The News

Abu Dhabi’s Mubadala emerged as the world’s top sovereign investor in 2024.

The fund deployed $29.2 billion across 52 deals — a 67% rise from the previous year, according to consultancy Global SWF.

Its Gulf peers weren’t far behind: Abu Dhabi Investment Authority, ADQ, Saudi Arabia’s Public Investment Fund, and Qatar Investment Authority all ranked among the top 10 global dealmakers.

Allocations shifted significantly, with increased focus on real estate, technology, financial services, private equity, and private credit, while health care, industrials, and consumer sectors saw declines.

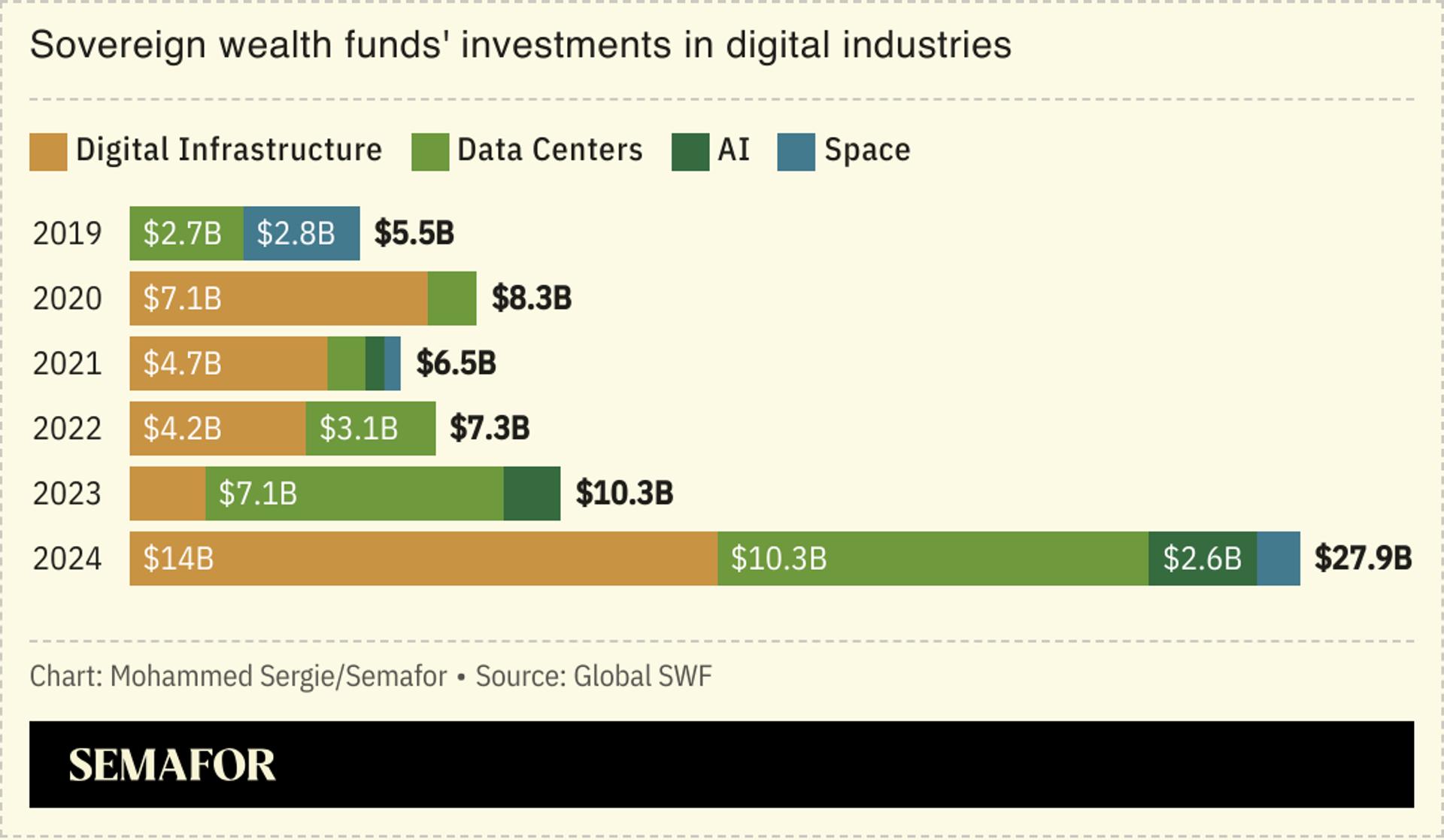

Among the big telecom deals were PIF’s $3 billion acquisition of TAWAL, the Middle East’s largest tower operator, while spending on local AI companies and US startups ramped up.

The space race is also heating up: Mubadala’s Space42 and PIF’s Neo Space Group are positioning their countries as emerging leaders in satellite industries.

Sovereign funds are expected to expand their operations in both developed and emerging markets, too. The Gulf freezones in Riyadh, Abu Dhabi, and Dubai may attract European, Asian, and Canadian funds “interested in club deals with regional” investors, according to Global SWF.