The News

Saudi Arabia’s national oil company said it would mine the country for lithium, part of a growing wave of fossil fuel giants upping their investments in the metal, which is crucial for the global energy transition.

Saudi Aramco said it would form a joint venture with Riyadh’s main mining company after finding “promising lithium concentrations” in areas where it is already producing oil.

“We expect that this partnership will leverage the world’s leading upstream enterprise . . . with a view to meeting the kingdom and potentially the world’s projected lithium demand,” Saudi Aramco added in the statement. The company also said that lithium demand in Saudi Arabia is projected to grow 20-fold between 2024 and 2030, contributing to a potential 500,000 electric vehicle batteries.

SIGNALS

Rising lithium demand is fueling big oil’s enthusiasm for the metal

As more cars go electric, lithium’s rising demand is driving big oil’s enthusiasm for the metal. ExxonMobil is allocating a “material” part of its $20 billion in low-carbon investments to lithium, with aims of producing enough to power 1 million EVs a year, an executive told The Economist last summer. Chevron, Equinor, and Occidental Petroleum have all voiced similar interest, Mining.com reported, given that the resource is abundantly available, and extracting the metal from saltwater brine involves many of the same processes used to extract crude oil, The Economist noted. Goldman Sachs predicts that extraction innovations “could do for lithium what fracking did for oil.”

Saudi Arabia is exploring lithium mining to diversify its revenue

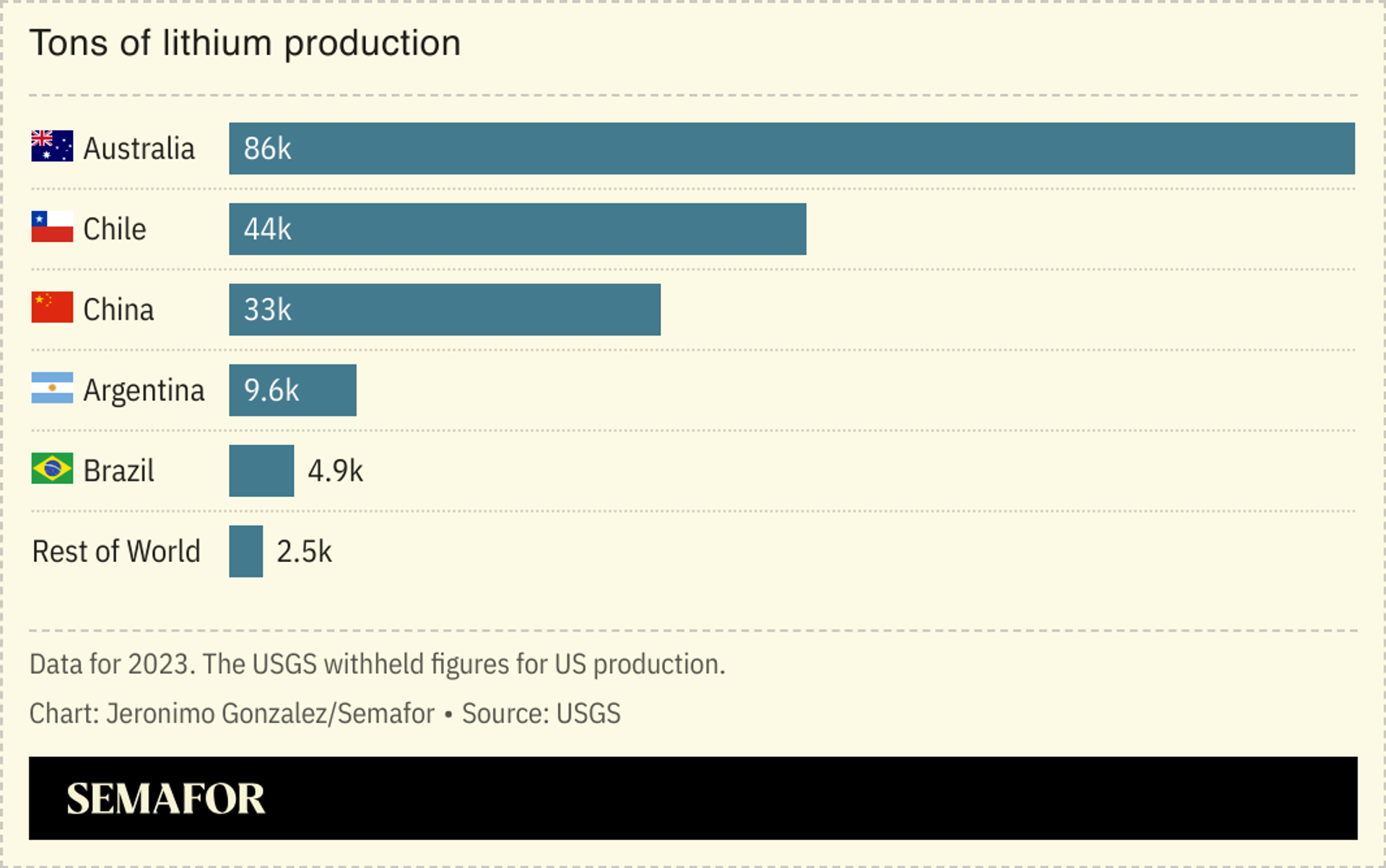

Saudi Arabia has long looked to diversify its oil-dependent economy, which as the finance minister described is holding the country “hostage” to the volatility of global markets. The kingdom is also “very well positioned” to pivot into lithium mining, the industry and mineral resources minister told the Financial Times. China currently dominates global lithium processing, controlling around two-thirds of the market, leaving other countries racing to develop their own supply chains. Though Saudi Arabia hasn’t “play[ed] much of a part in the battery raw materials or lithium space generally so far,” one data analyst told the FT, the kingdom currently has two processing facilities in the planning stages.