| In today’s edition, we look at the finance and business executives who have influence over the presi͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business.

Two groups of Wall Street executives were at very different parties on Tuesday night. In midtown Manhattan, Kamala Harris’ biggest supporters including Blair Effron and Roger Altman gathered at Aretsky’s Patroon, a swanky East Side haunt, their moods and hopes for White House jobs deflating as the results came in.

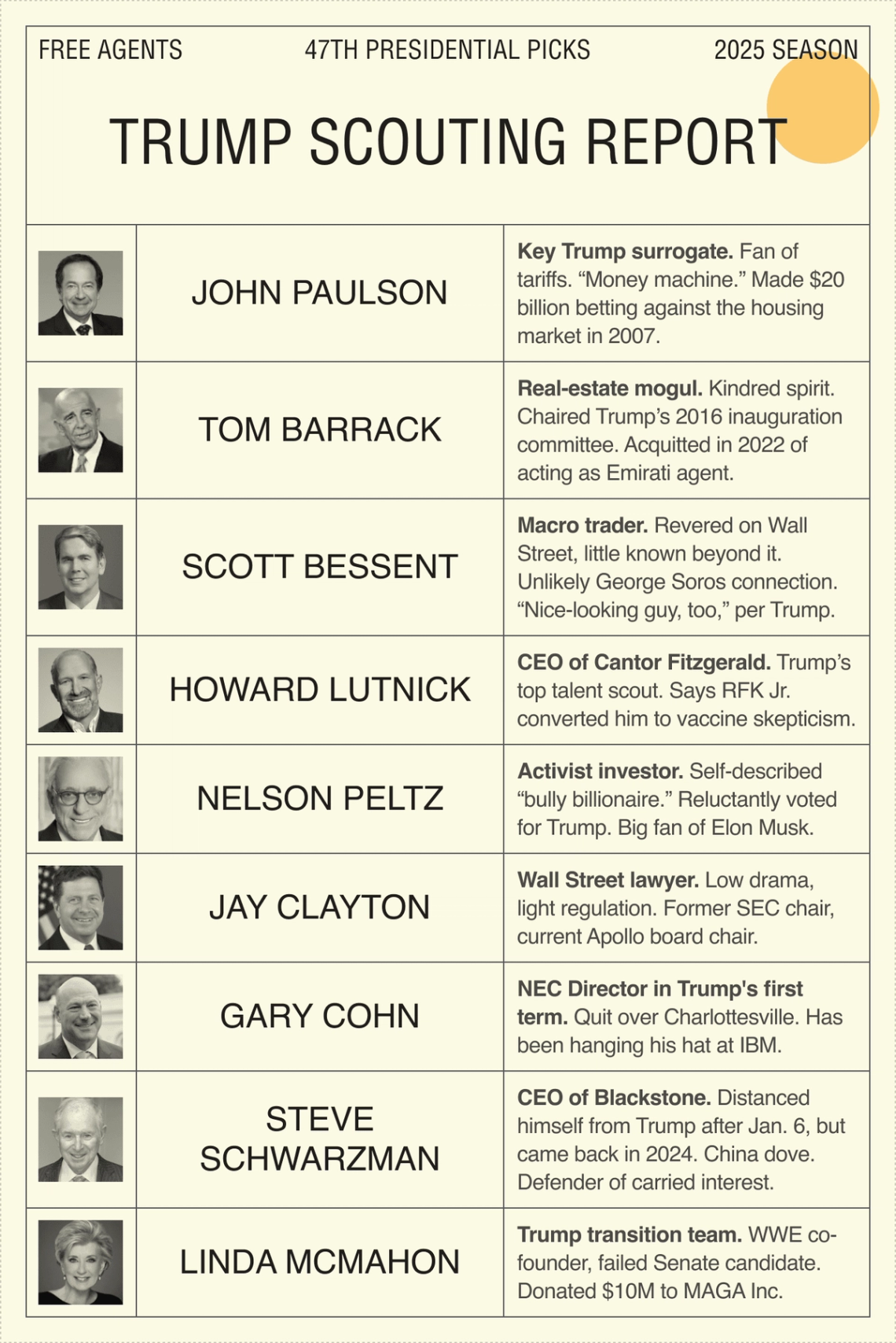

In Palm Beach, Tom Barrack, Scott Bessent and Howard Lutnick watched at Mar-a-Lago, then continued the celebration at a premium cigar lounge party hosted by Republican lobbyist Robert Stryk and conservative media mogul David Spady.

