| In today’s edition, experts weigh in on what the Fed’s big rate cut means for dealmaking, housing, s͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business.

Wall Street is divided into three groups: investors, traders, and bankers. Let’s set aside bankers for now, who are busy trying to will M&A deals back into existence. Traders and investors both buy and sell things, but what distinguishes them is their horizon.

Traders care a lot about day-to-day moves, and so the roughly one-half of them who were betting that the Federal Reserve would make a smaller, quarter-point cut to interest rates lost money yesterday when the central bank went for twice that. Investors take a longer view of things.

To the extent Fed Chair Jay Powell is either, he’s an investor, having spent his private-sector time as a partner at private-equity firm Carlyle. He sounded like one yesterday, deflecting reporters’ questions about potential trouble ahead in the job market. “The labor market is actually in solid condition, and our intention with our policy move today is to keep it there,” he said. “You can say that about the whole economy.”

The unemployment rate is ticking up, but at 4.2% is historically low. Layoffs aren’t rising. There are enough jobs for most people who want one and enough workers to fill most job postings, which should keep real wages growing but not inflationary. With a sightline to base borrowing rates in the 3% range, money costs enough to keep a lid on the financial nonsense of the ZIRP era, but not too much to stifle growth. The dollar is strong and stable. Powell sounded close to claiming victory.

Which explains why the Trump camp is not happy: Things are going well, so the fight is now over who gets credit. “The Fed very inappropriately placed its thumb on the election’s scales,” Trump economic adviser Stephen Moore tells Semafor, saying the larger cut “screams of interference … Why couldn’t this wait until the day after the election?”

In today’s newsletter: What Axel Springer’s split says about private equity and media. Plus, Donald Trump’s latest idea on credit cards, and experts weigh in on what lower rates mean for M&A, stocks, housing, and beleaguered banks (less than you’d think for now).

David Ryder/Reuters David Ryder/Reuters➚ BUY: Picket lines. Boeing furloughed tens of thousands of white-collar workers and cut its new CEO’s pay to alleviate the estimated $500 million it’s losing in revenue every week after its machinists went on strike. ➘ SELL: Ballot box. For the first time since 1996, the Teamsters won’t endorse a presidential candidate, a blow to Kamala Harris. Her last-minute charm offensive failed to win over the union, whose boss spoke at the Republican National Convention last month. |

|

Where’s Chopra?: The FDIC postponed a board vote scheduled for tomorrow to approve revamped bank capital rules as its swing vote, consumer-protection advocate Rohit Chopra, remains undecided, people familiar with the matter said. The agency is the holdup in advancing the new rules, which were rewritten earlier this year after heavy lobbying from Wall Street. They already have the support of the Federal Reserve and other bank watchdogs. |

