The Scoop

Venture capital firm 500 Global is launching 500 MENA, a fund focused on investing in tech startups across the Middle East and North Africa. The fund, managed by executives based in Riyadh, is backed by two Public Investment Fund units and Saudi Venture Capital, according to a statement seen by Semafor.

The firm, which has $2.3 billion in assets under management, began investing in the region in 2012. 500 MENA plans to deploy up to $10 million per investment in software-as-a-service, fintech, artificial intelligence solution, and similar companies in Saudi Arabia and the UAE.

Amjad Ahmad, a managing partner at 500 Global, will lead the fund, and chief operating officer Courtney Powell — based in Riyadh since 2021 — is on the investment committee, according to the statement.

In this article:

Melissa Hancock’s view

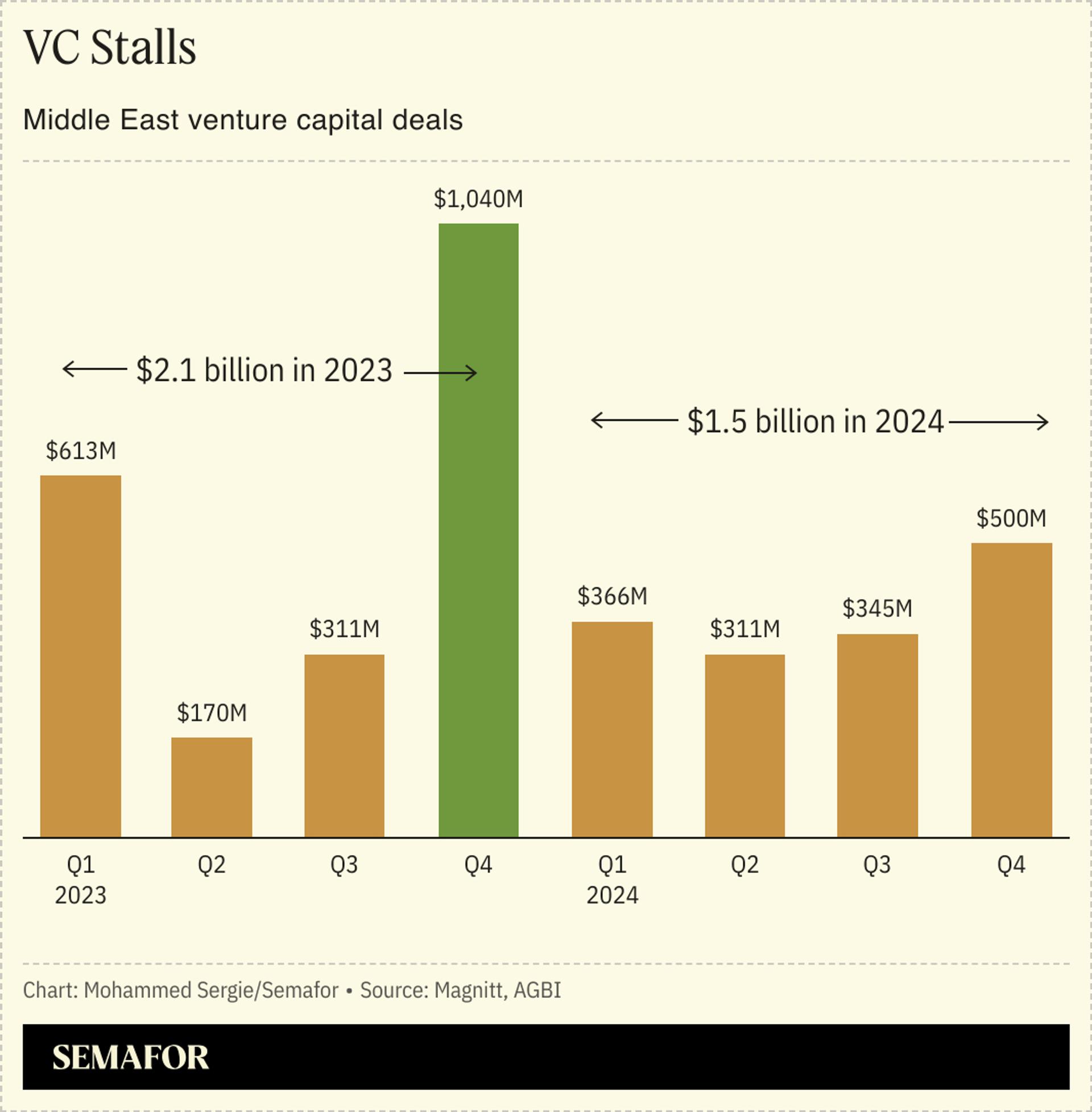

The new fund comes as welcome news for Gulf and MENA startups amid a regional venture capital slump. Funding for startups in Saudi Arabia dropped 44% to $750 million last year, the sharpest decline in the Middle East and North Africa, according to data analytics firm Magnitt. The UAE’s funding fell 8% to $613 million. This caution prompted a shift toward early-stage investments — almost half of last year’s funding rounds were less than $5 million and Series B deals hit a 5-year low, comprising 2% of deals.

500 Global’s new fund could help fill the gap in later-stage financing. The firm is expanding amid expectations that exit options — which fell by a third last year to 27 deals — will rebound this year, especially in Saudi Arabia.

Know More

500 Global has already invested in over 270 companies in the region, including logistics platform TruKKer and eyewear retailer Eyewa. The firm expects that “venture capital penetration levels” in the Gulf, supported by government policies, are on track to match those in the US as the region’s tech ecosystem continues to mature.