The News

Debts are piling up at a rapid pace in the Gulf, propelled by falling interest rates and huge investments in infrastructure and other diversification projects.

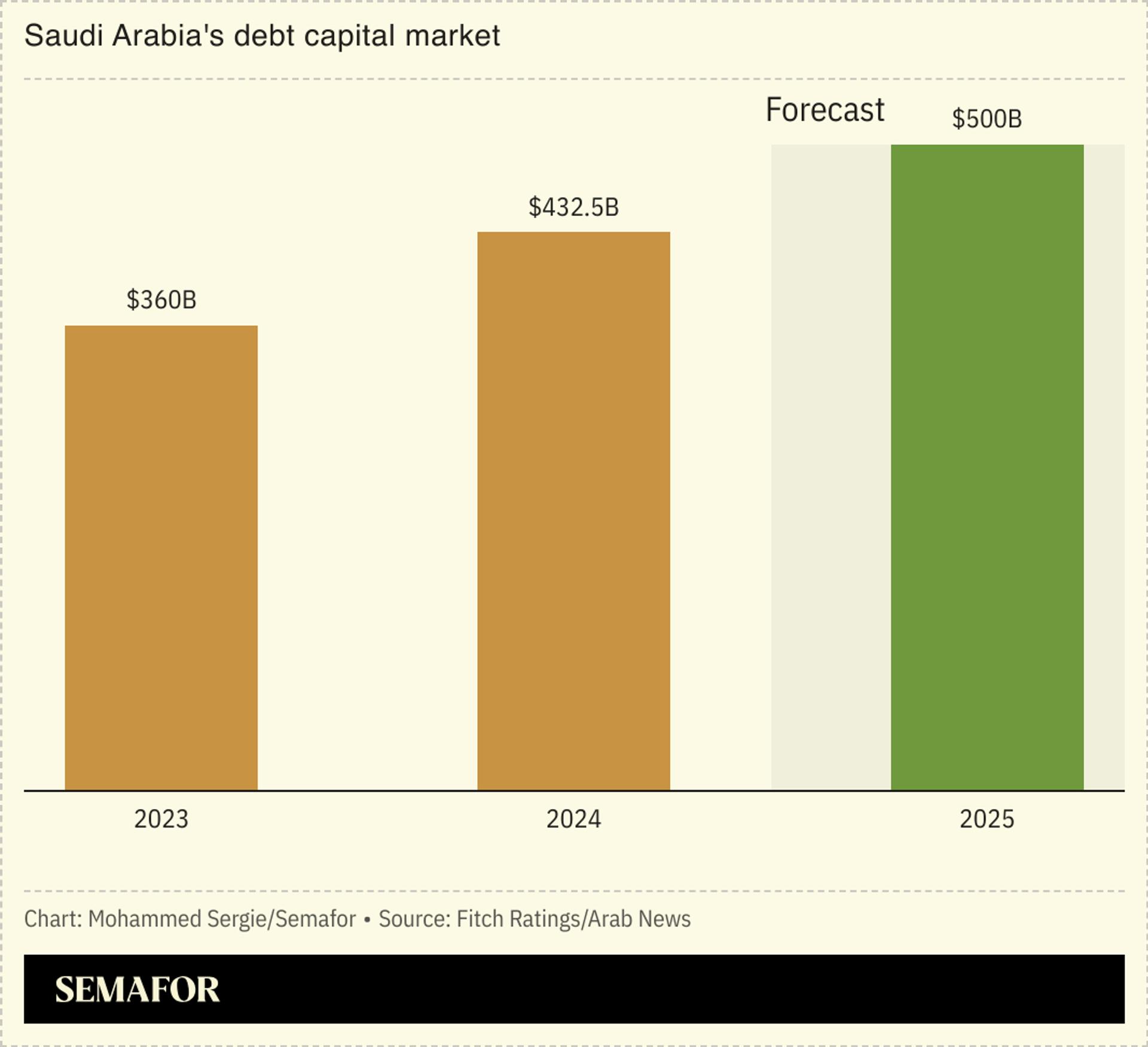

Saudi Arabia’s debt capital market could top $500 billion this year, according to Fitch Ratings, cementing its position as one of the largest emerging market issuers. That represents a 16% increase on the $433 billion of outstanding debts at the end of 2024. Across the border in the UAE, the debt capital market grew by 10% last year to more than $300 billion; Fitch expects it could surpass $400 billion in the next few years.

In both countries, a large portion of the debt is owed by the government and other state-owned bodies. Banks are regular issuers of debt and sukuk (Islamic bonds) too, but corporate borrowers are less active, particularly in the UAE. The expectation of falling oil prices could add further momentum — with defaults a rarity, investors are likely to keep buying.