| In today’s edition, an M&A revival, a Murdoch loss, and how the killing of a UnitedHealthcare’s CEO ͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business.

It’s a big week for corporate white whales: A blockbuster advertising merger in an industry with a string of combustible characters and failed deals, and renewed runs at Macy’s and Hershey, both of which have been unconquerable in the past.

My final scoop on The Wall Street Journal’s M&A team was Mondelez’s last hostile takeover attempt at Hershey, which delighted me as a native of The Sweetest Place on Earth whose first job was dressing up as a giant chocolate bar for tourist photo ops. It wasn’t going to work then — Hershey is controlled by an iron-fisted trust and its namesake town is dominated by its corporate patron. I doubt it will work now, but we’ll see.

There’s a noticeable front-footed vibe in the corporate world right now. I’m confused by it. Yes, the Trump administration is expected to take a lighter approach to antitrust, but as we wrote last week, the world is more unsettled and volatile than it’s been since the days after 9/11. Inflation may return thanks to Trump’s tariffs and broader global trends like remilitarization and reshoring. The swift glide path that investors were expecting to lower interest rates seems unlikely now. This is not, in CEOs’ preferred phrasing, a benign macro environment.

On the other hand, it’s an environment where longshot bets can pay off. More on those here-we-go-again deals below.

Plus, an arrest in last week’s killing of a UnitedHealth executive and a nervous scramble for corporate bodyguards.

And a programming note: Many of you clicked on a link in Thursday’s newsletter to sign up for our pop-up Davos newsletter and were sent to a New York Times story about Bangladesh. Sorry about that, and you can actually sign up here!

Peter Nicholls/Reuters Peter Nicholls/Reuters➚ BUY: Friends. Elon Musk donated $259 million to Donald Trump’s campaign, including $75 million in the final three weeks, new filings show. The billionaire’s wealth has risen more than $100 billion since the election, even without a mammoth pay package from Tesla that was again rejected by a Delaware judge last week. ➘ SELL: Family. Rupert Murdoch lost his legal effort to give control of his media empire to his favored son and political kindred spirit, Lachlan, Semafor confirms. A Nevada judge called the patriarch’s revisions to a family trust a “carefully crafted charade,” The New York Times reported. |

|

Suspect charged with killing UnitedHealth executive… M&A edges past 2023 total… China probes Nvidia “monopoly”… Apollo refis Canary Wharf… Oracle slips in cloud competition… Taylor Swift’s tour wraps with $2B haul… Accountants are screwing up at record rates… Jensen Huang’s secret sauce: regular emails from 30,000 employees… |

|

Goldman Sachs recently called sports investing the next trillion-dollar market. So the answers that 107 institutional investors from around the world gave to a survey this fall are surprising. Nine in 10 said it’s too risky. They also showed little appetite for two other hot areas — gaming and music rights, which NYT says is being swallowed, and ruined, by private equity. Middle Eastern investors may have this space to themselves. The report has grim news for the industry: 90% of investors said they’ve received requests from money managers for fund extensions as dealmaking remains slow, and more than two-thirds said they’ve seen funds raise less than what managers had targeted. |

