The News

African startups will have to become comfortable with longer fundraising timelines, a new report suggested, as more dealmakers flock to ventures at the seed stage in a changing investment landscape.

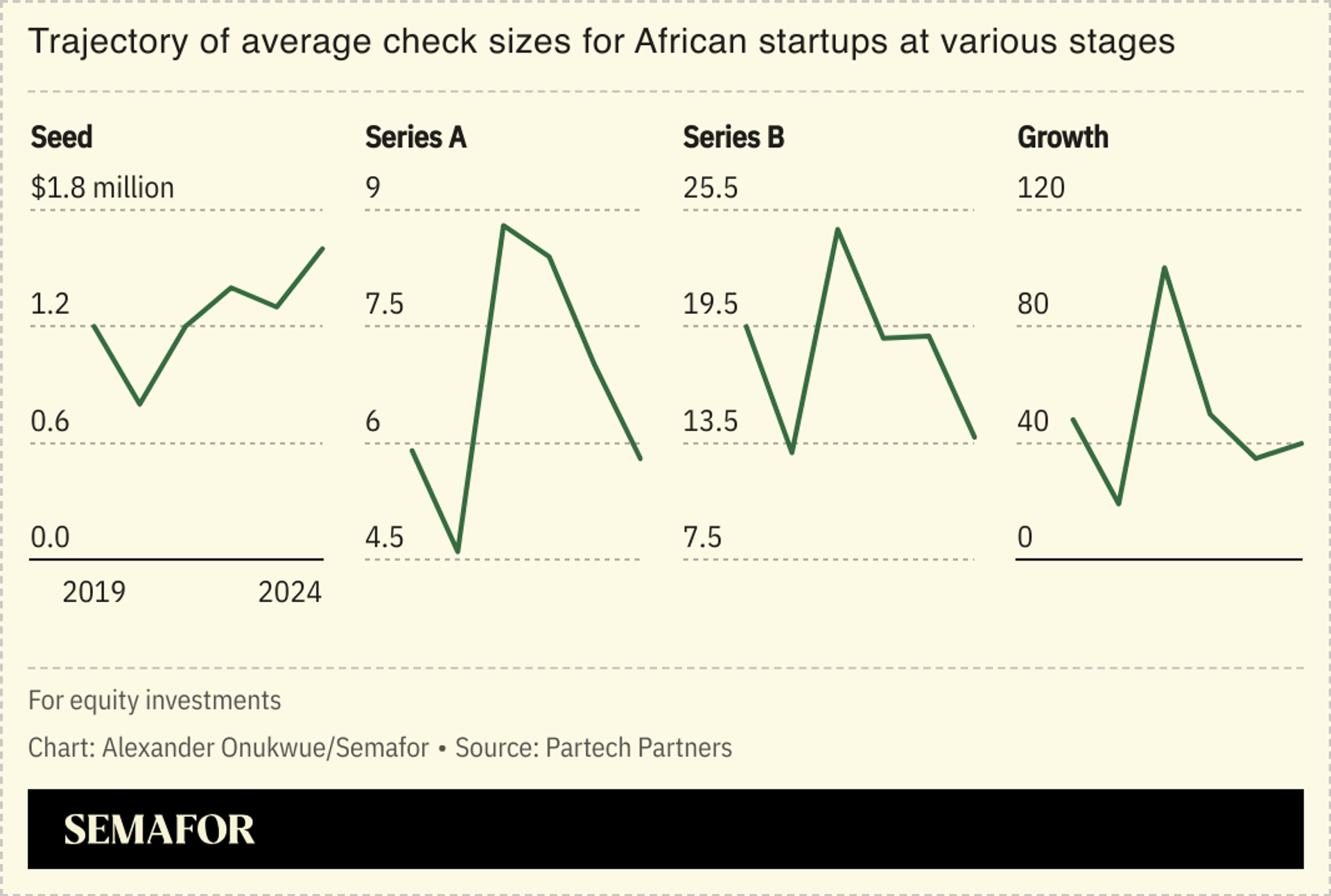

The average amount invested in seed-stage African startups rose by 26% to $1.6 million last year, compared to 2023, while that plowed into later growth-stage startups also rose 15% to nearly $40 million. But ticket sizes for those at Series A and B rounds — where money is crucial to solidify traction and product-market fit — fell by 18% and 27% respectively.

The time it takes for startups to complete fundraising at both stages is increasing too, the report by Senegal-based investor Partech Partners said.

One in five African startups was able to raise a subsequent round after the seed stage within a two year-period, as of 2021, the firm’s data showed. That ability has changed to about one in 20 startups since 2023.

The numbers portray a shift stemming from a sharp reduction in the number of investors signing big checks on the continent, said Partech General Partner Tidjane Deme. The slowdown in funding began with the withdrawal of global venture capitalists as interest rates began rising a few years ago. Investors who have remained active in Africa have been inclined to fund startups at an early stage where the ticket sizes are smaller, he said.

“There are less investors active in the market, the terms you find are much less attractive so negotiations take longer,” Deme told Semafor. “Investors right now are trying to protect their downside and founders are finding it difficult to take the more expensive and constraining terms.”

Know More

Partech’s report found African startups raised $3.2 billion through equity and debt deals in 2024, a 7% drop from the previous year.

It is a slower reduction than the near halving of the funding total that occurred in 2023 from the ecosystem’s peak of $6.5 billion in 2022. As in previous years, the sum is larger than the $2.2 billion reported by Africa: The Big Deal, a platform that tracks African startup fundraising. Partech said its methodology includes publicly undisclosed deals.

A smaller pool of funding sources constrains business operations from hiring to sales. About a dozen African startups shut down last year after failing to raise new funding, including agriculture data platform Gro Intelligence that had raised more than $125 million in rosier times.

But 2024 saw a slight uptick in the number of investors doing deals in Africa, Partech’s report said, giving faint signs of rebounding interest. Nubank, the Brazilian digital bank, made its African investment debut last year by leading the $250 million raised by South African digital bank Tyme.

With its $300 million fund announced a year ago, Partech is one of Africa’s largest investors and focuses on Series A and B rounds. It writes checks of between one and $15 million in equity deals and will look to invest this year in startups that can be “African champions” — those generating revenues beyond their home countries, Deme said.