The News

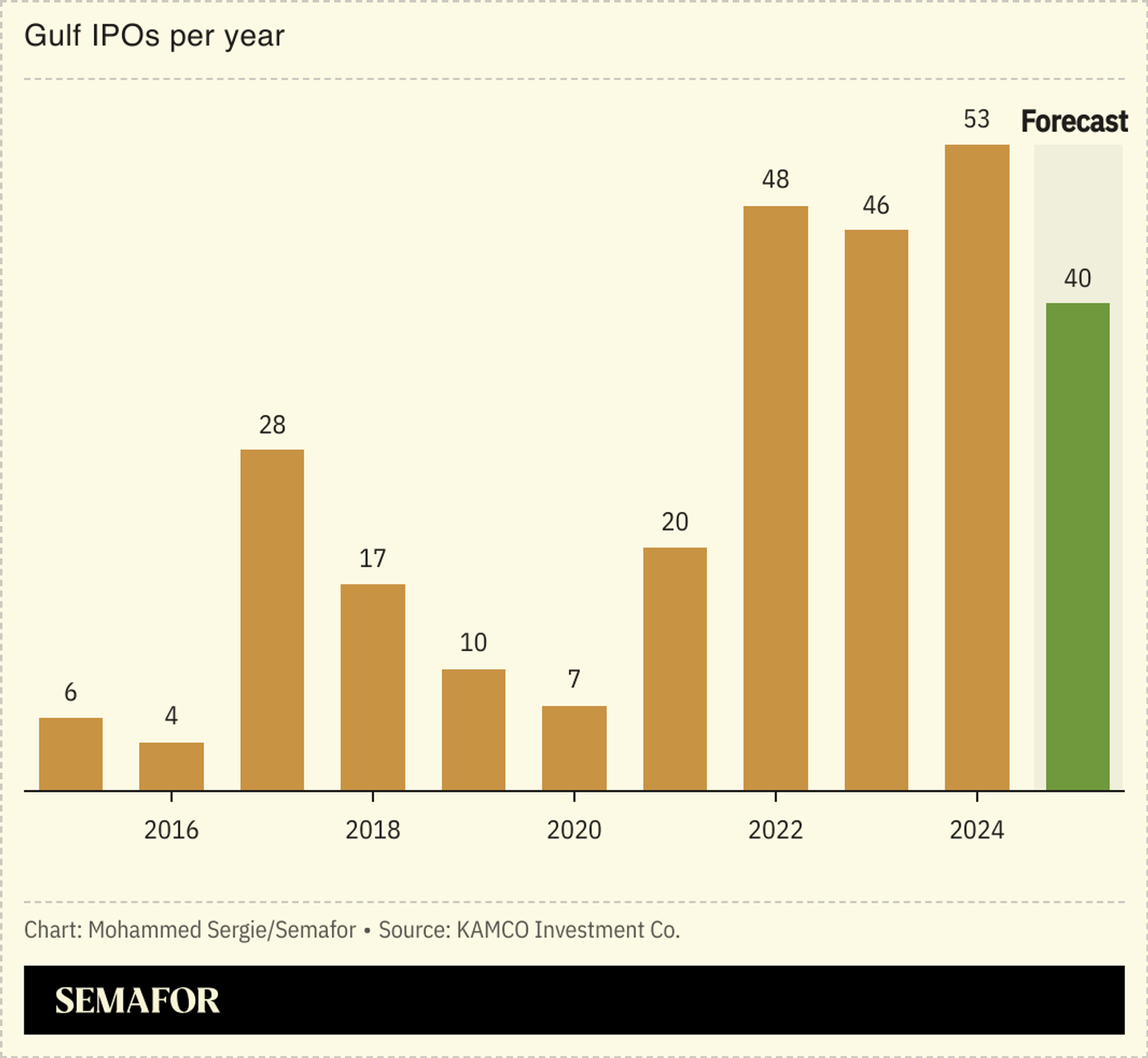

The Gulf initial public offering (IPO) market is expected to maintain momentum this year, fueled in part by sovereign wealth funds floating their assets.

Companies raised $12.9 billion in share sales in 2024, up nearly 20% from 2023, with Saudi Arabia dominating listings and the UAE delivering the region’s largest IPO, according to KAMCO Investment Co., a Kuwait-based asset manager.

Saudi Arabia will likely remain the most active market, with the Public Investment Fund planning to list port operator Saudi Global Ports, medical procurement firm Nupco, and district cooling company Tabreed. Private companies in the kingdom, including low-cost carrier Flynas, buy-now-pay-later firm Tabby, and IT company Ejada Systems, are also exploring IPOs.

Oman’s sovereign wealth fund aims to privatize around 30 assets over the next few years, with logistics group Asyad Group and Oman Electricity Transmission Co. among the expected contenders this year.