment. Real estate is going to be a problem, but not a systemic shock. Have we seen the last midsized bank to fail? My guess is that hundreds of small banks will default because of real estate. My guess is also that you won’t have heard of most of them. They’ll be resolved through mergers by the FDIC and it won’t even make headlines.  Does the U.S. have too many banks? Canada has something like 30. We have 4,500. The structure of the banking system today — continued pressure on fees, cost of regulation, cost of technology, fraud and cyber — has caused a big swath of the U.S. banking system, in my view, to be untenable. True community banks, many of them family-owned, I think serve an important purpose and will be around forever. But the midcap banks that were $5 billion balance sheet banks and tried to be heroes and grow to $50 billion find themselves in a really uncomfortable place. PNC bid for First Republic last spring, and I don’t think it’s a secret that you weren’t thrilled with how the process was run. Would you participate again? We tried to do something that was economically attractive for our shareholders, that would grow the franchise, and help the country out of a bind. Win, win, win. In the process, we would have been seen as a safe institution that had regulators’ blessing to grow larger. In that way, JPMorgan getting First Republic was somewhat unfortunate because [the government] almost said the opposite — that we can only give it to a giant bank. That was disappointing. I know they’re working on improving a process that was, probably by their own admission, a bit of a mess. In their defense, they hadn’t been put to the test in years. The skill sets and the playbooks were probably a little stale, and there were new players. In hindsight, it’s easy to say, ‘why did you do it that way? you could have saved the [deposit insurance] fund a lot of money,’ which is true. But nobody knew which way was up and there wasn’t a lot of time to figure out the right answer. I remember seeing you a few years ago, just after you bought BBVA’s U.S. business for $12 billion and I asked if you were done doing M&A. I think you said, “no, but that’s not by choice.” The sense was that PNC was as big as regulators were going to allow. Has the past year changed that? I think so. Whether they meant to or not, last March regulators basically said that large banks are safe and smaller banks aren’t. You were either a G-SIFI, or you were a regional bank. And I don’t think we go back to a world where a reasonable-sized corporation says ‘I’m going to have a regional as my lead bank.’ So the need for scale is greater than it’s ever been, and I think regulators see it. I think they want to create challenger banks to the big two or big three. I hope I’m right. But I’m also more willing to push on that than perhaps I was two years ago. Read the rest of this interview for Demchak's thoughts on the Capitol One-Discover deal and his new "brilliantly boring" ad campaign. → |

|