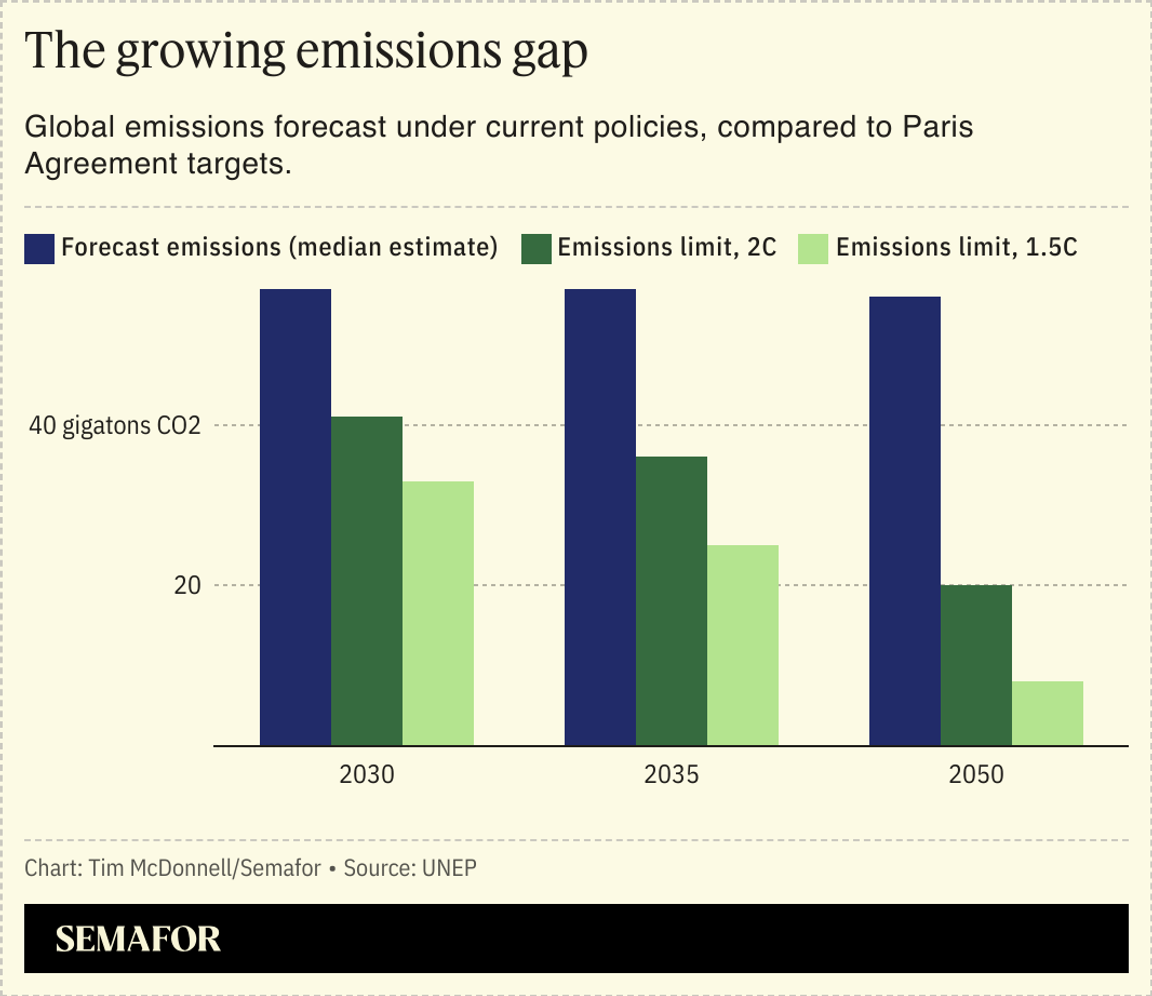

The odds that the world can meet the Paris Agreement aspiration to limit global warming to 1.5°C above pre-industrial levels are essentially zero without drastic policy change, the latest UN analysis concluded.  As COP29 approaches, countries with large carbon footprints are dangerously neglecting their obligation to adopt stronger decarbonization policies, as they’ve promised, according to the UN Environment Program’s latest Emissions Gap report. Under current policies, the world is on track for 3.1°C of warming by 2100, with “catastrophic” consequences; if countries manage to follow through on the nonbinding national plans they’ve submitted through the COP process, that forecast could fall to a still-devastating 2.6°C. Every year that passes without a marked drop in emissions makes it much harder and more expensive to close the future gap. And even though countries committed at each of the last three COPs to adopt stronger 2030 targets, so far only Madagascar — where per-capita emissions are among the lowest in the world — has actually done so. |