| In today’s edition, a look at how the revenue (donations) and expenses (campaign spending) of this c͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business, Election Day edition.

You’ve heard the superlatives. This is the most expensive, tightest, and most-gambled-on election in history. Across the presidential, congressional, and local elections, some $16 billion has been raised and spent, the last of it flooding swing states with ads today.

If the 2024 cycle were a company — its donations treated as revenue, and its expenditures as a corporate budget — it would be bigger than Keurig Dr Pepper and just smaller than MGM Resorts. Throw a standard media-company margin and stock-price multiple on that (because what are campaigns if not advertising agencies?) and you get a market cap somewhere around Dollar General’s, a fitting comparison for an election that’s been dominated by economic anxieties.

Not to add to those anxieties, but if you’ve been listening to financial executives over the past few weeks, a word you’ve heard more and more is “inflationary.” The Federal Reserve’s fight against runaway prices is barely won, but already leaders are sounding the alarm about policies — many of them bipartisan — that could spark a resurgence.

Most economists agree that Donald Trump’s plans to curtail immigration, slap tariffs on imported goods, and extend tax cuts would increase prices. Goldman Sachs economists say across-the-board tariffs alone could drive inflation back to 3%.

But budget deficits and economic protectionism are increasingly fixtures of both parties. Infrastructure and industrial spending programs like the CHIPS Act and the IRA can be disinflationary if they fix shortages of key goods. But if they bet on the wrong technologies, they just pump more money into the economy. And if they aren’t paid for, they add to deficits.

Unclear, too, is whether the current antitrust crackdown will result in increased competition, and therefore lower prices, or just an expensive unbundling where we all end up having to pay for Gmail.

Countries and companies around the world are deliberately becoming less efficient, which may be good policy but costs money. Post-pandemic rejiggering of supply chains adds redundancy and moves economic activity away from the lowest-cost providers. So does national-security pressure to decouple from China. European governments that don’t trust NATO to protect them them will spend billions of dollars remilitarizing.

“We have greater embedded inflation in the world than we’ve ever seen,” BlackRock CEO Larry Fink said last week at a conference in Saudi Arabia. “We have government policy that is much more inflationary, whether it’s immigration, our policies of onshoring. No one is asking the question of ‘at what cost?’”

See you Thursday, when we’ll (hopefully) have a winner and a look ahead at the agenda for the next president.

Evelyn Hockstein & Octavio Jones/File Photo Evelyn Hockstein & Octavio Jones/File Photo➚ BUY: Even. The election is literally closer than a coin toss. ➘ SELL: Odds. Betting platform Polymarket has been paying US influencers to promote its site, despite being barred from accepting trades from Americans. |

|

Eight years ago, Carl Icahn famously left President-Elect Donald Trump’s victory party in the early hours, went home, and bet $1 billion on US stocks that soon rallied. All around Wall Street today, traders will be trying a repeat; you’ll read a lot about those who do, and none at all about the whiffs. So far, markets are pretty sanguine but, like the electoral map itself, bleating some contradictory signals. Stocks are slightly up. Treasury bonds are holding onto yield gains, presumably an expectation of a Trump win and ensuing inflation (see today’s intro above). But the dollar is slightly down, despite Wall Street analysts saying the greenback would appreciate under Trump and decline under Harris. Perhaps the purest proxy for Trump’s chances are shares of his media company, which are up 30% since Friday from levels already unsupported by its complete lack of profits. Private prison stocks are making a late rally, too, in a grim expression of Wall Street’s expectations. There’s no single “Trump trade,” and investing is full of accidental winners and intellectual martyrs. Here’s how some popular proxies for his candidacy have fared this year:  |

|

What political fights, distraction, and absenteeism are expected to cost US employers today in lost productivity, according to human-resources consultancy SHRM, whose chief executive told NPR it takes the average worker 31 minutes to recover from an “act of incivility.” |

