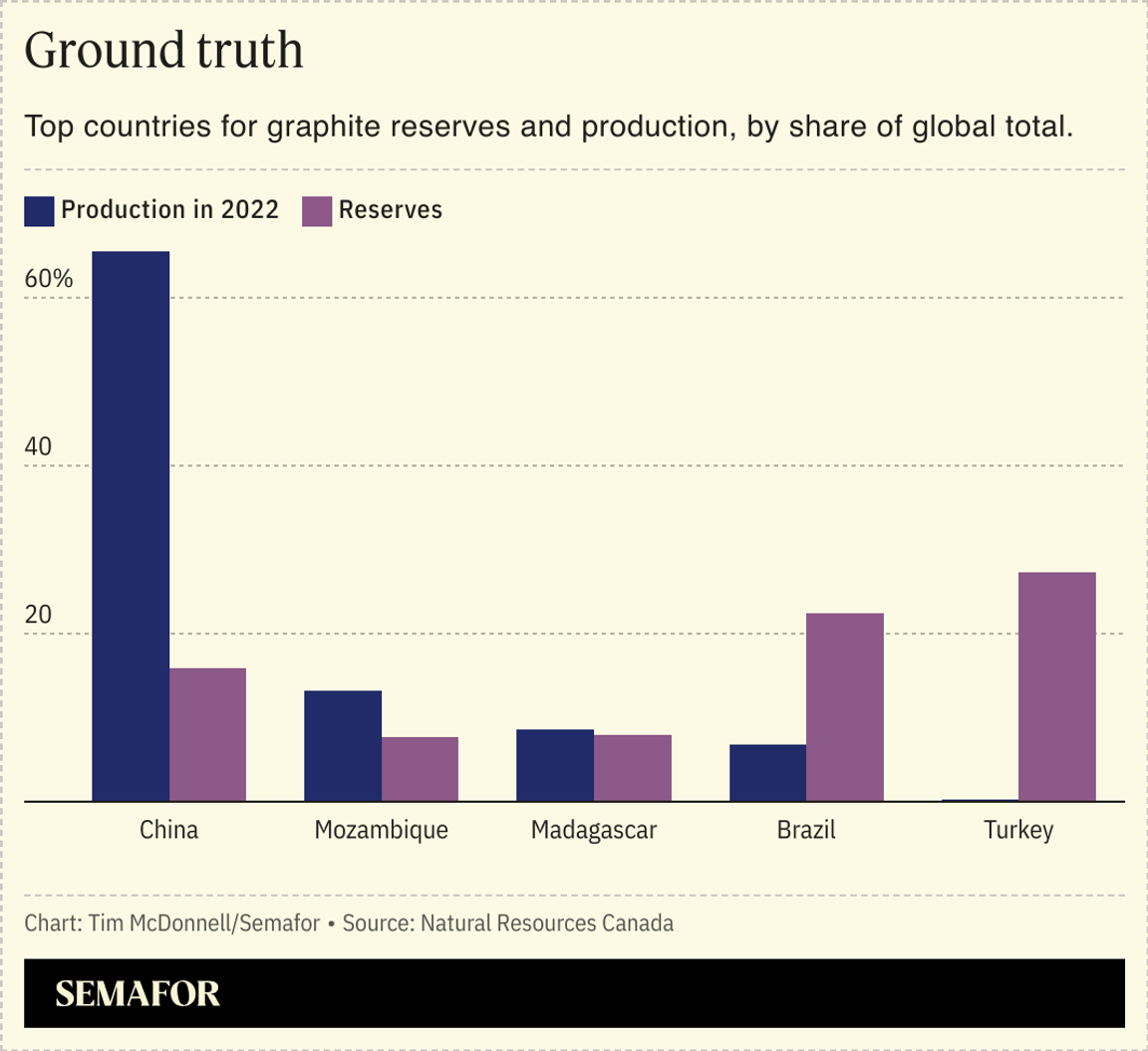

Investors and businesses are increasingly focusing on an often-overlooked material — graphite — because of its vital role in batteries, storage technology, and the potential fortune to be made in undermining China’s overwhelming dominance of its production.  Graphite is a key element in lithium-ion batteries used in electric vehicles and other devices that require energy storage. China’s monopoly over its production, refining, and export is worrying executives looking to diversify their supply chains and could see it emerge as a potential flashpoint,between Washington and Beijing. “Twenty four months ago, all the conversation was about more energy-dense batteries,” Keith Norman, chief sustainability officer at Lyten, an advanced materials company that is one of several looking to replace graphite in batteries, said in an interview. “Then, in the middle of last year, we started to see talk ramp up around resiliency of the supply chain.” Companies like Lyten and Group 14 are leaning into business models that reduce Western dependence on graphite from China, betting that if unseating the country’s dominance is indeed possible, it won’t be by building industries that directly compete with China’s own behemoths, but by developing new technologies that allow battery customers to choose to sidestep China. |