The Scene

LAGOS — Three years ago, when the Central Bank of Nigeria (CBN) barred commercial banks from carrying out cryptocurrency transactions, the then-governor Godwin Emefiele gave a definitive reason in an appearance before Nigeria’s Senate. “We know enough at this stage to decide that a continuation of these opaque activities significantly threatens the safety and soundness of our financial system,” he declared.

But last month, Emefiele’s successor went in a different direction.

Citing “current global trends,” the CBN said it now wants to regulate providers of virtual assets. It lifted the February 2021 ban, permitting banks to resume relationships with crypto trading platforms. Certain conditions, including valid licensing by Nigeria’s securities and exchange commission, are now required for banks to operate accounts for crypto providers. Banks must set “prudent” transaction limits and not allow cash withdrawals from such accounts.

Crypto executives and analysts have broadly welcomed the reversal. Yellow Card, an Africa-focused exchange that entered an agreement this month to help U.S. company Coinbase establish a presence in 20 of the continent’s countries, said it will apply for a license in Nigeria. Regulators have not set a timeline for issuing licenses and industry insiders are cautious about how many will be issued. “There aren’t going to be as many exchanges as I don’t think they’ll be giving so many licenses out,” one crypto company chief executive told Semafor Africa, requesting anonymity to discuss regulatory matters.

Know More

The restrictions imposed by the central bank during Emefiele’s tenure failed to prevent crypto use. Nigerians used peer-to-peer transaction features offered by local and international trading platforms as workarounds to bypass the ban.

