The News

Updated with company confirmation

Herbert Wigwe, the chief executive of Nigeria’s Access Holdings, parent of Access Bank, one of Africa’s largest banking groups, died in a helicopter crash in California on Friday night, the company confirmed on Sunday morning Nigeria time.

His wife, son, and a former group chairman of the Nigerian Exchange, which operates the country’s main stock market, were also killed in the crash alongside two others, two people close to Wigwe’s team told Semafor Africa. There were no survivors.

The helicopter, identified by the U.S. Federal Aviation Administration (FAA) as a Eurocopter EC130, crashed near the border between California and Nevada, the New York Times reported today. The FAA and the U.S. transportation safety agency are investigating the crash, the Times reported.

The crash occurred about 60 miles from Las Vegas. One person close to the Wigwe team said that he was expected to attend this weekend’s Super Bowl American football event which is taking place in Las Vegas on Sunday.

In a tweet on Sunday morning Access Bank’s main account posted: “Today, we bid farewell to a visionary leader, @HerbertOWigwe, whose passion and unwavering commitment to excellence transformed Access into a global powerhouse.”

Know More

Wigwe, who was 57, had led Access Bank as CEO since 2014.

After early years at an accounting firm that merged to become PricewaterhouseCoopers, Wigwe started his banking journey with a decade at Guaranty Trust Bank, also one of Nigeria’s largest banks today. He left GTB to acquire Access Bank in 2002 with fellow banker Aigboje Aig-Imoukhuede and became deputy managing director. He took over from Aig-Imoukuede as chief executive in 2014, later becoming chairman of the group’s holding company as it revised its structure to accommodate ambitions for Africa expansion and diversification into fintech.

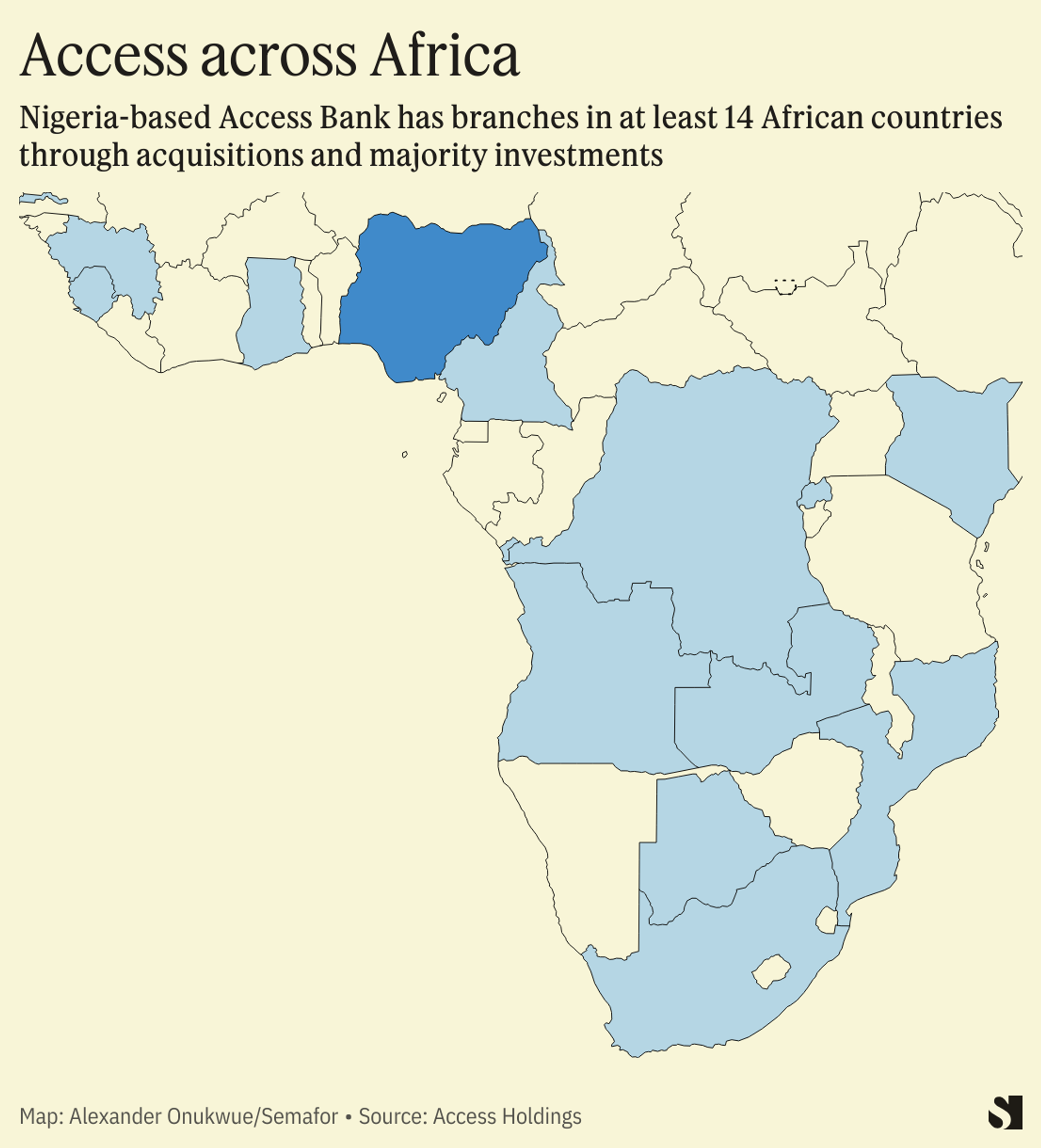

He spearheaded an Africa expansion drive that has involved taking majority stakes in, or outright acquisitions of, banks including Kenya, South Africa, Angola, Botswana, and Mozambique. Access Bank’s acquisition of a competitor in 2019 saw it become Nigeria’s largest bank by total assets. At last count it was reported to have 600 branches and service outlets, across three continents, 18 countries and over 49 million customers.

Wigwe told Semafor Africa in November the bank was close to finalizing a regulatory process to launch its first full banking service in Asia in the first quarter of 2024.

Beyond banking, Wigwe’s other major interest was in higher education. His Wigwe University, located in the oil-producing Rivers state in southern Nigeria, is set to take off with its inaugural academic session later this year. The project is estimated to cost $500 million and plans to enroll 10,000 students over the next five years.

Notable

In a One Big Idea piece for Semafor last month, Wigwe explained his view that investing in higher education is critical for broadening Africa’s economic opportunities around the world, and a necessary pillar of stemming the migration trends that feed fears of destabilization in Europe and America.