|

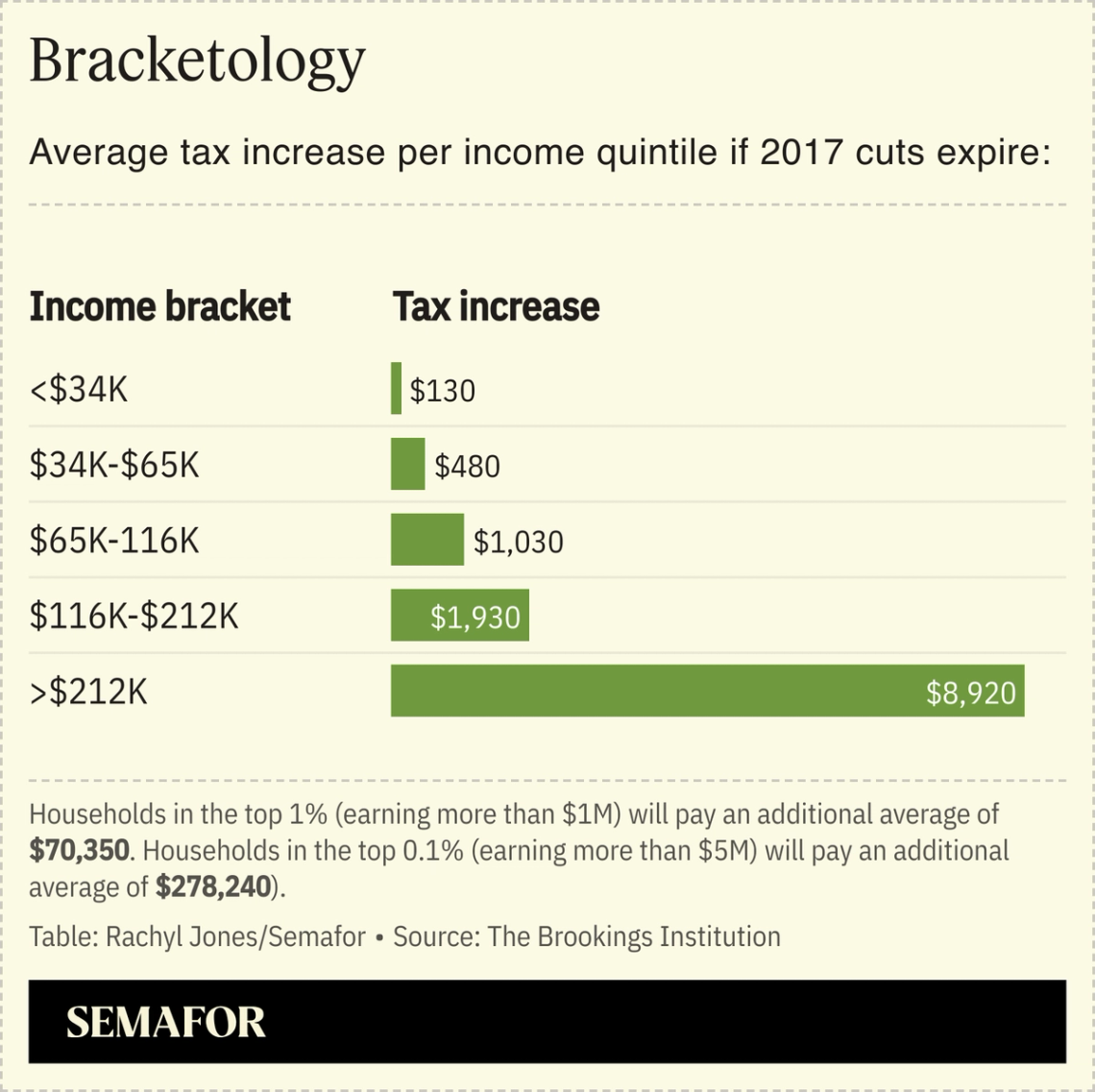

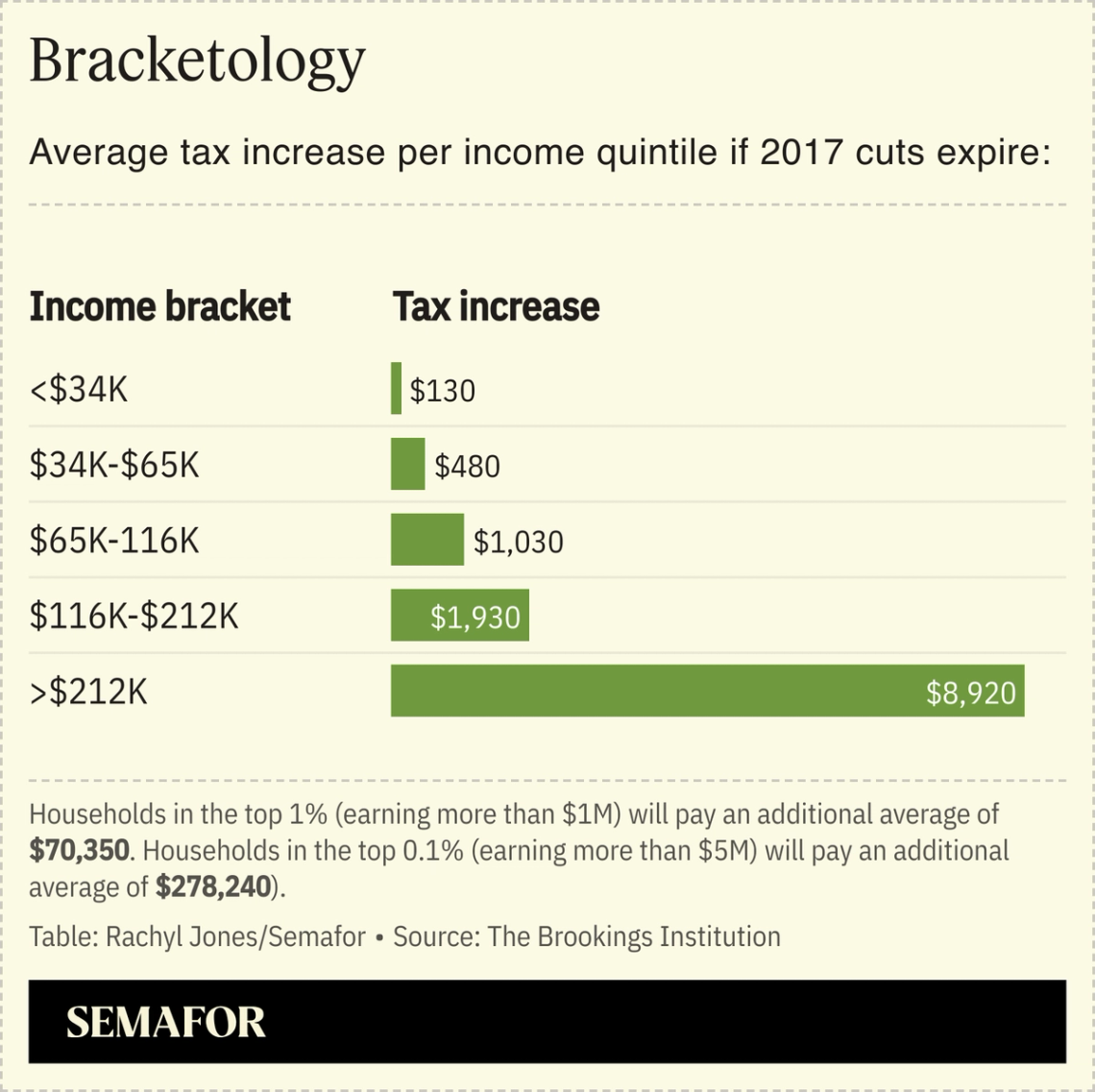

The big fight for the next president and Congress will be over the 2017 Trump tax law, most of which is set to expire in 2025. Republicans want an across-the-board extension, which congressional researchers say would add $4.6 trillion to the deficit. Democrats want to keep the reductions for households making less than $400,000 a year, and also want to raise the corporate tax rate, which is not expiring, to its pre-Trump levels. |

