The News

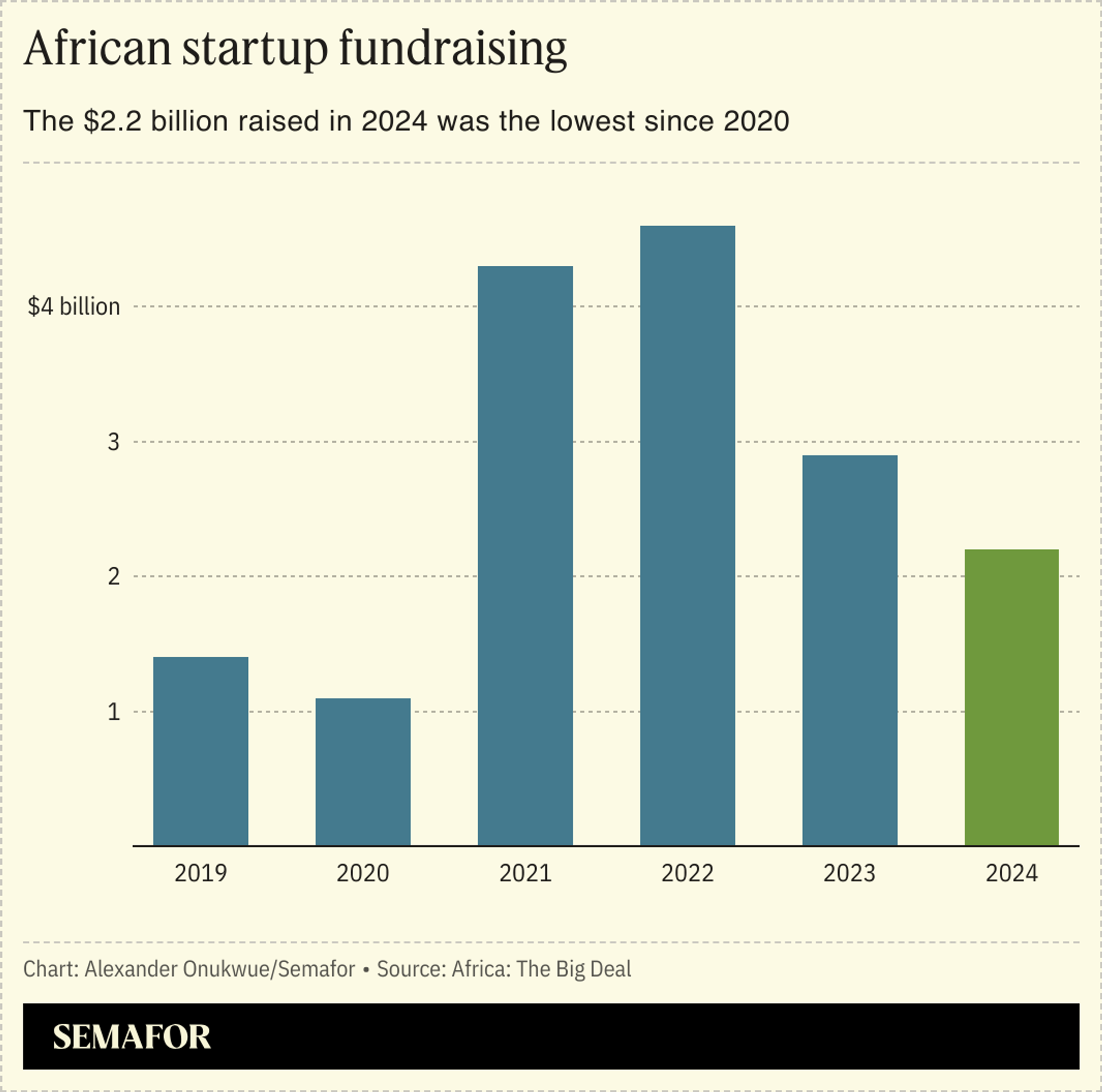

Startup fundraising in Africa fell by 25% in 2024 to $2.2 billion, a new report showed, marking a second successive year of reduced investment into technology companies on the continent.