The Trump trade wasn’t just a financial wager. The conservative donors and cheerleaders who went all-in for Trump are sitting as pretty today as those who bought the US dollar or bank stocks or Treasury bonds, all of which surged post-election. (Let’s see if Bill Ackman revives that IPO.) On the wrong side of that wager are Wall Street’s Democrats, who believed this was their year, are out millions of dollars and facing another long stint in the political wilderness. And CEOs who kept their distance from Trump are now racing to cover their bets.

Today we have a scouting report on the financial executives in Trump’s kitchen cabinet, some of whom may end up in his actual Cabinet.

Plus, crypto’s election win, Germany’s economic funk, and what to expect from a Republican Senate.

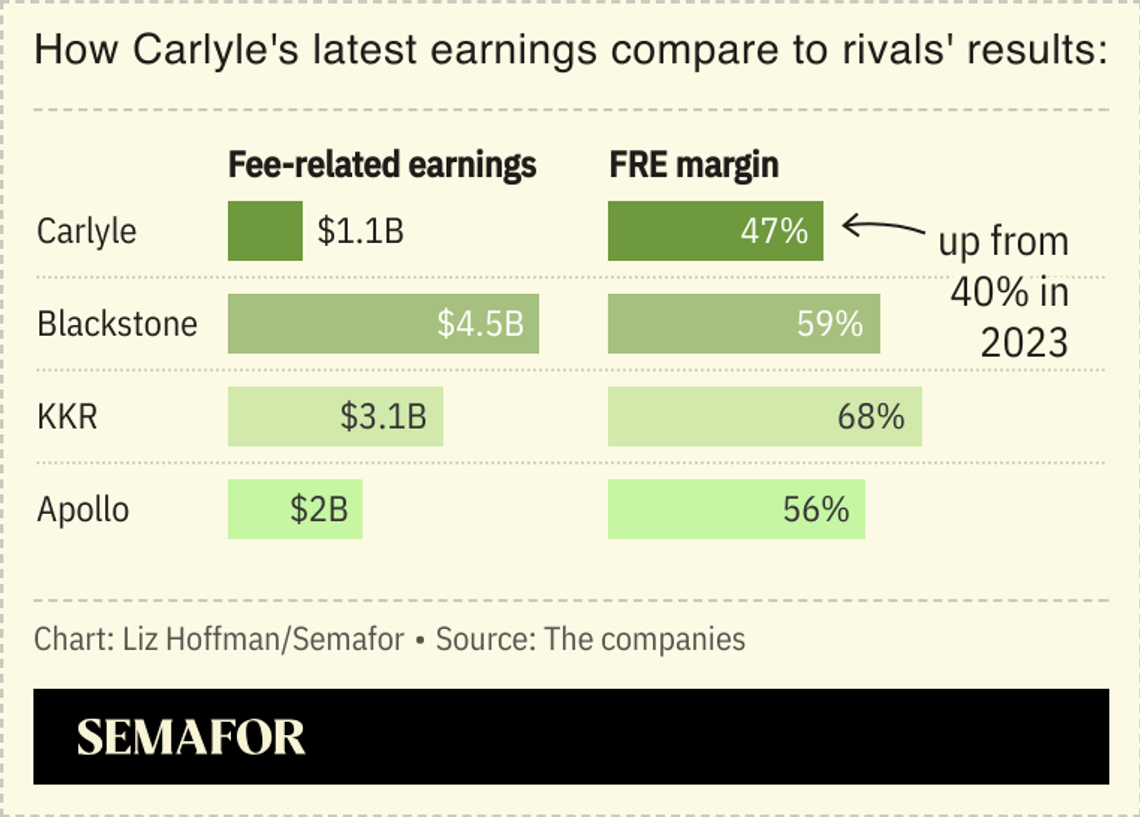

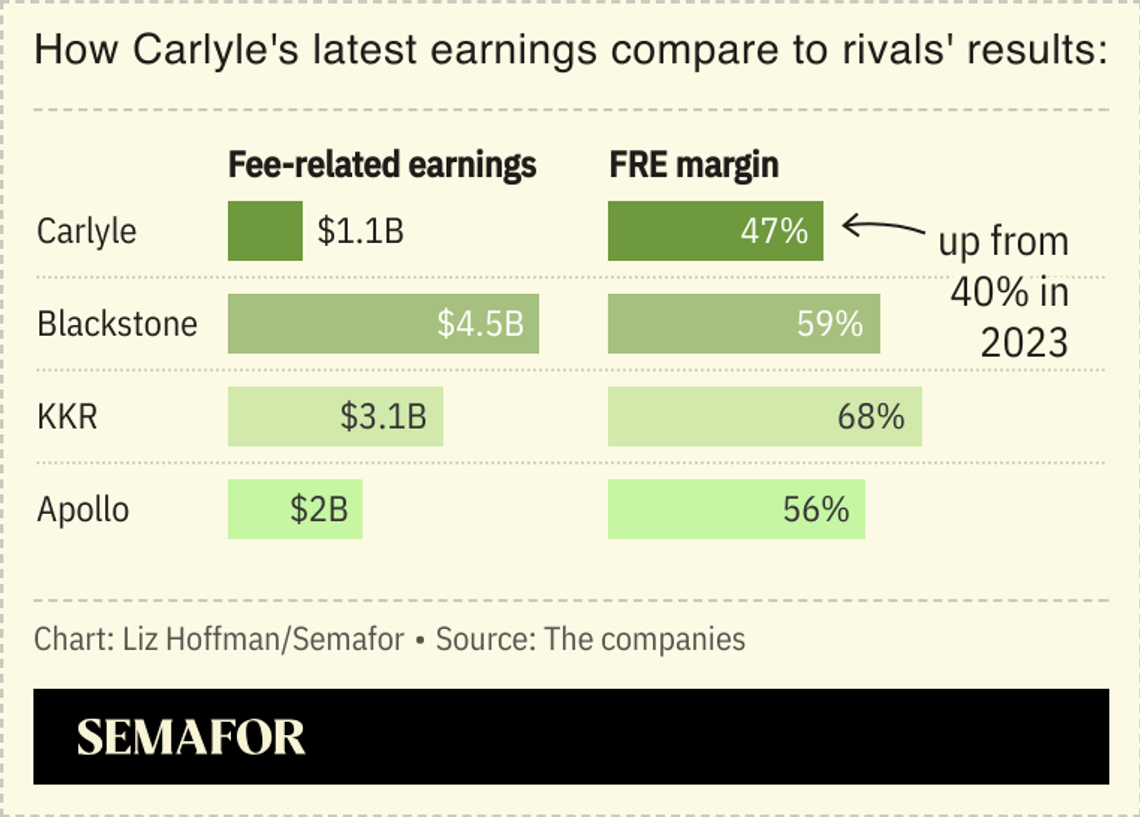

➚ BUY: Bogeys. Carlyle hit its goal of generating more than $1 billion in fee-related earnings, the PE industry’s preferred (if wholly invented and slightly opaque) metric of profits and one on which Carlyle has long trailed rivals. ➘ SELL: Par. Creditors holding even AAA-rated slices of debt on ghosttown office towers are unlikely to get their money back. “Horrific,” one investor told Bloomberg. |

