The News

The carbon offset market is poised to surge in 2024, setting up a test of whether the industry’s early attempts at self-regulation are sufficient to crack down on pervasive fraud and greenwashing.

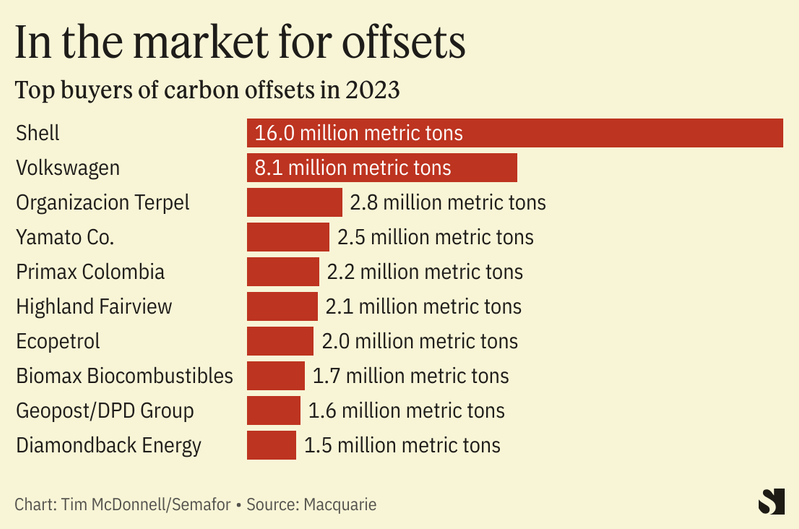

Shell, in particular, closed out 2023 with an offset shopping spree, ending the year as the world’s champion carbon buyer by far, as it sought to compensate for its massive carbon footprint. The oil major was responsible for about 10% of all global carbon purchases, according to Australian financial firm Macquarie.

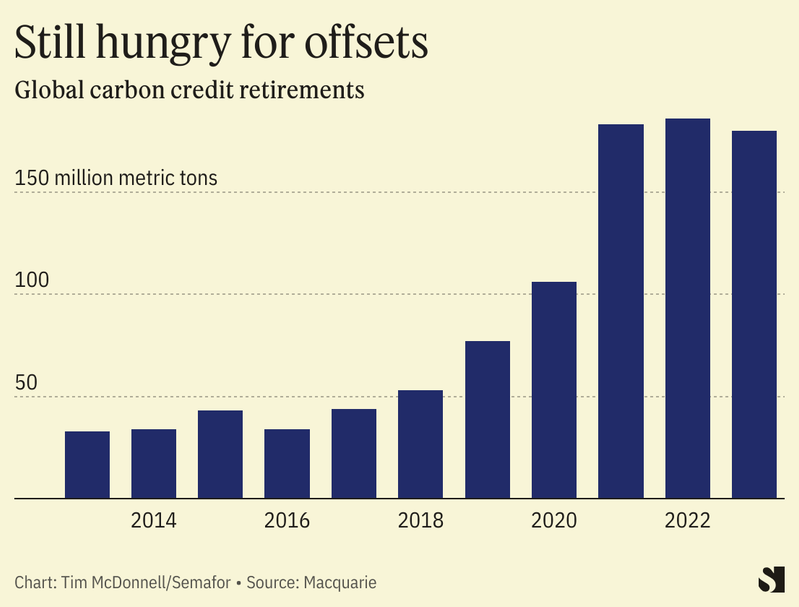

Top-ranked buyers after Shell include Volkswagen, Texas-based Diamondback Energy, and Colombia’s Terpel. Overall, Macquarie found that demand for carbon offsets fell only 3% from 2022, a sign the market was not much dented by recent bad press about dubious offset-generating projects, such as a forest conservation project in Zimbabwe, which the world’s top offset dealer dropped from its portfolio following investigations suggesting it overstated both the climate and local development benefits of its work.

Fear of reputational damage may keep some buyers away, and a dip in prices also cut into the supply of new credits last year. But for now the carbon market has contracted as much as it is likely to, barring more major scandals, said Macquarie analyst Serafino Capoferri. 2023 also saw a growing number of first-time purchasers, suggesting the market’s reach is broadening — and that its buyers and sellers are willing to forge ahead while major oversight issues remain unsettled.

