The News

Nuclear energy is set to generate record levels of electricity in 2025 but significant hurdles remain for the industry, particularly in advanced economies, the International Energy Agency said in a report released Thursday.

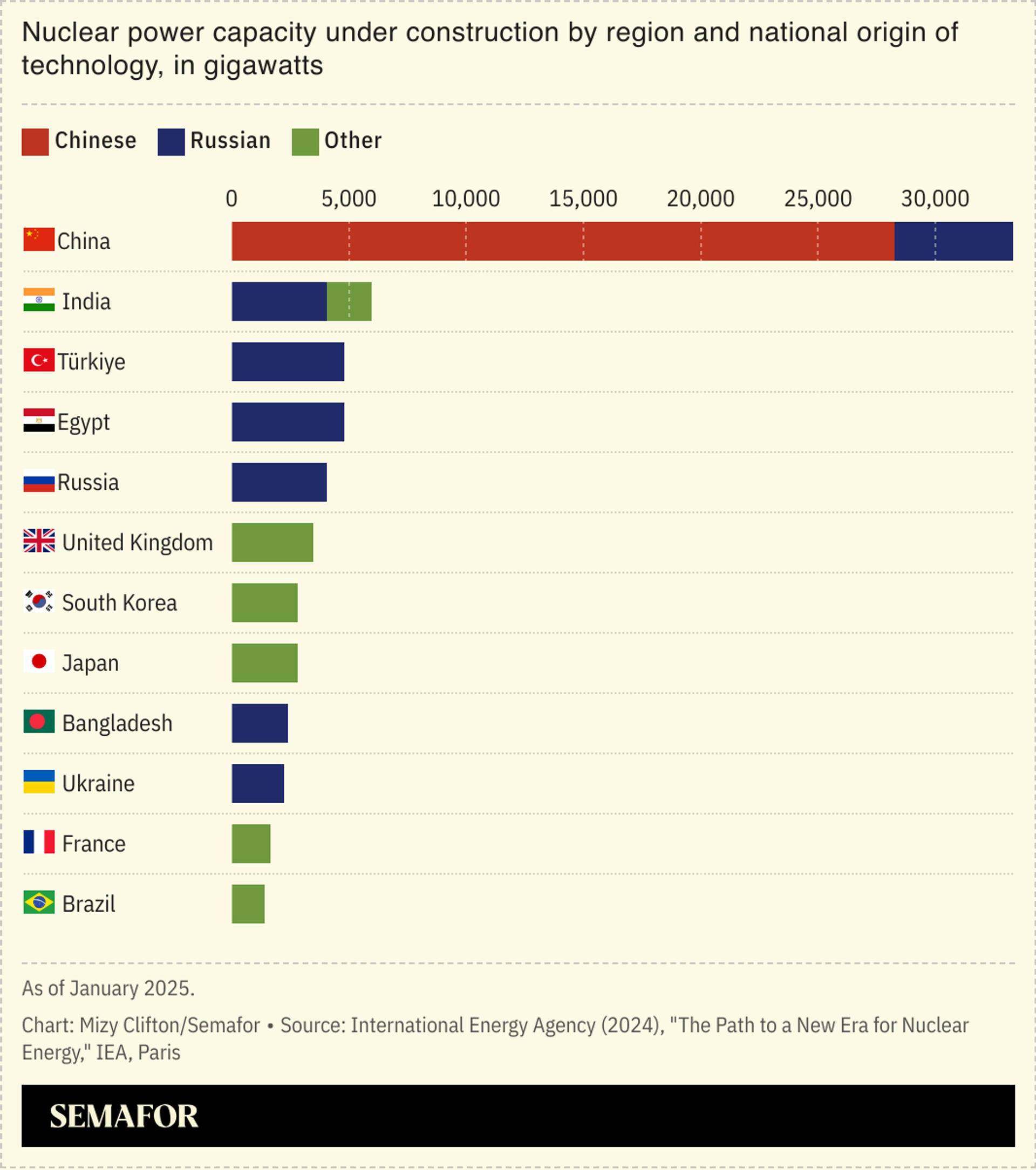

Annual global investment in nuclear power was around $65 billion in 2023 and is on track to reach $75 billion by 2030: Some 63 reactors are under construction, representing more than 70 gigawatts of added capacity. That growth can partly be attributed to rising private sector interest, in particular to meet the round-the-clock energy needs of data centers.