|

Three corporate dramas got a reboot this week:  Wikimedia Commons Wikimedia CommonsSweeter the second time around: Mondelez is taking another run at Hershey after being rebuffed for $23 billion in 2016. Hershey is worth $38 billion after its stock jumped on the Bloomberg report of Mondelez’s approach, which comes as high cocoa prices and inflation-weary consumers have hurt Hershey’s financial outlook. Cadbury, Nestlé, and Wrigley (now Mars) have all taken runs at Hershey over the years but hit resistance from the company, the trust that controls it, the local community, and the state’s attorney general, who can block a takeover. Christmas parade: For at least the fourth time in 10 years, Macy’s is in the crosshairs of an activist investor. A hedge fund showed up this week with a stake of unclear size and the same ideas tried by Starboard (2015), Jana (2021), and others (2023), namely that Macy’s should cut costs and sell prized real estate. Working in Barrington’s favor are an untested CEO who took over in February and an internal accounting error that raises investor concerns about who is tending the store. Working against it: For activists, taking on Macy’s has been like fighting land wars in Asia — a tempting prize that usually ends in the opponent’s retreat. Back into the fray: Ad giant Omnicom is back in the M&A game. A decade after its industry-reshaping merger with Publicis fell apart over ego, Omnicom is buying rival Interpublic in a deal that will create the world’s largest advertising firm by revenue and market value. It’s a bet on cost savings in an industry not known for frugality. Advertising companies still love an expense account, and their collections of brands that operate independently — Interpublic’s full name is Interpublic Group of Companies — can make belt-tightening hard. Omnicon expects annual savings of $750 million off the combined companies’ $22 billion budgets. Investors are skeptical: Shares fell more than 10% Monday. |

|

Last week’s killing of a UnitedHealth Group executive and Monday’s arrest has companies reevaluating their security protocols. Police charged a 26-year-old former Ivy Leaguer with murder and said he was carrying a handwritten manifesto critical of corporate America, which offers clues to his motivations. Some social media users celebrated his alleged actions as retaliation on an industry they say hurts Americans, which has companies nervous and demand for executive bodyguards rising. “The rhetoric is more heated,” said John Torres, a former Department of Homeland Security agent and now a corporate security consultant.  @sixinchbeys/X @sixinchbeys/XSome companies spend millions annually on their CEOs’ security and private jet benefits in the name of safety. But three-quarters of S&P 500 chief executives don’t receive regular company-funded protection. Since the attack, Allied Universal has been hired to guard executives from five Fortune 500 companies, said Glen Kucera, the company’s president of enhanced protection services. “Unfortunately, sometimes it takes an event like this to shock people into reality,” he told Semafor. |