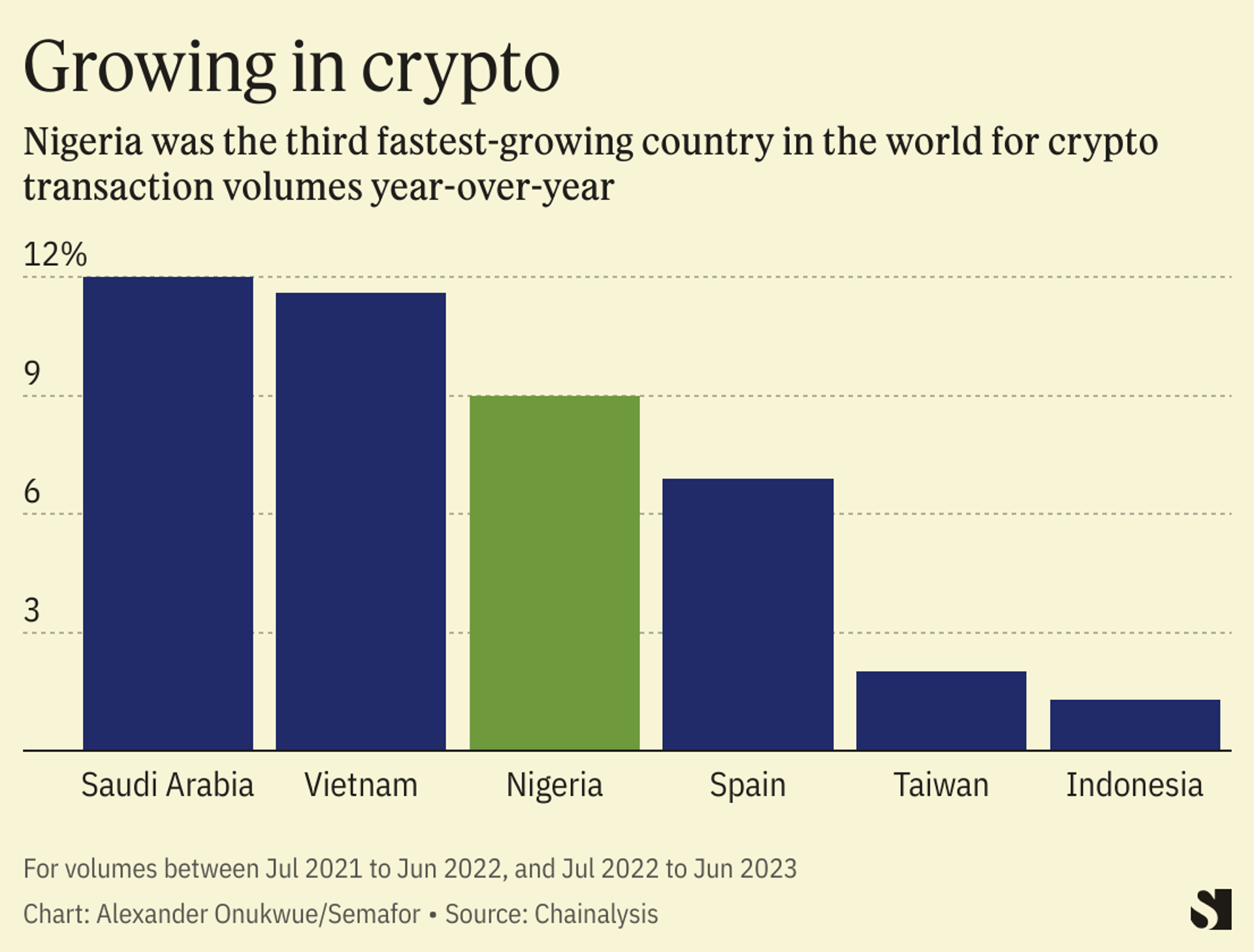

Sub-Saharan Africa received only 2.3% of the value of global crypto transactions between July 2022 and June 2023, according to blockchain analysis firm Chainalysis. But that share was worth $117 billion and most of it came from Nigeria which Chainalysis ranked second on its global crypto adoption index. Nigeria’s 9% annual growth in crypto transaction volume by mid 2023 was only surpassed by Saudi Arabia and Vietnam.

Nine in ten Nigerians surveyed last year by blockchain company Consensys and pollster YouGov on their familiarity with crypto wanted regulations that will protect investors. With the new rules, Nigeria follows South Africa in providing “clear guidance” for secure engagement between financial institutions and the digital asset ecosystem, Arushi Goel, Chainalysis’s policy lead for Middle East and Africa, told Semafor Africa.

Alexander’s view

The CBN’s new rules reflect public opinion and crypto industry demand for clarity and consumer protection. The shift also seems to mark the regulator’s acceptance that a prohibitive approach towards crypto was costly both in terms of financial benefit for banks and effective regulation. This comes as the bank moves to expand licensing and anti-fraud measures in fintech broadly while trying not to stifle innovation.

The initial ban leaned heavily on the view that crypto is a tool “to facilitate scams which we all popularly call 419 transactions,” as Emefiele, the former CBN chief, described it. But, rather than dissuade users, the ban seemed to drive a surge in crypto awareness and usage over the period. Rising inflation and the local naira currency’s continuous devaluation against the dollar made crypto — particularly bitcoin and stablecoins — an attractive hedge. Crypto transactions in Nigeria in the 12 months up to June 2023 alone were worth $57 billion, according to Chainalysis.

And so while lifting the ban suggests an updated capacity to manage crypto-related risks, it “feels like the CBN and government on the whole are wanting to take a cut on the lucrative crypto business that is being done too,” David Omojomolo, emerging markets economist at London-based firm Capital Economics, told me.

Nigeria’s new tone “is also an attempt to be removed from the FATF gray list,” says Gwera Kiwana, who heads crypto at Onafriq, the pan-African payments company formerly called MFS Africa. The Financial Action Task Force rates governments’ compliance measures against money laundering and terrorism financing. The Paris-based body requires countries to license and supervise virtual asset providers. Its “gray list” tracks countries with deficiencies in their anti-fraud frameworks.

After being added last February, Nigeria remains on the FATF’s gray list. Graylisted countries tend to receive skeptical treatment from global banks who consider the FATF’s guidelines part of their due diligence processes. Being graylisted correlates with declines in capital inflows by 7.6% of GDP, a 2021 IMF working paper suggests, and reduced development financing receipts, another study last year said. South Africa, Senegal and eight other African countries are also on the gray list.

But beyond fraud prevention, Kiwana expects Nigeria’s new rules to produce “a surge in partnerships” between crypto-native companies and other institutions to increase crypto use cases. The CBN could then adapt what it sees of increased adoption to enhance the eNaira, a central bank digital currency Nigeria issued in 2021, Kiwana said.

Room for Disagreement

Adedeji Olowe, founder of Lendsqr, a Nigerian fintech that serves digital lenders, says the central bank may ban crypto transactions again in the near future because there will be too many bad actors to ignore — even if they are in the minority of users.

“The guys who will spoil this are those who steal money somewhere, quickly buy crypto and use it to move the money,” he told Semafor Africa. “When news of this starts going around, what do you think the CBN will do?”

The View From Kenya

The Blockchain Association of Kenya (BAK) received parliament’s approval in November to draft its crypto bill which aims to create a regulatory framework for cryptocurrencies and other digital assets in Kenya. The proposal includes provisions on the licensing of companies, consumer protection, anti-money laundering, and terrorism financing.

BAK’s head of legal and policy, Allan Kakai, said a strong crypto regulatory framework would attract global investors, innovators and companies, given Kenya’s reputation as a tech hub. “Investors want reliability, predictability, consistency and accountability. Regulation gives you that,” he told Semafor Africa.

— additional reporting by Martin Siele in Nairobi

Notable

- Nigeria’s central bank-owned eNaira digital currency, created as an alternative to cryptocurrencies, has “not moved beyond the wave of initial adoption,” an IMF review has found.