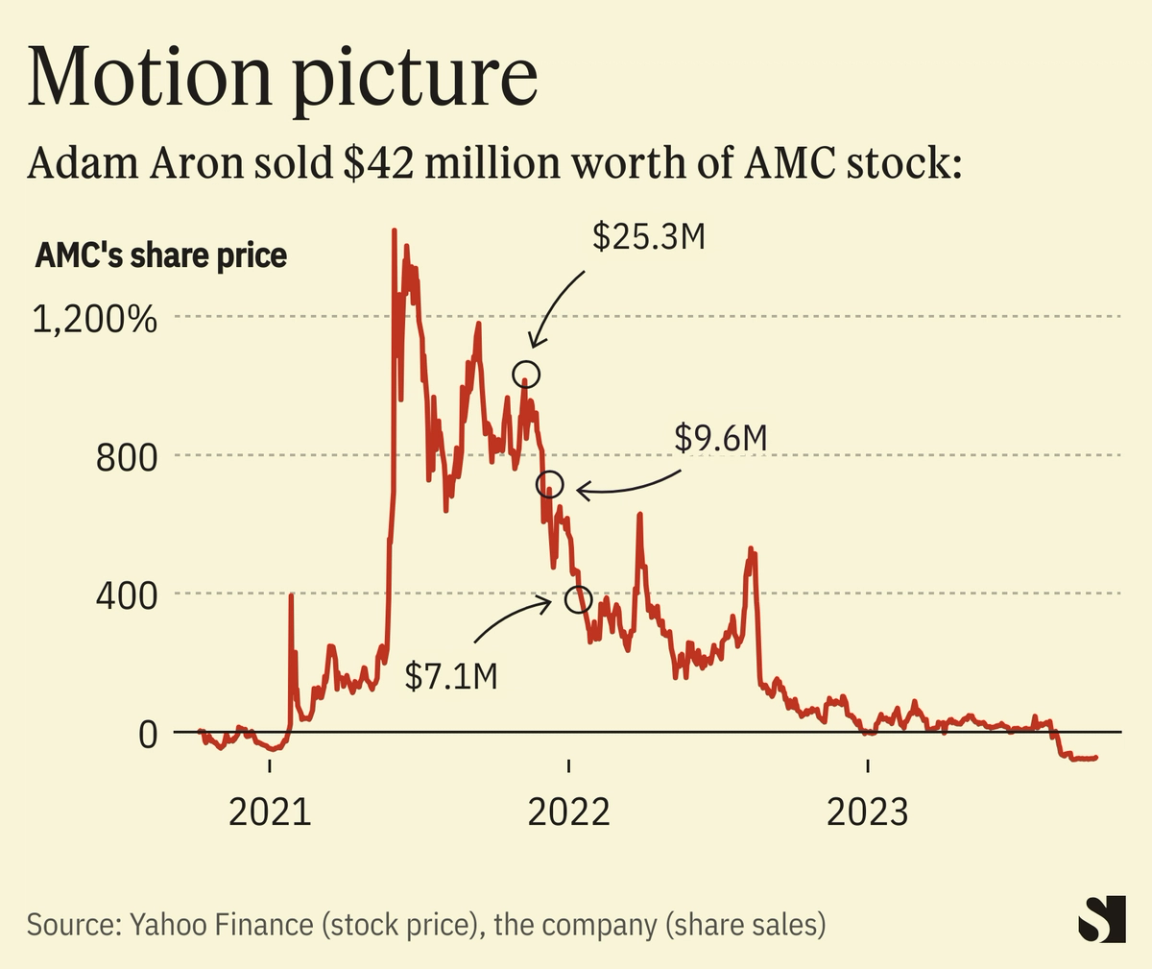

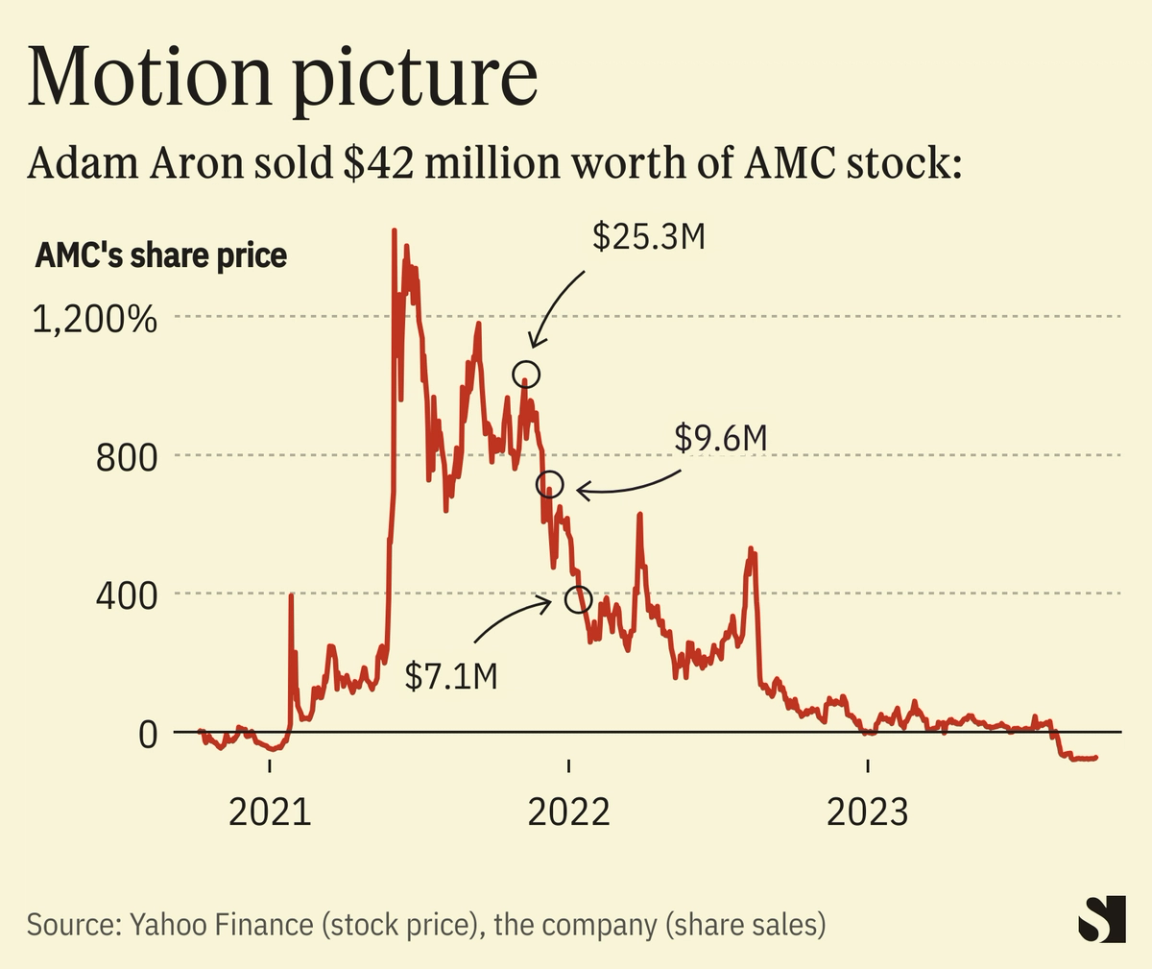

THE SCOOP The high-profile and feisty CEO of the movie theater company AMC, Adam Aron, sent sexually explicit images and messages in a weeks-long text exchange with a woman who tried to extort hundreds of thousands of dollars from him using fake identities. The outlines of the catfishing scam, which included demands for hush money and threats to tell the press and AMC’s board, were laid out in a 2022 federal indictment of a Bronx woman, who pleaded guilty this summer. Aron is “Victim 1,” according to biographical details in documents filed in the Southern District of New York and confirmed by people familiar with the matter. At the direction of the FBI, Aron told AMC’s board about the incident only after the woman, Sakoya Blackwood, was sentenced in July to time already served, one of the people said. AMC’s board confirmed Aron’s involvement and said in a statement to Semafor: “The board retained independent counsel, WilmerHale, to look into the incident. The board determined it was a personal matter, and considers the issue resolved.” Aron declined to comment through a spokesman. Aron embodied the meme-stock craze, when AMC shares soared alongside those of GameStop, BlackBerry, and other left-for-dead companies. Calling himself “The Silverback” and taking to Twitter, now X, he became the spiritual leader of an online army of retail investors, known as Apes, who gather on social-media sites to await the #MOASS — mother of all short-squeezes — that will bankrupt hedge fund investors betting against AMC stock.  Semafor/Al Lucca Semafor/Al LuccaIn March 2022, Blackwood began texting Aron under the name “Mia.” She sent photos of a person that her attorneys later said was a 17-year-old Russian model. (Prosecutors said the photo was of a Russian model but didn’t specify an age.) Aron, who has been married since 1987, mistook her for a woman with whom he’d had a prior relationship, asking whether she was a ballerina who had done “unmentionable things” to him, according to court documents. The two began trading messages, and Aron eventually sent her explicit pictures, including of him and another