|

| Congratulations, in Order |

With loyalty selling at a premium, CEOs — especially those with key matters before the incoming administration — have started making public shows of support. Few have more to lose than Pat Gelsinger at Intel. The company is awaiting billions of dollars from the CHIPS Act, which Donald Trump has called “so bad” and House Speaker Mike Johnson hinted that Republicans would seek to repeal, before quickly backtracking. (Read our scoop on Washington’s growing concerns over Intel’s viability.) More well-wishes from Jeff Bezos, Sam Altman, Mark Zuckerberg, Sundar Pichai, Satya Nadella, and Tim Cook. |

|

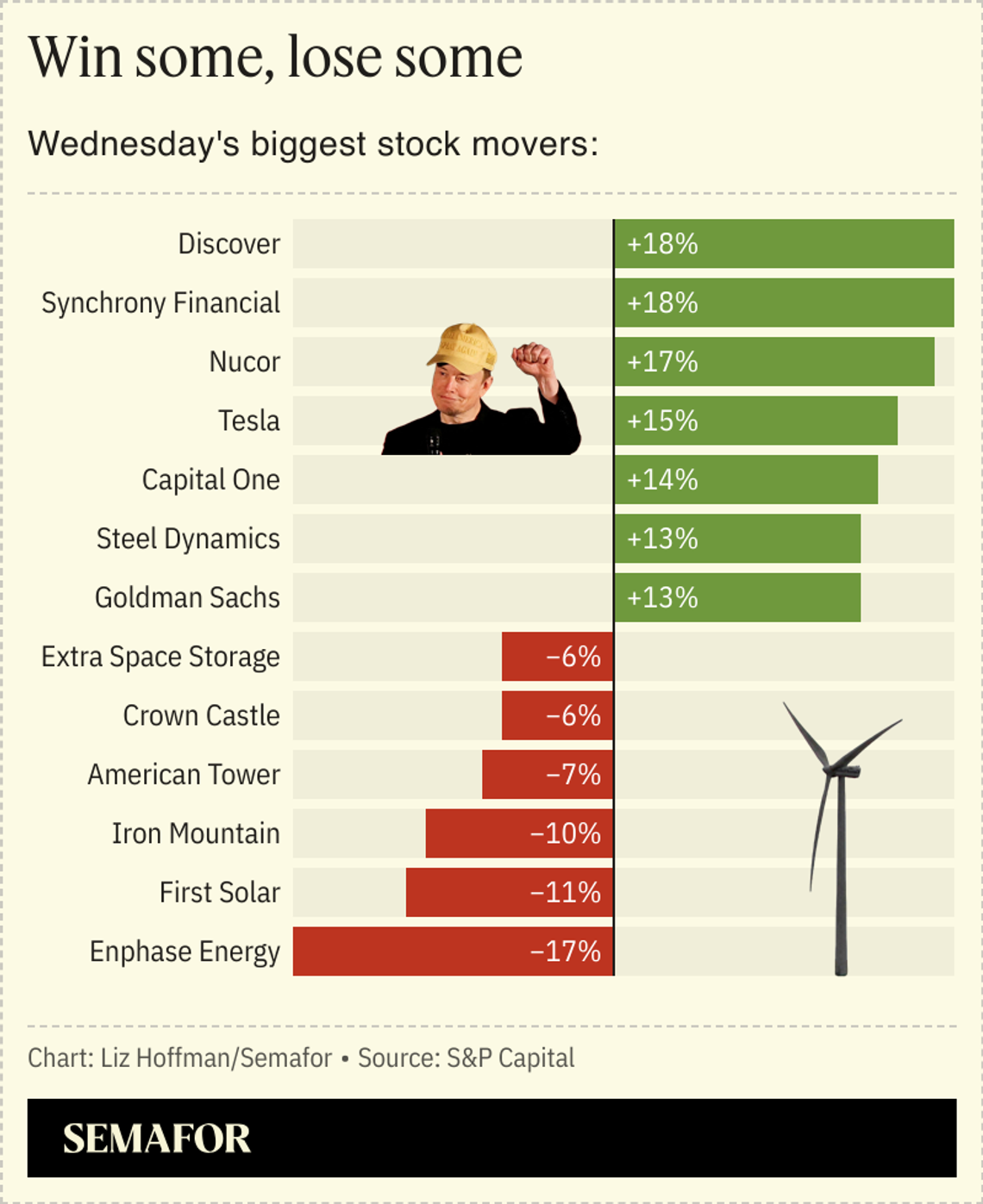

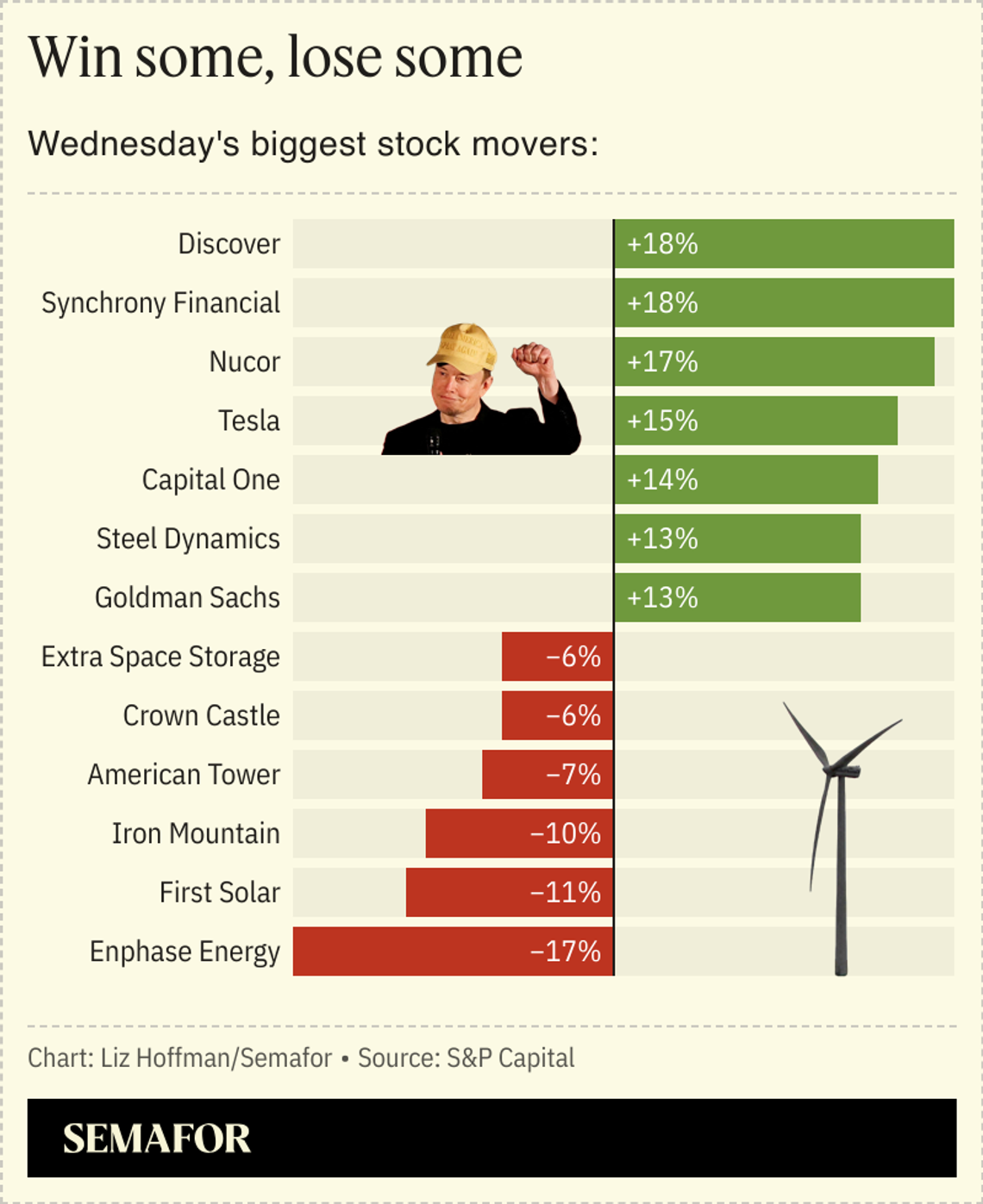

The 10 best-performing US stocks on Wednesday included seven banks, two domestic steel producers, and Tesla, whose rise made Elon Musk $26.5 billion richer, according to Bloomberg’s Billionaire Index, which had its biggest one-day gain since it launched in 2012. Discover and Capital One both surged, suggesting investors think their $35 billion merger will be approved after all. Renewable-energy stocks fell. So did real-estate trusts, whose dividends get less attractive when bond yields rise, as they did sharply on expectations that Trump’s policies will juice the economy and potentially risk double-dip inflation. |

|

