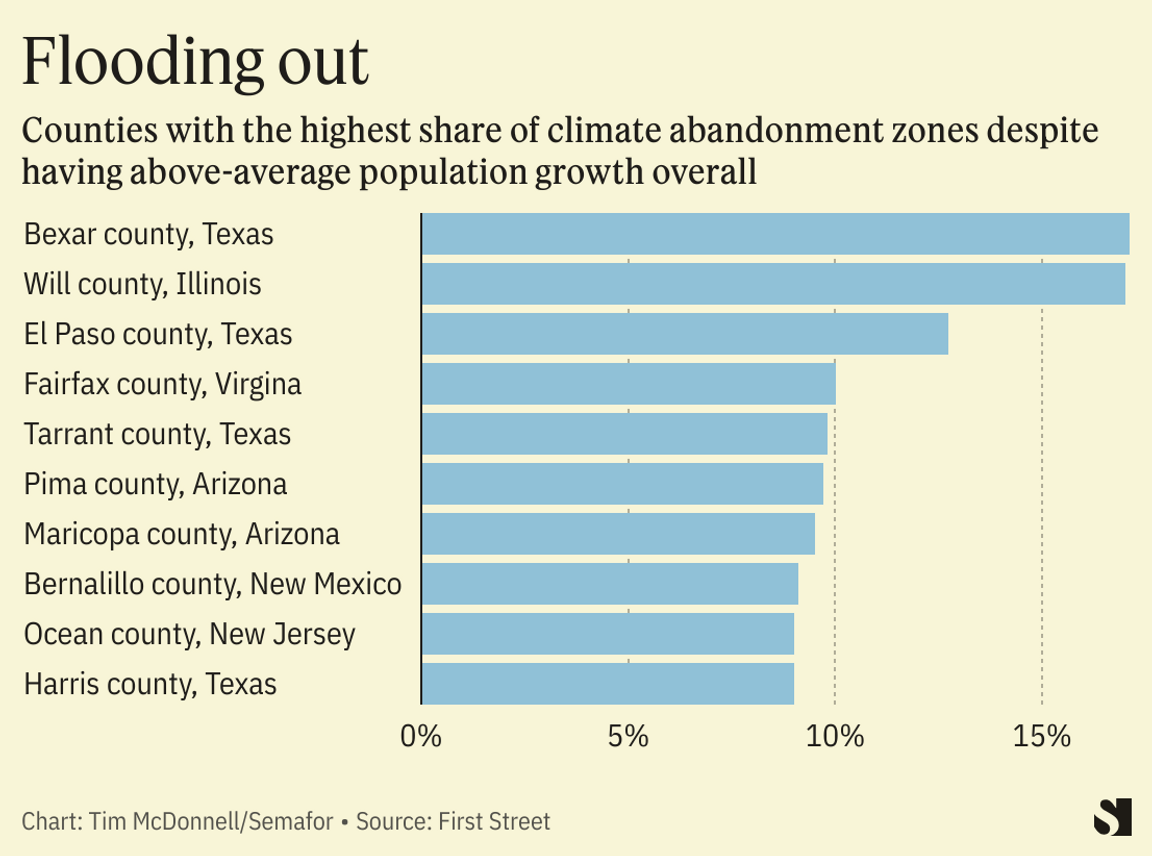

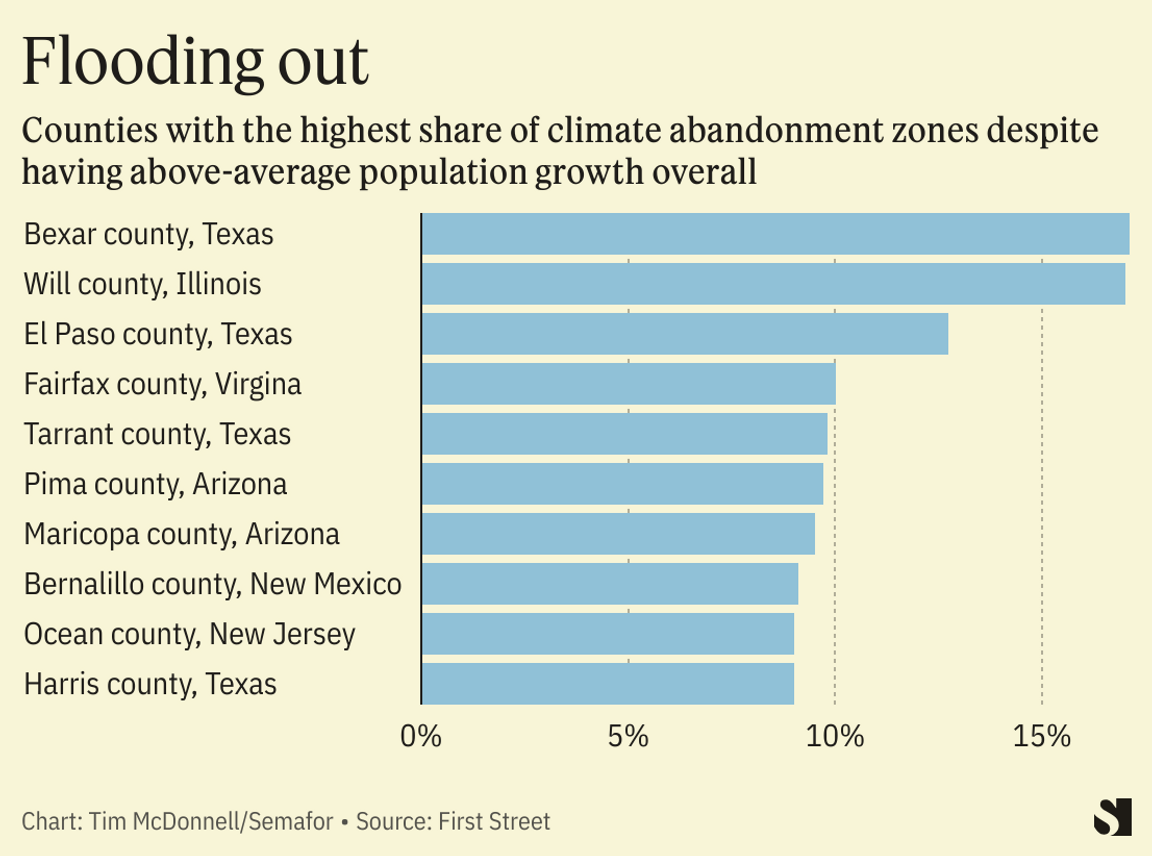

Millions of Americans could already be considered climate migrants, a new study argues — but they’re not moving from the places you might expect.  The research group First Street compared block-by-block population census data from 2000 and 2020, linking all 11 million blocks in the U.S. to social and economic indicators that can influence relocation decisions: Crime rates, school quality, job opportunity, etc. They also factored in flood risk. In some major metropolitan areas with significant flood risk — think Miami or Houston — they found that the population has grown over time, as the social benefits of those locations outweigh the risk of floods. But they identified about 818,000 blocks that should have a growing or stable population based on the socio-economic indicators but, because they had high flood risk, actually lost population. Most of these “climate abandonment zones” are in the Midwest and Northeast, study author Jeremy Porter said. The counties in the chart all experienced above-average population growth overall, but had the highest portion of individual climate abandonment blocks, suggesting that residents are becoming more perceptive and responsive to hyper-local flood risk. The data also suggest that some flood-vulnerable counties with high population growth overall aren’t growing as quickly as they would without the flood risk, he said. “The big-picture statistics mask negative demographic trends that are creeping into these communities,” he said. “But if you just change the resolution of the question, we actually see that people are taking climate into account.” |