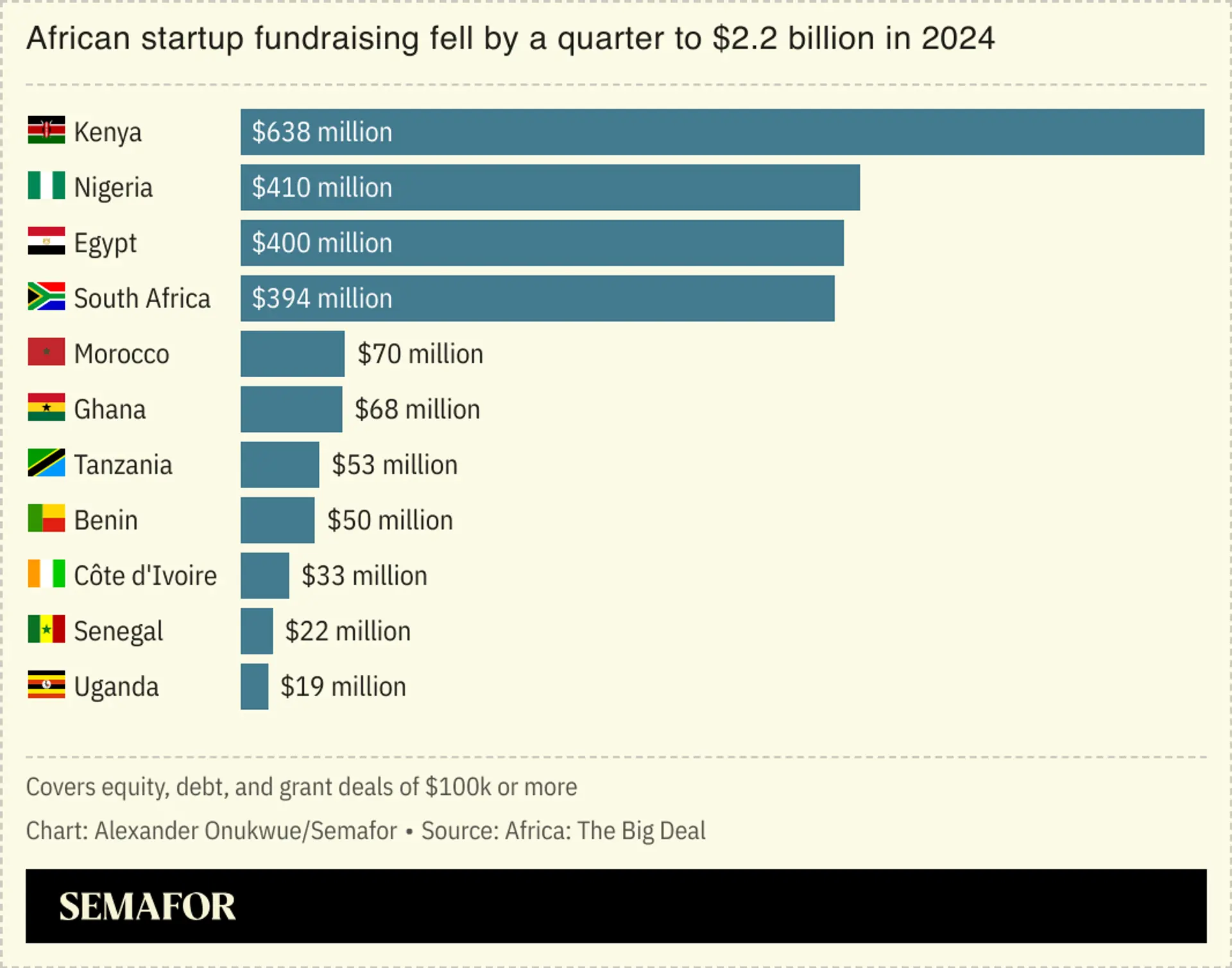

Kenyan startups drew the bulk of the funding for the second year in a row with $638 million, driven by climate tech deals, Africa: The Big Deal (ATBD) found, while Nigeria, Egypt, and South Africa together attracted $1.2 billion.

The year gave rise to two new unicorns — Nigeria’s payment processing firm Moniepoint, and Tyme Group, a digital banking platform from South Africa.

Know More

Two-thirds of the funding total was raised in the second half of the year.

The $2.2 billion figure reflects expectations during the year that African startups would raise less money than in previous years. Fundraising has been falling since the peak of 2022 when startups raised $4.6 billion, according to ATBD.

One reason for the dip last year was a 40% reduction in funding in the form of debt, ATBD said, while equity type deals fell by 11% by comparison.

Most startup funding is in the form of equity but debt deals have been an increasing source in recent years. It rose nearly six-fold between 2018 and 2022 to $1.5 billion, according to data by African tech investor Partech Partners.

Step Back

The overarching reason for the lowered receipts for African startups remains the pullback from the continent by venture capitalists from developed markets. Initially spooked by increased interest rates, many have focused their cash on markets closer to home.

Moniepoint and Tyme were among a handful of African startups to raise nine-figure sums last year. But while each deal featured a US-based ‘Big Tech’ company — Google and Uber respectively — institutional VCs like Tiger Global which invested in five African startups in 2022 have largely been absent from the scene since.

Notable

- African investors say they are stepping up to fill the region’s startup funding gap created by the reluctance of foreign venture capital firms to return to the market over the last two years.