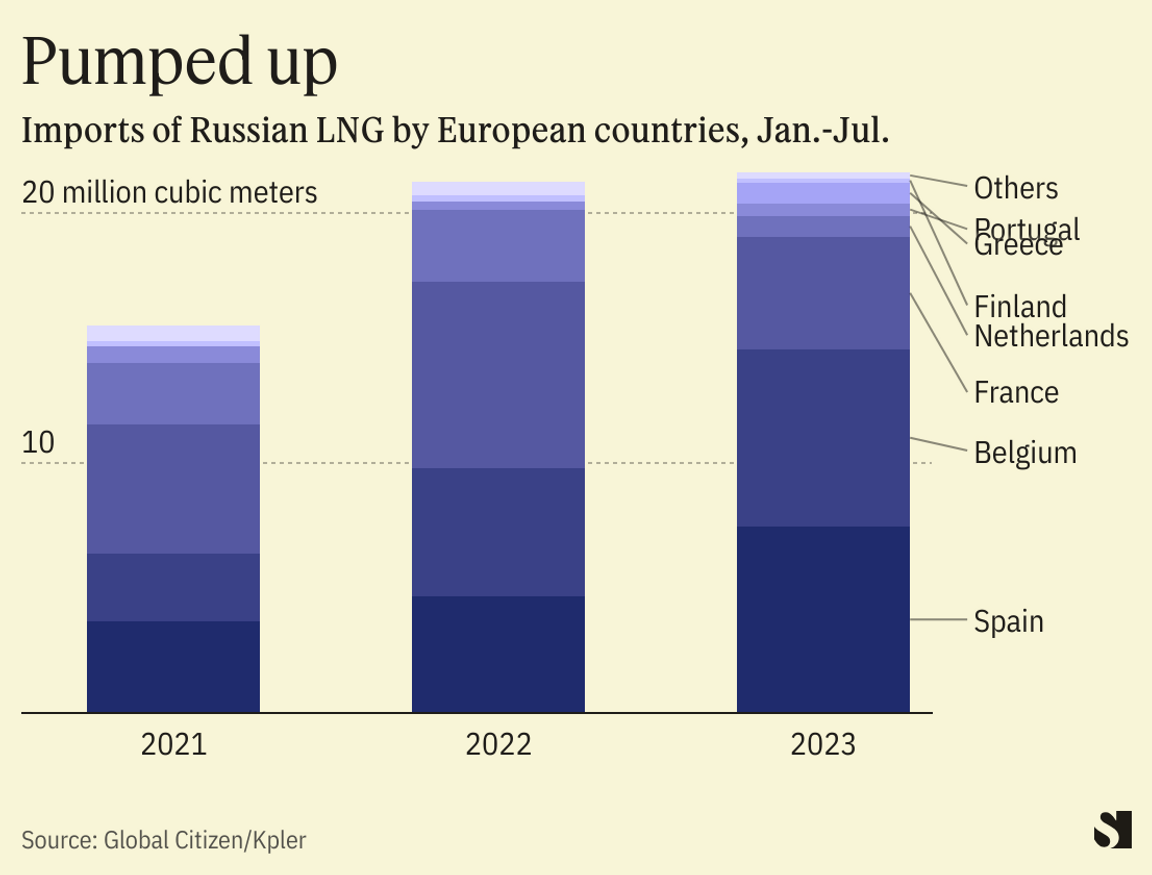

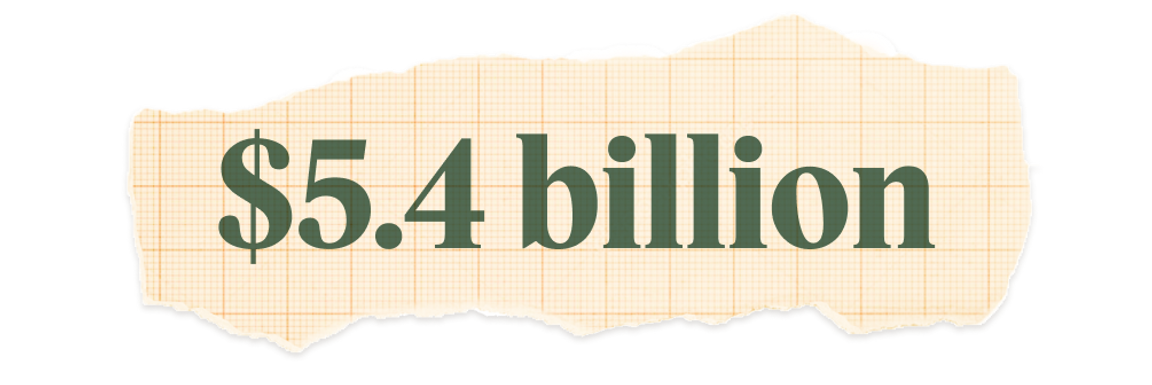

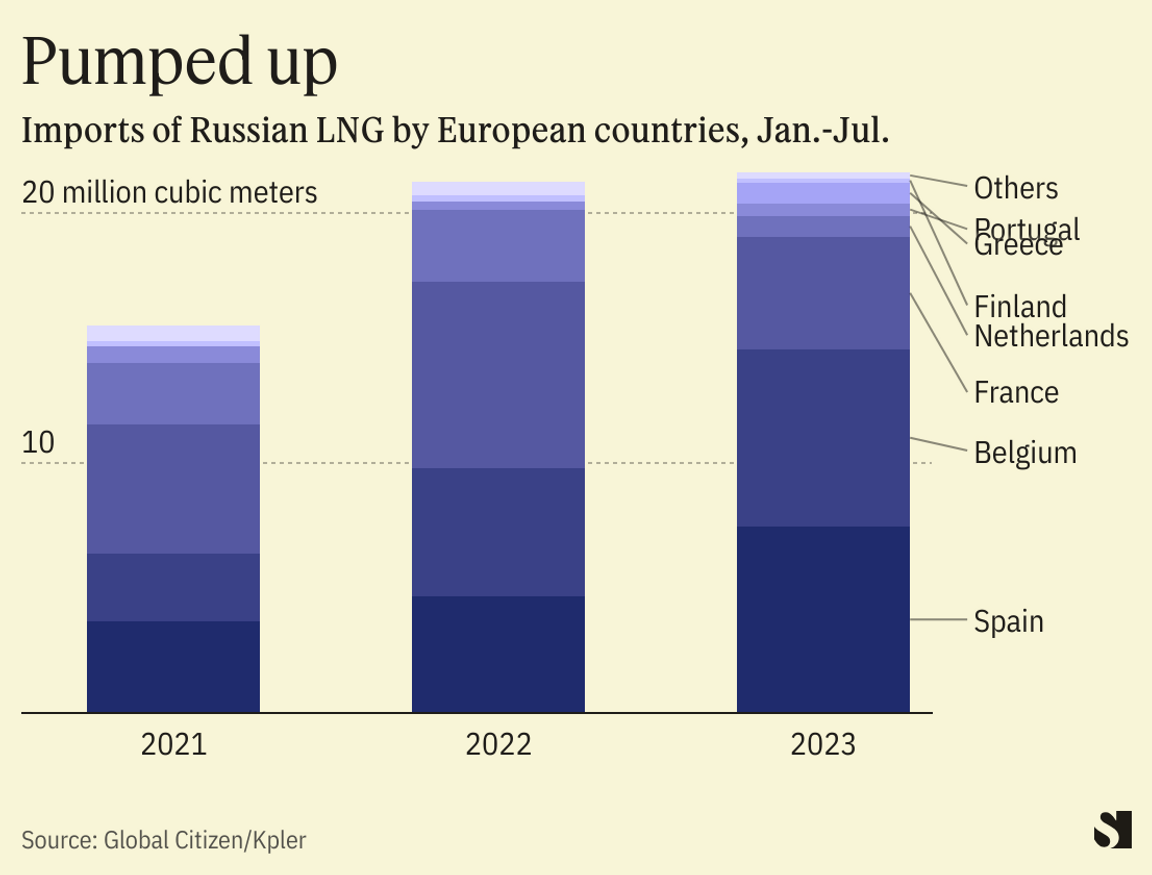

Jan Arrhénborg / AGA Jan Arrhénborg / AGABy Tim McDonnell THE NEWS European countries are buying more liquified natural gas from Russia than they did before its full-scale invasion of Ukraine last year, revealing a weak spot in the energy sanctions targeting Russia that is unlikely to be resolved anytime soon. In the first six months of 2023, EU countries bought 40% more Russian LNG than they did in 2021, amounting to $5.7 billion in revenue for Russia, according to an analysis this week by the advocacy group Global Witness. This makes Europe the biggest customer for Russian LNG; only the U.S. sells more LNG to the bloc. TIM’S VIEW After the invasion, European countries quickly cut their dependence on natural gas delivered via pipeline from Russia, which until then had supplied about half of the continent’s principal fuel for electricity production and industrial facilities. But they’ve effectively swapped one fossil fuel import dependency for another that will be harder to kick.  Many European countries are accelerating plans to expand their LNG import infrastructure, while also speeding construction of renewables. Last winter, Russian gas cuts caused record-breaking energy price spikes that the continent is still recovering from: In Germany, the bloc’s top industrial economy, manufacturing activity has contracted for 14 consecutive months largely because of energy costs. This week Germany’s chancellor rejected a call from industry groups for greater energy subsidies, arguing that the government’s plan to boost