|

| Belt, Road, and Suspenders |

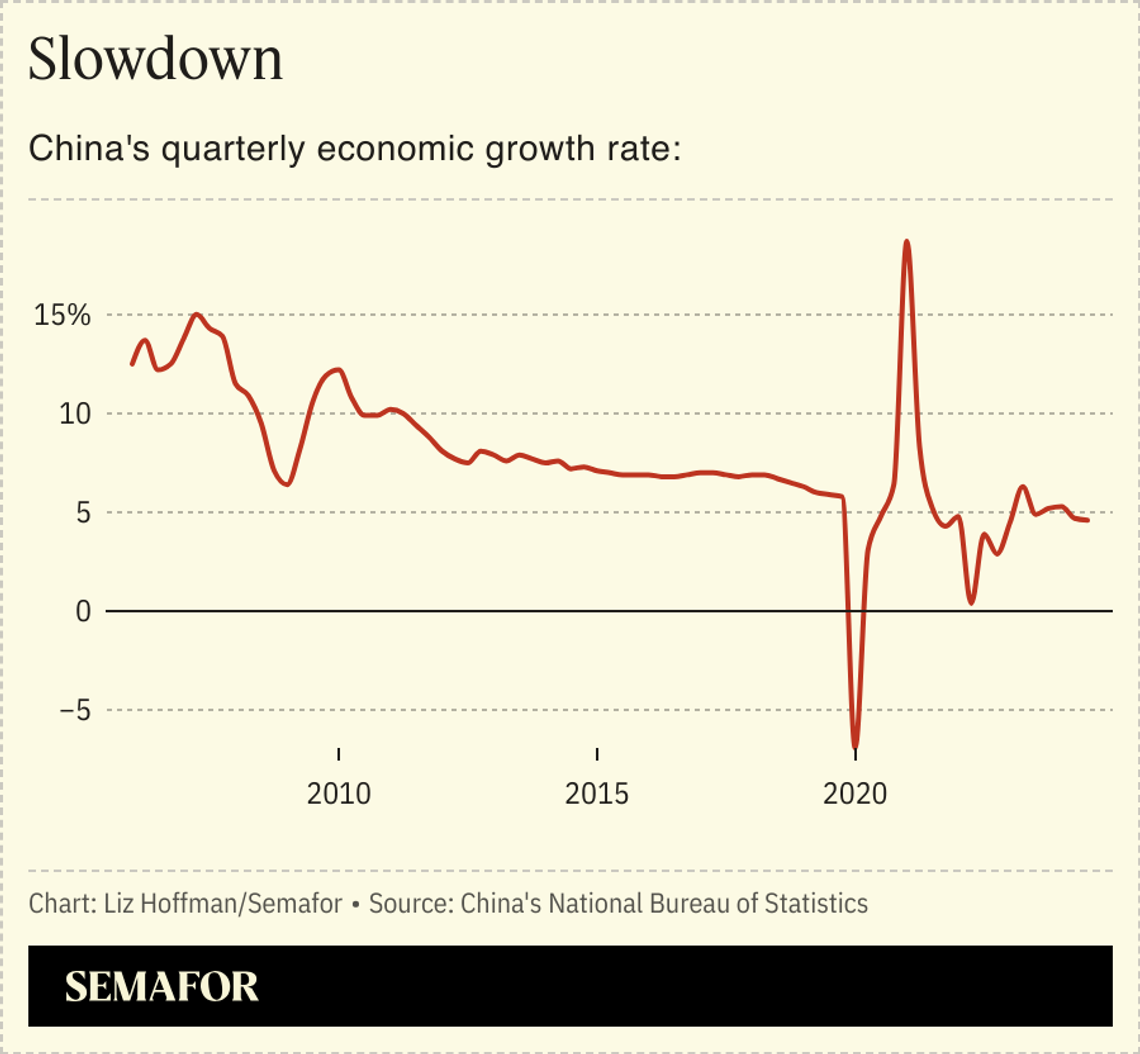

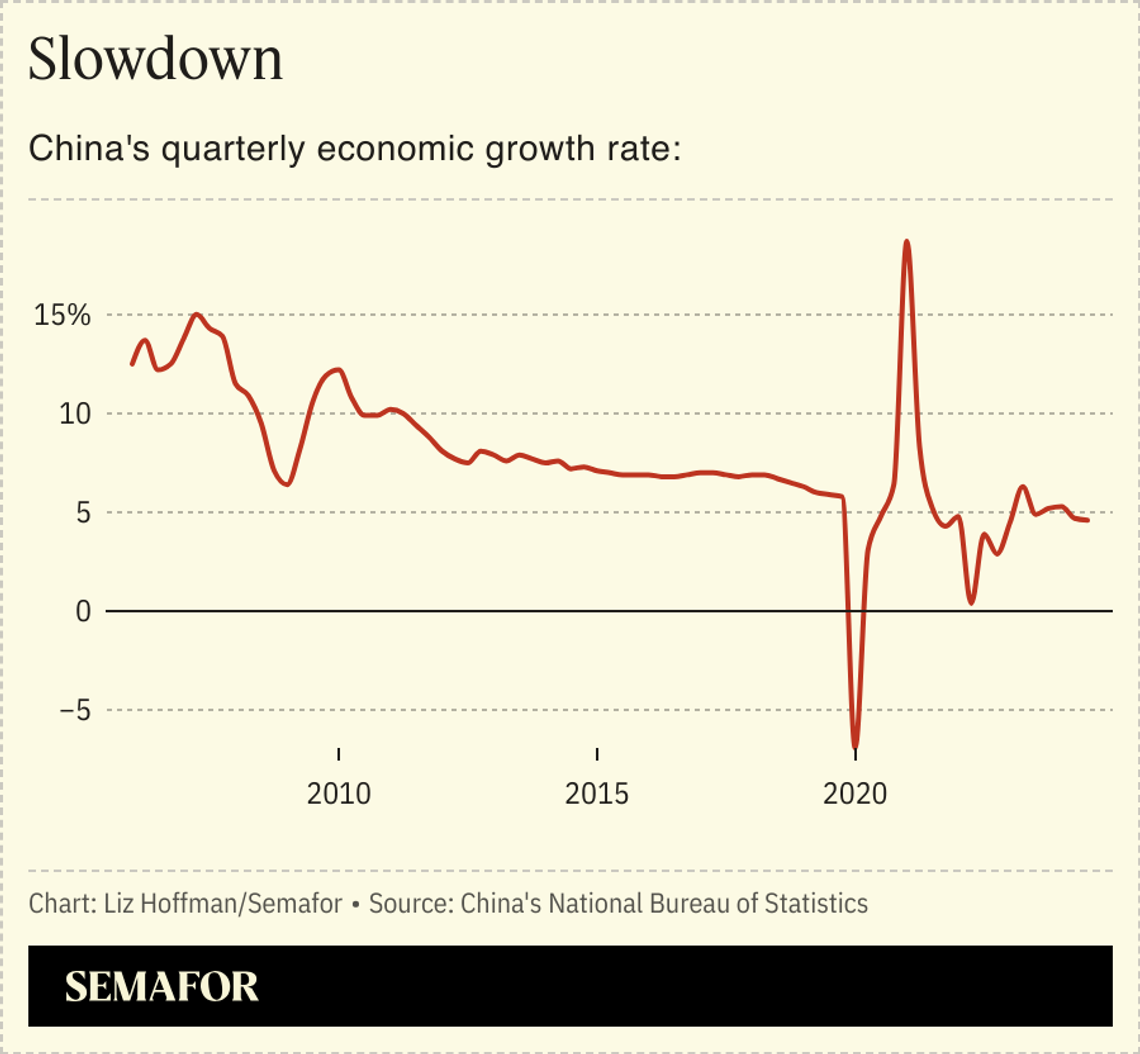

China signaled new support for its ailing economy this week, leaving everyone trying to dissect the Politburo’s wording. The central bank said it’s shifting from a “prudent” stance to a “moderately loose one,” hinting at a stimulus that has been slow in coming as the world’s second-biggest economy continues to struggle with a property bubble and high debt levels.  “In true Chinese fashion, the details are left to the imagination,” said Peter Alexander of Z-Ben Advisors, a Shanghai-based market intelligence firm. But he said Beijing, for the first time, explicitly addressed ways to stabilize the real-estate and stock markets, and bought itself “optionality” to put teeth behind its vague statement if the economy worsens. President Xi Jinping may be holding back some financial firepower waiting for a clearer view of Trump’s policies. He told a gathering of global finance ministers that China would hit its 5% growth target this year and remain the world’s “growth engine.” |

