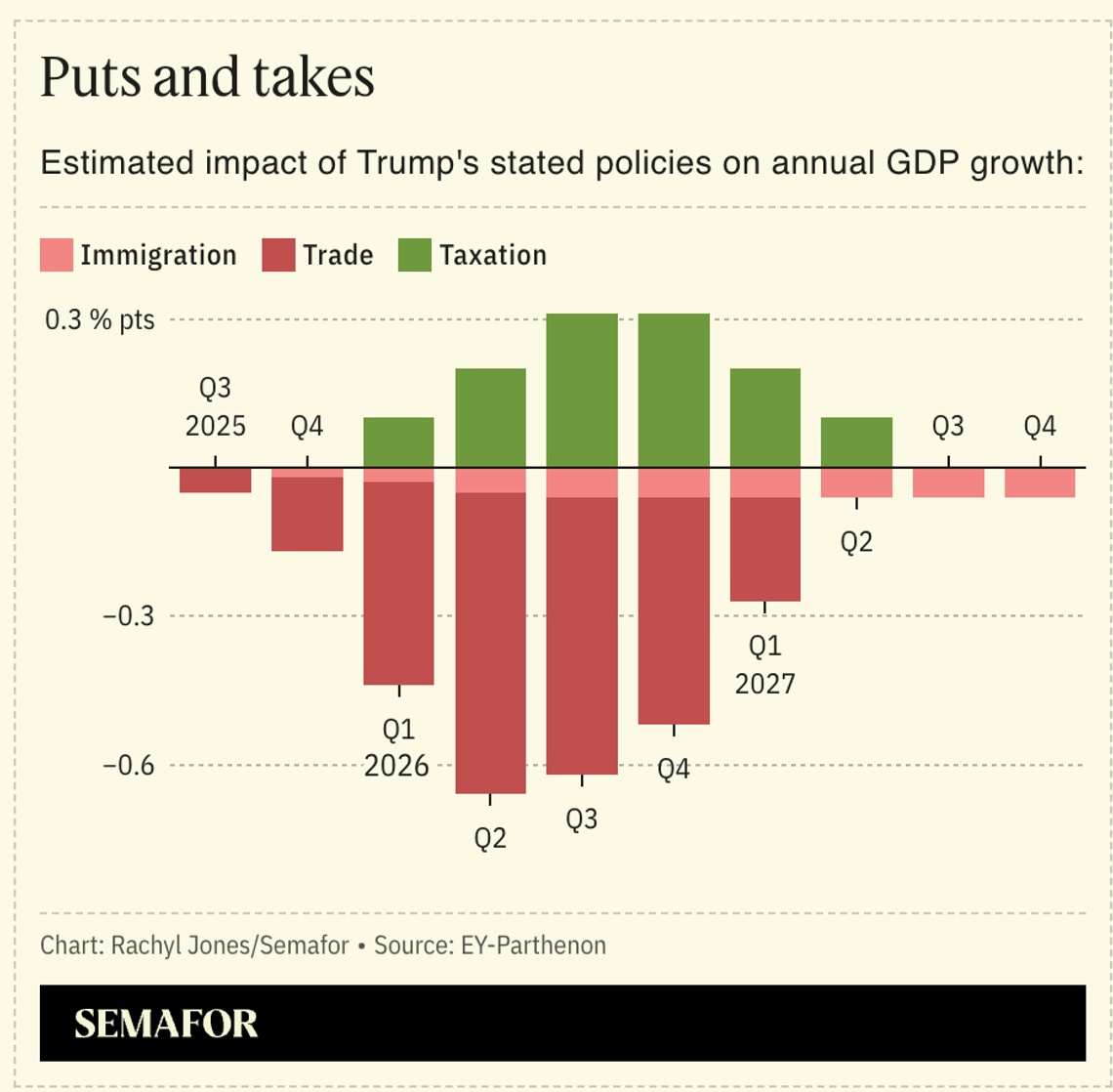

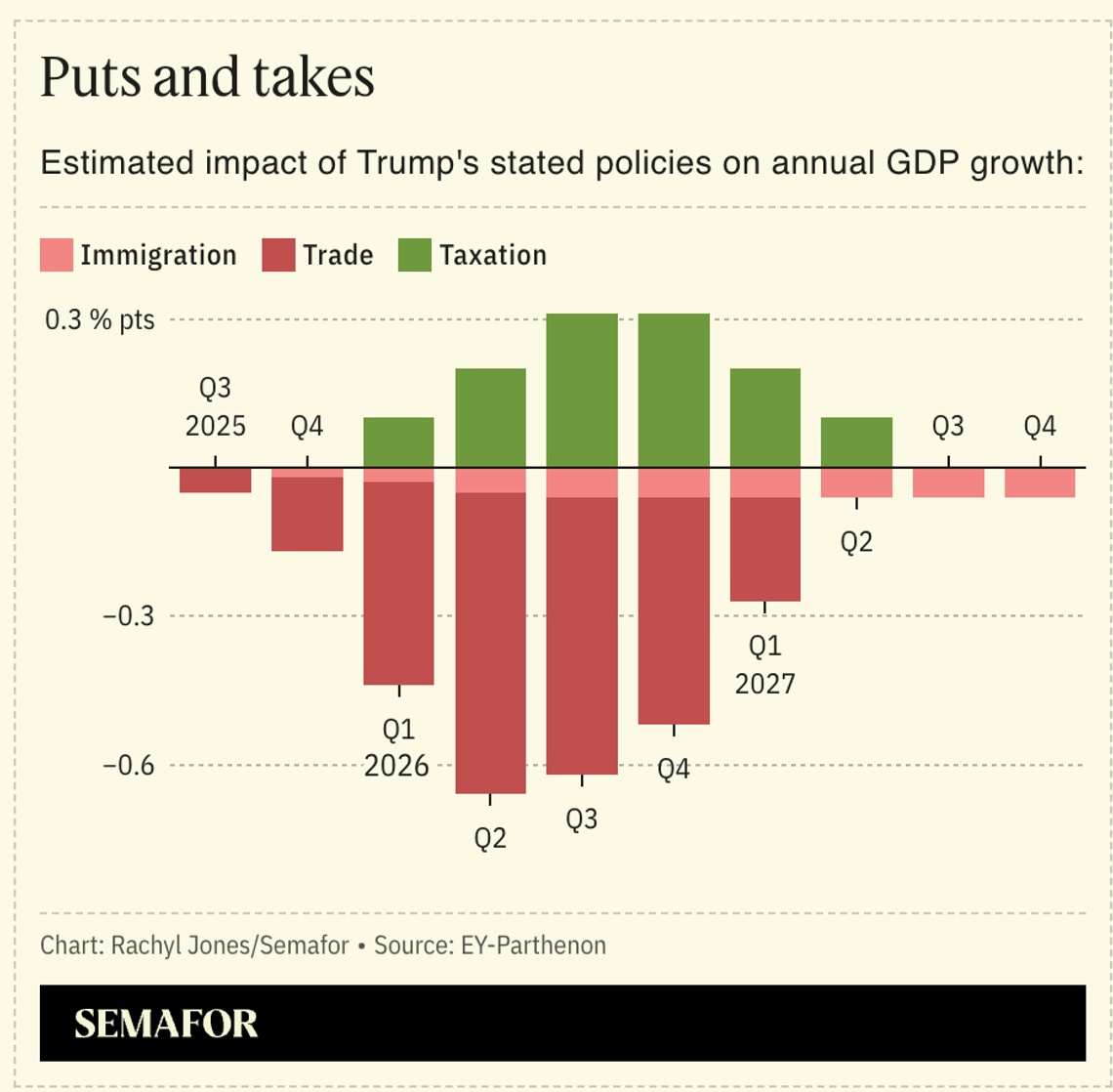

Most economists agree that Trump’s plans of tax cuts, tariffs, and mass deportations of undocumented workers would slow the economy, but the scale and speed remains a big unknown for investors. Taxes will be a fight in Congress, where control of the House of Representatives is still pending, on the heels of some of Trump’s 2017 tax cuts expiring in 2025. Tariffs may encourage more US manufacturing, but building domestic factories and retraining workers takes time. “The US economy is a big tanker,” Gregory Daco, chief economist at EY-Parthenon, an arm of the consulting giant, told Semafor. “Even with big policy changes, it just doesn’t turn that quickly.” Daco expects the cumulative effect of Trump’s preferred set of taxes, tariffs, and immigration curbs would shave 0.45 percentage points off an expected annual growth rate of around 2%. And as with his first term, corporate executives will have to muddle through the question of whether to take Trump literally or seriously. Daco’s advice: “Refamiliarize yourself with the idea that scenarios are your friend.” Bursting your bubble: Both the left-leaning Center for American Progress and the right-leaning American Action Forum say that Trump’s proposed tariffs of 10% to 20% across the board, and 60% on Chinese goods, would cost the average family $3,900 a year. |