One takeaway from the 2024 election: Don’t mess with crypto. Shaking off two years of bad headlines, including the conviction of its kid-messiah, Sam Bankman-Fried, the crypto industry barrelled back into national politics and scored big wins. Three PACs backed by venture capitalists Marc Andreessen and Ben Horowitz, Coinbase, and Ripple Labs spent more than $100 million across 49 congressional races, and got the outcome they sought in at least 40 of them, with some House races still uncalled. They spent $40 million defeating Sherrod Brown, the Democratic chair of the Senate Banking Committee, and $10 million to keep Katie Porter out of a California Senate seat. “Being anti-crypto is simply bad politics,” Coinbase CEO Brian Armstrong wrote on X yesterday, saying that 257 pro-crypto candidates won their congressional races. |

|

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersThe likely Republican sweep of Congress means top US bank CEOs can skip their annual flogging in Washington. Under the likely leadership of Sen. Tim Scott, the Senate Banking Committee would take a deregulatory turn and may train its sights on Fed Vice Chair Michael Barr, who could be one of the lone watchdog holdouts from the Biden era. Senate musical chairs make Elizabeth Warren the likely senior Democrat on the committee, but her sharp words will be empty threats with her party in retreat. Meanwhile, Republicans have been preparing for months to execute perhaps the most unanimous part of their agenda: Extending the Trump tax cuts. “We’ve been having meetings all through the fall,” Sen. John Barrasso, R-Wyo., told Semafor’s congressional bureau chief, Burgess Everett. “In terms of: OK, if we are able to take the House and Senate in the White House, what are the opportunities that we have?”

|

|

Getty Images for Semafor Getty Images for SemaforGerman Chancellor Olaf Scholz fired his pugnacious and penny-pinching Finance Minister Christian Lindner after repeated disputes about spending priorities. The move essentially dissolved the coalition government, raised the possibility of snap elections, and underscored the deep funk that Europe’s biggest economy finds itself in. Germany’s GDP is expected to shrink for the second straight year. Volkswagen is closing factories for the first time ever. Higher energy prices and cheap competition from China have hurt its all-important chemicals sector. The FT questions whether the entire country’s business model is broken. Lindner had demanded belt-tightening reforms, rejected calls for EU common borrowing, and repeatedly offended the French, isolationist stances that put him at odds with Scholz. Germany’s financial rectitude toward its neighbors has long rankled in the region, but schadenfreude is counterproductive here: If Germany stumbles, so does the rest of Europe. |

|

Tingshu Wang/Reuters Tingshu Wang/ReutersGeneral Atlantic and its partner could begin construction of their first green hydrogen project in Oman within 18 months and have products to ship by 2030, Semafor’s Mohammed Sergie reported. The country has ambitions to become one of the world’s largest green hydrogen exporters, and expects its sales to exceed those of liquefied natural gas by 2050. |

|