The News

Startups that help Africans overseas send money home are rapidly expanding their businesses as remittances to sub-Saharan Africa scale new heights.

Earlier this month, remittance firm LemFi raised $53 million from Silicon Valley investors after crossing $1 billion in monthly transactions. The UK-headquartered company, which launched in 2021, already has more than a million users including in Europe and North America. Most of them send remittances to countries in Africa. Nigerian co-founder and CEO Ridwan Olalere told Semafor that “the market has always been big” and is only set to grow. Late last year LemFi added countries including France, Germany, Italy, and Norway to its growing list.

Nala, a remittance startup born in Tanzania in 2017, also expanded this month, starting operations in the Philippines and Pakistan to target a migrant labour population that includes Africans. Both countries are in the top five global remittance destinations — only behind India, Mexico, and China. In July, Nala raised $40 million from investors including tech-focused Norrsken22, one of Africa’s largest venture capital firms.

LemFi and Nala are part of a wave of companies tapping into the remittance boom in sub-Saharan Africa, which received an estimated $56 billion from overseas migrants in 2024, a fourth successive year of increases and a record peak, according to the World Bank.

Know More

Remittance startups have injected new competition into a market long dominated by US giants like Western Union and MoneyGram. “Banks in Europe do not support remittances to Africa without a lot of hassle,” according to Olalere, who referred to the documents they can demand for large transfers and the days it can take for money to arrive.

With promises of faster and cheaper transactions, new startups are rapidly luring new customers. They’ve also made efforts to emphasize their commitment to tackling the ongoing challenge of fraud and flickering forex rates that can turn off some financial institutions from entering the sector.

Some are innovating with new technologies too. Juicyway, a startup headquartered in London and co-founded by a Nigerian, uses stablecoins — a cryptocurrency pegged to the US dollar — for crossborder money transfers in Africa. It has processed $1.3 billion for 4,000 customers since 2021 and raised $3 million last month from Nigerian venture capital firms.

In recent months Flutterwave, a Nigerian online payments firm, has expanded its remittance services, capitalizing on the sector’s rapid growth. Last September, it finalized a major deal with a Virginia-based bank that will enable users of its app to send money to Nigeria from every US state except Texas.

Alexander’s view

Remittances account for more than 5% of gross domestic product in 15 sub-Saharan African countries. And the true size of remittances is thought to be even larger due to flows through informal channels.

In the region’s smaller countries — such as The Gambia, Lesotho, and Comoros — money from migrants overseas represents large shares of GDP, reflecting the importance of remittances for local economies. The sector presents key opportunities for governments and companies to improve payment service systems, both within the region and internationally.

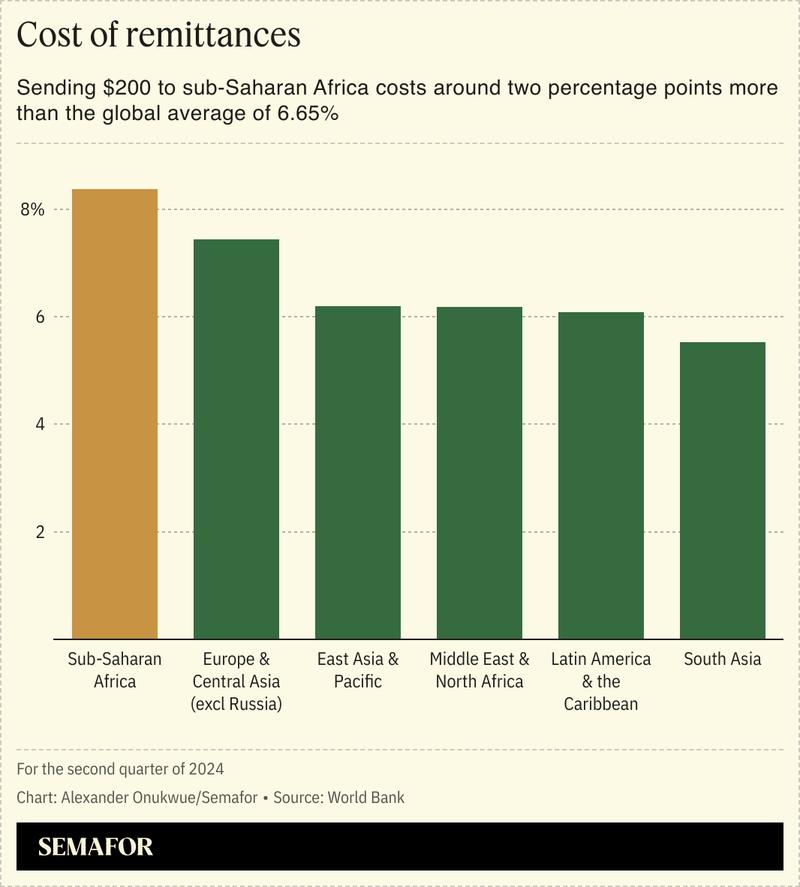

Still, reducing the cost of money transfers remains the biggest concern for most providers and policymakers with fees to send money to sub-Saharan Africa around two percentage points higher than the global average, according to the latest World Bank figures. For instance, sending money from South Africa — home to the highest number of immigrants in Africa — to other parts of the world is more expensive than from any other G20 nation.

Room for Disagreement

Despite the flow of funding to remittance startups targeting Africa, sending money within and out of the region remains fraught with difficulty, said Babacar Seck, founder of Askya IP investment firm and a former Africa investor at French development financier Proparco.

“Is it easy today to send money abroad? No, it’s terrible. You pay very high fees, it’s slow, and there’s a lot of inefficiency,” Seck told Semafor. While it is increasingly convenient to send money into Africa, “even there, the reality is that you still have forex fees” that make the service expensive, he said.

The biggest rewards in remittances will flow to innovators who change the game, Seck added, by “reducing cost(s) and thinking about not just sending to Africa but from and within Africa.”

Step Back

Nigeria remains sub-Saharan Africa’s top destination for remittances, receiving an estimated $20 billion in 2024 — more than the combined totals for eight of the top 10 including Kenya, Ghana, Senegal, and DR Congo.

Expanding job opportunities for foreign-born workers in high-income countries have driven up remittances since the COVID-19 pandemic, the World Bank noted in its recent report, adding that “enormous migration pressures” will only accelerate this growth.

Notable

- Semafor’s Alexis Akwagyiram wrote about why Nigeria’s “japa” economy has spurred a battle over remittances.

- Inconsistent regulation is one reason for the high cost of sending remittances to sub-Saharan Africa, the BBC reported last year.