|

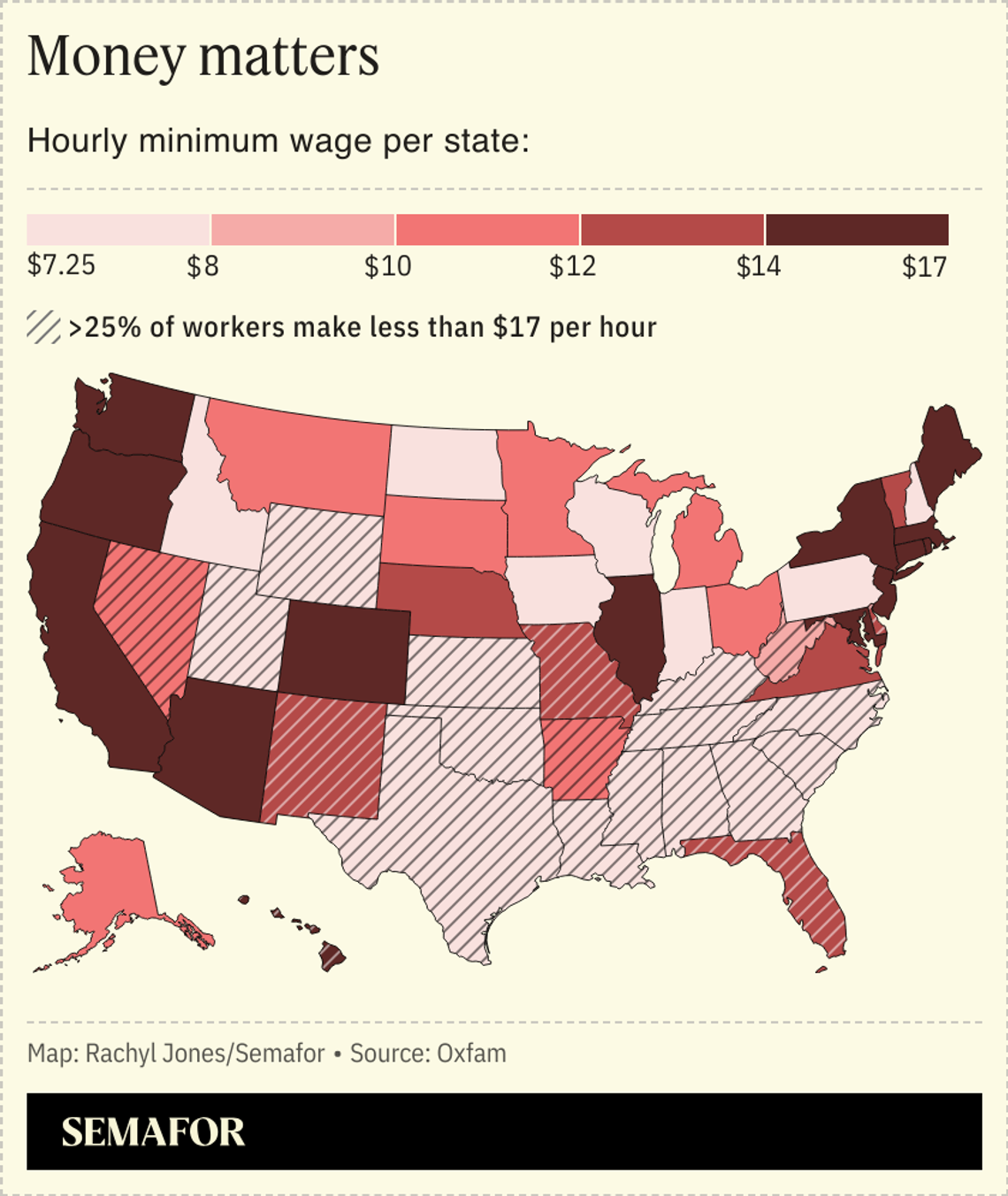

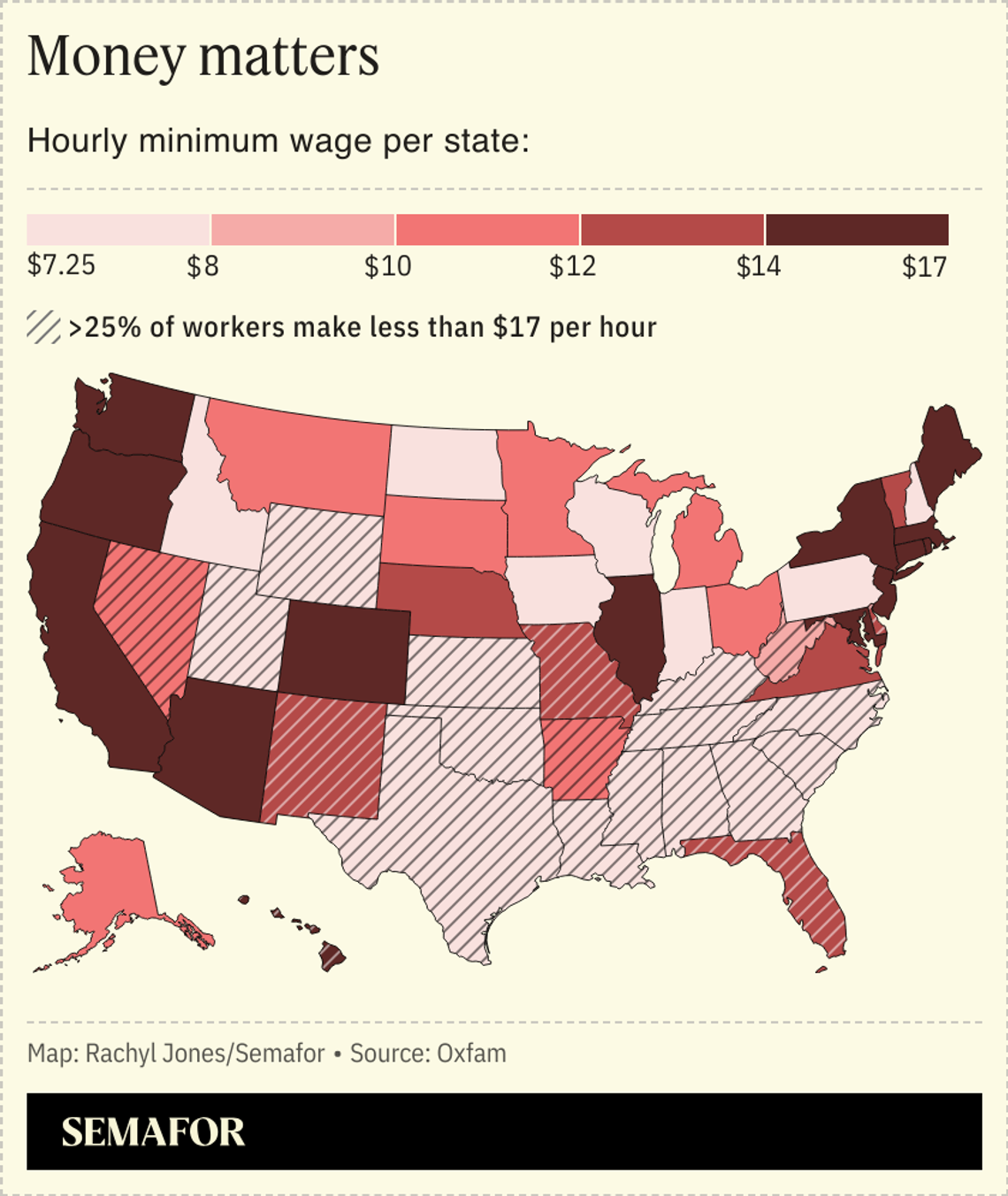

California votes today on raising the state’s minimum wage to $18 by 2026, which would surpass Washington as the state with the highest pay floor. Opponents including California’s restaurant and grocery trade groups say the measure would force businesses to charge more and inflate the already high cost of living, a concern validated by an independent economic consultancy. The outcome is a toss-up, with recent polling from University of California, Berkeley, signaling support hovering around the 50% needed for approval. Blue states like California tend to have higher minimum wages. But red states, particularly in the Southeastern US, offer the lowest minimum wage possible (that’s the federal one of $7.25 per hour) and have a disproportionately high rate of low earners. Mississippians are twice as likely as Californians to make low wages. |

|

David Smooke/Unsplash David Smooke/UnsplashNew York Times journalists confronted their editors about the paper’s coverage of Donald Trump, amid criticism from the left that the Times is too soft on him, Semafor’s Max Tani scooped. “We got a lot of questions from folks worrying about what is in effect the ‘sanewashing’ of him, a term that has come up in terms of criticism of our coverage,” one reporter said during a meeting. Subscribe here to Semafor’s Media newsletter for what’s new in the news industry. → |

|

|