The News

It’s not an easy time to be a startup in the Middle East.

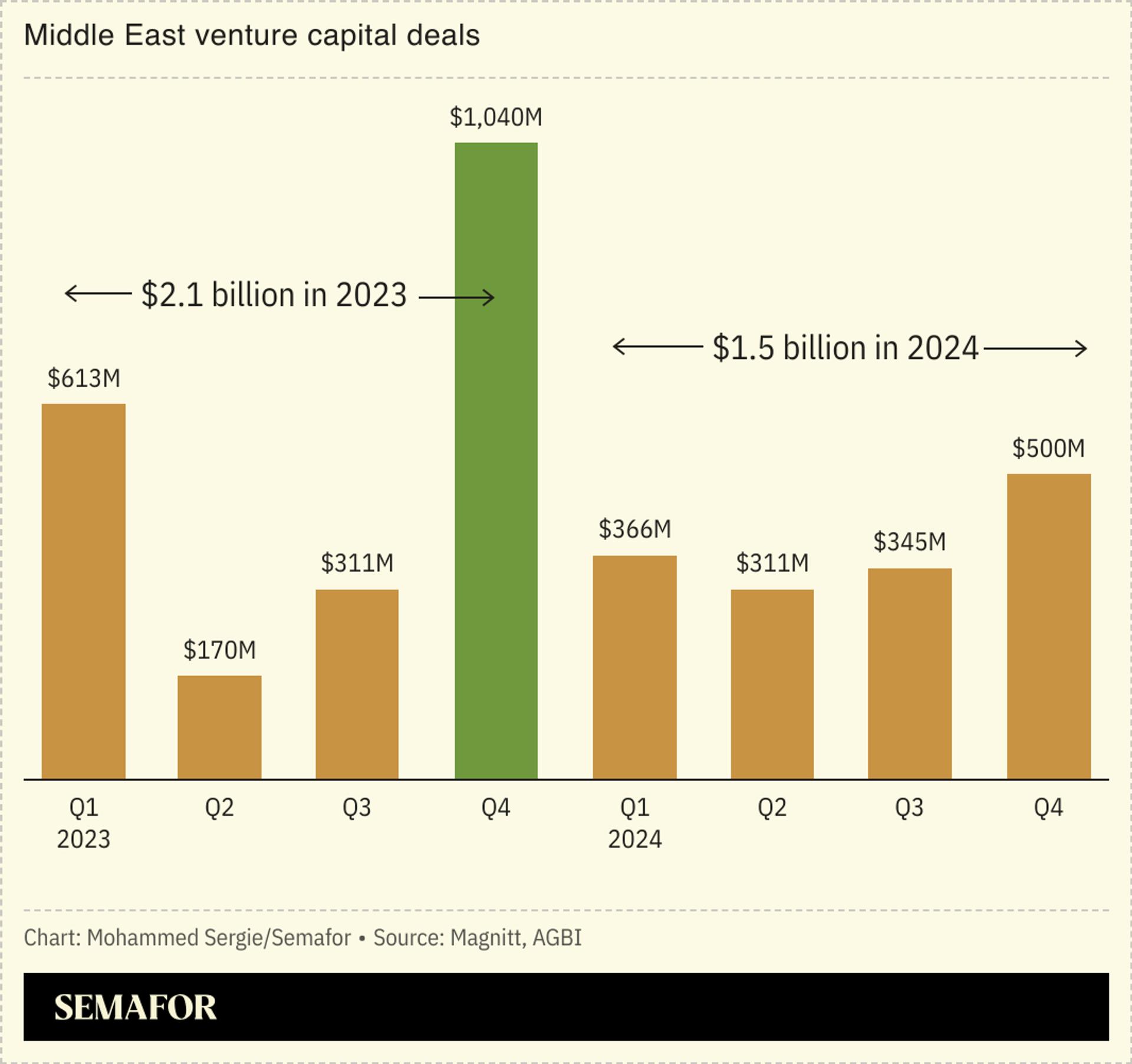

Globally, the value of venture capital deals ticked up last year, but in the Middle East it dropped 29%, to $1.5 billion.

That’s bad news for Gulf governments trying to build up new economic sectors and diversify away from oil.

It could have been worse, though. VC funding in Southeast Asia was down 45%, according to the data analytics firm MAGNiTT’s 2024 Emerging Markets Venture Capital Report.

The number of Middle East deals was up 10%. More deals but less money means the average transaction size was down, dropping to $3.3 million. The UAE had the most deals, with 188. Saudi Arabia is still the biggest market by value, though, with $750 million deployed there last year, compared with $1.4 billion in 2023.