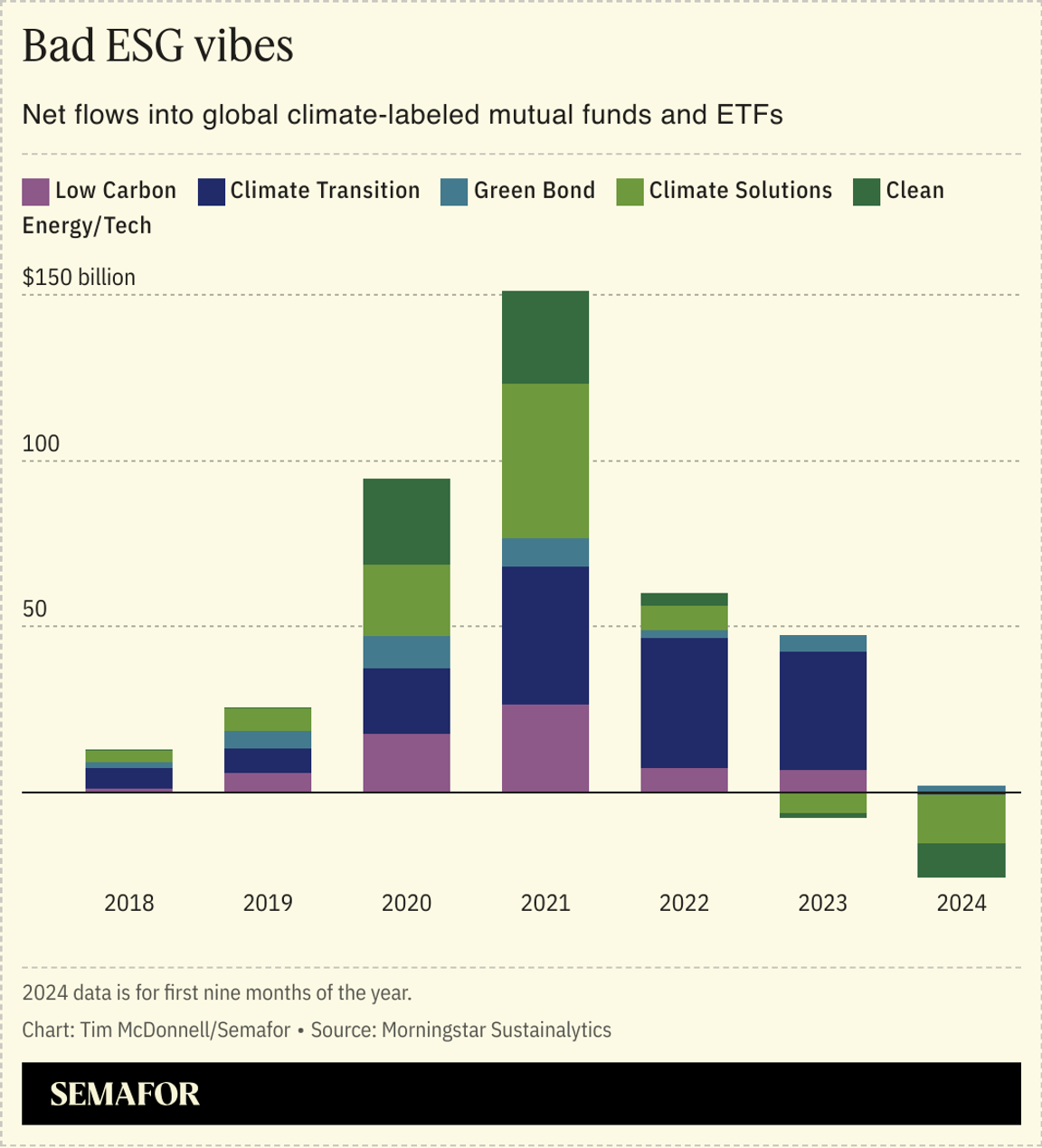

Stock market investors are pulling a record amount of cash out of climate funds, even though many have not underperformed.  Globally in 2024, nearly $600 billion was held in mutual funds and ETFs designed around shares of companies participating in the energy transition, according to a report this week from Morningstar Sustainalytics. That’s 6% more than last year. But the growth is only because many of those stocks have gained value, not because more investors are putting their money into the funds, said Hortense Bioy, Morningstar’s head of sustainable investing research. To the contrary, investors pulled $24 billion out of these funds, reversing a rush into climate funds that peaked in 2021. High interest rates that are bad for renewable energy companies are one reason. But the main driver of the exodus, Bioy said, is bad vibes. “These aren’t bad strategies, and they haven’t underperformed,” she said. “It’s more about the anti-ESG sentiment.” One segment that remains popular, she said, is “climate transition” funds that select companies based on their long-term decarbonization targets, not their carbon footprint today — and that are often loaded with Big Tech and fossil fuel companies. |