|

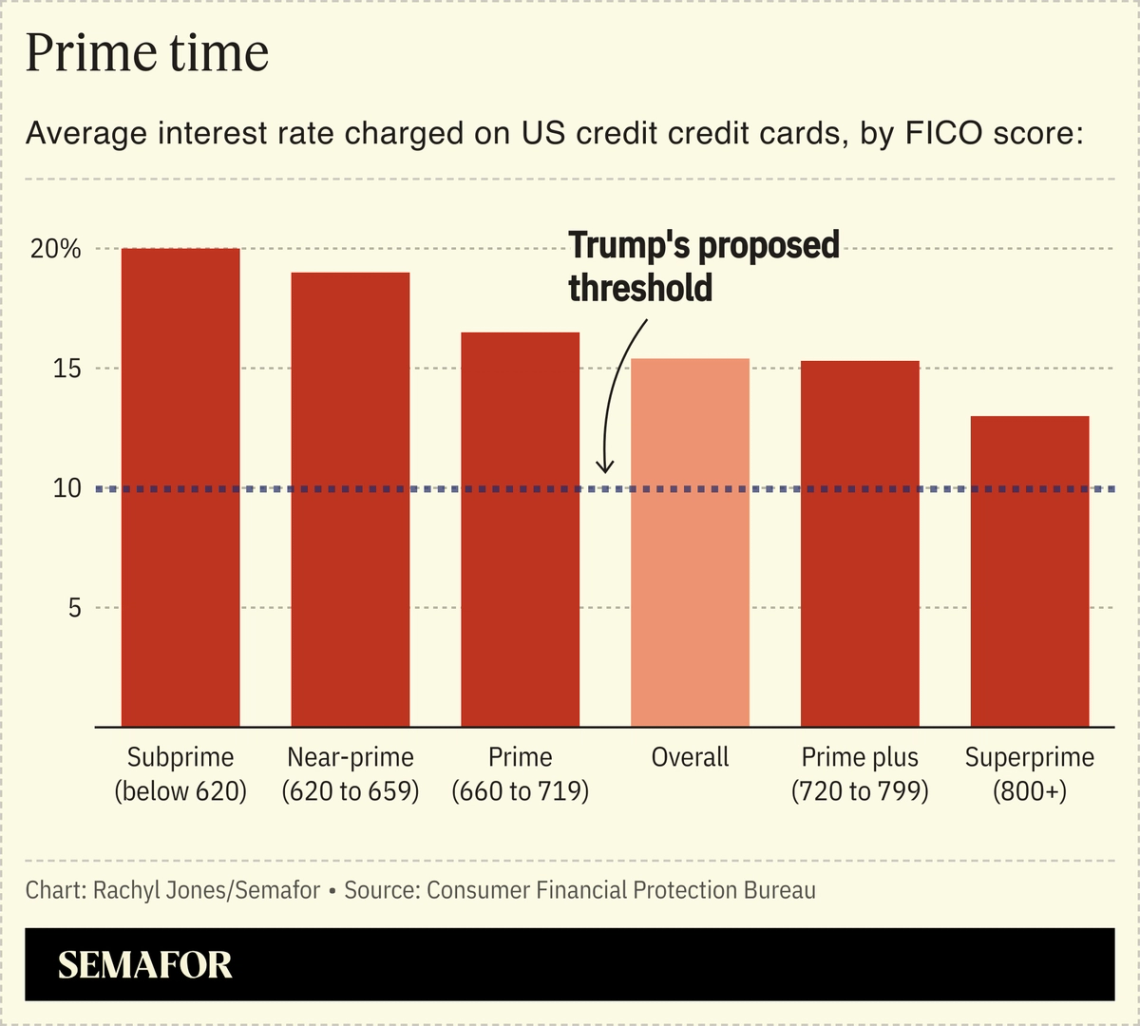

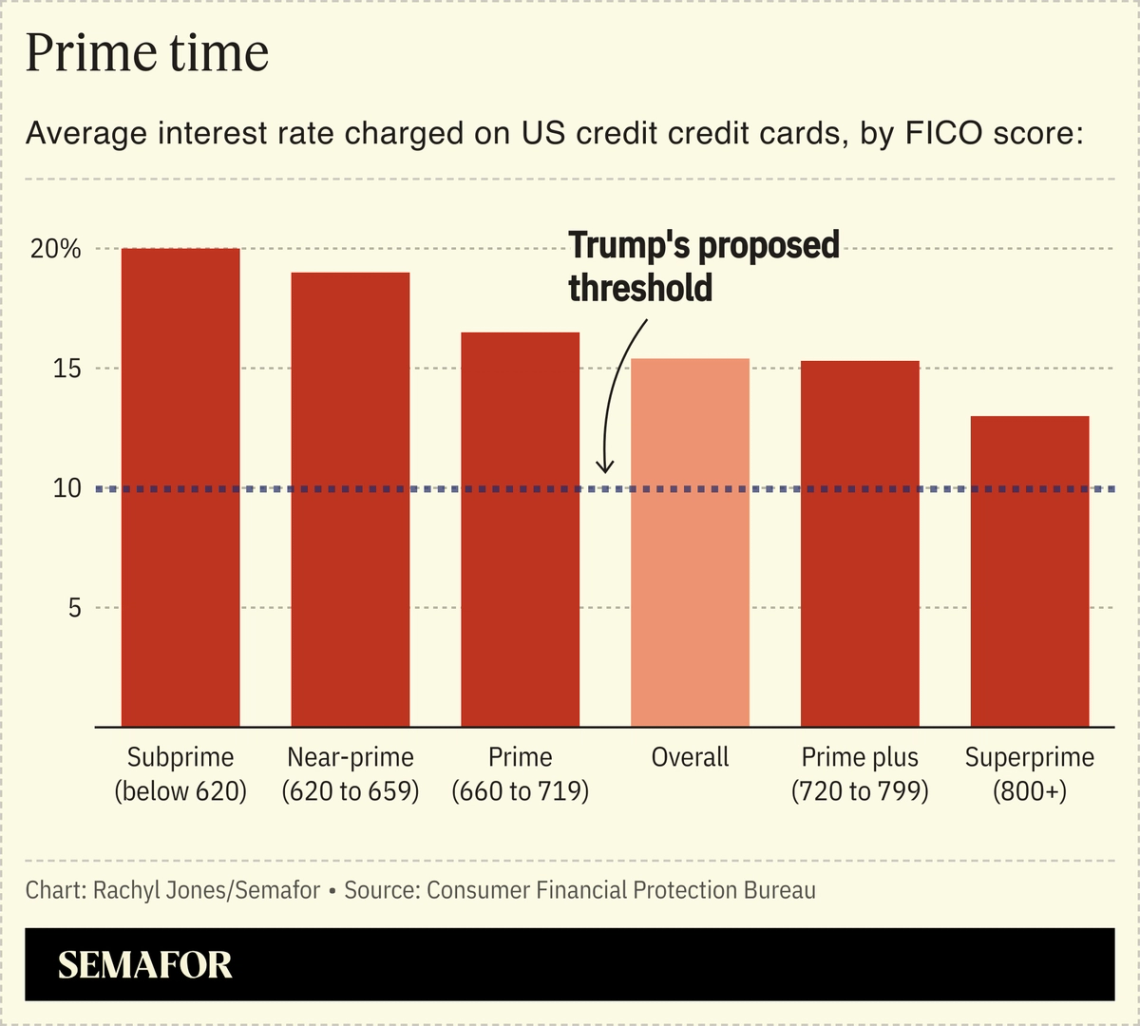

Donald Trump floated a 10% cap on credit-card interest rates. That outflanks even Bernie Sanders, who would be happy with 15%. Republican Sen. Josh Hawley has proposed 18%, showing the horseshoe theory of politics at work in this election cycle. Trump keeps rolling out policies that many economists say are unhelpful or unworkable but are popular with voters, like steep tariffs and no taxes on tips or overtime. Banks would likely respond to caps in that range by simply not offering cards to borrowers with lower credit scores, whose higher delinquencies make them riskier customers to begin with. Progressives may howl, but even conservative economists have found that price controls around financial products help the wealthy and hurt poorer consumers. Worth noting: The Biden administration’s plan to cap credit-card late fees — though not the interest rate charged on overdue balances — was halted in May by a Trump-appointed judge. |

|

The Fed went big. Now what? |

|

Axel Springer’s split shows the problem with PE and media assets. The more fun they are to own, the less money they make. The company announced today that CEO Mathias Dopfner and Friede Springer, the widow of the company’s founder, will take back Axel’s influence-wielding publications, which include Business Insider and Politico. KKR will take its cash-cow advertising assets, which include an online job board and a Zillow competitor called Aviv. Private-equity firms can manage websites and maintain margins, something Apollo has done well with AOL and Yahoo. But they’re finding it harder to play in the culture and politics that make owning media assets so much fun and still get the returns their investors demand. Power is expensive and, as Axel Springer’s adventures in the orbit of Donald Trump show, sometimes problematic. (See also: TPG has been trying for months now to sell out of Graydon Carter’s Airmail. Talks reported earlier this year by Semafor have stalled and the company is now trying to reboot them, NYT reports.) |