Tim’s view

The carbon market’s year ahead will be precarious: If it can avoid more scandals, carbon credits will look more like a legitimate corporate net zero strategy, and a reliable asset that can be traded more legitimately between investors on the secondary market, which would drive prices up and increase pressure on high-carbon companies to actually shrink their footprint rather than buy credits. If more scandals emerge, restrictive government regulation won’t be far behind.

“The key element that is missing from the market is confidence,” said Mark Kenber, executive director of the Voluntary Carbon Markets Integrity Initiative, an industry group.

Negotiators at the COP28 summit hit a wall on negotiations for a U.N.-administered carbon market, something that has been in the works since the Paris Agreement but has failed to launch over disagreements about its rules. High-emitting companies are still clamoring for offsets, however, and many developing countries see the carbon market as an indispensable track for moving climate finance into their pockets.

The absence of a U.N. market puts more pressure on the existing voluntary market, which is experimenting this year with its first industry-wide standards for what can count as a “good” carbon credit, and what kinds of green claims buyers can make. There’s also nothing stopping governments from signing bilateral carbon trading deals, even though global rules for these also failed to materialize at COP28.

But more rules are coming. The European Union is preparing to ban companies from calling products “carbon neutral” if the claim is based on offset purchases. U.S. financial regulators are planning rules for the trading of carbon credit futures and other derivatives. And within months, an independent oversight group of carbon market experts plans to release its first rating labels for specific carbon projects, which give buyers more clarity about how to find high-quality projects.

“For the market to fully develop in the next two years, as the U.N. and governments have called for, regulation needs to happen quickly,” Kenber said. “This is overdue.”

Know More

Last year, Shell walked back its specific long-term target for carbon offset purchases, which some observers took as a sign the company was giving up on the carbon market — which has been rocked by one greenwashing scandal after another — altogether. On the contrary, said Paul Connolly, a Shell spokesperson, the company plans to continue buying offsets as a key element of its climate strategy. In 2023, it retired nearly twice as many credits as it did in 2022. “This approach complements our activities to avoid and reduce emissions from our own operations, as well as working with customers to help develop more low-carbon energy solutions to meet their energy needs,” Connolly said.

Shell’s offset purchases were screened “to deliver positive impacts for ecosystems and communities, as well as having a robust carbon benefit,” Connolly said. But the Macquarie report notes that most of Shell’s purchases are relatively old, dating from 2015 and 2016, which Gilles Dufrasne, lead analyst at the watchdog group Carbon Markets Watch, said raises the risk that they were derived from projects with lower accreditation standards.

The View From Switzerland

The year isn’t off to a great start. On Monday, a Thai transit company officially transferred 2,000 carbon credits to a Swiss foundation, which the government of Switzerland will count toward its official net zero target. It’s the first example of a bilateral carbon trading deal under the Paris Agreement, essentially opening a new branch of the global carbon market, and could kick off dozens more similar deals in the year ahead.

But the trade is already drawing criticism. A Swiss advocacy group complained that the Bangkok electric bus program from which the credits are derived — in theory, the infusion of carbon cash made the e-bus rollout possible, curbing emissions from the existing bus fleet — overstated its emissions benefit, and that the buses likely would have been rolled out anyway. Because COP28 negotiators failed to agree on transparency rules for these deals, countries are under no obligation to disclose specific details of how emissions or prices are calculated.

“This free-for-all nature of the market leaves countries able to do all the wrong things, and they still face all the same pitfalls the market has faced historically,” Dufrasne said.

The View From Kenya

This week, Kenya’s government said it intends to place a 15% tax on earnings from carbon offset projects there, with the aim of channeling most of that revenue back into the communities in which the projects are located. Zimbabwe announced a similar policy last year, sparking concern from some project developers that it could choke off investment. Kenyan President William Ruto has been a leading proponent of carbon credits, which he says can become one of Africa’s biggest export commodities. But more rules are needed to ensure the profits don’t all escape the country.

Room for Disagreement

Even if the carbon market becomes higher-quality, seeing it grow isn’t necessarily desirable, Dufrasne said. Ultimately, the market exists only to plug gaps left by companies’ or countries’ lack of more concrete near-term decarbonization, and those with means — which include buyers like Switzerland or an oil major like Shell — should devote more of their resources to low-carbon investments, he said. Oil companies in particular, he said, “should not be part of this market unless they have a transition plan and an expectation of leaving the oil and gas sector.”