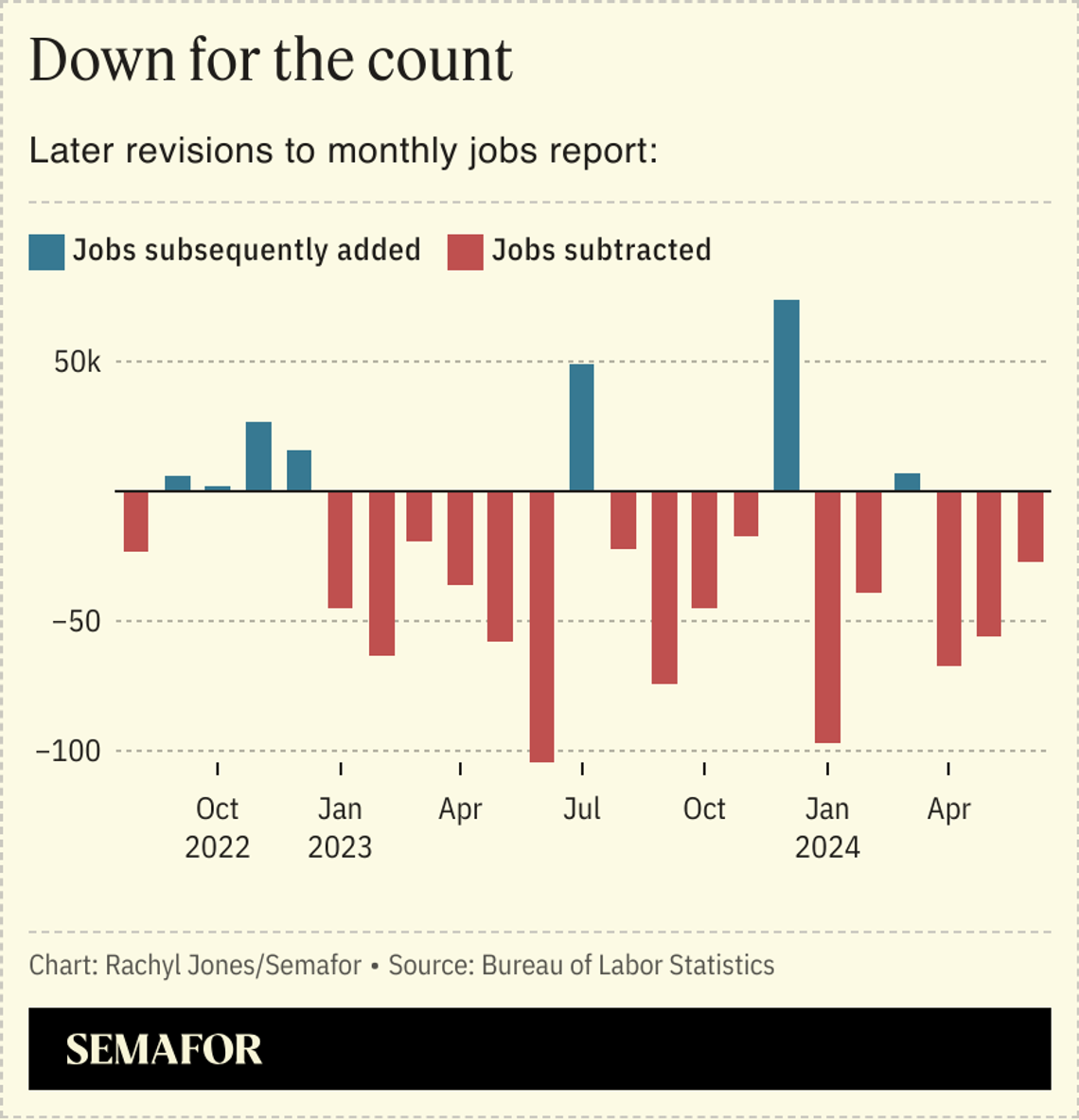

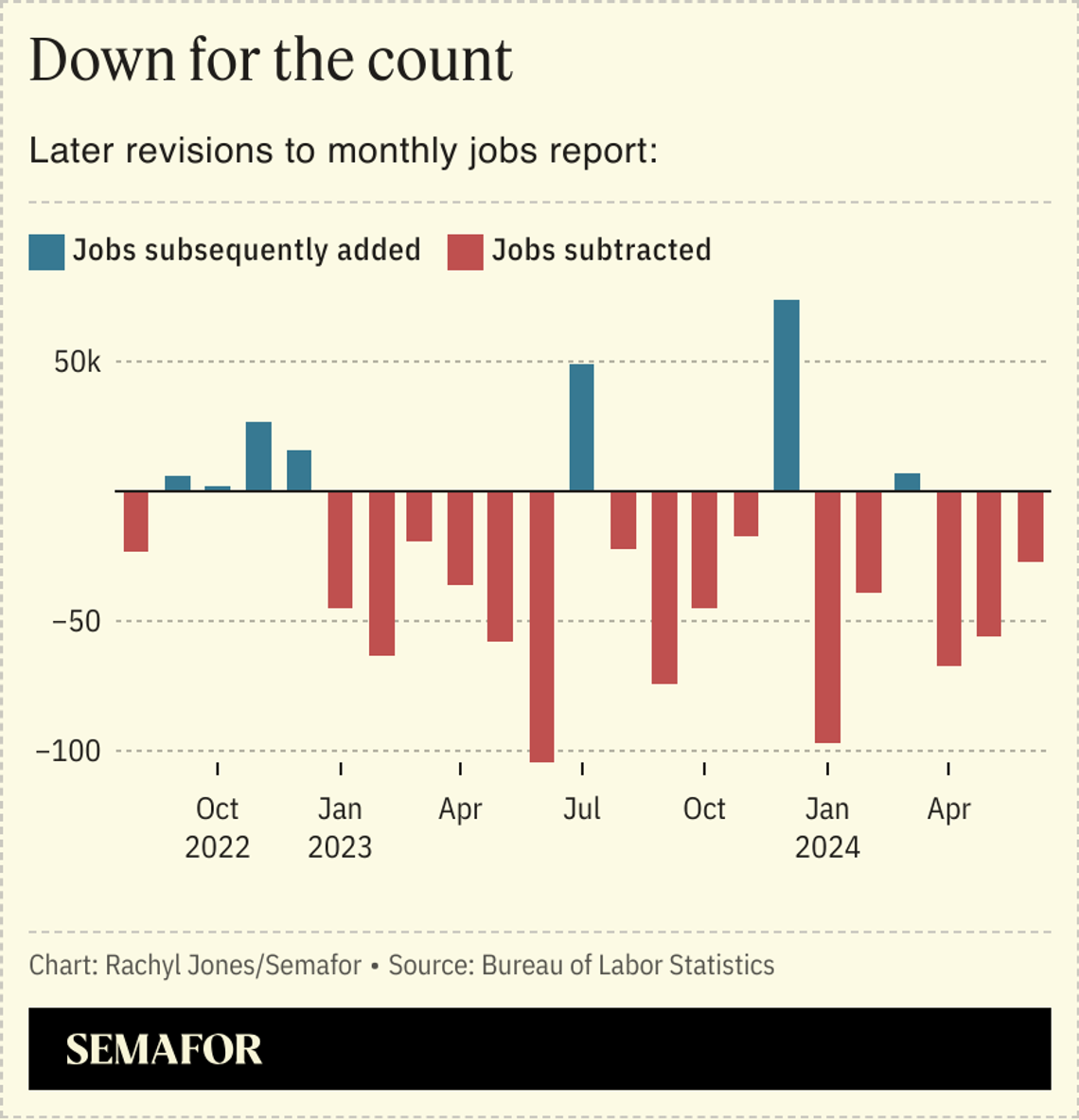

We’ve had a lot of data points in the past few weeks, some of them contradictory. How do you weigh them? Jason Furman: It’s a weird economic situation right now, because GDP and consumers and business investment are all booming, just fantastic, 3% growth. But you have the forward-looking signals about manufacturing and concerns about consumer balance sheets, things like delinquencies, going the other direction. The hard data is mostly very strong, and a lot of the soft data reflects expectations about the future being weak. So it’s this sense of foreboding. Isn’t the forward-looking stuff more meaningful? Like the turkey-in-the-oven problem? I’m nervous about it, but I believe what businesses and people do with their dollars more than what they do with their words. And businesses are continuing to invest. Manufacturers are continuing to build structures. Consumers are still buying both goods and services. So when people have a choice to make, they are acting in a confident way.  Flickr FlickrWhy does it seem like the revisions to the jobs numbers are always down, not up? One possibility is that the revisions are wrong. That’s what Goldman Sachs is saying, that tax data doesn’t capture all immigrants. But historically, when you have an economy that is slowing, you get a lot of serial negative revisions and when it’s speeding up you get a lot of serial positive revisions. I remember talking to President Obama in 2015 or so and we’d had, I think, 24 straight months of positive revisions, and he asked ‘Why can’t we have the great number the day we announce it? Why do we wait two months when nobody is paying attention?’  What do you think about the idea of taxing unrealized capital gains? The tax nerd in me likes it. There are practical implementation issues, but there are also a lot of issues like tax avoidance and distortion that are caused by tying capital gains to realization. But boy, do people hate the idea, and I think it is way less central to [Kamala Harris’] campaign and economic plans than it is to the magnitude of discussion. [Harris rolled back Biden’s plan yesterday but appears to still be supporting a minimum tax on billionaires that would include unrealized capital gains.] On the other end of the labor market, what about untaxing tips? I don’t know any economist who thinks that’s a good idea. One, it treats different types of income differently. Two, a lot of low- and middle-income workers aren’t paying taxes, so it’s not going to do anything for them. And three, in the long run it will encourage more tipping, which I don’t think anyone wants. |