woman, according to the government’s sentencing memo. Blackwood later made up other characters and texted Aron through online burner accounts from a fake ex-boyfriend and a fictitious Vanity Fair reporter who claimed to have seen some of the messages. She demanded hundreds of thousands of dollars in hush money and threatened to take the photos and messages to the press and AMC’s board, at one point texting Aron the unlisted cell phone numbers of six directors. “Offers are coming in like crazy ppl love a scandal,” she texted Aron under the guise of the ex-boyfriend. Aron didn’t pay the blackmail and reported the events to the FBI, prosecutors said. LIZ’S VIEW Aron is a victim here, and prosecutors say he never compromised corporate secrets. But this is his latest display of questionable judgment and could put new pressure on him from his board or already-restive investors. He appeared not to be wearing any pants in a 2021 interview. In 2022, AMC spent $28 million buying a stake in a teetering gold miner, a deal that Aron called a “bold diversification move” and one analyst called “idiotic.” He announced a plan to deliver fresh movie popcorn from AMC theaters to people’s houses. He pivoted to NFTs. He sold huge amounts of stock into the meme craze, cashing out ahead of a 94% decline in the share price over the past two years.  A massively dilutive $325 million share sale last month alienated even loyal backers. The company recently warned investors that “negative sentiment among AMC’s retail stockholder base could have a material adverse impact” on the stock. ROOM FOR DISAGREEMENT Aron’s unorthodox behavior has arguably been good for AMC, in the same way that Elon Musk’s antics have arguably been good for Tesla over the years. By embracing the Apes, Aron was able to raise millions of dollars through stock offerings to see AMC through the pandemic. (The company issued so much stock that it literally ran out, then fixed that problem by issuing preferred shares that it called AMC Preferred Equity, or APEs.) A CEO getting catfished might unnerve traditional investors — in the same way that a CEO getting repeatedly sued by the SEC might — but I’m not sure the Apes will care. NOTABLE |