LNG imports, especially from the U.S., is a better long-term solution. But a greater reliance on LNG inevitably leads back to Russia, which is seeking to triple exports from its Yamal LNG facility in Siberia. That’s a problem for the bloc’s stated goal to completely eliminate its consumption of Russian fossil fuels by 2027. And it has made LNG a focal point for Ukrainian activists, who are calling for a ban on imports from Russia (and also bemoaning the EU’s weak enforcement of existing sanctions on refined oil products). “These figures are really horrifying,” said Svitlana Romanko, director of clean energy advocacy group Razom We Stand. “These countries are spending a lot of resources to help Ukraine, so I can’t explain why they’ve become so addicted to Russian LNG.” That viewed is shared by Spanish Energy Minister Teresa Ribera, who has called the volume of Russian LNG imports “absurd” even as her country has become the top importer, and EU Energy Commissioner Kadri Simson, who has backed a plan, currently stalled in negotiations, to block EU companies from signing new deals with Novotek, Russia’s LNG export company. But even though European countries are ahead of schedule in storing gas for the winter, there is still a pervasive fear among policymakers of a repeat energy crisis once temperatures begin to fall, dimming the prospects for an LNG ban anytime soon. “I’m sure they want to cut LNG imports from Russia entirely,” said Ben Cahill, a senior energy fellow at the Center for Strategic and International Studies, “but for now they don’t have the luxury of doing so.” To read the Room for Disagreement and View from Beijing, click here. |