|

If you’re in NYC for the United Nations General Assembly, be sure to check out the programming lineup from the Business Council for International Understanding. BCIU will host a series of programs featuring global heads of state and ministers, covering a wide range of topics, including AI, climate, health, agriculture, and more. Learn more and RSVP here. |

|

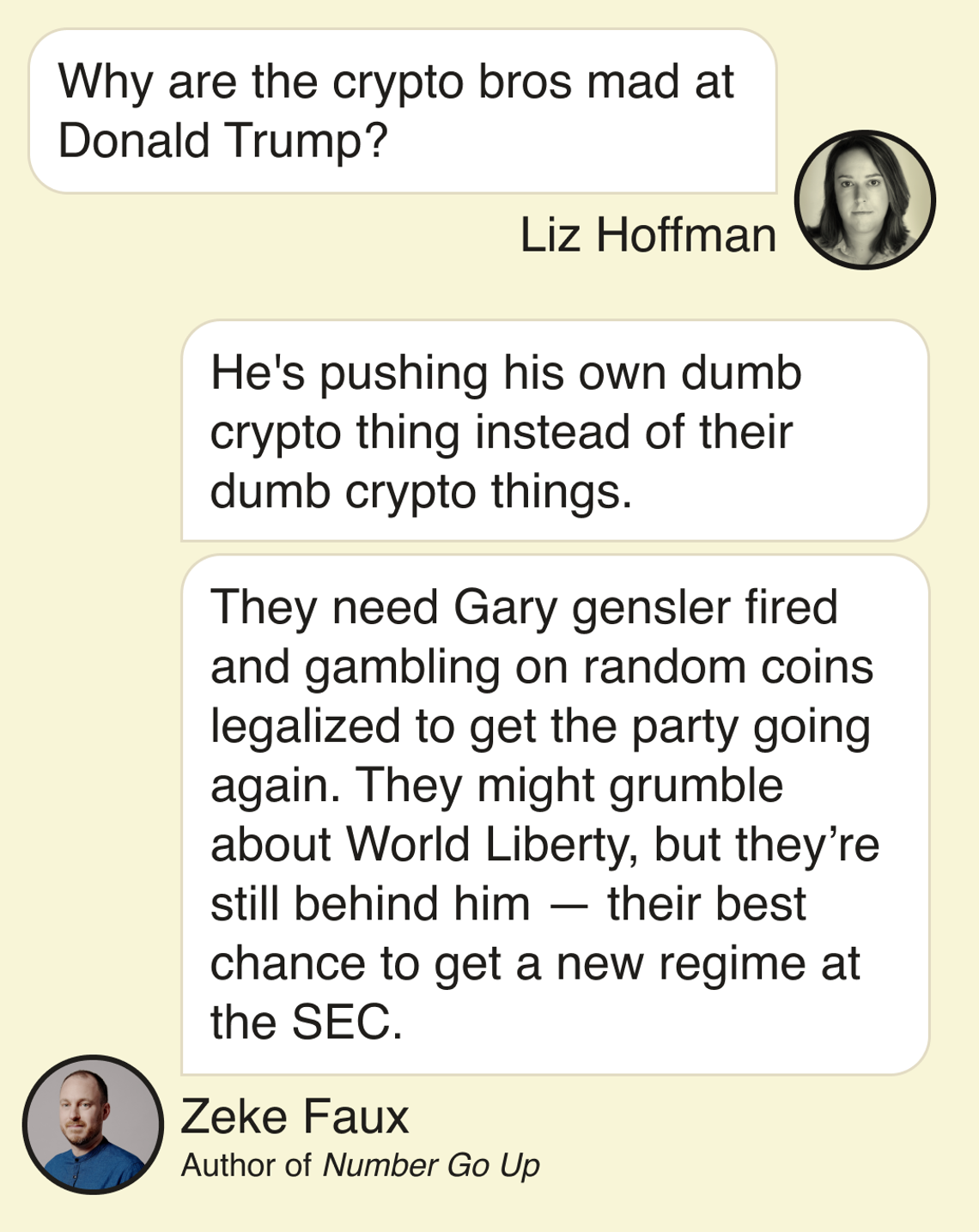

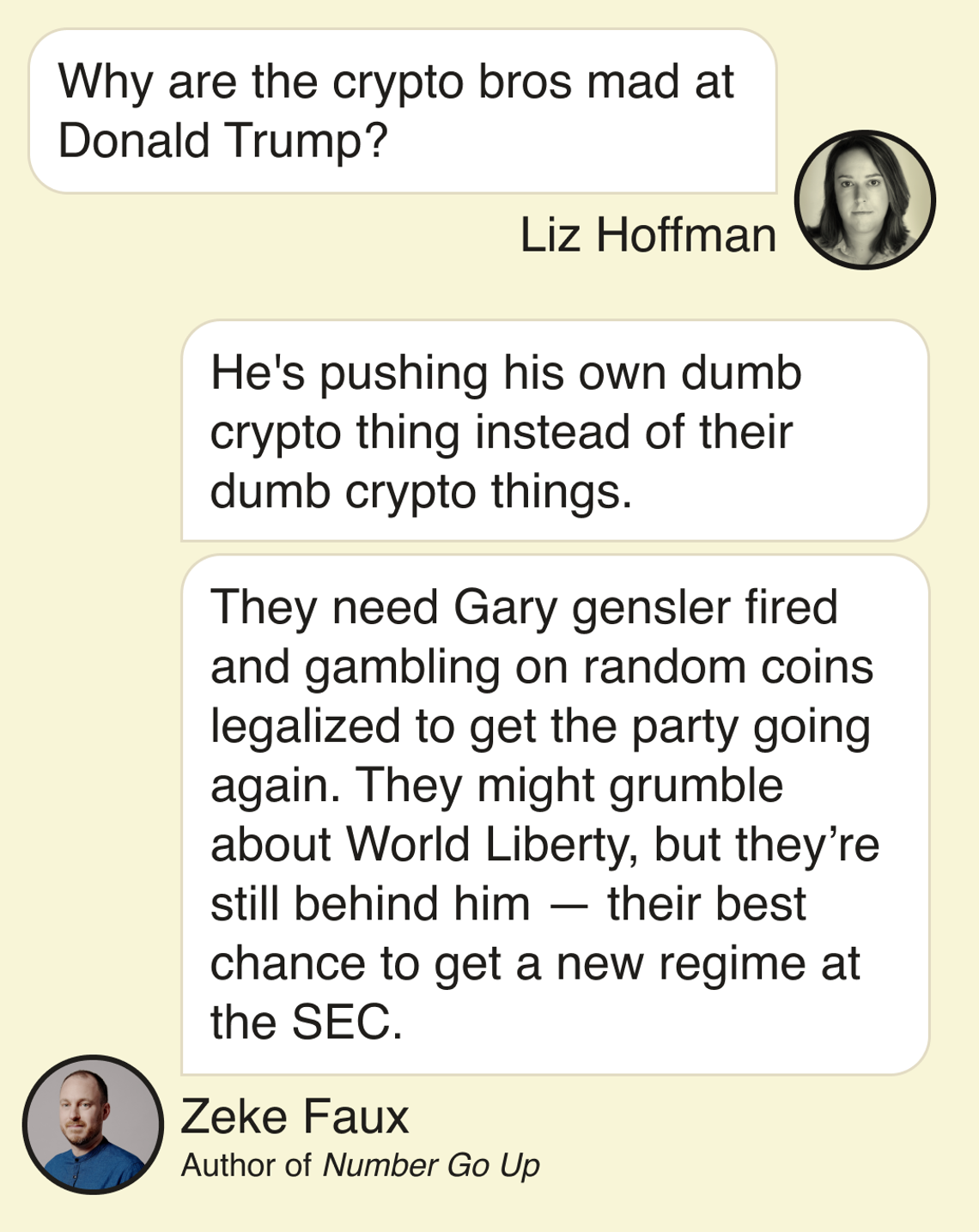

Zeke Faux is the author of Number Go Up (paperback edition out Oct. 1) and has covered the rise of crypto for Bloomberg Businessweek.  |

|