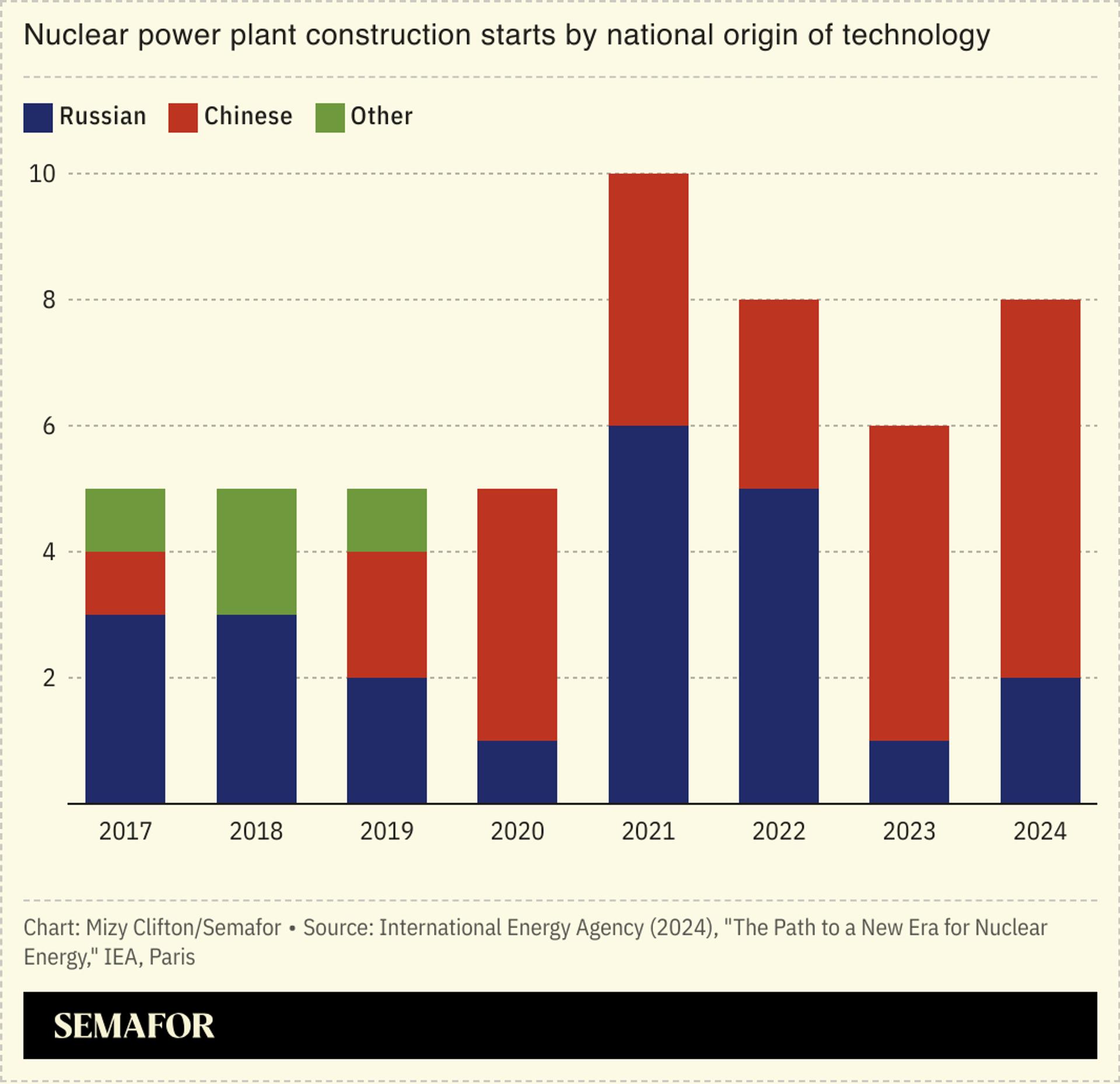

The renewed momentum is “heavily reliant” on Chinese and Russian technologies, the IEA warned: 92% of all reactors that have started construction worldwide since 2017 are of Chinese or Russian design, while France and the US are losing ground as they struggle to rejuvenate ageing fleets and fund new projects beset by delays and cost overruns.

SIGNALS

Nuclear supply chains are vulnerable to geopolitical uncertainty

Highly concentrated nuclear-technology markets threaten energy security and affordability, the IEA said. The cost of nuclear fuel, for example, has soared since Russia’s full-scale invasion of Ukraine: Moscow dominates much of global uranium conversion and enrichment capacity, but those services are largely out-of-bounds for Western utilities amid US import restrictions and alternative facilities in countries like France face delays in getting to full production, the Financial Times reported. Kazakhstan, the world’s largest uranium producer, is also having to balance the “delicate geopolitics of supply” as Chinese, Russian, and South Korean companies compete for contracts to construct its first nuclear plant, two experts noted for the Carnegie Endowment for International Peace.

Hurdles remain in getting SMRs off the ground

Tech giants are showing increased interest in small modular reactors as clean means of fueling their electricity-hungry data centers: Google and Amazon recently announced agreements with SMR developers, and SMR developers are in turn targeting Big Tech, Verdict noted. But the touted benefits of SMRs are still mostly theoretical, MIT Technology Review wrote in 2023: Only three SMRs are in operation globally, two of which are in Russia and China, and a combination of regulatory hurdles and spiraling costs have delayed efforts to commercialize the technology in the US, CNBC reported.

A new electricity supercycle

The energy transition and growth in artificial intelligence has ushered in “a new electricity supercycle,” with investments in new technologies and grid fortification surging across both the public and private sector, The Economist argued. But the promised supercycle could fail to materialize: Mining groups, for example, have started to look elsewhere for growth as electric vehicle sales slow, the Financial Times noted in 2024.