|

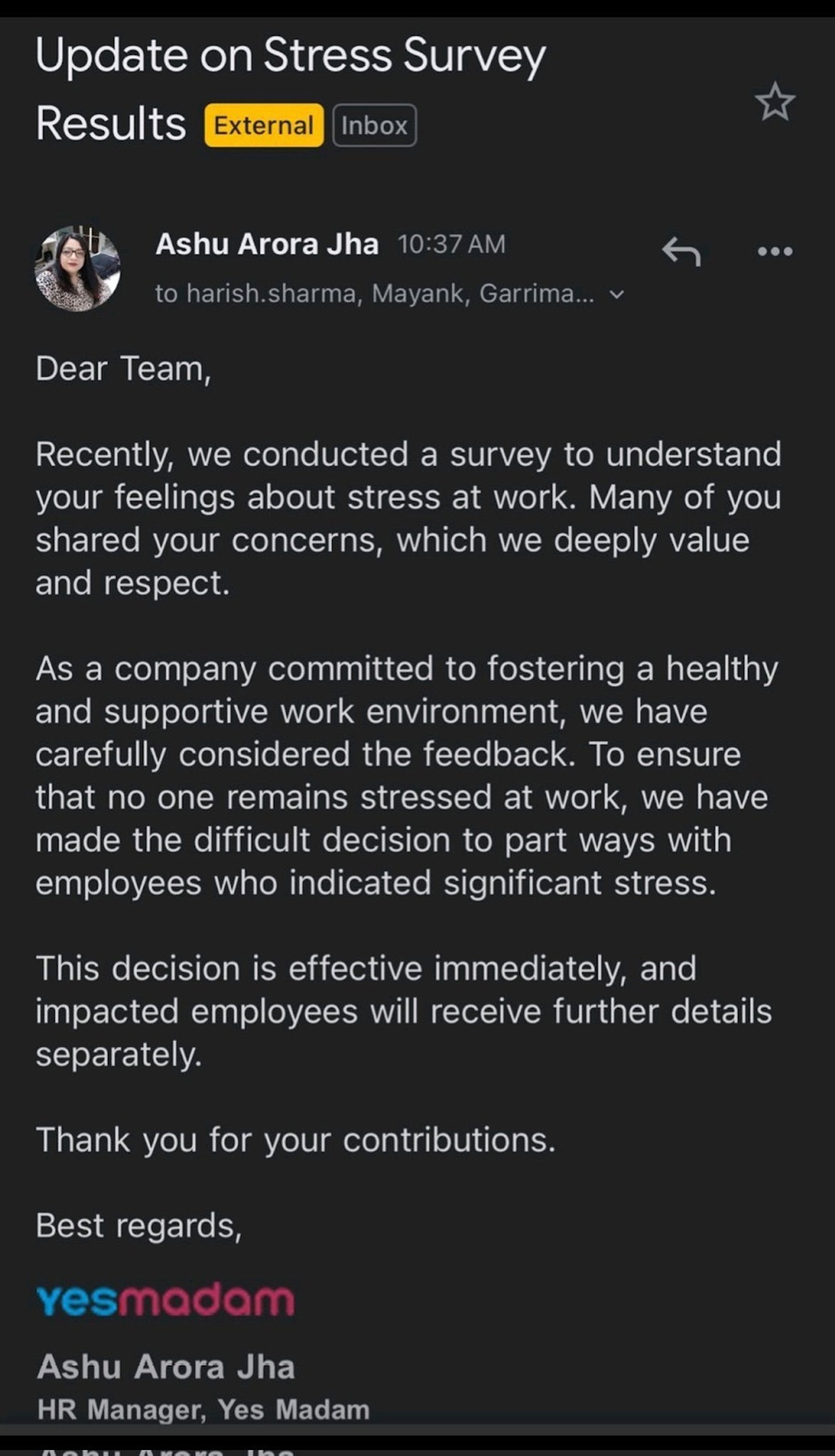

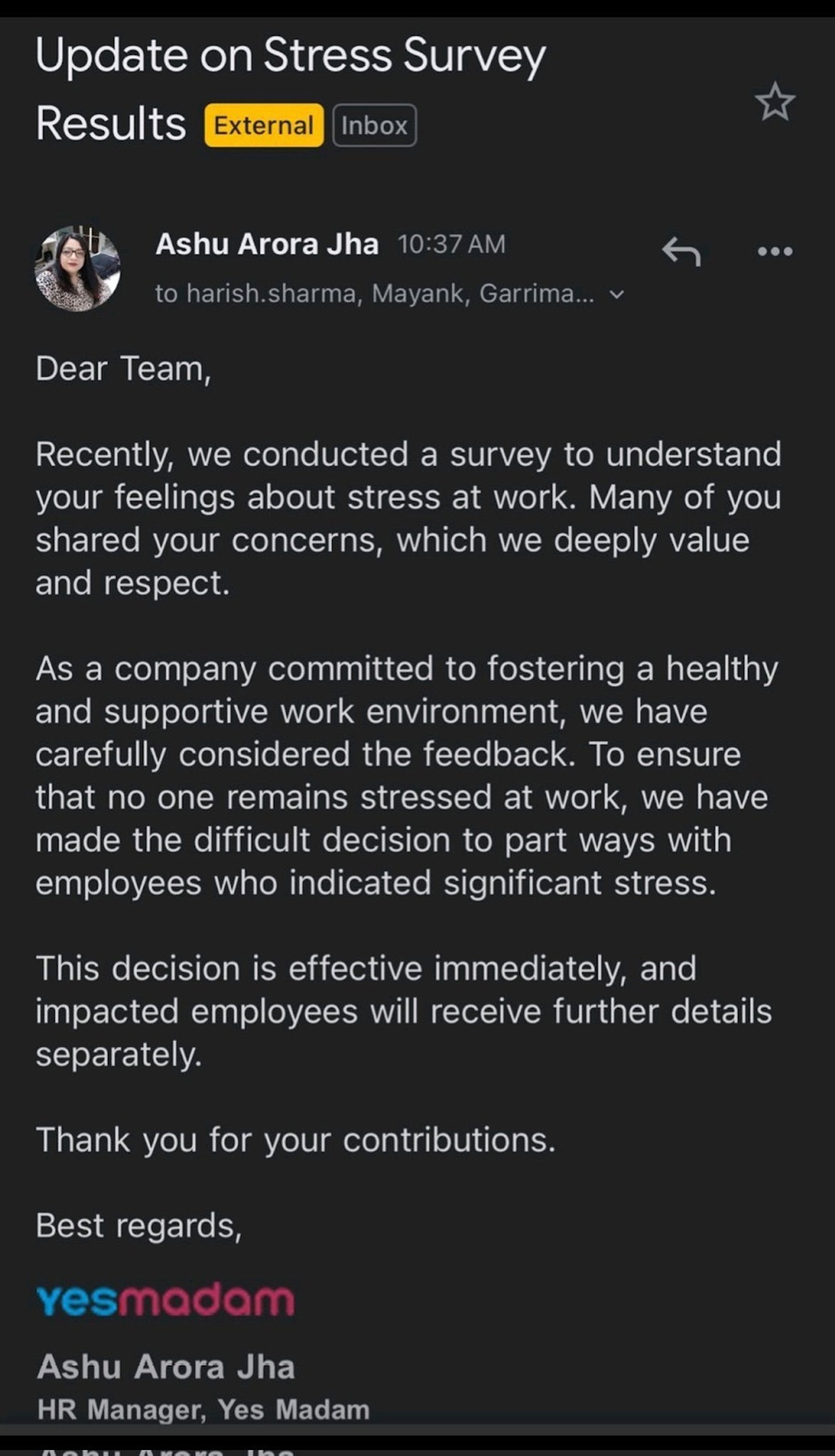

Indian salon company Yes Madam pretended to fire unhappy employees. The company, which was featured on Shark Tank India, later said the email was a PR stunt meant to highlight workplace stress. “To those who shared angry comments or voiced strong opinions, we say Thank You. When people speak up, it shows they care,” it wrote on LinkedIn. Yes Madam also unveiled its newest services: head massages and spa sessions in the office. |

|

Jeenah Moon/Reuters Jeenah Moon/ReutersRepublicans have plenty of questions about Tulsi Gabbard’s views on Syria and how they relate to her nomination as Trump’s director of national intelligence, but they’re not immediately deeming her past meeting with ousted leader Bashar al-Assad as disqualifying. She has explaining to do, a half-dozen Republican senators told Semafor’s Burgess Everett. “She’s too undefined to really form an opinion [on], so she needs to get out” and meet with more senators, said Sen. Shelley Moore Capito, R-W.Va. |

|