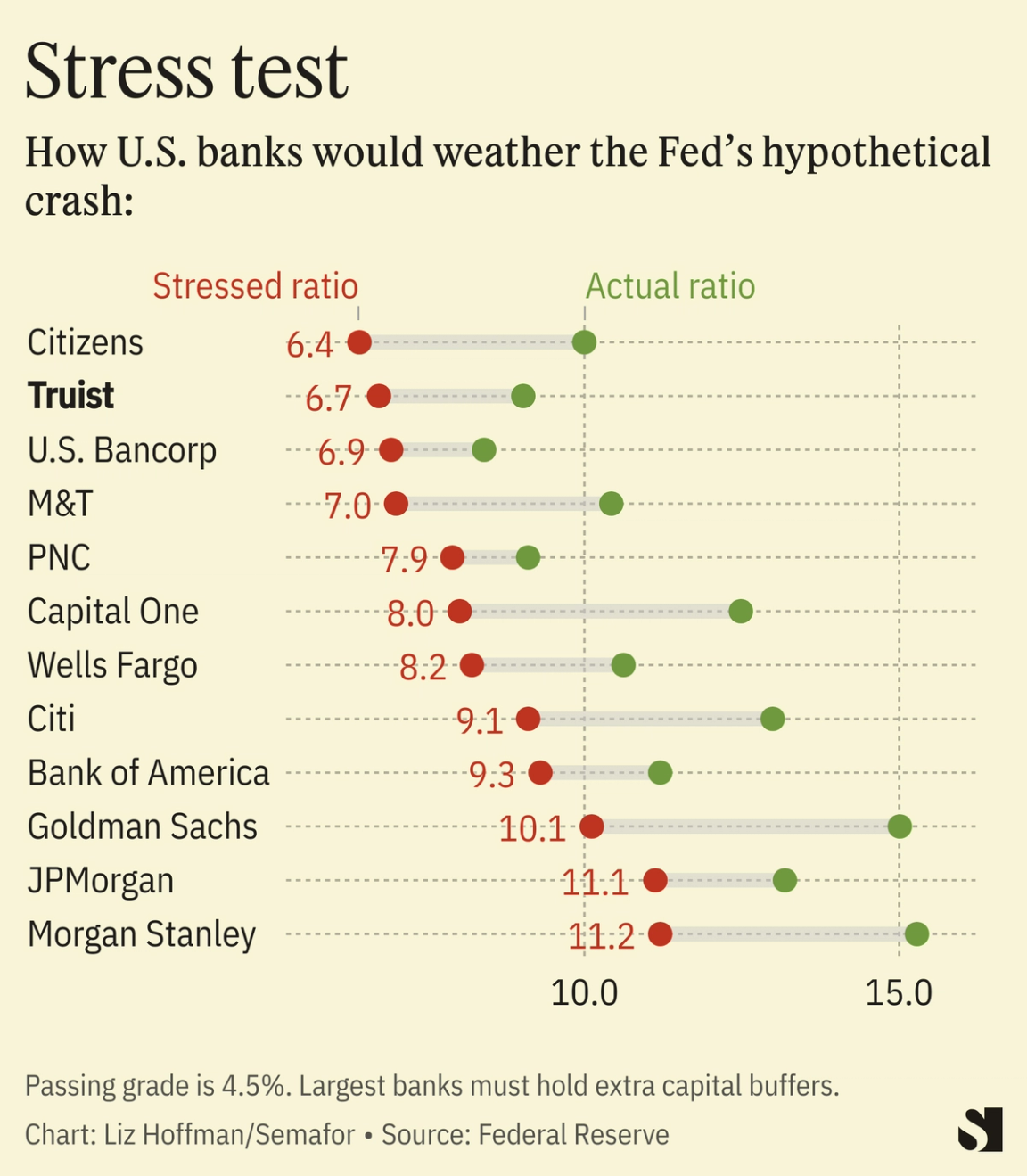

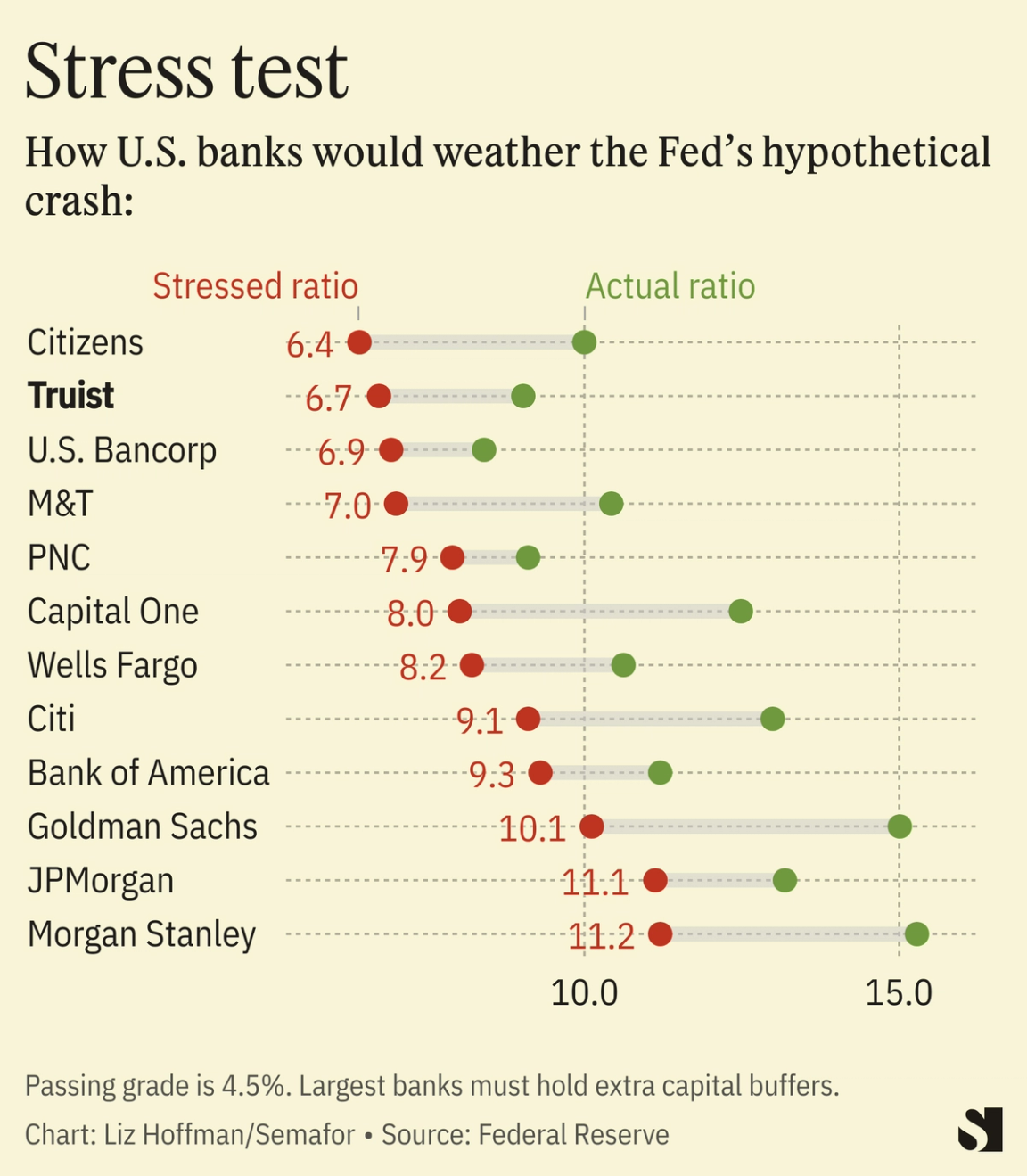

THE SCOOP Regional bank Truist is in talks to sell its giant insurance brokerage to private-equity firm Stone Point for about $10 billion, an early consequence of new, tighter regulations meant to avoid another run of bank failures. Stone Point earlier this year bought 20% of the business and is now negotiating to acquire the rest, people familiar with the matter said. Truist Insurance Holdings says it’s the seventh-largest insurance broker in the world. The stake sale in February, which included money from Emirati sovereign fund Mubadala, valued it at $14.5 billion. It’s not clear whether the current deal would include other investors. Talks are ongoing, the people said, and a deal may hinge on Stone Point’s ability to scrounge up enough debt in a market that’s been skittish on buyout loans. A spokesman for Truist declined to comment. Stone Point did not respond to requests for comment.  Reuters/Graeme Sloan Reuters/Graeme SloanKNOW MORE Stone Point, which managed $45 billion at the end of last year, has carved out a niche taking unwanted divisions off of financial firms’ hands. It bought TIAA’s bank last year and recently partnered with insurers AIG and Axis Capital in separate deals to free up capital. LIZ’S VIEW Regulators didn’t put this deal together over a weekend, but their fingerprints are all over it. In February, Truist sounded keen to hold onto its 80% stake. Then four regional banks failed and now new rules are coming for Truist and its peers. Regulators are likely to raise banks’ required ratio of loss-absorbing capital to assets, and Truist was cutting it close in its latest Fed stress test. “We’re in a build-capital mode,” CEO Bill Rogers said at an industry conference in May. “We’re going to be in build mode until we have more information, more certainty” about regulators’ plans. The insurance operation is an obvious place to get it. Rogers said last month that Truist’s stake was tying up 2 percentage points of capital and hinted at a sale. As of June 30, Truist’s all-important ratio was 9.6%, versus a minimum that rose to 7.4% this month and may rise further yet.  ROOM FOR DISAGREEMENT Truist might regret parting with a business that churns out 25% margins and never gets anyone hauled in front of Congress. Banks prize steady, fee-based businesses, and so do regulators and investors. Truist’s living will, its plan for an orderly wind-down in a crisis, involves selling its insurance arm for cash. Offloading it now will leave Truist with just two business lines — consumer banking and commercial banking — where scale has favored giants like JPMorgan and Bank of America. NOTABLE |